Interest rates are in the news again. If not in Australia, at least in the US, where they are being “blamed” for a sell-off in tech stocks. And it is not the first time they have been labelled as the culprit – whenever the tech sector has a small hiccup, it is put down to a rise in interest rates or more specifically, the yield on the ’10 Year US Treasury Bond’.

But why should higher interest rates impact tech and other growth stocks?

Firstly, a historical perspective on interest rates in the US. The chart below shows the yield on the US Treasury 10 Year Bond (the benchmark long term interest rate) over the last 50 years. From a high of over 15% in the early 1980s when stagflation was the major concern to a low of just over 0.5% mid last year at the depths of the Covid-19 pandemic.

US 10 Year Treasury Bond – 1971 to 2021

Source: Trading Economics

But as the chart shows, interest rates have been rising over the last 15 months. On Wednesday, the 10 year yield was around 1.64%. The latest rise follows the reappointment of Federal Reserve Chairman Jerome Powell over the other leading candidate, Lael Brainard.

Powell is viewed by the market as more “hawkish” than the very “dovish” Brainard, meaning that the tapering of the Federal Reserve’s bond buying program could potentially be accelerated and certainly, not slowed down.

Tapering is the policy of unwinding the purchases of US Treasury Bonds and mortgage backed securities made by the Federal Reserve since the outbreak of Covid-19. The US Government’s massive budget deficit has essentially been funded in part by its own Central Bank (the Fed) financing it and buying bonds. Call it “money printing”, when it stops, other investors will have to be found to buy treasury bonds and in anticipation, the market has sold off to make the existing bonds cheaper (higher yielding).

So, what has this got to do with tech stock share prices?

Theoretically, buying a share in a company is buying an earnings stream. No one expects the company to be wound up, so the amount you pay for a share is the value of what it is expected to earn in the future and pay back to shareholders in dividends and capital returns.

When interest rates were higher and inflation was a concern, everyone understood that $100 today wouldn’t buy the same amount of goods in five years’ time. Speak to anyone responsible for the grocery shopping and they will tell you that over time, prices go up. Looking at it the other way, what you can buy today for $100 would have cost a lot less a decade ago (perhaps $70).

Future earnings, which is what we pay for when buying a share, need to be discounted to get an equivalent amount of “today’s dollars”. This is done using an interest rate, most typically the 10 Year Treasury Bond.

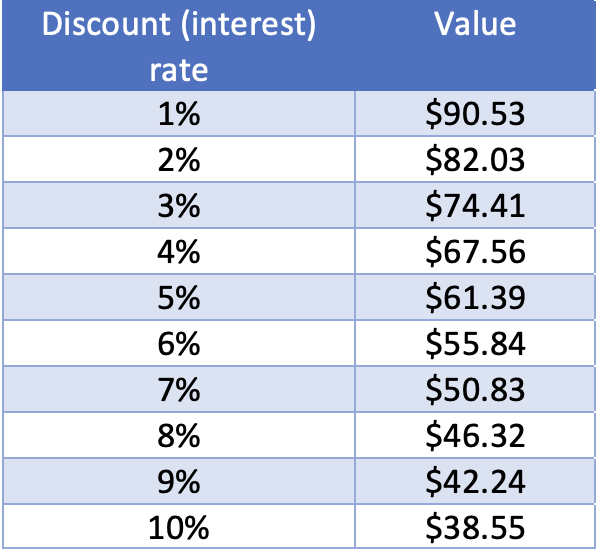

Let’s see how interest rates impact “today’s value”. The table below shows the impact of discounting $100, to be received in 10 years’ time, at interest rates from 1% to 10%.

Value today of $100 to be received in 10 years

So if interest rates (bond yields) rise, from first principles, companies are worth less. That’s the theory, at least. If the discount rate is 1%, $100 in 10 years’ time is worth $90.53 today. If the discount rate is 2%, it drops to $82.03. If it is 10%, it is worth just $38.55 today.

Looking at tech companies, they are impacted more than other companies because more of their “value” is in the future. Many aren’t making a profit now or only a small profit, reinvesting what they earn back into the business. They are growing customers and revenue, and as they develop scale and reach critical mass, should be able to rapidly increase their earnings.

Compare this to traditional “blue chips” such as a bank or seasoned industrial company. Revenue growth is low, earnings growth is low, but there is a higher degree of certainty over its delivery. In a valuation sense, the earnings are sooner rather than later.

In “today’s dollars”, $100 in one years’ time is worth more than $100 in two years’ time which is worth more than $100 in three years’ time. So when interest rates go up, tech and other growth companies get hit harder (in a valuation sense) because more of their earnings are further away.

There is one important caveat to this. If due to inflation companies can increase prices and earnings (inflation is often the cause of higher interest rates), they may not be badly impacted – if impacted at all.

While this is the theory, markets aren’t rational and rarely take too much notice of “first principles” when it comes to stock prices. It is just as likely that a drive for rotation (from a very “hot” tech sector to other “cheaper” sectors) was the catalyst for the sell-offs. However, there is a basis for the behaviour, so if bond yields rise materially in the short term, expect more wobbles with tech and other growth companies.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.