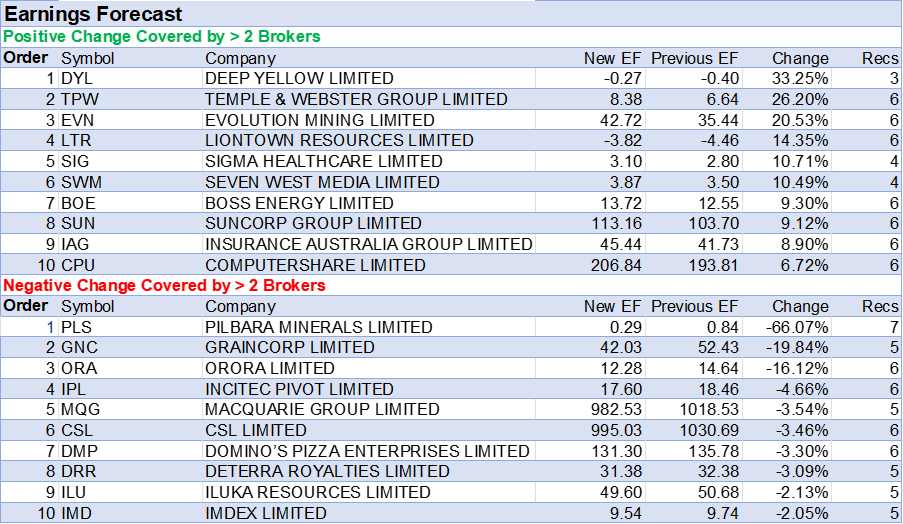

Percentage increases in analysts’ average 12-month target prices and earnings forecasts significantly outpaced declines, as shown in the tables below.

In last week’s update, Sigma Healthcare was highlighted for the largest increase in average earnings forecasts by brokers after management upgraded FY25 normalised EBIT guidance to $64-70m from $50-60m due to an improved operational performance, including strong execution of the new Chemist Warehouse supply contract which commenced on July 1, 2024.

The newly merged Chemist Warehouse and Sigma Healthcare began trading on the ASX last Thursday, ending the week at a market capitalisation of $36bn, up from $4.5bn for standalone Sigma. The combined entity is now the eighteenth largest company on the ASX, when measured by market capitalisation.

After Morgans updated its research for the prior week’s earnings guidance, average earnings forecasts for Sigma rose another 10.7% last week.

Chemist Warehouse shareholders hold approximately 49% of Sigma Healthcare, with shares in escrow until August, when 10% can be released, while the remaining 90% will stay in escrow until August 2026.

Sigma will be re-weighted into the ASX200 and ASX300 indices, and at the March rebalance, Morgans expects it will move into the ASX100 and possibly the ASX50, subject to vacancies, which could drive an additional $280m of demand from index funds.

Appearing ahead of Sigma on the earnings upgrade table below are uranium and lithium exposures Deep Yellow and Liontown Resources, with increases in average forecasts of 33% and 14%, respectively.

For Deep Yellow, the percentage increase was magnified due to the small numbers involved. Prior to management’s final investment decision for Tumas next month, and following an 18% reserve upgrade in December, the analyst at Morgans visited the company’s project in Namibia.

Noting early works are well underway after commencing in late-2024, the broker (Speculative Buy) raised its target to $1.73 from $1.69, after allowing for increased mined inventory following the reserve upgrade.

Reacting to one of the last December quarter operational reports, UBS highlighted management at Liontown Resources exceeded its own production projections, while cost control proved better-than-expected, as the ramp-up at Kathleen Valley tracks ahead of expectation.

After the broker raised its FY25 and FY26 production estimates by 13% and 8%, respectively, and lowered cost forecasts by -26% and -11%, the target was increased to 75 cents from 50 cents and the rating upgraded to Neutral from Sell. A further boost to fundamentals, according to the analysts, is $192m of cash on hand and a further $100m of debt available. Also, spodumene prices are trading better-than-expected.

On the flipside, fellow lithium miner Pilbara Minerals received the largest percentage cut in average earnings forecast by brokers after management pre-announced some outcomes ahead of the 1H result on February 20. While Macquarie trimmed its FY25 EPS estimate by -16%, the analyst’s FY26 forecast increased by 28%.

This broker had just resumed coverage of Pilbara Minerals with a Neutral rating and $2.30 target price, following completion of the Latin Resources acquisition, noting the key asset, Colina in Brazil, will be accretive for net asset value and long-term earnings. Evaluating Pilbara Minerals in the context of its lithium sector peers, Macquarie highlights the underlying asset quality and low risk profile, though acknowledges short-term valuation metrics screen as expensive.

GrainCorp was next with a nearly -20% fall in average earnings forecast after both its trading update and FY25 guidance fell short of consensus forecasts. While the 2024/25 winter harvest volume proved in line with expectations, the anticipated margin increase was not forthcoming, explained Macquarie.

Elevated global grain supply has weighed on margins more than the broker expected. Beyond FY25, the 2025/26 season is firming and the winter harvest profile across the east coast appears much like 2024/2, noted the analyst. Ord Minnett highlighted positives such as strong East Coast crop volumes, strong crush volumes and a recent increase in grain pricing. Orora also had a rough week. First half results missed consensus expectations and management lowered FY25 guidance.

In the good books: upgrades

BRAVURA SOLUTIONS LIMITED ((BVS)) was upgraded to Outperform from Neutral by Macquarie. B/H/S: 2/0/0

Macquarie upgrades Bravura Solutions to Outperform from Neutral, raising the target price to $3.17 from $2.05 due to higher earnings forecasts, lower capex, and improved operating efficiency. The company reported better-than-expected 1H25 revenue, around 5% above the broker’s forecast, which underpinned a 14% beat on earnings before interest, tax, and depreciation (EBITDA), along with a return of capital and dividends announced for 2H25.

The EMEA segment was well ahead of forecasts, while APAC was slightly lower. Cash on hand ended at $151.8m following the Fidelity license sale. Following a FY25 guidance upgrade in November, management further raised revenue guidance by 2.9% at the midpoint and EBITDA by 11.8% at the midpoint. Macquarie lifts EPS forecasts by 25% for FY25 and 9% for FY26.

CAR GROUP LIMITED ((CAR)) was upgraded to Add from Hold by Morgans. B/H/S: 4/2/0

Morgans raises its target for CAR Group to $41.40 from $37.20 and upgrades to Add from Hold following a resilient first-half result, with pro forma revenue growth of 9-30% across key markets. The broker attributes the negative share price reaction on results day to a slight earnings (EBITDA) miss versus consensus and a deferral of a price rise for Trader Interactive in the US.

The 50%-franked interim dividend of 38.5c was in line with consensus, according to the broker. Morgans notes management continues to build the foundations for long-term growth in Australia and internationally.

DOMAIN HOLDINGS AUSTRALIA LIMITED ((DHG)) was upgraded to Buy from Hold by Bell Potter. B/H/S: 2/3/1

Bell Potter raises its target for Domain Holdings Australia to $3.30 from $3.20 and upgrades to Buy from Hold after a 27% increase in adjusted EPS in H1, beating market expectations. Management also slightly raised the outlook for FY25 listings. Listings and controllable yield growth of 5% and 8%, respectively, generated a residential revenue increase of 12%, in line with the broker’s forecast. A flat 2 cent fully franked interim dividend was declared. While early days, Bell Potter suggests Domain may be at the start of a consensus earnings upgrade cycle.

DOMINO’S PIZZA ENTERPRISES LIMITED ((DMP)) was upgraded to Neutral from Underperform by Macquarie. B/H/S: 1/5/0

Macquarie raises its target price for Domino’s Pizza Enterprises to $35.10 from $28.20, driven equally by higher earnings forecasts and a lift in the assumed terminal growth rate. The rating is upgraded to Neutral from Underperform. The broker attributes these changes to a rapid strategic turnaround, with management refining its focus on franchisee sales and long-term network performance.

A minimum of $34m per annum in network savings has been identified, with proceeds set to be reinvested into franchisees, according to the broker. Management sees little risk of further store closures beyond the approximately 200 already announced.

IMDEX LIMITED ((IMD)) was upgraded to Neutral from Sell by Citi. B/H/S: 1/4/0

Citi upgrades Imdex to Neutral from Sell, raising the target price to $2.85 from $1.95 following the 1H25 earnings report. Citi believes Imdex delivered a “resilient” 1H25 result, with earnings before interest, tax, and depreciation slightly above expectations. The analyst highlights a higher percentage of R&D was capitalised. Despite a soft backdrop in global exploration levels, the company generated a better-than-expected APAC result with improved margins well above estimates, leading to stronger-than-expected earnings before interest, tax, and depreciation.

Sensors and SaaS via the digital service showed good top-line growth. The broker notes the decline in revenue for the period as a negative, and cash conversion was lower than forecast. Management does not provide guidance, but Citi explains sustained activity levels were flagged for the remainder of FY25, while industry sentiment was highlighted as improving and exploration levels are expected to turn in FY26. Citi slightly raises earnings forecasts on better margins and a more positive business mix, with improved cost efficiency from management.

JB HI-FI LIMITED ((JBH)) was upgraded to Hold from Lighten by Ord Minnett. B/H/S: 2/3/2

Ord Minnett upgrades JB Hi-Fi to Hold from Lighten and raises the target price to $89 from $85 following the 1H25 earnings report. The broker believes the strong results contrast with the challenging market conditions described by management, attributing the performance to good cost management and market share gains. Same-store sales growth in January has been strong. Ord Minnett lifts the forecast fully franked dividend per share to 310c from 280c. The fall in the stock price post-result makes the valuation more appealing, leading to the rating upgrade, the broker explains. See also JBH downgrade.

LIONTOWN RESOURCES LIMITED ((LTR)) was upgraded to Neutral from Sell by UBS. B/H/S: 1/4/1

UBS highlights Liontown Resources’ December quarter production was ahead of its own projections and costs were better than expected as the ramp-up at Kathleen Valley tracks ahead of expectation.

The broker has now raised FY25 and FY26 forecasts on increased confidence, lifting production estimates by 13% and 8%, and lowering costs by -26% and -11% respectively.

Additionally, the broker reckons the company funding looks more comfortable with $192m cash, a further $100m debt available, the ramp-up progressing well and spodumene prices trading better than expected. Target price rises to 75c from 50c. Rating upgraded to Neutral from Sell.

NEWS CORPORATION ((NWS)) was upgraded to Accumulate from Hold by Ord Minnett. B/H/S: 4/0/0

Ord Minnett upgrades News Corp to Accumulate from Hold with a new target price of $61 from $50. The analyst notes the company recorded a robust 4Q 2024 while offering what is described as a mixed outlook for 2H25. Ord Minnett expects the US realty portal to benefit from a recovery in the property market at some stage. Book publishing is anticipated to generate ongoing earnings growth in 2H25, though at a weaker clip than 1H25, while Dow Jones is expected to have more robust earnings due to improved business-to-business results, the broker states.

New media could be more challenging due to weakness in advertising across Australia and UK markets. The broker lifts EPS estimates by 2% and 8% for FY25/FY26, respectively. Ord Minnett also increases the target price for REA Group to $260 from $240 post the earnings results.

PRO MEDICUS LIMITED ((PME)) was upgraded to Buy from Hold by Bell Potter. B/H/S: 2/2/2

Despite first half misses for revenue and earnings against consensus expectations, Bell Potter raises its target for Pro Medicus to $330 from $260 and upgrades to Buy from Hold. The broker prefers to focus on the ten contract wins in the last 12 months and upgrades its FY25 and FY26 revenue forecasts by 4% and 2%, respectively. The analysts highlight demand for Visage is increasing despite price rises and an influx of approvals of AI tools in the radiology space, which have little/no reimbursement. The recent Australian dollar slide is expected to add around $6m to FY25 revenues, and Bell Potter expects more contract wins shortly, based on the strong pipeline.

SOUTH32 LIMITED ((S32)) was upgraded to Buy from Neutral by Citi. B/H/S: 6/0/0

Citi assesses a solid performance, though cost pressures remain, in South32’s 1H25 results. Earnings (EBITDA) of US$375m were in line with consensus but beat the broker’s forecast of US$322m.

FY25 production guidance was largely unchanged, but unit cost guidance was raised.

Group net debt decreased by -US$715m to US$47m due to the sale of metallurgical coal, offset by Hermosa capex, including a $267m build in working capital.

Positively, the broker notes cash generation rose with an unwinding of working capital and reduced open positions on increased production. The buyback was extended, with news on exiting Cerro Matoso.

The broker upgrades the stock to Buy from Neutral, lifting the target price to $4 from $3.90, highlighting investors should focus on FY27 and increased production, with Citi forecasting an FY27 copper price of US$4.76/lb.

SCENTRE GROUP ((SCG)) was upgraded to Neutral from Sell by UBS. B/H/S: 3/2/0

UBS has lifted Scentre Group’s earnings forecasts by an average 6% for FY25-30 after incorporating a -25bps rate cut in 1H25 and 4% from 2H25 onwards, and refinancing the hybrid notes, assuming a 230bps margin with the full $4bn reset over a 2.5yr period.

The broker has upgraded Scentre to Neutral from Sell, reflecting more resilient retail conditions vs its previous expectations and debt cost tailwinds.

Target price rises to $3.74 from $3.53.

In the bad books: downgrades

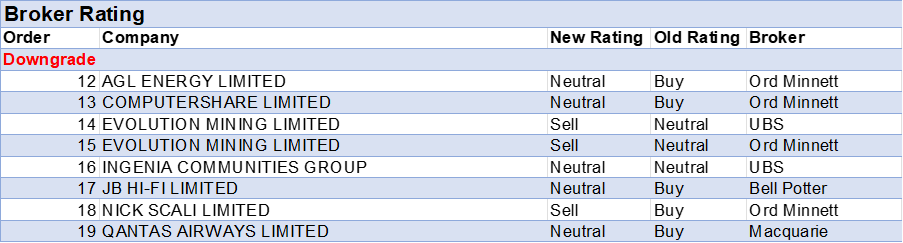

AGL ENERGY LIMITED ((AGL)) was downgraded to Hold from Accumulate by Ord Minnett. B/H/S: 2/2/0

Ord Minette notes AGL Energy’s 1H25 net profit was well ahead of market expectations, driven by wider margins. The interim dividend met the consensus forecast.

The company tightened FY25 earnings guidance as strong customer market margins are expected to erode in 2H, interest costs increase, and D&A charges drag on the bottom line. The broker expects these drivers will likely spill into FY26.

Following the result, the analyst cut both FY26 and FY26 EPS estimates by -3%. Target price lowered to $11.0 from $11.2, and rating downgraded to Hold from Accumulate.

COMPUTERSHARE LIMITED ((CPU)) was downgraded to Hold from Accumulate by Ord Minnett. B/H/S: 0/6/0

Ord Minnett notes Computershare’s 1H25 earnings and interim dividend were ahead of market forecasts, as increased transaction revenue more than offset higher interest charges and operational expenses.

The company upgraded its FY25 EPS growth guidance to 15%, on increased margin income from higher client balances, a lower tax rate and the completion of its share buyback.

The broker upgraded EPS forecasts by 7% across the FY25-27 horizon. This pushed the target price higher to $42.00 from $36.25 but the rating is downgraded to Hold from Accumulate on valuation grounds.

EVOLUTION MINING LIMITED ((EVN)) was downgraded to Lighten from Hold by Ord Minnett and Downgrade to Sell from Neutral by UBS. B/H/S: 1/2/2

Ord Minnett notes Evolution Mining capped off a strong 1H25 with net profit beating its forecast by 6% and consensus by 20%. Interim dividend of 7c beat the consensus of 5c but missed the broker’s 8c forecast.

The broker sees potential capex risk associated with Ernest Henry Mining extension and Open Pit Continuation project and increases its capex assumptions for FY26-27 to better align with management commentary.

Target price lowered to $5.30 from $5.35, and rating downgraded to Lighten from Hold on stretched valuation.

UBS raises its target for Evolution Mining to $5.45 from $5.40 following 1H results and downgrades to Sell from Neutral as the share price has surged ahead of the broker’s valuation.

The analyst describes 1H earnings (EBITDA) of $985m as a “decent beat”, and while profit was also stronger-than-expected some accounting changes contributed.

The 7 cent interim dividend beat expectations held by the broker and consensus.

As Evolution’s copper production dilutes gold leverage, the broker suggests Northern Star Resources ((NST)) and Newmont Corp ((NEM)) currently offer better exposure to higher gold prices.

INGENIA COMMUNITIES GROUP ((INA)) was downgraded to Neutral from Buy by UBS. B/H/S: 2/1/0

UBS downgrades Ingenia Communities to Neutral from Buy with a higher target price of $6.15 from $5.79. The downgrade is due to strong share price performance.

The analyst anticipates an increase in volumes in FY25 following more normal production and additional sites becoming available. Robust growth in manufactured housing estates is flagged, with new unit demand outpacing supply, UBS explains.

The broker raises EPS estimates by 16% and 11% for FY25/FY26, respectively. While the market is anticipating earnings upgrades, the analyst believes attention should be focused on any cyclical uplift in the housing market post rate cuts and improved operational efficiency.

Neutral. Target $6.15.

JB HI-FI LIMITED ((JBH)) was downgraded to Hold from Buy by Bell Potter. B/H/S: 2/3/2

Bell Potter notes JB Hi-Fi’s 1H25 revenue and net profit after tax were better than expected, alongside a robust trading update for January, including like-for-like sales growth of 7.1% for JB Hi-Fi Australia, 10% for NZ, and 5.9% for The Good Guys.

Accounting for an increase in revenue growth assumptions, the analyst lifts net profit after tax forecasts by 2.8% and 3.8% for FY25 and FY26, respectively.

Bell Potter downgrades the stock to Hold from Buy due to the current valuation. Target price lifts 1% to $99.

See also JBH upgrade.

NICK SCALI LIMITED ((NCK)) was downgraded to Sell from Accumulate by Ord Minnett. B/H/S: 2/0/1

Ord Minnett downgrades Nick Scali to Sell from Accumulate due to valuation concerns and lowers its target price to $14.50 from $15.

The analyst notes the company announced better-than-consensus 1H25 earnings and dividend per share, with higher-than-forecast results from Australia.

Deeper investigation suggests to the broker the company experienced a softer order book in 2Q25 and into January. Ord Minnett now forecasts revenue to fall in 2H25 by -6%, from previous growth of 6%.

Management pointed to ongoing volatility in 2H25, with higher-than-expected losses in the UK due to more refurbishments and new store openings.

Ord Minnett lowers EPS forecasts by -12% and -5% for FY25 and FY26, respectively.

QANTAS AIRWAYS LIMITED ((QAN)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 2/4/0

Macquarie downgrades Qantas Airways to Neutral from Outperform, raising the target price to $9.30 from $8.40.

Qantas is expected to report a strong 1H25 result, up around 21%, the broker explains, with tailwinds from lower oil prices, a buyback, and “optimal” load factors.

Trends from 2H24 are anticipated to continue, including Jetstar leading capacity growth in both domestic and international segments.

Macquarie expects load factors to reach 1H19 levels of around 80% for Qantas and 89% for Jetstar, maximising the return on assets.

The outlook for FY26 is tempered by currency headwinds and yield pressures from Europe and US routes, the analyst believes. The broker lowers the FY25 EPS forecast by -0.9% and raises FY26 by 1.1%.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.