This won’t surprise you, but I’ve found more evidence to reinforce my view that it’s safe to believe stocks can go higher this year, despite the big three US market indexes at all-time highs. Overnight, those indexes are again in positive territory. And in case you missed it, our S&P/ASX 200 index is also at record highs.

So, despite a significant rebound and drive higher for stocks, one of the world’s most respected market players, Ray Dalio, founder of Bridgewater, one of the world’s largest hedge funds, has been reported on CNBC saying the US stock market, “doesn’t look very bubbly”!Dalio, who confessed in his book Principles, that he had realised over time, because of mistakes, that his reliance on his and his team’s human brains to work out how to play markets wasn’t best practice. They needed help from a computer model that could take in a whole lot more criteria before they made big investment plays, and this was a better way to run his huge fund.

Putting it altogether, when he says that he and his computer model have analysed the market based on his bubble criteria, which includes valuation, sentiment, new buyers and unsustainable conditions, he isn’t nervous about the current state of these record high markets.“When I look at the U.S. stock market using these criteria, it — and even some of the parts that have rallied the most and gotten media attention — doesn’t look very bubbly,” he said on LinkedIn this week.So Dalio doesn’t think US stocks are in a speculative bubble and I suspect he’s right if we rip out the big US market performers called the Magnificent Seven, namely, Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla. By the way, the Magnificent Seven are now being renamed the Magnificent Six, with Tesla smashing into a Wall Street sell-off! Dropping Elon Musk’s baby could be premature because most of his babies, including Twitter, can go through trying times, given their controversial ‘father’.

Tesla is down 18% year-to-date, but is up 7.68% for the month, so killing off its magnificence could be a premature creation from those journalists who could possibly like Elon to lose out.“Tesla is going through ‘one of these moments’ with … a dark day for the bulls (and us) with the door left open for more price cuts and a lack of guidance for 2024 putting massive pressure on shares,” said Dan Ives, analyst at Wedbush, investors.com reported.

OK, that’s an issue for Elon and Tesla, but this week we saw Dell surge 20% on strong earnings and with that we saw a strong reason to believe stocks can go higher and why this market optimism is not displaced. Apart from the better-than-expected earnings results, the Chief Financial Officer Yvonne McGill referred to the “strong demand for its artificial intelligence servers”.

So market optimism has at least three drivers. First there’s the potential of AI and what it might mean to companies in the early days of discovering how valuable it will be to their bottom lines, like Dell has just revealed. Next, there’s lower inflation, which is good for businesses and their profits. And thirdly, there’s the interest rate cuts that are coming.

Putting this together, then I’m not monkeying around and I’m happy to sing that “I’m a believer” for stocks for 2024.

An alternative view could be this from Jamie Cox, managing partner at Harris Financial Group: “We’re seeing this big run up in tech because there’s a massive emphasis on what it might be — there’s so much emphasis on AI and this is a big sort-of redux of the late 90s. People (now) just completely disregard the rest of the market. And that generally does not turn out well”.

Cox can be right if you’ve over invested in the big surging stocks now, but if they hold their gains and the other 493 stocks in the S&P 500 start to play catch up because of falling interest rates, lower inflation, good economic growth, or surprise AI benefits, then the overall market can go higher. And as Dalio has said, the market can be seen as not being “bubbly”.

Yep, I’ll run with that.

To the local stock market and the S&P/ASX index was up 102 points (or 1.33%) for the week to 7745.60 after six out of seven past trading sessions ended up positive.

Helping here was a slightly better week for earnings, and this view of AMP’s Shane Oliver explains the recent market optimism: “The Australian December half earnings reporting season is complete and actually improved over the final week, with companies beating earnings expectations.” Oliver went on to add: “So, the bottom line has been that results have been better than feared, but profits are still likely to be down this financial year.” Oliver also thinks stocks will be helped by future rate cuts this year.

I liked this from David Bassanese, chief economist at Betashares, who said this to the AFR’s Tom Richardson: “Economic data out of the US is showing growth and inflation is still coming down, so the optimistic theme remains the same. Equity valuations in Australia aren’t that stretched — we’ve gone through a slow patch on earnings and now the RBA might take its foot off the economic brake”.

Bassanese then threw in that the S&P/ASX 200 could reach 8000 points by the end of 2024, which would be a 3.2% gain. I’ve known David for decades and he’s very conservative so I like that he’s seeing the market going higher but I bet we do better than 3.2%.

Big news this week was Life360, which the AFR says “soared 38.5 per cent to $11.30 after it said more than 61 million people used its app each month to track friends and family members.”

Also, it was good to see that the benchmark futures for the lithium traded higher in China, so Pilbara Minerals gained 4.3% to $4.38, and Arcadium Lithium was up 10.3% to $8.56.

By the way, you might want to know that shares of AMP, ASX, Ampol, Cleanaway Waste Management, Johns Lyng, Mineral Resources, Sonic Healthcare and Stanmore Resources traded ex-dividend on Friday.

What I liked

- Retail sales rose by less than expected in January after a slump in Decemberleaving sales flat since September and down in real per capita terms. This helps stop the RBA from any more rate rises.

- Australian inflation still looks like its falling faster than the RBA expects. The January monthly CPI came in weaker than expected, managing to hold at 3.4% year-on-year with underlying measures of inflation also falling slightly.

- Business investment rose a slightly stronger-than-expected 0.8% in the December quarter(helped by strong growth in renewable energy investment). I want a slowdown but not a recession, so this news is good.

- US, Eurozone and Japanese shares rose to new record highs in the last week helped by key US inflation data coming in as expected and leaving the Fed on track to cut rates from around mid-year.

- Chinese shares also edged higher on hopes for more policy stimulus.

- The view that the earnings reporting season was better than feared, with improving prospects for better earnings ahead once interest rates start to fall.

- This on US economic data makes me think a US rate cut could come sooner rather than later: “US economic data was mixed, with new home sales up but pending home sales down, home prices rising, underlying capital goods orders trending sideways, the Conference Board’s measure of consumer confidence down, personal income up solidly but real personal spending falling and jobless claims up but still very low.” (AMP’s Shane Oliver)

- US core private consumption inflation picked up to 0.4% in January, as foreshadowed by the CPI, but fell from 2.9% to 2.8% year-on-year. The trend is good.

What I didn’t like

- Home price gains picked up pace to 0.6% in February, with Sydney and Melbourne hooking up, and continued strong increases in Adelaide, Brisbane, and Perth. We’ve had enough house price rises. The RBA wouldn’t like continued house price rises as it adds to inflation.

(Yes, you’ve read correctly, there’s only one thing I didn’t like this week, which helps to explain why I’m positive on stocks.)

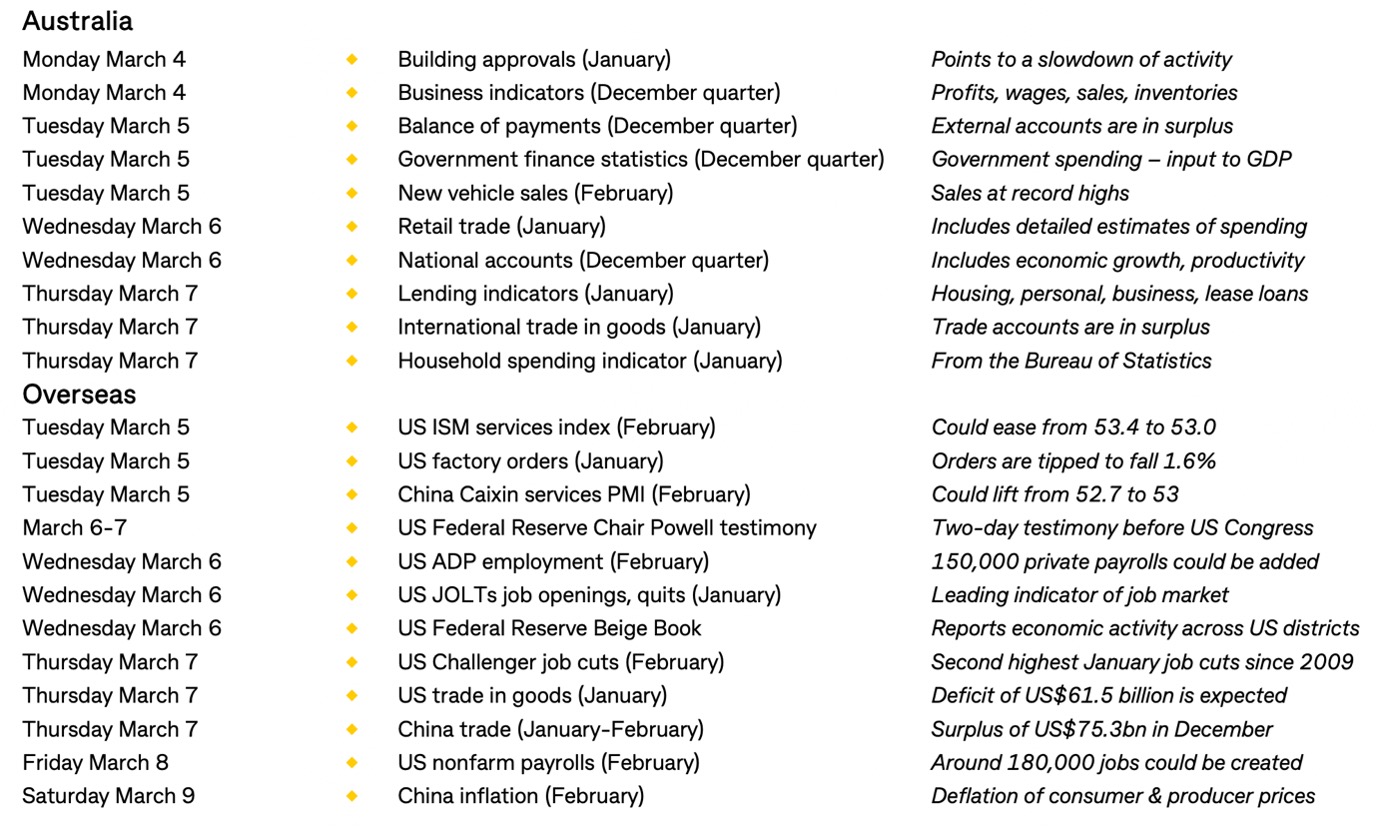

Big week of data ahead

Locally, I’m keen to see the National Accounts and what happened to economic growth in the December quarter. I think the March quarter is showing that the mortgage cliff is really kicking in and we might be more certain that rate cuts are coming sooner than many had thought, if that growth data looks weaker than tipped.

Meanwhile, the US sees a lot of important economic data, but the big market mover will be the jobs report out on Friday. Also, I’m hoping to see some better China economic news because this will be crucial to commodity prices, the share prices of our miners and how high our market indexes for our ETFs can go this year.

Switzer This Week

Switzer Investing TV

- Boom Doom Zoom: Peter Switzer and Michael Gable answers your questions on RHC, GMG, APA & more

- SwitzerTV Investing: 34 stocks that reported last week, which ones look like great buys now? Peter and Jun Bei Liu give their tips.

Switzer Report

- Back-to-the-office trend gaining momentum

- “HOT” stock: Pilbara Minerals (PLS)

- Questions of the Week

- Check out the views of analysts on these 34 companies

- The top ‘10’ report – so where to from here?

- HOT stock: Lovisa (LOV)

- 3 small gold stocks

- Buy, Hold, Sell — What the Brokers Say

Switzer Daily

- Push for nuclear to be part of the ABC of future power generation escalates

- Is the economy booming or dooming?

- Will the impact of Taylor cause inflation to swiftly rise?

- CEOs head for gallows as ‘woke’ demands kill careers

- Energy companies and their shocking bill behaviour!

The Week Ahead

Top Stocks — how they fared

Most Shorted Stocks

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before

Quote of the Week

After Inflation as measured by the monthly CPI indicator was unchanged at 3.4% for the year to January, which was below the consensus estimate for a 3.6% outcome, I liked this from CBA economist, Steven Wu.

“Inflation is moving in the right direction. Annualising the last four months yields a 2.1% annual growth rate. In December 2023 the smoothed annualised rate was 1.8%.”

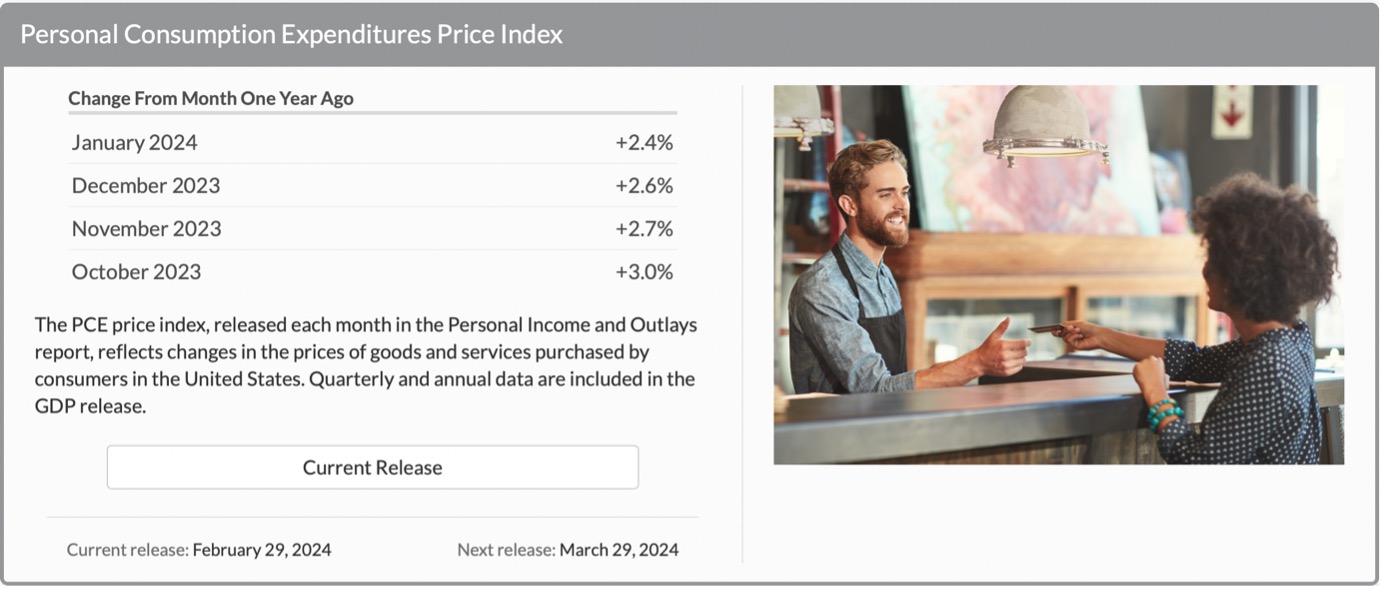

Chart of the Week

The Federal Reserves preferred inflation measure is the Personal Consumption Expenditures Price Index and this chart shows how it is falling. The Fed wants inflation at 2% but this trend down is good for interest rate cuts and stock prices in 2024.

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.