We have a fear versus fear versus fear show going on in that great market determinator called Wall Street, with stocks up overnight big time, despite the latest jobs report coming in better than expected!

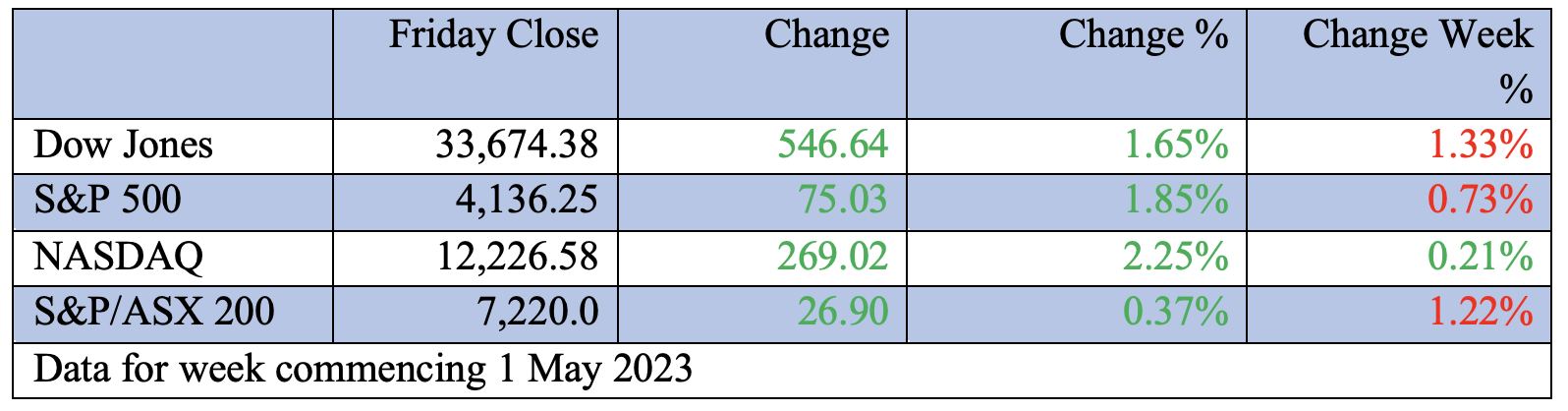

In 2022-23, a good employment story of 253,000 jobs created in April, rather than the economists’ survey guess of 180,000, would have made the market influencers think that this will keep the Fed raising interest rates. This, in turn, would have led to a sell-off of stocks but the Dow was up 1.65%, the S&P 500 1.85% and the very rates-sensitive Nasdaq surged 2.25%.

By the way, unemployment came in at 3.4% rather than the expected 3.6%, but still they bought stocks!

It looks like the fear of recession is taking prominence over the fear of the Fed raising rates too aggressively, following the change of tone from the US central bank boss, Jerome Powell during the week. So, this good jobs report reduces those recession fears.

AMP’s chief economist, Shane Oliver, put this dissipating fear into both believable and historical context. “Still more central bank rate hikes, but at least the Fed is sounding a lot less hawkish,” he observed. “The Fed hiked by 0.25%, taking the Fed Funds rate to 5-5.25% as expected, but it softened its tightening bias substantially – dropping its anticipation of more tightening and noting that it will closely monitor data and developments in determining the extent to which additional rate hikes may be required.”

He then took us back in history: “This is similar to the language it used at the end of the rate hiking cycle into 2006. It’s prepared to do more but further tightening is no longer the default.”

Oliver explains that the Fed’s preferred yield curve is now clearly flashing recession warnings and given that additional tightening coming from the banking stresses and inflation are likely to slow, with his US Pipeline Inflation Indicator still pointing down for US inflation, he argues that the Fed has now reached the top and there’s a high chance we’ll see easing by year’s end.

And he’s not alone. “This is in line with money market expectations,” he added.

All the above helps understand this bounce-back for stocks overnight, but you can’t resist thinking the worst for stocks is past us, though I suspect it is. That doesn’t mean sell-offs are over but serious ones look less likely.

Helping my overall positivity for stocks is the downgrading of the third fear that I haven’t addressed — the banking crisis. On that front too, we saw some helpful developments, though I’m not too sure they are 100% long lasting.

On Wall Street, confidence overnight was helped by a rebound for regional bank stocks, which was assisted by a note from JPMorgan, which upgraded Western Alliance, Zions Bancorp and Comerica to overweight. That’s good news, but given JPMorgan bought the troubled First Republic for $US10.6 billion, it is in the bank’s interest to talk up the regional banking sector.

Personally, I think JPM’s view will be right long term, but short term there’s still a lot of nervousness about smaller banks in the US.

This from Liz Young, head of investment strategy at SoFi, is a good explanation of what the market has to deal with to look past these current banking concerns.

“When the whole news cycle started, it was sort-of explained away … as a unique circumstance for certain institutions. The reality is that liquidity is a universal challenge,” Young told CNBC. “The issue originally was that deposit flight was occurring, but now the pressure is no longer necessarily deposit flight. It’s this mark to market of the securities on all their books.” (What this means is that banks assets are being looked at more realistically and that could cause some trouble for some smaller banks.)

This is the kind of nagging market doubt that doesn’t just easily get forgotten as Wall Street tries to climb its proverbial wall of worry.

On the flipside, US companies are doing their best to keep stock players in the game. Apple was a big driver for stocks on Friday, with its share price up over 4% following better-than-expected revenue and earnings. Big iPhone sales, solid retail numbers in emerging markets and, importantly, a better supply chain, all helped the result. Year-to-date, Apple’s stock price is up over 38%. I argue this is a prelude for what lies ahead for other stocks, once inflation and recession fears are played out.

In case you’re interested, by Thursday, 83% of S&P 500 companies had reported and 78% had surprised on the upside, which is far better than in the December quarter and above the long-term norm.

“The average beat is running at 7% and consensus earnings expectations growth for the quarter has risen from -6.2% year on year to -3.2%, implying an actual rise in earnings in the quarter itself,” Shane Oliver reported. “Non-US earnings growth is running around 10% year on year and beating consensus by around 14%”.

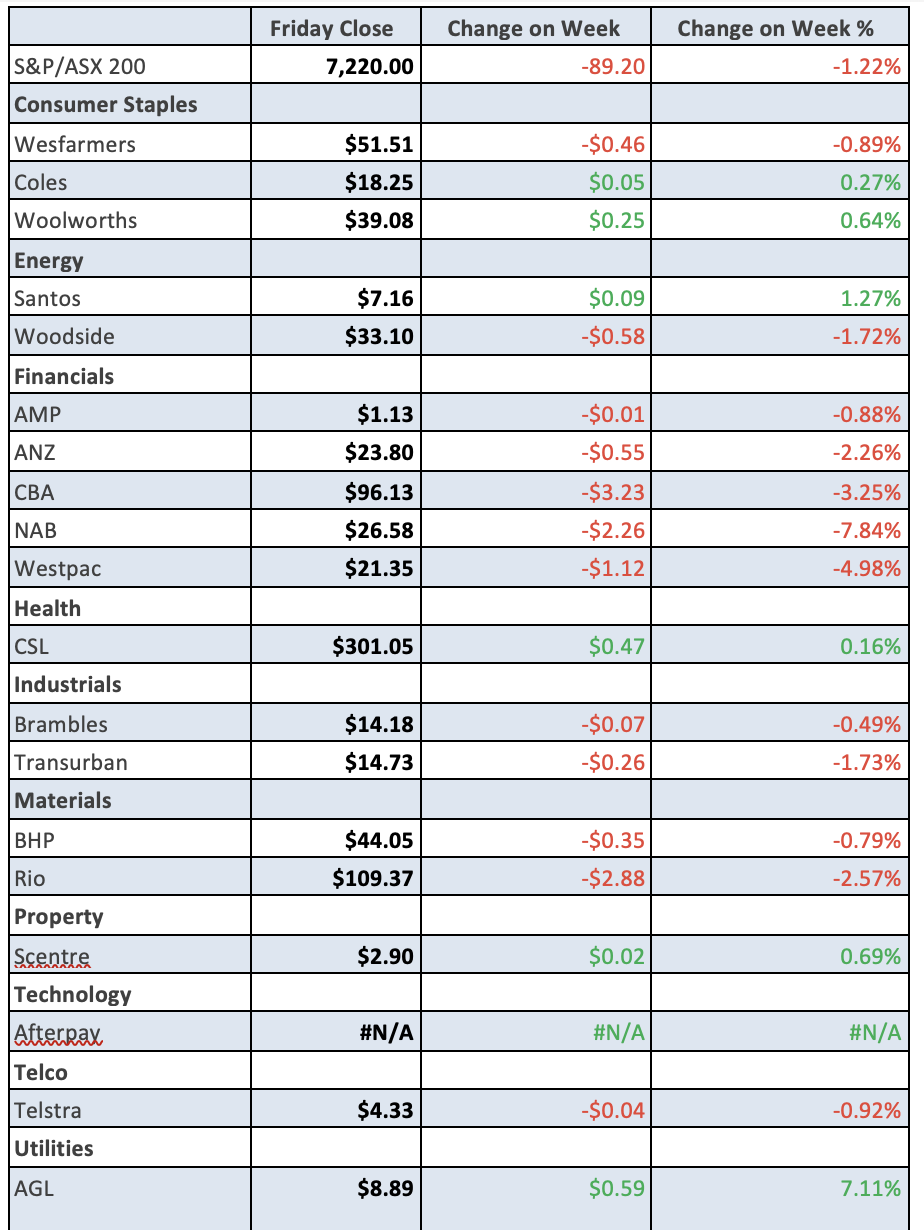

To the local story and the S&P/ASX 200 had a positive finish for the week but still gave up 1.2% over the five days, to end at 7220. The US banking problems and their capacity to drop the US into recession was the big issue hurting stocks this week. But there is also another local concern, with Chinese economic data implying Beijing wants more growth out of services rather than its conventional growth drivers that push up demand for our coal and iron ore.

BHP was down 0.79% for the week to $44.05 and 2.22% for the month. Rio Tinto was off 3.42% for the week and 5.97% for the month. The more reactive Fortescue is down 4.48% for the week and 6.12% for the month.

To the banks, and NAB’s profit story and lower dividend were not well-received, losing 8.66% for the week. But ANZ surprised with a record half-year cash profit of $3.82 billion, just beating expectations, which took its share price up 1.45% to $23.80.

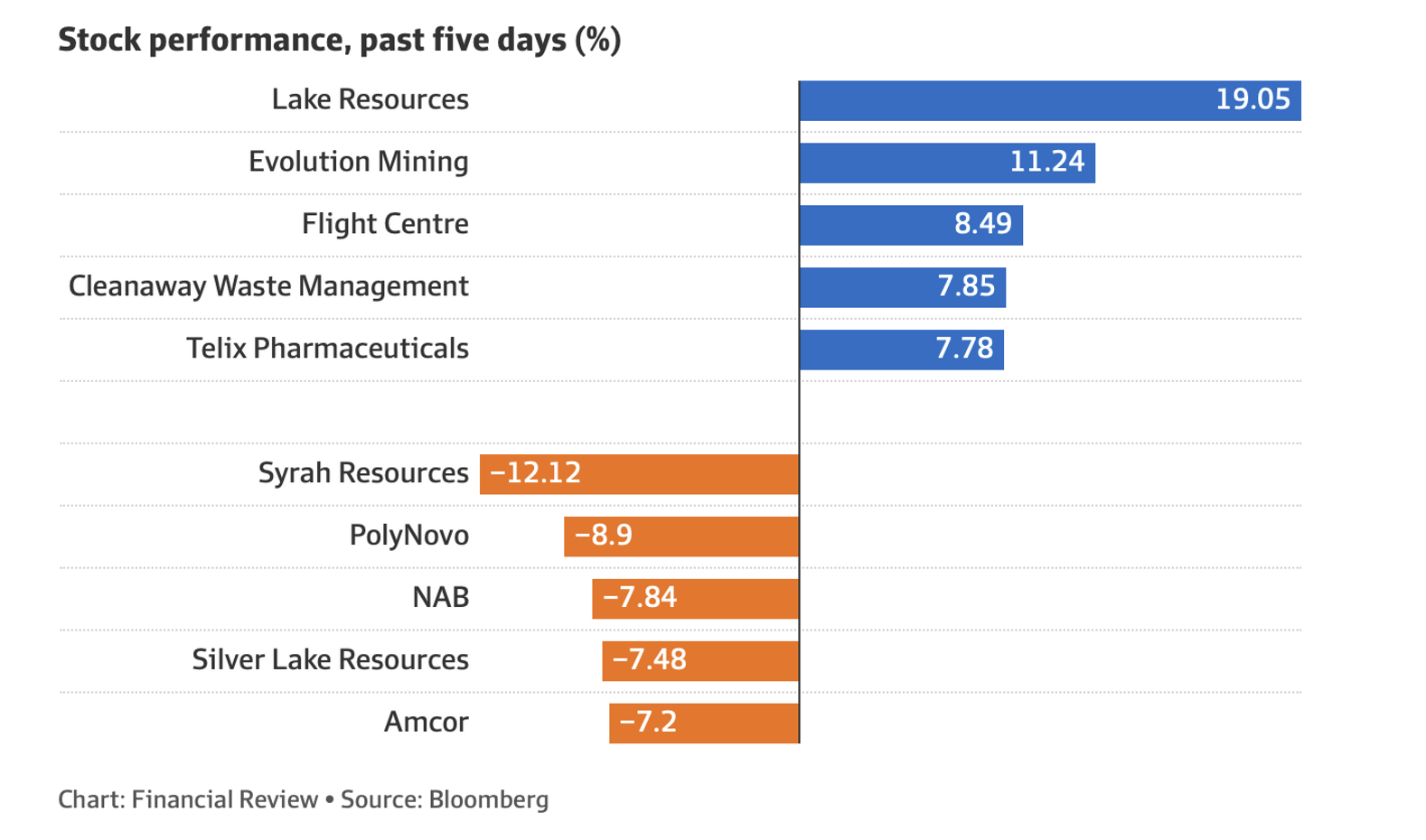

Here are the big winners and losers for the week.

On Macquarie, the AFR raised an issue worth chewing over. “Macquarie Group shed 0.2 per cent to $177.35 despite posting a record profit of $5.2 billion for its fiscal year ended March 31 as investors worried it was overly reliant on its lucrative commodities division,” Sarah Jones reported. “Net profit in the Commodities and Global Markets rose 38 per cent to $6.1 billion from the year earlier as more customers hedged against volatile energy markets.”

That China story is no help for Macquarie and is an issue we’ll have to pursue, as many of us, including yours truly, are long the millionaire’s factory!

Another story worth watching is the better-than-expected run for the likes of Dexus, which was up 1.92% for the week to $7.98, and it’s 4.59% higher for the month, just when we thought the office block business was terrible.

“Gold miners were also in demand with Ramelius Mining rising 5.6 per cent to $1.43, Evolution Mining firming 2.3 per cent higher to $3.96 and Newcrest Mining shares rising 2.2 per cent to $29.80. Gold Road added 1.5 per cent and Northern Star advanced 1.5 per cent,” the AFR reported.

Why? The gold price is being helped by bank collapse stories in the US and Europe, central banks are buying the stuff, and the rising belief that the US Fed is close to the peak of its tightening cycle. Also, recession fears are good for the yellow bar as well.

My favourite gold play, which I always refer to in our Boom, Doom, Zoom webinar, Northern Star, is up a whopping 51.78% over the past six months!

What I liked

- The RBA expects annual inflation to be 4.5% in the fourth quarter of 2023 and 3.2% in the fourth quarter of 2024. Inflation doesn’t return to the top of the target band on the RBA’s forecasts until the second quarter of 2025.

- Inflation, as measured by the Melbourne Institute’s Inflation Gauge, slowed to 0.2% month-on-month in April, but rose to 6.1% year-on-year. It looks to be peaking but it lagged the ABS measures on the way up.

- New housing lending rose by 4.9% a month in March, the first increase since January 2022, which suggests calls of 30% falls in house prices were way over the top.

- Dwelling prices rose by 0.7% across the eight capital cities in April – the second consecutive monthly gain. While I would like house prices to be more subdued, I also don’t want a recession, so this better housing story is OK.

- The European Central Bank slowed down to a 0.25% hike this week.

- EU core inflation fell slightly to 5.6% year-on-year.

- The Fed also slowed down to a 0.25% rate rise.

- In the US, both ISM business conditions (goods and services) indexes for April rose slightly but manufacturing conditions remain very weak

What I didn’t like

- The RBA Board increased the cash rate by 25 basis points to 3.85%. One day, Dr Phil will regret this mistake.

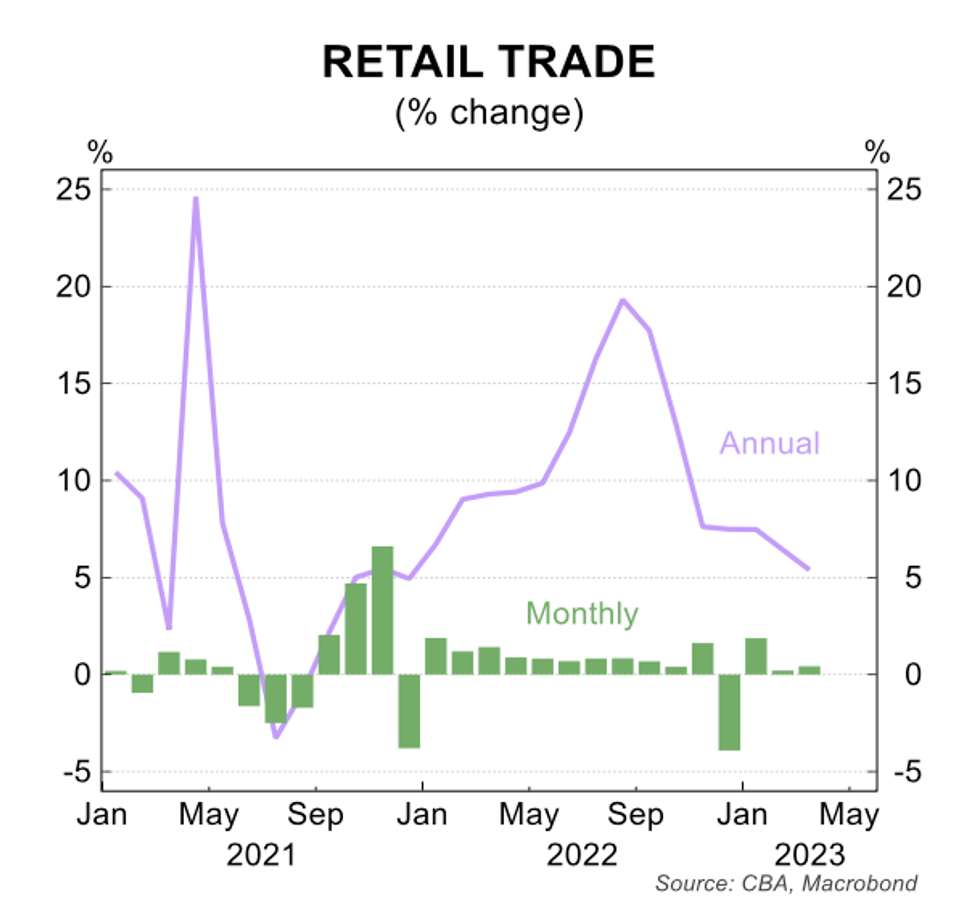

- Retail trade rose by 0.4% in March and the annual pace of growth sits at 5.4% — we need falls in retail to stop the RBA raising rates.

Goldman Sachs on those good job numbers

CNBC’s Jeff Cox says the Wall Street firm’s economists think policymakers could look through the non-farm payrolls report and instead focus on the 13-month run of interest rate hikes and the ramifications of the banking troubles.

“We continue to expect a pause at the June meeting because of tighter credit conditions, the restrictive level of the funds rate, and [Fed Chairman Jerome] Powell’s view that the May FOMC statement represents a meaningful change,” a Goldman Sach’s client note told us.

The Week in Review

Switzer TV

Switzer Report

- Two ETFs that can provide cautious exposure to Chinese equities

- “HOT” stock – NextDC (NXT)

- On Adbri: Questions of the Week

- Artificial intelligence – it’s the next big thing

- Our portfolios perform solidly in April

- https://switzerreport.com.au/hot-stock-coles-group-col/

- 3 promising miners

- Dr Jim, be careful when you play around with our super next Tuesday.

- Buy, Hold, Sell — What the Brokers Say

Switzer Daily

- Good stock market news is building

- Is Dr Phil a genius or a prized nincompoop?

- Budget will make bosses cough up your super with each pay packet

- Will escalating insolvencies stop the RBA’s interest rate rises?

Top Stocks – how they fared

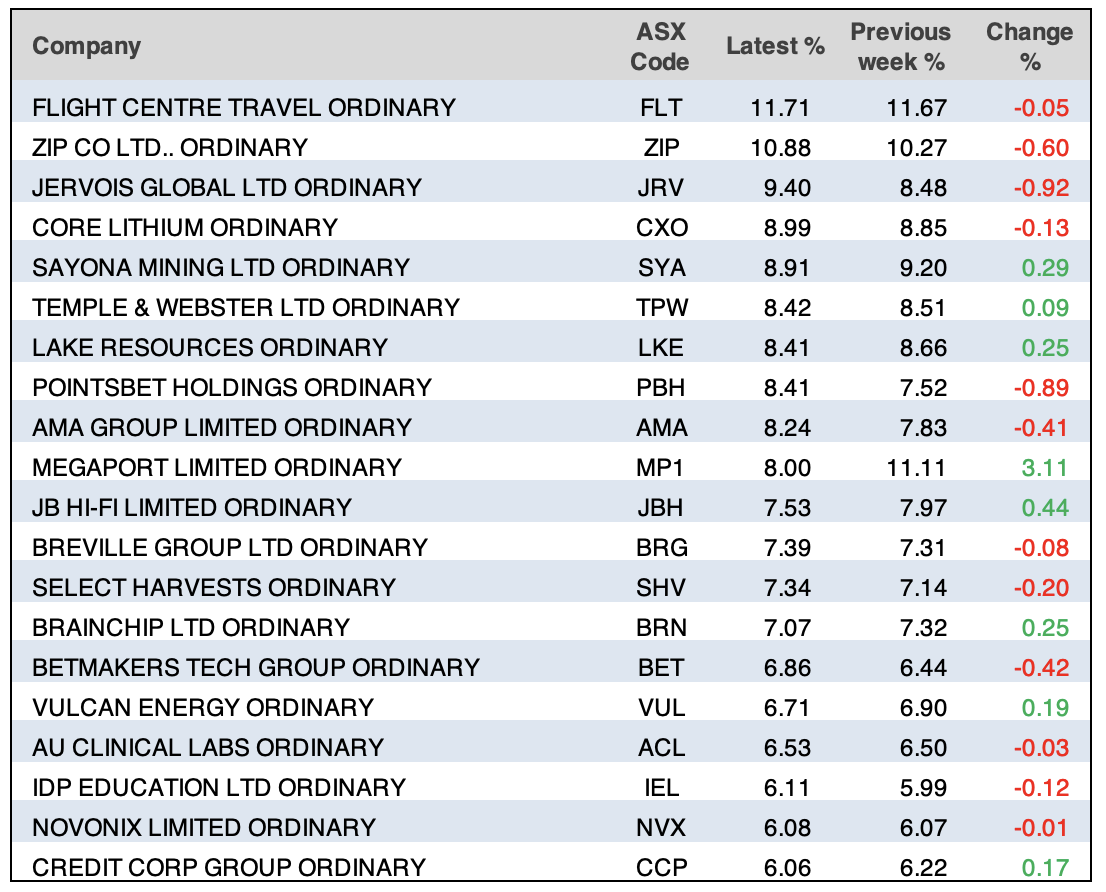

Stocks shorted

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the Week

If you want interest rates to stop rising then we need to see retail spending fall and it is!

Quote of the Week

CNBC came up with this important headline: “Goldman Sachs names a slew of energy companies to buy right now as attitudes shift.” And this observation should be noted: “We believe this shift towards greater Energy ownership has not solely been driven by 2022 sector performance, but rather a confluence of the expanding focus on engagement, growing passive ESG share and rising ESG debates,” said Goldman Sachs analysts led by Brendan Corbett in a note to clients on May 3.

Conclusion? Don’t dump your energy stocks!

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.