“Treasury Wines (TWE) first half 2025 financial year result was strong, albeit it was cycling a weak previous corresponding period and Penfolds benefited from China’s reopening and Treasury Americas (TA) from the acquisition of DAOU,” Raymond said.

“Pleasingly, its two luxury portfolios grew strongly, while its much smaller and low margin Treasury Premium Brands (TPB) continues to disappoint.

“Financial year 2025 EBITS guidance was revised by 1.9% at the mid-point due to TPB’s underperformance.

“DAOU’s synergy target was materially upgraded.

“TWE’s targets for both of its luxury wine businesses over the next few years, if delivered, will underpin double digit earnings growth out to financial year 2027.

“While not without risk given industry and macro headwinds, TWE’s trading multiples look particularly attractive to us,” Raymond said.

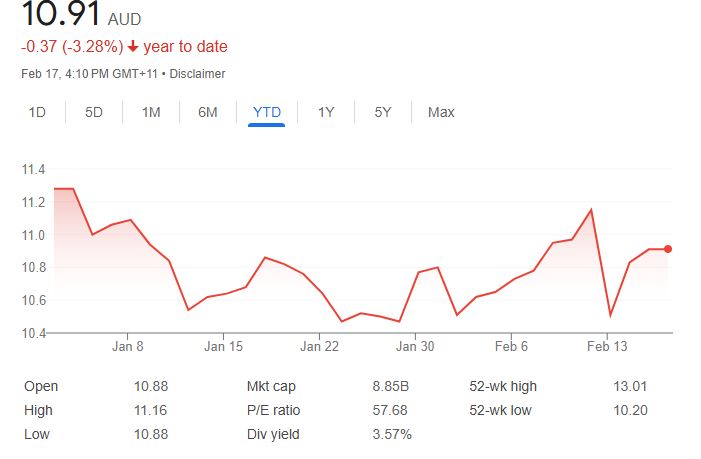

Treasury Wines (TWE)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.