The US stock market has been on a four-week tear higher, with the S&P 500 up over 7% and the Nasdaq 8% plus up. This shows what lower inflation and the expectation that rate rises are over, on top of the merry market month of November (which historically is good for stocks) can do for share prices. But here in Oz, we’re only limping higher.

Our four-week gain is only 2.72%, and a lot of that restrained improvement in stock prices is linked to the implications of sticky inflation, the tough talking of the new RBA Governor Michele Bullock, and what money markets are factoring in for future rate rises.

It’s interesting that this concern that Ms Bullock has about “homegrown inflation” should counterweigh the good news that China looks set for better growth than was expected a few months ago. Furthermore, it’s a fact that a rising Wall Street usually adds positivity to our market.

To be less locally focused, there are other bigger world negatives. AMP’s Diana Mousina captured those other issues neatly with this: “Inflation has fallen but remains higher than central banks would like and could start to rise again, the war in Israel could still escalate and broaden to other countries, the risk of a recession in 2024 is high, bond yields could drift up again and pressure share market valuations and investor sentiment is yet to fall to levels that are usually associated with major market bottoms. This means that shares could still have another leg down over coming months, and some caution is needed,” she said.

However, they are threats for all economies and stock markets, so our poor market pick-up has to be inflation and possible future RBA actions affected.

This chart from AMP shows how our inflation-killing record doesn’t look good compared to many countries, so have a look below.

And while this poor inflation story helps to explain why our market gains have been less emphatic as the US, it does give us a sneak preview of what’s likely to happen when Ms Bullock signals “mission accomplished!”

I see this as annoying that we’re not enjoying the same ride higher as the US stock market indexes, the German DAX (which is up 7.73% over the month) and even the French CAC 40 (which is up 5.47%).

That said, what we have is a buying opportunity for when inflation does fall, and the rate rise fears are over. I have a gut feeling that inflation numbers between now and late January will be better and that could be the market surprise we have to have.

Of course, my lower inflation hope might take longer, but when the CPI falls, it will be good for many stocks that are now out of favour because of the threat of rising interest rates.

To the local story and the S&P/ASX 200 fell 8.6 points (or 0.12%), with the best performers being energy and utilities, while tech stocks copped it. The aggressive stance of the RBA on rates isn’t helping tech stocks, which usually take their lead from the Nasdaq, but not this week.

That index was up 1.41% up to Thursday’s close and 8.57% for the month. Meanwhile, our star tech stock Xero dropped 3.12% for the week and is down 8.2% for the month. I bet this will be reversed when inflation cools and the RBA stops talking tough, but this play is for the patient.

Financials had a good week. You have to think a rate-rising RBA helps the bottom lines of lenders. However, AMP’s 5.81% rise was more linked to company-specific good news. Uncertainty over the extent of a financial settlement from a class action had dogged AMP since July 2020. The market thinks AMP got off lightly, though it was $100 million settlement!

In other news, Select Harvest fell 10.53% to $3.91 after losses were worse than expected. Wisetech lost 3.17% to $64.05 on the news its chairman was exiting. Virgin Money dropped 6.08% to $2.78 on potential bad debts linked to credit cards.

What I liked

- Despite RBA minutes implying future rate rises are possible, I liked this from the CBA team: “Our base case sees the RBA on hold, but upcoming CPI data will be crucial”.

- The temporary truce between Israel and Hamas.

- Oil prices rose this weekto US$76 on West Texas Intermediate,but they are still lower relative to the start of the Israel/Palestine conflict.

- Iron ore rose to $127, its highest level since June 2022, on optimism from Beijing’s latest stimulus (news that Chinese regulators were drafting a list of 50 private and state-owned developers eligible for financing, which will help the property sector).

What I didn’t liked

- The tone of the RBA minutes that say the board is willing to raise the cash rate again. That said, central bankers do use scare tactics (this is called jawboning) in an attempt to scare consumers and business to try and bring spending and price rises under control.

- The overall hawkish tone from all RBA communication this week led financial markets to price in around a 60% chance of another rate hike by mid-2024, up from 25% a week ago.

- AMP’s economics teams says: “We think the risk of another hike has lifted to around 45% over the next few months. There doesn’t appear to be an urgency to do a follow-up hike in December but there is a risk of another hike in February after the quarterly consumer price figures in January.

- TheAustralian composite PMIfell further in November to 46.4 from 47.6 last month, with both manufacturing down to 47.7 from 48.2 last month, and services to 46.3 from 47.9. Any number under 50 implies contraction.

- The US data this weekshowed the leading economic index had fallen in October, which is still showing conditions consistent with a recession.

- Durable goods orders in the USwere down by 5.4% in October, which may be impacted by the auto workers’ strike. This means orders should recover over coming months.

- University of Michigan inflation expectations were surprisingly revised up in November, with consumers now expecting 1-year inflation to be 4.5% (from 4.4% on the last measure) and 3.2% over 5-10 years (up from 3.1%) and above the Fed’s inflation target, which is a problem if this trend continues.

The big watch dates for our inflation

Many economic readings will be looked at to work out if the RBA will raise rates again in December, February, or March. Right now, December seems unlikely, but February and March are a chance.

The big inflation dates are:

- October monthly CPI: 29 November.

- November monthly CPI: 10 January.

- December monthly CPI: 31 January.

- December quarter CPI: 31 January.

The biggie is the last one, and we need to see a decent fall in inflation from the 5.4% we saw for the year to the end of September.

Switzer This Week

Switzer Investing TV

- Boom Doom Zoom: ST Wong of Prime Value joins Paul. I’m in London and the time zone difference is a killer!

- SwitzerTV: 20th November 2023 – Gable’s chart on Lithium’s outlook

Switzer Report

- 3 ETFs to gain exposure to out-of-favour asset class

- “HOT” stock: BHP

- Questions of the Week

- Here’s why lithium stocks PLS and LTR look like good long-term bets

- Should you be overweight or underweight banks?

- HOT stock: Aristocrat Leisure (ALL)

- Four Under 40 cents

- Buy, Hold, Sell — What the Brokers Say

Switzer Daily

- Why I want to bah humbug Black Friday

- Bosses winning the battle to get workers back to the office

- Get afraid or the RBA’s rate rises will make you so

- Not another doom prediction for house prices!

- A rising stock market could be the best Christmas gift this year!

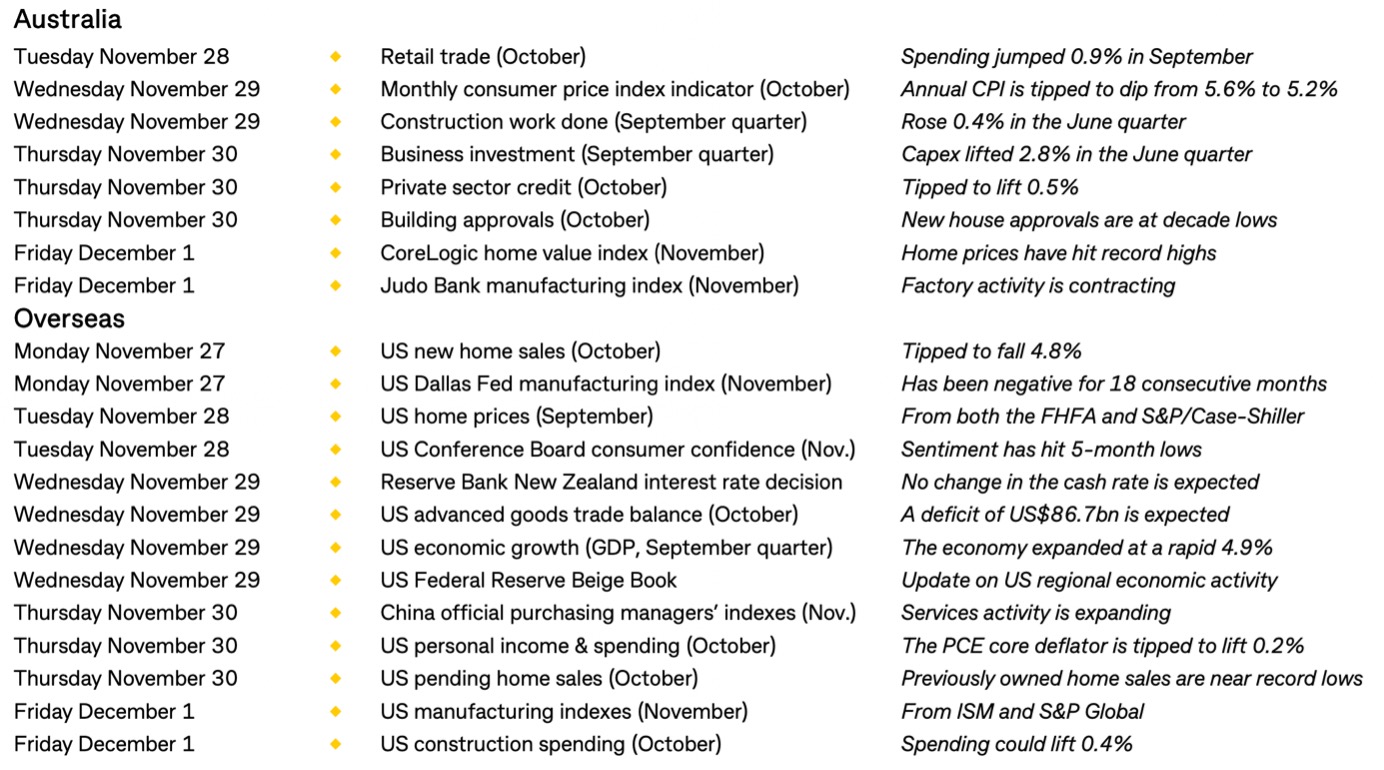

The Week Ahead

Top Stocks — how they fared

Most Shorted Stocks

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before

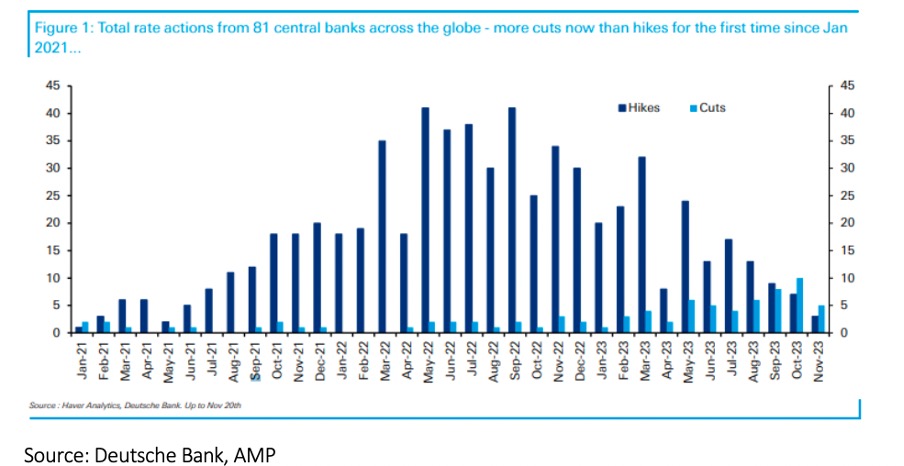

Chart of the Week

AMP economist, Diana Mousina gave some good news on interest rates with this revelation:

“…there are now more central banks cutting rates than hiking for the first time since January 2021.”

Revelation of the Week

The RBA minutes from the Cup Day rate rise tell us the following: “Members noted that the risk of not achieving the Board’s inflation target by the end of 2025 had increased and that it was appropriate that monetary policy should be adjusted to mitigate this”. And a hike would reduce the “risk of inflation expectations increasing if the Board left the cash rate target unchanged at this meeting, particularly given the Board’s repeated statements that it has a low tolerance for inflation returning to target after 2025”.

What does this mean? The RBA is trigger happy on rate rises to kill inflation and only good inflation data will save us from another interest rate rise, either in February or March. I think these guys are overtightening but I will apologise if I’m wrong but if I’m right I will give it to them.

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.