Treasury Wine Estates (TWE) and ASX Limited (ASX) reported first half profit results last week. The reports surprised moderately on the upside. ASX rallied a touch, while TWE initially got sold down as it re-affirmed full year profit guidance towards the bottom of the range.

Leaders in their respective industries (the ASX an effective monopoly), both companies are currently in the “unloved” category with investors and trading “cheaply” compared to historic averages. Here’s a look at what they have to offer.

- Treasury Wine Estates (TWE)

TWE delivered a strong performance in the first half with EBITS (earnings before interest, tax, material items and the fair value gain/loss on harvested grapes) of $391.4m, up 35.1% on 1H24 (first half of FY24). The result was marginally higher than consensus of $387m.

With the Chinese market open again, the Penfolds division saw revenue rise by 24.4%, margin improvement and EBITS up 33.9% to $250.2m (about 64% of the Group). Treasury Americas (which incorporates the recently acquired DAOU Group) also performed better, with EBITS up 66.9% to $155.3m and an improved margin. Offsetting these divisions, the Premium Brands division struggled, with the commercial portfolio suffering both volume and price pressures. EBITS collapsed for the Premium Brands division by 50% to just $22.9m.

TWE is fighting a global decline in wine consumption. This decline is most marked in the commercial (cheap) wine categories, as consumers (particularly the young) consider other beverages and are increasingly discerning in what they buy. In response, Treasury has been executing for the last few years a “premiumisation” strategy by developing the Penfolds brand, acquiring DAOU in the USA and selling/exiting other non-premium labels/vineyards. (Treasury defines a “luxury” wine as sold at a price point above A$30 per bottle; “premium” from A$10 to A$30 per bottle and “commercial” below A$10 per bottle).

Treasury confirmed that it had been unable to find buyers (at the right price) for its commercial wine portfolio (chiefly Wolf Blass, Lindemans, Yellowglen) and that it would retain the brands for the time being.

Treasury Wine Estates (TWE) – 5 years from 2/20 to 2/25

Source: nabtrade

Looking ahead, TWE guided to full year EBITS of $780m (at the lower end of the previously guided range of $780m to $810m), citing ongoing challenges with the Treasury Premium Brands division.

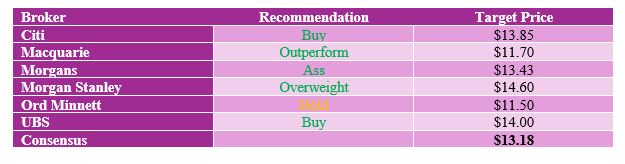

What do the brokers say?

The brokers are supportive of TWE. According to FN Arena, of the six major brokers who cover the stock, there are 5 ‘buy’ recommendations, 1 ‘neutral’ recommendation and 0 ‘sell’ recommendations. The consensus target price is $13.18, 21.7% higher than Friday’s closing ASX price of $10.83.

The table below shows individual recommendations and target prices.

Brokers noted the increased confidence by the Company of selling luxury wine into China and other global markets. While disappointed with the performance of the premium and commercial portfolios, the Company’s offer to provide multi-year earnings guidance was seen as a key positive.

What’s the bottom line?

On a PE 17.8 times forecast FY25 earnings, and 15.2 times forecast FY26 earnings, TWE is attractively priced. The company is making good progress with its premiumisation strategy, with the integration of DAOU now expected to deliver synergies of US$35m (up from US$20m). While it is hard to see what the catalyst for the market to “love” TWE will be again, I am a believer in the TWE (and Penfolds) stories. In the buy zone.

- ASX Ltd

ASX reported underlying NPAT of $253.7m, up 10% on the first half of 2024 (1H24). This beat consensus estimates by around 3%. Higher revenue in markets and data, accompanied by flat costs and higher interest income, drove the outcome. The share price rallied by around 5% following the result.

ASX Limited (ASX) – 5 years from 2/20 to 2/25

Source: nabtrade

Looking ahead, ASX reconfirmed total expense growth of 6% to 9% for FY25, and operating expense growth of 4% to 7%. It expects elevated capital expenditure of $160m to $180m in FY25, staying at this level until FY27, before starting to reduce. This is primarily driven by its technology modernisation program (including the replacement of the CHESS system).

It sees early momentum in listings activity, growing interest in interest rate futures and increasing demand for data and technology services. It is set to launch debt market activity services in the second half.

Financially, ASX has a medium term target of underlying ROE (return on equity) of 13.0% to 14.5%. In the first half, it delivered 13.5%.

What do the brokers say?

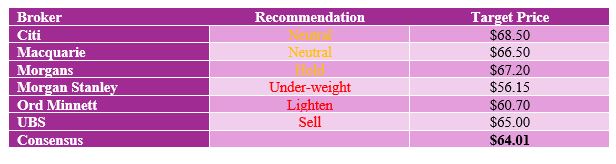

In summary, the brokers are marginally negative on the stock. According to FN Arena, of the six major brokers who cover the stock, there are 0 ‘buy’ recommendations, 3 ‘neutral’ recommendations and 3 ‘sell’ recommendations. The consensus target price is $64.01, 4.4% lower than Friday’s closing ASX price of $66.98. The table below shows individual recommendations and target prices.

While noting the higher than expected first half profit, most brokers remain concerned about the cost outlook, regulatory challenges and risk associated with technology projects (in particular, the CHESS replacement project).

Morgans says: “it considers ASX a quality company but remains cautious on large technology projects and the regulatory backdrop”. Macquarie says: “It assesses that there are ongoing challenges around expenses for ASX and will not become more constructive on the stock as a result. It awaits clarity on the medium term outlook at the investor briefing scheduled for June”.

What’s the bottom line?

I get a sense that under CEO Helen Lofthouse, ASX has turned the corner and there is an acute focus now on cost management, capital discipline and delivery on its key regulatory outcomes, including the CHESS replacement program. Time will tell.

On a PE of 26.0 times and prospective yield of 3.2% (fully franked), ASX is no bargain. However, monopolies (and super defensive stocks like the ASX) are never cheap. By comparison to its price in early 2022 of over $90, the current share price looks cheap. For the long term investor, a stock to accumulate.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.