Before Friday’s revelation about a new Coronavirus variant spooked our stock market along with Asian counterparts, ahead of putting the frighteners on European, UK and then US markets, the big stock issues were interest rates, who was the next Fed chairman, and rising oil prices.

Also, earlier in the week, Reuters had reported that shares in Apple rose after JP Morgan flagged possible improvements to the supply of the iPhone 13 in the coming months.

Things were chugging along nicely until Covid reality started biting and we all became poorer. And it will get worse next week. The only positive I can see is that Wall Street didn’t get as scared as EU markets, which were down about 4%!

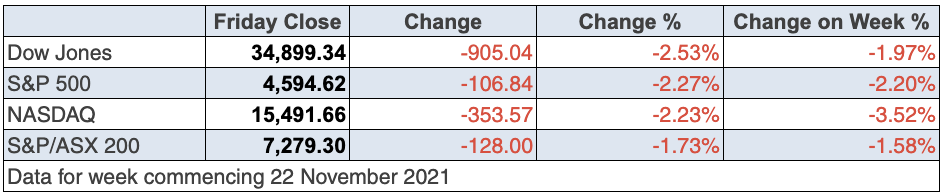

It was also a shorter trading day in the US as they closed early for Black Friday (the shopping day after Thanksgiving) but it was the worst trading day of the year, with the Dow Jones off 905 points or 2.53%!

This half-day might prove a plus as the trading may have controlled the knee-jerk reaction to the news that the UK was suspending flights from six countries in southern Africa and a new threat to global economic normalcy was on the way. “The new Covid variant has more than 30 mutations to the spike protein, according to South African scientists, and the WHO is holding a special meeting Friday to discuss what it may mean for vaccines and treatments,” CNBC reports. “Cases have so far been reported in South Africa, Botswana, Israel, Hong Kong and Belgium.”

And what will hurt stocks next week is the fact the medical experts say it will take weeks to understand how this variant will impact diagnostics, therapeutics and vaccines.

Travel-related stocks were clobbered and so were energy shares with the likelihood of reduced global demand meeting the fact that US President Joe Biden had encouraged other countries to join him in releasing emergency stockpiled oil to offset rising oil prices. “Oil prices plunged about $10 a barrel on Friday, their largest one-day drop since April 2020,” Reuters reported. “Brent crude fell $8.62, or 10.5%, to $73.60 a barrel”.

To understand the real-world implications, which has to mean more lockdowns and restrictions if this variant isn’t handled well, consider this from Reuters: “Drug makers Pfizer and BioNTech said, if necessary, they would be able to redesign their shot within 6 weeks and ship initial batches within 100 days”.

That’s a quarter of a year that would undoubtedly stretch out to half-a-year and is now making Dr Phil Lowe and his “rates won’t rise until 2024” more of a chance. And yep, bond yields tumbled. And yep, Zoom Video Communications was up 5.72% overnight!

It’s back to the future next week while the market scrambles for beneficiaries of lockdowns!

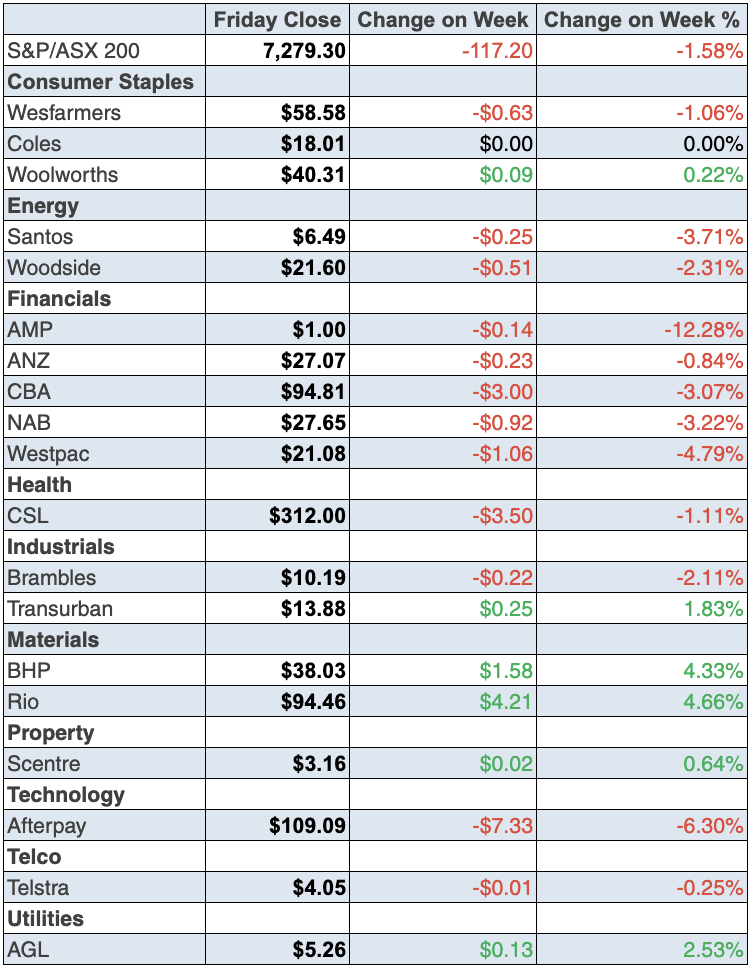

To the local story and it looks like the local stock market has been captured by every negative headline the world’s media can dream up, but the thought of another variant lockdown clobbered our market yesterday. “The Australian share market receded on Friday after the detection of a new COVID-19 variant triggered a wave of panic selling in Dow Jones futures and spread to other stock markets,” the AFR’s Cecile Lefort reported. “The S&P/ASX 200 dropped 1.7 per cent, or 128 points, to 7279.3 ending the week 1.6 per cent lower in its third consecutive week of losses.”

S&P/ASX 200

The South African variant infected Dow futures and our market took the negative bait and went for it! The five-day chart showed we tried to get positive but that SA news was too much.

Clearly, anything spooks us about world tourism, as another pesky variant on the Coronavirus is not great for travel stocks. But remember, the sellers are those who have to show results on a short-term basis. The longer-term players can buy and wait, which is what I will be doing some time in the not-too-distant future.

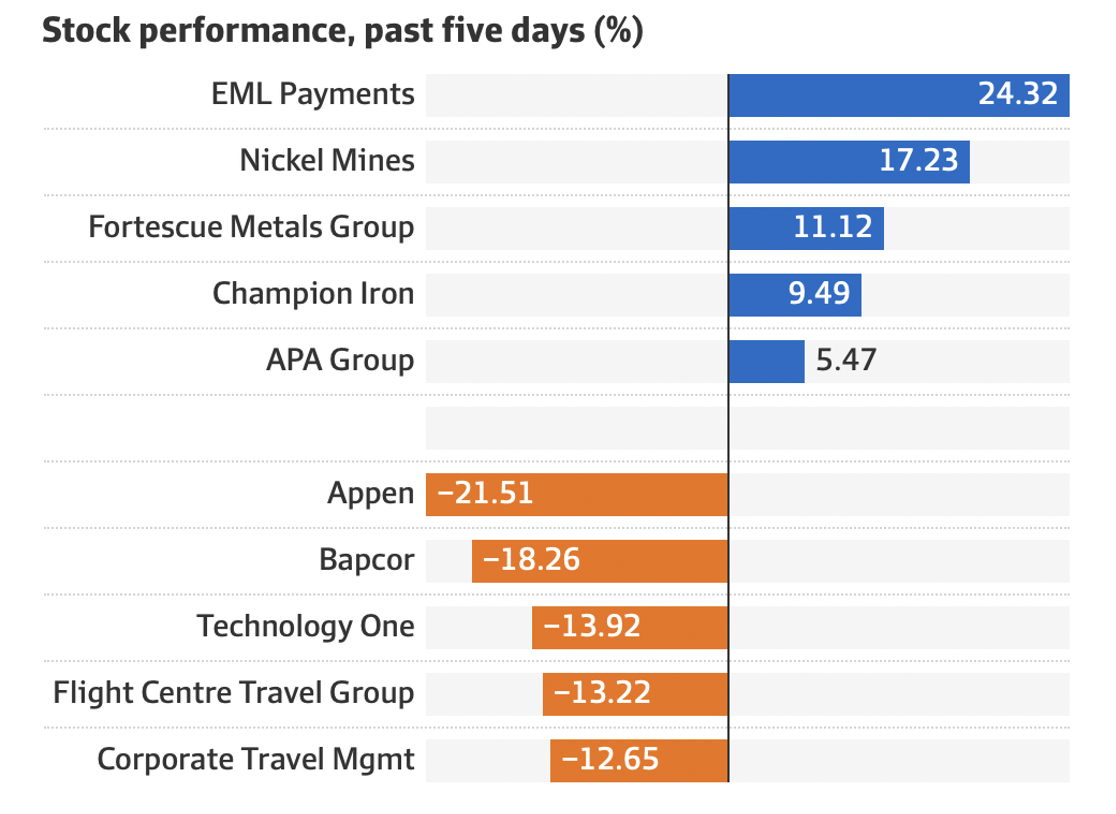

To the winners and the losers, and it was good to see the Irish central bank cut EML some slack. Anyone holding the stock should see my interview with Ron Shamgar of Tamim Asset Management on my Switzer Investing program.

Copping it this week was tech stock Appen, with Macquarie speculating that a downgrade is in the wings. While that is speculation, the company is its own worst enemy not keeping the market informed. The consensus of analysts still say they expect 35% upside — let’s hope the majority is right or the CEO could be looking up Seek’s website soon!

Source: Bloomberg

If you hold Webjet, the Switzer Investing program provides you with some great insight after my interview with the MD of the company — John Guscic.

I actually asked him about his company’s preparedness for more Covid challenges, though I’m not sure if he was ready for the news out of South Africa.

The stock was off 5.14% on Friday to $5.35, like Qantas, which slipped 5.48% to $5.

For the week, our banks were lower, with the CBA off 3.08% to $94.81, Westpac down 4.44% to $21.08, ANZ down 0.51% to $27.07, while NAB lost 3.62% to $27.65.

During the week I talked to NAB’s CEO Ross McEwan, who’s very confident his bank is on a positive roll, which conforms to our house view here at Switzer. But it was good to see Ross so bullish on his company’s future.

What I liked

- The weekly ANZ-Roy Morgan consumer confidence rating rose by 1.3% to 107.4.

- Retail trade rose by 4.9% in October (survey: 2.2%) to be up 5.2% on a year ago.

- The preliminary IHS Markit Australia Composite Purchasing Managers’ index (PMI) rose from 52.1 in October to a 5-month high of 55 in November. A reading above 50 indicates an expansion in activity.

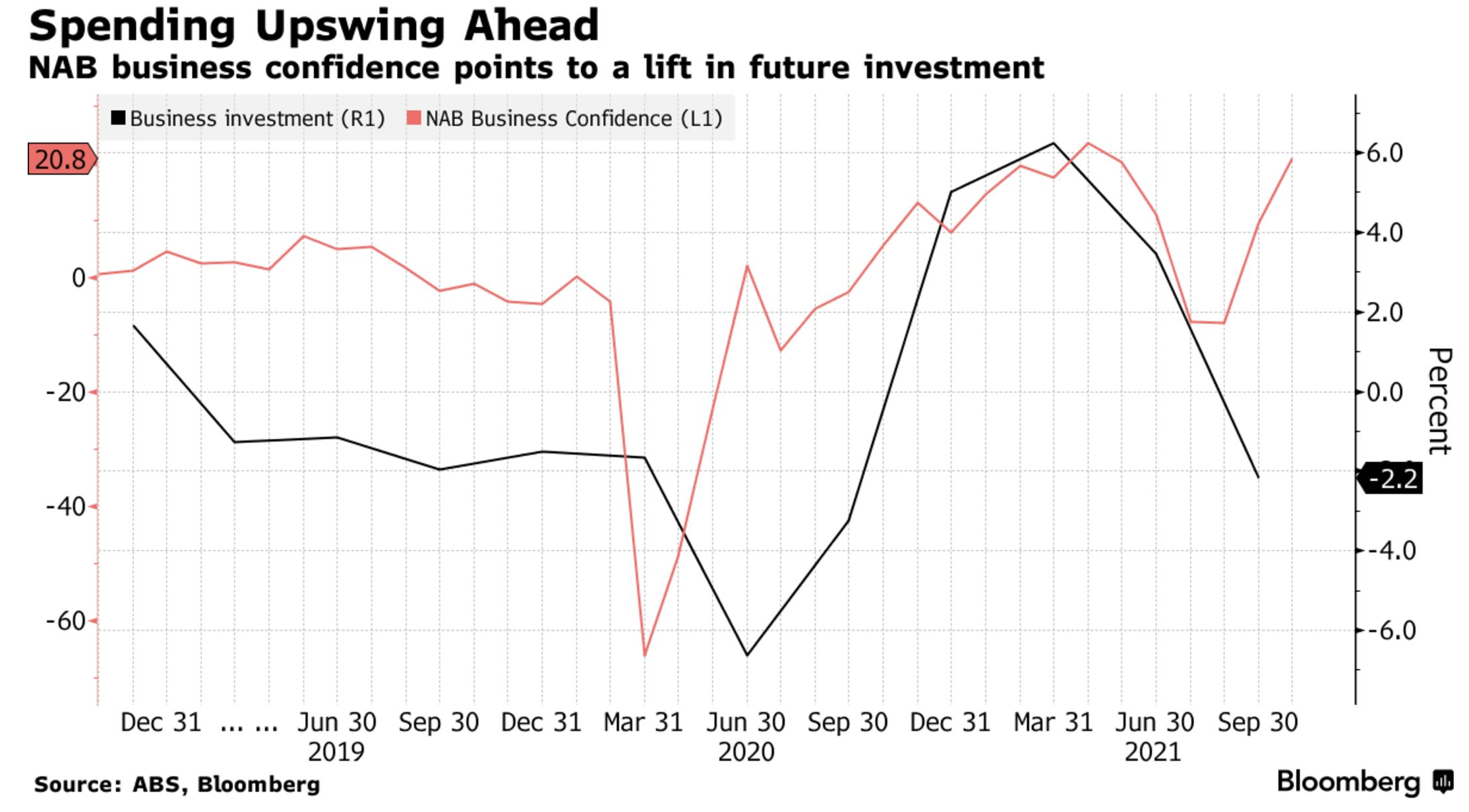

- Plans to invest are strong, with the fourth estimate of expected investment in 2021/22 coming in at 19.7% higher than the equivalent estimate for 2020/21 – the biggest lift in a decade.

- The value of construction work done fell by 0.3% in the September quarter but that was lockdown affected. Importantly, construction was up by 3.5% on a year ago – the strongest annual growth rate in 3½ years.

- The value of alterations and additions (renovations) rose by 5.6% in the September quarter to be up 18.8% over the year. The value of renovation work hit a record-high $2.91bn.

- The Markit purchasing managers index (PMI) for manufacturing in the US rose from 58.4 to 59.1 in November (survey 59).

- Personal income in the US grew 0.5% in October (survey: 0.2%), with spending up 1.3% (survey: 1%).

- The Chicago Federal Reserve national activity index rose from -0.13 to 0.76 in October.

What I didn’t like

- The Australian Bureau of Statistics (ABS) said new business investment (spending on buildings and equipment) fell by 2.2% in the September quarter – the first fall in a year, but you have to blame the lockdowns.

- The cost of investment goods rose 1.6% in the quarter – the biggest rise in 12 years and you can blame supply chain problems linked to Covid for that.

- The US economy grew at a 2.1% annual rate in the September quarter (survey: 2.2%). I would’ve liked it stronger.

- Minutes of the last Federal Reserve Open Market Committee meeting indicated that participants judged that inflation pressures could take longer to subside than they’d previously assessed but participants generally saw inflation to be driven by factors that were likely to be transitory, which is a plus.

- Shares in US retailer Gap (-24.1%) and Nordstrom (-29%) fell, after noting supply chain issues.

The big stories ahead

Next week the impact of potential lockdowns, restricted travel and supply problems will dominate analysis and stock-trading as the seriousness of this variant, how quickly drug companies can respond and what governments might decide about restrictions will hit many stocks, while others will be beneficiaries. As I’ve already said: “It’s back to the future!”

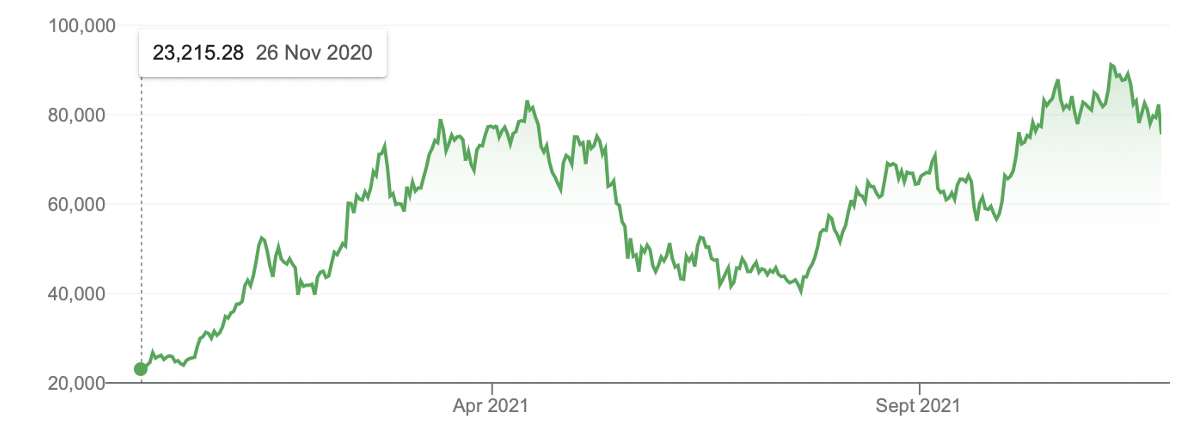

The short-term story is hard to work out but the long-term play says some great companies will get cheaper next week and will be attractive to the patient investor. And speculator playthings like cryptocurrencies will cop it, short term. Bitcoin was down 7.65% overnight to $75,958 but is up, wait for it, 227% for the year!

Bitcoin (AUD)

The week in review:

- This week in the Switzer Report, I look at the fundamentals of what makes 2022 a good year for Australian stocks, such as how the economic activity tracker shows our economy climbing on a U-turn uptrend, and that “We’re up about 3.7% from our pre-pandemic peak while the Yanks are up 38%! I think we should play catch up with room to move higher over 2022”.

- While a larger proponent of investing in individual stocks, Paul Rickard acknowledges the merit of index or ETF investing for many retail investors. As such, he breaks down the ideal ETF allocation using something called the ‘core and satellite’ approach. Later in the week, Paul addressed the intricate topic of bond yields and their effect on share prices, specifically in the tech sector which is impacted heavier as their growth is projected by future earnings.

- James Dunn delves into a sector that seems to be on everyone’s radar at the moment, especially post the COP26 climate conference earlier this month. And that sector is none other than hydrogen. His article outlines some solid stocks and ETFs for investors looking to gain exposure in this sector.

- While not as alluring to investors in today’s economic climate compared with sectors such as lithium, BNPL or semiconductors, Tony Featherstone argues that Australia’s lifestyle community sector is one of the most important plays for investors given our ageing population that will be entering retirement by the busload over the next decade. He lists 4 lifestyle community stocks that could thrive in this demographic shift.

- In our “Hot” stocks segment this week, Raymond Chan of Morgans analyses a fast-growing Australian tech company, data centre operators NEXTDC (NXT), while Managing Director at Fairmont Equities, Michael Gable looks at the current buying opportunity being presented by Mineral Resources Limited (MIN).

- This week in Buy, Hold, Sell – What the Brokers Say, there were five upgrades and three downgrades in the first edition, and the second edition saw APA Group (APA) receive an upgrade, while Bapcor Limited (BAP) and Technology One Limited (TNE) both copped downgrades.

- In Questions of the Week, Paul answers your questions on Aurizon (AZJ), the current difficulty of finding solid stocks in Australia’s infrastructure sector, and Macquarie Group’s (MQG) Share Purchase Plan.

Our videos of the week:

- Is it time to buy BHP, CBA, TYRO, Z1P, Lend Lease, Lynas, and Mike Gable’s hot pick?

- MD of Webjet thinks his company will fly + how to invest in bitcoin on the cheap & why EML soared

- How did Joe Biden KO tech stocks + has BHP made Woodside a big big big buy!? | Mad about Money

- Dr Ross gives us his insight on genes | The Check Up

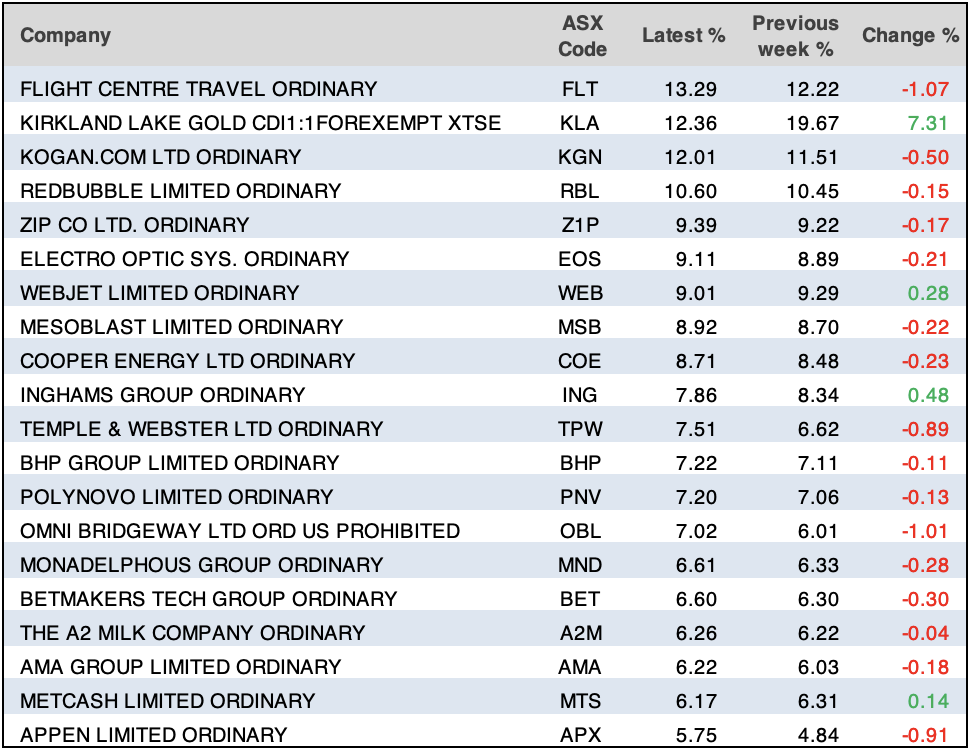

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday November 29 – Business Indicators (September quarter)

Tuesday November 30 – Balance of Payments (September quarter)

Tuesday November 30 – Building approvals (October)

Tuesday November 30 – Speech by Reserve Bank official

Tuesday November 30 – Private sector credit (October)

Wednesday December 1 – CoreLogic Home Value Index (November)

Wednesday December 1 – National accounts (September quarter)

Wednesday December 1 – Purchasing manager indexes (November)

Thursday December 2 – International trade (October)

Thursday December 2 – Lending indicators (October)

Thursday December 2 – Retail trade (October)

Overseas

Monday November 29 – US Pending home sales (October)

Tuesday November 30 – US Consumer confidence (November)

Tuesday November 30 – US House price indexes (September)

Tuesday November 30 – China Purchasing manager indexes (November)

Wednesday December 1 – China Caixin purchasing managers index (November)

Wednesday December 1 – US ADP private sector payrolls (November)

Wednesday December 1 – US Purchasing managers indexes (November)

Wednesday December 1 – US Federal Reserve Beige Book

Thursday December 2 – OPEC+ oil ministers meet

Thursday December 2 – US Challenger job cuts (November)

Friday December 3 – US Non-farm payrolls (November)

Friday December 3 – US Purchasing managers indexes (November)

Friday December 3 – China Caixin services index (November)

Food for thought: “The ultimate resource in economic history is people. It is people, not capital or raw materials that develop an economy.” — Peter Drucker

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

Further to my article this week heralding some positive markers for a strong 2022 for the Australian economy, the Bloomberg chart below shows investor sentiment on the rise as businesses across all sectors begin to ramp up spending despite a drop in the September quarter. This is on the back of data from the Australian Bureau of Statistics that reveals firms intend to invest $138.6bn in the twelve months through June 2022, a 10% increase on actual spending a year earlier. “The result is likely to boost the Reserve Bank of Australia’s confidence in the economy’s prospects as the board prepares to review the A$4 billion weekly pace of its bond-buying program in February,” Bloomberg reports. The ABS releases its third-quarter gross domestic product data next Wednesday.

Top 5 most clicked:

- Stocks for 2022 – Peter Switzer

- How to target above market returns using a portfolio of ETFs – Paul Rickard

- Hydrogen stocks & ETFs – James Dunn

- “HOT” stocks: NEXTDC (NXT) – Maureen Jordan

- 4 lifestyle communities stocks – Tony Featherstone

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.