Advertising experts say the Commonwealth Bank has used the work “CAN” to show it understands what’s important to customers in an uncertain world.

Well, the world of investing in stocks continually turns on uncertainty and one of the big questions many of my advice clients and Switzer Report subscribers want me to answer is this: how certain am I that the CBA share price will fall significantly?

One of the toughest aspects of investing is to know that while you will be right about a stock’s future, you have to admit that you’ve been wrong for a time longer than expected. The recent experience of the CBA is a case in point for yours truly, I have to test out whether I was right or wrong to reduce my exposure to this country’s greatest share.

The legendary economist Lord John Maynard Keynes, who actually was a great market investor, once advised: “Markets can remain irrational longer than you can remain solvent.” Similarly, a stock that looks overbought can defy the experts and keep on rising. That’s what the CBA stock has done, but I simply can’t believe that this rise can keep going on. An expected action this week could be the start of something ‘bad’ for the country’s biggest bank and most valuable stock.

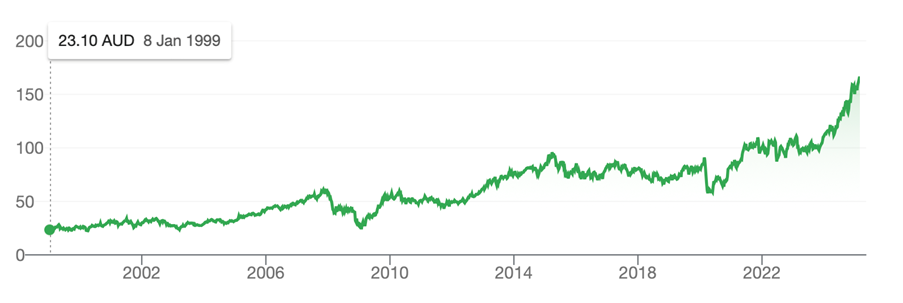

This 25-year chart shows CBA share price does fall from grace. The first was the GFC when in November 2007 it fell from around $57 to $24, which was a 57% slump! It fell from $90 to $72 — 25% drop — in 2015 and was in the doldrums until 2018, because of the local financial system inquiry, the Hayne Royal Commission and the debt crisis of Greece, which undermined confidence in European banks.

CBA

And then the Coronavirus hit and hurt the share price in 2019, with a fall of 35% from $89 to $58, before heading to $165 in 2025. However, it did fall from $106 to $87 — that’s an 18% fall — when inflation spiked, and interest rates started to rise here and worldwide.

Since 2007, the CBA has fallen 57%, 25%, 35% and 18%, so let’s concede that history is probably telling us that its share price is not an escalator to infinity.

The easiest reason to predict a CBA share price fall would be a Wall Street crash but I suspect that’s some time off yet, though President Trump’s tariff trade war could be a trigger, especially if China and the EU push back and hit the US with reciprocal tariffs.

I’d be more in the Shane Oliver camp as he can see a 15% sell-off this year but still expects stocks to finish up for the year. The big call merchant, Tom Lee, of Fundstrat Capital thinks any Trump tariff sell-off will be a buying opportunity. I concur with that.

The start of something bad for the CBA and other top 20 stocks that have done well as interest rates rose, could come on Tuesday, when the RBA is tipped to start the rate-cutting cycle. My anti-CBA stance was linked to two issues:

- The share price has spiked too high, and profit-taking will eventually take the price lower.

- The cut in rates should lead to a rotation out of the recent big market gaining stocks in favour of those companies that will be more profitable because of lower interest costs, and because more of their customers can afford to spend.

This is why I expect the EX20 ETF (that holds the stocks numbered 21 to 200 in the S&P/ASX 200 index) to do well as rates come down. In contrast, lower interest rates don’t help the CBA’s bottom line until economic activity starts to boom again, and people want to borrow like there’s no tomorrow.

This what the analysts surveyed by FNArena think about the CBA’s potential: it’s a 35% slide over the year ahead. And here’s the table that shows six out of six analysts say “you’ve ‘gotta’ be a seller!”

All these negative assessments were updated only last week, after Matt Comyn did his show-and-tell as CEO.

Citi is the most committed to trash-taking CBA’s future. The FNArena reporter has summed up Citi’s view on the bank with the following: “The analyst believes the key positive aspects of the results —stable asset quality and strong volume growth— could face greater challenges going forward, and further EPS upgrades are seen as unlikely.

“Citi highlights revenue downgrade risks from funding pressure, increased competition for deposits, and slowing credit growth. Costs and investment spending are guided up by 10%. The analyst lowers EPS estimates by -1% for FY25/FY26 on reduced core earnings forecasts. Sell rated on a challenging valuation, with a $90.75 target price, down from $91.50.”

It’s a long way from the $165 CBA was on Friday to Citi’s call of $90.75, but the smallest drop in share price predicted by the expert-assessors is 23.24% from Morgan Stanley. I think that’s more realistic because a 20% drop is bound to trigger buying, especially from dividend-chasing investors and even big super funds, with their big buying power, which is already partly to blame for the bank’s elevated share price.

Think about it” if they sell out of CBA, where do they go? You could go to BHP and Rio Tinto, but is a miner as reliable an investment as CBA? I don’t think so, and that’s despite I’m going long BHP for the year or so ahead.

Clearly, there’s a case for selling 15% or 20% of CBA to pocket profit, but there’s another case for new investors not buying the bank. It’s forecasted dividend for 2025 is 2.9% and 3% for 2026.

The best term deposit out there is close to 5%, and given the CBA share price is likely to fall by something in the year ahead, which means a capital loss is looming, then a term deposit with say 4.75% and no capital loss looks like a better one-year play than keeping the faith with our beloved CBA.

Also, there’s an old rule of thumb of investing that when the market’s price earnings number (PE) goes over 20, a 5% fixed interest investment, such as a term deposit, looks more attractive.

The CBA’s PE is forecasted to be 27.1 for 2025 and 26.2 for 2026!

I might be wrong on the CBA now. I could be wrong even with the first rate cut hopefully very soon, but once we see a few more cuts, and there’s the Trump tariff fallout or some other market curve ball, I’m certain we’ll see that the bank’s share price “CAN” fall.

And that will lead to the question: When do we buy in again? But that’s a story for another time.