The inflation battle in the US (and for that matter here too) is nearly over but few economists and key market players are prepared to say it. History has told them that you can’t trust central bankers, who are like those cautious tradesmen who use one or two more nails than really needed.

And it’s why they have a history of overtightening and over loosening, as we saw during the pandemic lockdown years. Here’s an example of market apprehension, when it comes to someone who won’t succumb to believing the Fed is now going to stop raising rates, though you suspect he thinks they should. After the August jobs report, which showed unemployment rose from 3.5% to 3.8%, when economists expected no change, Steve Wyett, the chief investment strategist at BOK Financial, said this to CNBC: “It would be a mistake to look at today’s employment report, along with recent data, and say the Fed is done…even though trends in inflation are moving in the right direction and a broader view of the employment market would indicate wage pressures should abate, overall economic growth is above trend and inflation remains well above the Fed’s recently confirmed 2% target.”

And while the latter observations are true, the trends are pointing to the likelihood that inflation is on the way down with a slowing economy, which will soon get some worrying that a recession becomes the new concern. In the bond market, the numbers show what these guys thought about the job stats, with average hourly earnings increasing by 4.29% on a year-over-year basis, which was less than the 4.4% increase expected by economists polled by Dow Jones.

Consequently, the CME Group’s Fedwatch tool said there was a 91% chance that the US central bank won’t raise rates in a few weeks’ time. In contrast, CBA economist Ryan Feldsman suggested our bond market players were more frank after looking at our good monthly inflation number. “Following the release of the CPI report, money markets moved to price in a 99.5% probability that the Reserve Bank would pause its rate hikes for a third straight month in September,” he revealed. “Traders also pared back the chance of one last hike by the end of the year to just 35%, signalling that policymakers appear largely done with tightening.”

We’re definitely close. Provided the flow of economic data confirms that the excessive rate rises in an incredibly short period of time are now doing their work to slow down spending and price rises, then the stock market will increasingly believe that rate rises are over and stocks will take off.

I expect that to show up in the December quarter to set the scene for a good year for shares in 2024, which is both the US election year and what is the second-best year for stocks. The third, this year, is historically the best and that augurs well for the non-Nasdaq stock market indexes.

Year-to-date, the Dow is up 5.1% and the S&P/ASX 200 has risen only 4.8%, while the tech-heavy Nasdaq is up a whopping 35%. The S&P 500 is also up a nice 18% but largely because the big-tech stocks have driven that index higher. I see the next 16 months a time when ignored companies will gain friends as rate rises stop and then fall.

Just as rising interest rates hurt tech and growth companies, falling rates will lead to re-rating and greater buyer enthusiasm. All we need is for central banks to stop this rate-rising madness. For that to happen we need to see economic data scream “Mission accomplished”, just like George W. Bush did six weeks after the US invasion of Iraq. (Of course, the invasion was successful, but the war didn’t end, and that’s why central bankers will be more careful than George W. with their battle against inflation.)

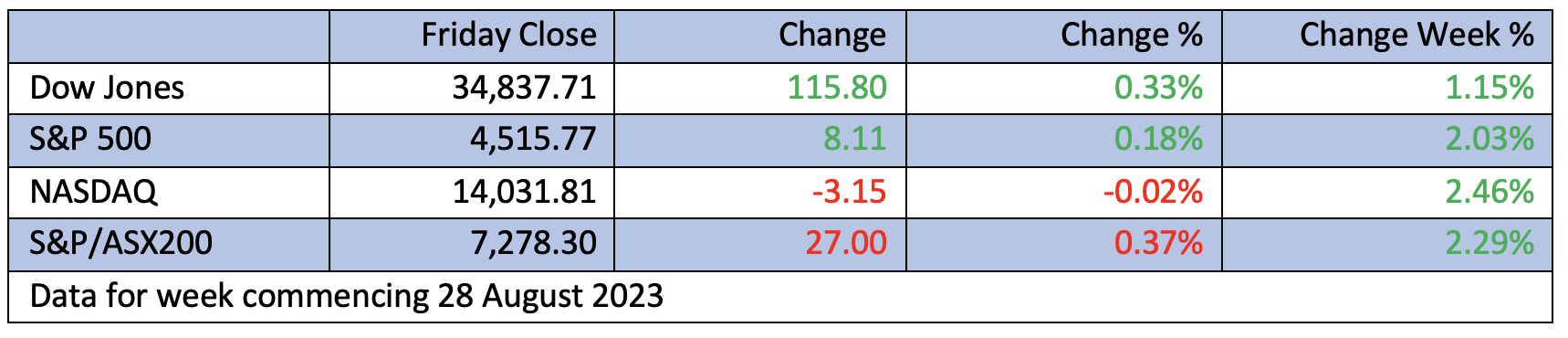

For the record, overnight the Dow and the S&P 500 were up, and the Nasdaq was only down a few points. If the job news pointed to inflation, it would’ve been red across the board for all US market indexes. Our market is tipped to open 27 points higher on Monday on the back of US action and other building positive forces affecting our stocks.

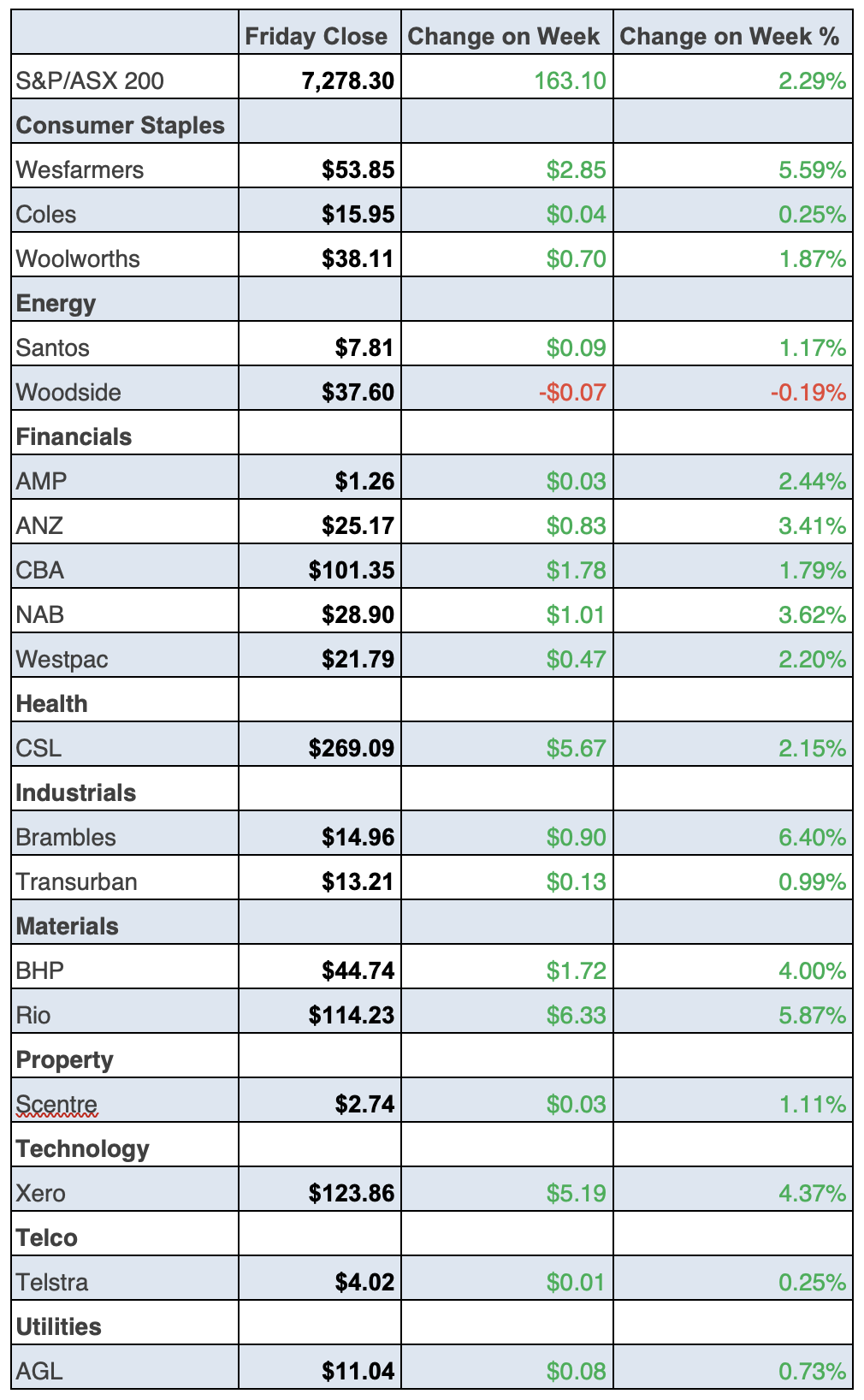

To the local story, and the S&P/ASX 200 had a good week rising 2.29% (or 163 beautiful points) for the week, helped by improving inflation-detecting data and Chinese banks cutting interest rates.

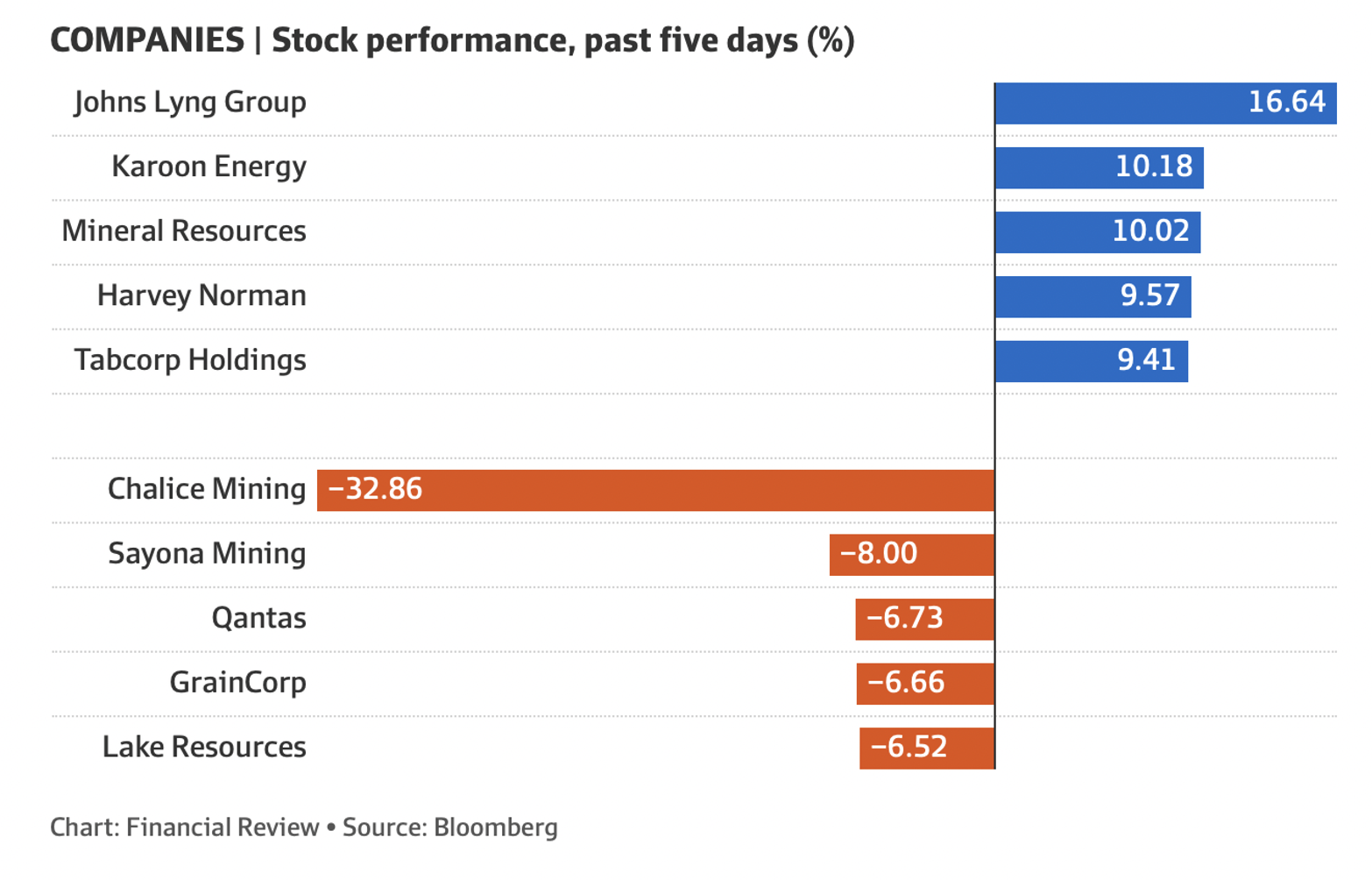

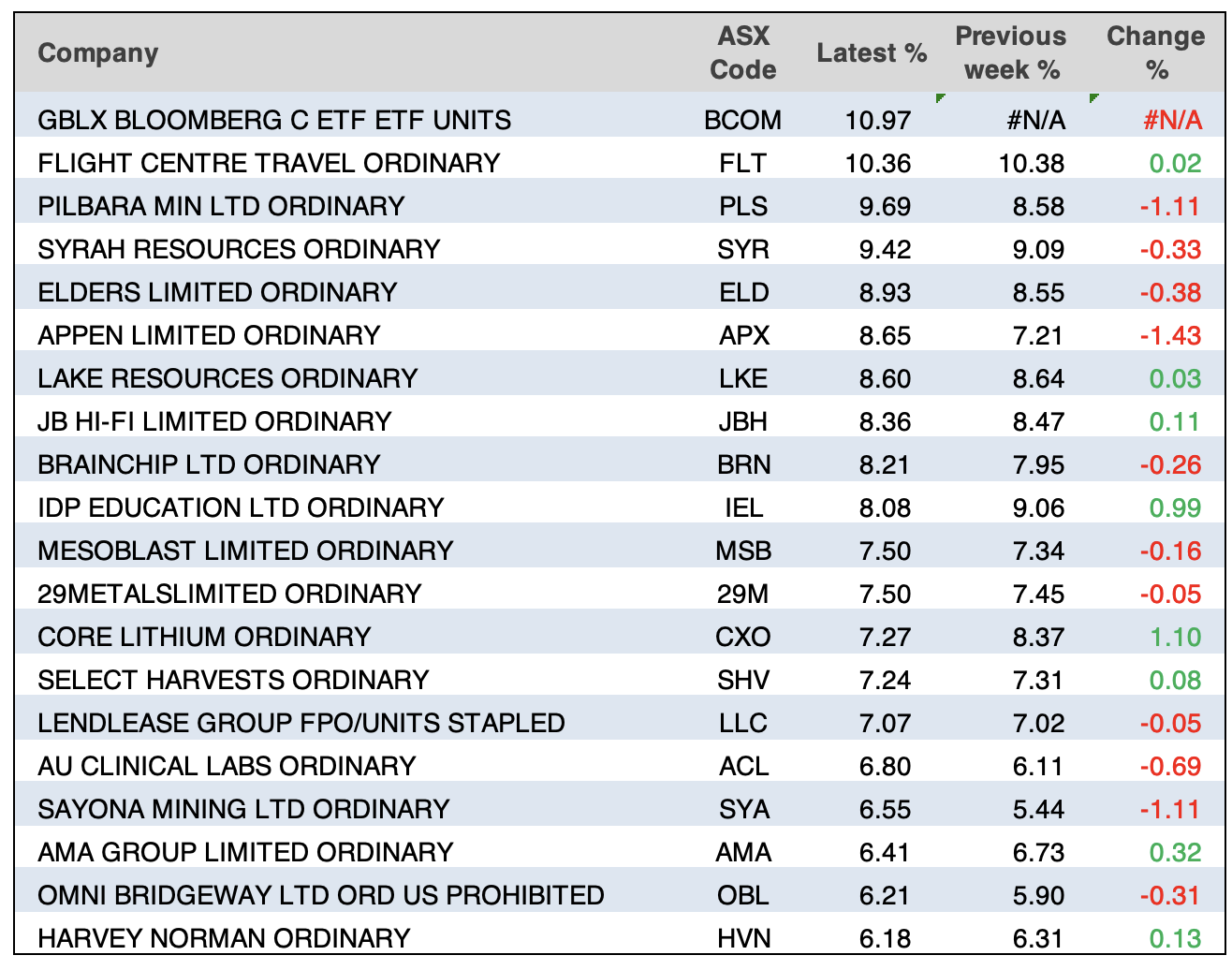

Here were the big winners and losers of the week, as calculated by Bloomberg and the AFR:

Fortescue didn’t make the above loser’s list but had a bad one, dropping over 5% on Friday after losing a CEO, a CFO and former RBA Deputy Governor Guy DeBelle. Twiggy Forrest is racking up losses on par with his home state’s AFL team — the West Coast Eagles. For the week, FMG’s share price was only off 1%, but analysts are expecting this bad news to result in a 20.5% drop in its current share price to $16.14. And seven out of seven analysts hold this negative view on the company’s future.

And at long last, Santos is sustaining good news, with the share price up 1.83% on Friday, with the AFR informing us that the company has finalised “…the delayed sale of a 2.6 per cent stake in its liquefied natural gas project to Papua New Guinea’s Kumul Petroleum in a $US1.4 billion ($2.2 billion) deal.”

In case you missed it, the STO share price is up 9.85% over the past six months. There might be more upside with oil prices on the rise. Woodside’s share price was up 1.57% on Friday, but over a six-month period it’s only up 0.03%, meaning Santos has been a better play than WDS. You don’t see that too often, as STO shareholders know!

What I liked

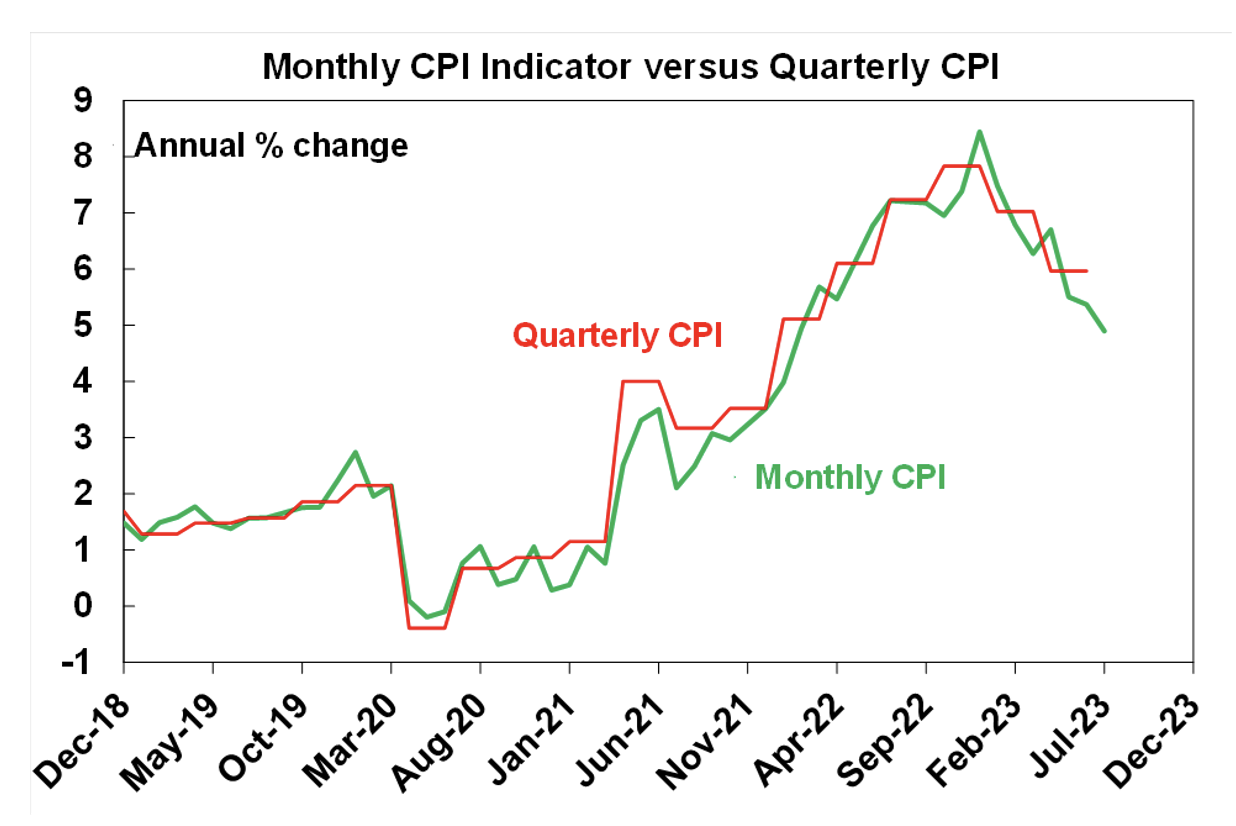

- The Australian monthly consumer price index rose by 4.9% year-on-year to July, down from a rise of 5.4% in June, which implies a 0.3% rise in the CPI over the month of July. This was below consensus expectations of a 5.2% jump.

- With the CPI up by only 0.3% in July, it took the three-month annualised growth rate down to 2.8%.

- New housing lending fell by 1.2% in July to be 14.1% lower through the year, which helps keep the RBA on the sidelines with their rate rises.

- The total volume of capex rose by 2.8% in the June quarter and the March quarter was also revised higher, which helps us beat down recession fears.

- Retail trade rose by 0.5% in July, rebounding after a big fall in June, which is another plus for recession worriers.

- US treasury yields were lower across the curve, which is a reason why stocks have had a good week.

- The St George economics team says: “Cash rate futures imply just a 25% chance of another rate hike from the Reserve Bank (RBA) this cycle. A rate cut is almost fully priced for December 2024”!

- US wages growth is moderating. Workers who stayed in their job saw a 5.9% median pay increase in August, the smallest advance since 2021.

- US gross domestic product (GDP) increased at an annualised rate of 2.1% over the June quarter. This was down from the previous estimate of 2.4%, mainly reflecting a downward revision to business investment. This is good for stopping the Fed from raising rates.

- The Personal Consumption Expenditure Price Index (both headline and core) were also revised slightly lower in the US, which is another plus for lower inflation.

- With US consumer confidence coming in more downbeat than expected in August, this could also keep the Fed on the sidelines. The sentiment index fell to 106.1 from a revised 114 in July – the largest monthly fall in two years. Expectations on the outlook were particularly weak, driven by souring views on the labour market, higher borrowing costs and lingering inflation.

What I didn’t like

- Dwelling prices rose by 1% across the eight capital cities in August and the likes of CBA expect a 7% rise in prices this year. The RBA won’t like that.

The What I like smashed What I didn’t like

The numbers don’t always tell you an accurate story but I do construct my likes and dislikes based on what I think is needed to get stocks up. Today’s count was 11 plays one. If I wanted to be negative, I could throw in some statistical changes that might suggest a recession could come along but that would only speed up rate cuts that the stock market would love!

The set-up for a broader stock market recovery is looking promising but the bulls won’t start to charge until central banks really believe that their mission has been accomplished. I’m starting to buy ahead of that time.

The Week in Review

Switzer TV

- Switzer Investing: SwitzerTV Monday 28th August 2023

- Boom Doom Zoom: 31st August 2023

Switzer Report

- Two property-related stocks to watch

- “HOT” stock: Amcor (AMC)

- Questions of the Week

- Let’s look at 5 winners and 5 losers of last week

- Is a 6.6% yield for a defensive stock enough?

- HOT stock: Wesfarmers Ltd (WES)

- Two lottery stocks where you could be a winner!

- Buy, Hold, Sell — What the Brokers Say

Switzer Daily

- The life and troubled times of Andrew ‘Twiggy’ Forrest

- Under mortgage stress? Call your bank and ask for help!

- Businesses search for smaller and/or cheaper offices with staff working from home but where are these places?

- Is Dan Andrews an honest politician or a self-serving exaggerator?

- Australians to live in and close to our cities

- Victoria’s democracy mess continues – Malcom Mackerras

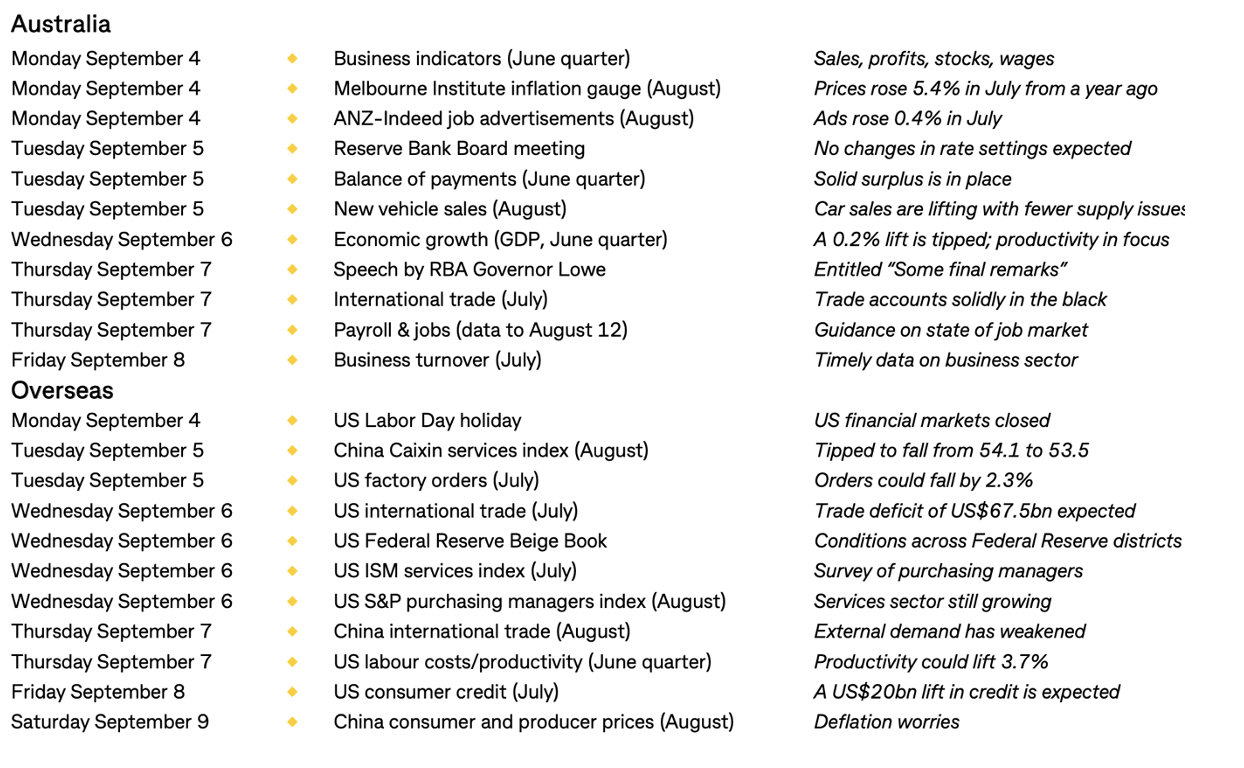

The Week Ahead

Top Stocks — how they fared.

Chart of the Week

The Inflation Battle looking better for interest rate rise worriers.

Stocks Shorted

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before

Quote of the Week

Here’s an optimist when most critics are worried about September. This is what George Ball, chairman of Sanders Morris Harris in the US thinks lies ahead: “September is historically the stormiest month of the year for equities as the Barbie days of summer come to an end,” he said Wednesday. “I don’t think that will be the case this year. The economic resilience of the domestic economy, and the earnings outlook that comes with it, argues otherwise.”

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.