After a nice comeback for stocks after a mid-week sell-off following a worse-than-expected Consumer Price Index on Tuesday in the US, Friday’s trade on Wall Street and the Nasdaq’s Times Square building, went negative on a bigger-than-tipped Producer Price Index (PPI).

That said, US market indexes tried to shake off the negativity in late trade, underlining how the consensus believes being long stocks in 2024 isn’t a dumb play. And while I agree, only time will tell.

For the record, as Reuters reported: “In the 12 months through January, the CPI increased 3.1% after advancing 3.4% in December. Economists polled by Reuters had forecast the CPI would gain 0.2% on the month and rise 2.9% on a year-on-year basis”.

That monthly gain was a bigger 0.3% and while it was a small miss in the scheme of statistical things, it led the market to presume that the news would mean the Fed would cut interest rates later and there would be less this year. “Progress towards the central bank’s inflation target of 2% is ongoing, but challenges remain, particularly the so-called ‘last mile problem,’” said Sung Won Sohn, professor of finance and economics at Loyola Marymount University (Los Angeles) and chief economist of SS Economics.

He also made the point on CNBC that the Fed “faces a challenging task in balancing economic growth and employment while trying to control inflation.”

This all speaks to delays in the arrival of rate cuts and the PPI figures haven’t made it easier for the US central bank.

The measure of wholesale prices or what prices producers receive for their domestic goods and services, rose 0.3% for the month, and this proved to be the biggest move since August.

And it surprised economists surveyed by Dow Jones, who’d been looking for an increase of just 0.1% after the PPI actually dropped 0.2% in December.

So, why has the stock market bounced back this week? Well, I’m sure there are a lot of committed share players (both professional and retail) who think we’re in a “buying the dip” situation as I argued last week. And this is a good play, provided the Fed gets past the “last mile” challenge of getting inflation down to its target of 2%.

If this last 1.1% becomes a stubborn roadblock to rate cuts in the US, a more sustained sell-off will be driven by short-term players, such as fund managers, who can’t afford to be wrong and losing money for too long.

On the other hand, more long-term players will have an opportunity to buy good quality stocks at better prices until inflation gives in and the 2% goal looks to be on the horizon.

I suspect US inflation readings will resume their falls, remembering that the annual increase in consumer prices has moderated from a peak of 9.1% in June 2022, and this explains the resumption of US stock market optimism in 2023.

This chart of the Dow Jones clearly shows that surge in positivity for shares last year, which has been a little more muted in 2024.

So, data-watching of all numbers that give us an insight on what’s happening to US and local inflation will remain the main game for stocks, especially as reporting season in the US has been better than what was predicted by experts.

AMP Capital’s chief economist Shane Oliver reported the following on Friday: “Around 80% of US S&P 500 companies have now reported December quarter earnings with 78% coming in better than expected, which is above the norm of 76%. Earnings growth for the quarter is running around +9.4% year on year, which is well up from consensus expectations for 4.3% growth at the start of the reporting season.”

Meanwhile I liked the fact that this S&P 500 rise is now extending to other stocks and not just the Magnificent Seven — Alphabet, Apple, Amazon, Meta, Microsoft, Nvidia and Tesla. Over this week, 53 companies in the Index hit new 52-week highs, which is a good sign that this rally is broadening. I’ve regularly argued that 2024 should be a year where many companies play catch-up on the Magnificent Seven as falling interest rates make many de-loved and smashed share price companies, re-loved.

All we need is US inflation to resume its downward trend.

To the local stock market, and the S&P/ASX 200 Index crawled off the canvas after a shocker of a sell-off on Wednesday, to add 0.18% for the week, to finish at 7658.30, which is a 0.4% rise year-to-date. However, you have to like the 4.2% bounce from Thursday that vindicates my call last week that sell-offs should be looked at as a buying opportunity.

While the week might have been tough, it was good to see iron ore miners and lithium producers play starring roles on the market on Friday.

BHP rose 0.97% to $45.61, as iron ore prices kicked, but I liked more the spike for lithium producer Mineral Resources, which added 4.6% to $59.75. But trumping the latter was Pilbara Minerals, up 7.23% to $3.71.

Meanwhile, Chalice Mining (CHN) benefited from nickel being placed on the government’s critical minerals list, which the AFR says might mean these “miners may be eligible for financial support”. CHN was up 6.73% for the week to $1.11.

Meanwhile, insurers QBE and IAG Ltd both fell after missing analysts’ profit forecasts. QBE lost 1.7% to $16.11 and IAG dropped 3.8% to $6.08, the AFR reported.

And once much-loved Pro Medicus lost 7.2% on Friday to $87.24, taking its two-day fall to 19.3% since its profit result. That surprise will be looked at my TV Show on Monday.

What I liked

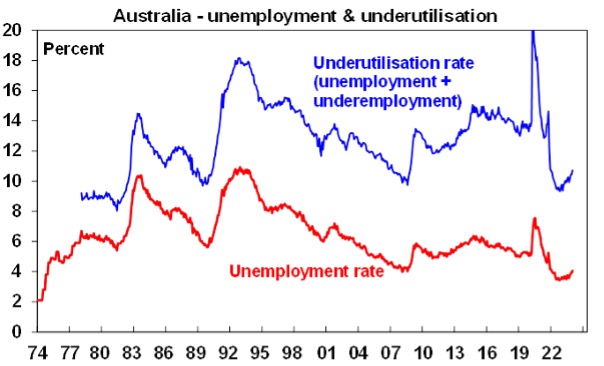

- Australian jobs data in January was soft with close to zero new jobs and unemployment rising to 4.1%, which is above 4% for the first time in two years, and labour underutilisation rising to 10.7%.

- US January retail sales fell sharply both in headline terms and after excluding autos and gasoline but may have been impacted by bad weather. The Yanks need to slow down for rate cuts to happen.

- US industrial production fell, with manufacturing capacity utilisation falling to its lowest since April 2021, which is a positive sign for inflation.

- Around 80% of US S&P 500 companies have now reported December quarter earnings, with 78% coming in better than expected, which is above the norm of 76%.

- Consumer confidence bounced in February on rate cut optimism, but still remains weak and survey responses taken after the RBA meeting, where it retained a tightening bias, actually showed a slight fall in confidence compared to January. This will help the RBA to start thinking about cuts.

- On local company reporting, so far 47% of results have surprised consensus earnings expectations on the upside, with 34% surprising on the downside.

What I didn’t like

- The US CPI this week, with the headline inflation number in January falling to 3.1% for the year but core inflation was unchanged at 3.9%. The result was less than expected and pushes out the first US rate cut.

- The slide into technical recessions for the UK and Japan, while the Eurozone is very close to it, which shows interest rate rises eventually do their work!

Curve balls revealed…

Here are the two questions I’m getting right now: What will a new President Trump and China do for stocks? And what will this do for my 2024 optimism? They’re both hard ones to get right but that’s my homework for the weekend and I’ll reveal my findings on Monday. Watch this space!

Switzer This Week

Switzer Investing TV

- Boom Doom Zoom: Paul Rickard and Peter Switzer answers your questions on BHP, HVN, TLS & more

- SwitzerTV Investing:Interest rate worriers will love Shane Oliver’s call of 3 rate cuts this year! And Jun Bei Liu likes A2M and Harvey Norman.

- The Switzer Show Podcast: 8/2/24 – Everything you wanted to know about Superannuation but was too afraid to ask.

Switzer Report

- Two more small cap retailers to add to your buy list

- “HOT” stock: Accent Group (AX1)

- Questions of the Week

- Switzer’s on the hunt for good value stocks

- Why Transurban (TCL) offers value…at the right price

- HOT stock: Dexus Industria REIT (DXI)

- Two billing software stars

- Buy, Hold, Sell — What the Brokers Say

Switzer Daily

- 13 rate rises starting to bite BIG time

- Mad as hell CBA customer strikes back

- Valentine’s Day spending is a test of love and the economy

- ATO tells small businesses to cough up

- Stamp duty escalation shows how out of touch state politicians are

- Labor will win Dunkley – by Malcolm Mackerras

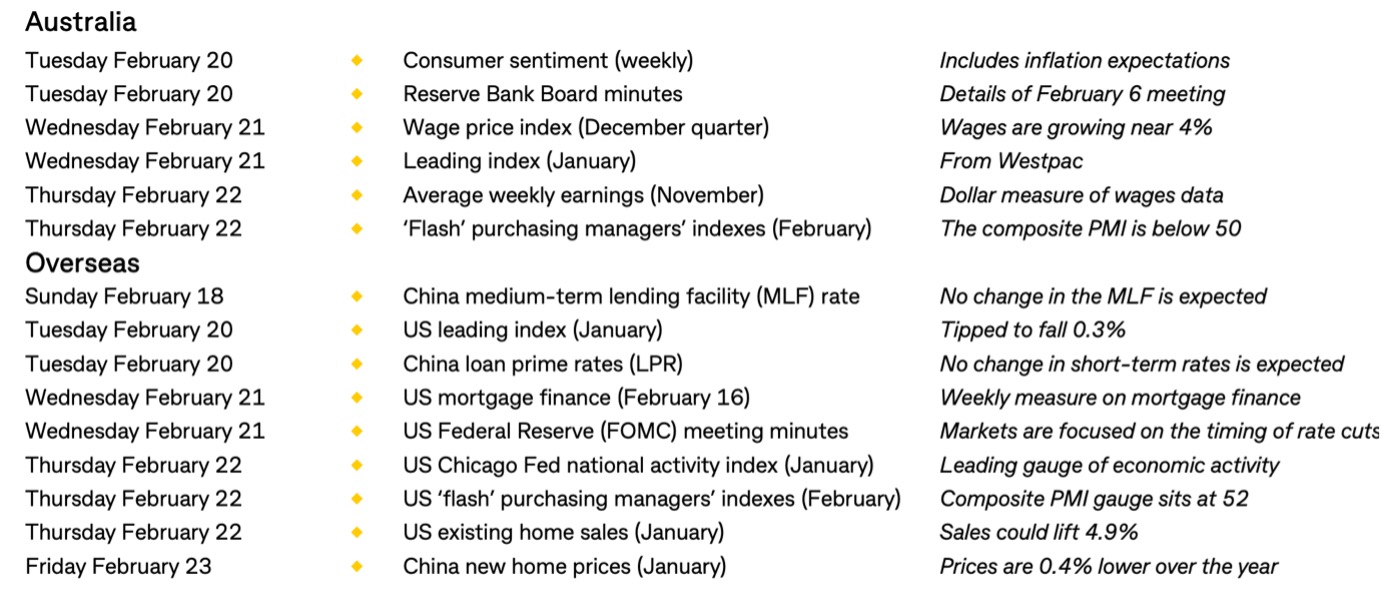

The Week Ahead

Top Stocks — how they fared

Most Shorted Stocks

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before

Chart of the Week

The unemployment spike from 3.9% to 4.1% changed the view on rate cuts, which should also be a plus for stock prices.

Quote of the Week

This CNBC headline needs to be shared: ‘Bubble may be far from bursting’: Capital Economics says S&P 500 could hit 6,500 by end of next year.” And here is the supporting quote: “The bubble in the S&P 500 that is forming now resembles the bubble that formed in the second half of the 1990s in many aspects, not least the way in which it is an attempt to capture the future benefits of a transformative technology,” said John Higgins, chief markets economist at Capital Economics in a note to clients on Feb. 12 titled “This bubble may be far from bursting.”

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.