The last year has been a shocker for Telstra shareholders. In an environment where the ASX t has returned 4.8% since the start of the year, Telstra’s return is negative at -5.1%. It is worse over 12 months and comes at a time when some other “growthless, boring” stocks such as the major banks have soared.

The chart below paints a pretty sorry story.

Telstra (TLS) – 5/23 to 5/24

Source: nabtrade

Telstra’s big move down in share price came last August when the company announced that it would keep its infrastructure business, called InfaCo Fixed, which includes all the telephone exchanges, data centres, fibre, ducts, and other equipment, and not spin it out or demerge it. The market was banking on the latter, figuring that “the sum of the parts” was worth more than the whole. But the Board thought otherwise, with CEO Vicky Brady saying:

“We have concluded that the greatest value to be created for shareholders is by maintaining the current ownership of InfaCo Fixed, for at least the medium term.”

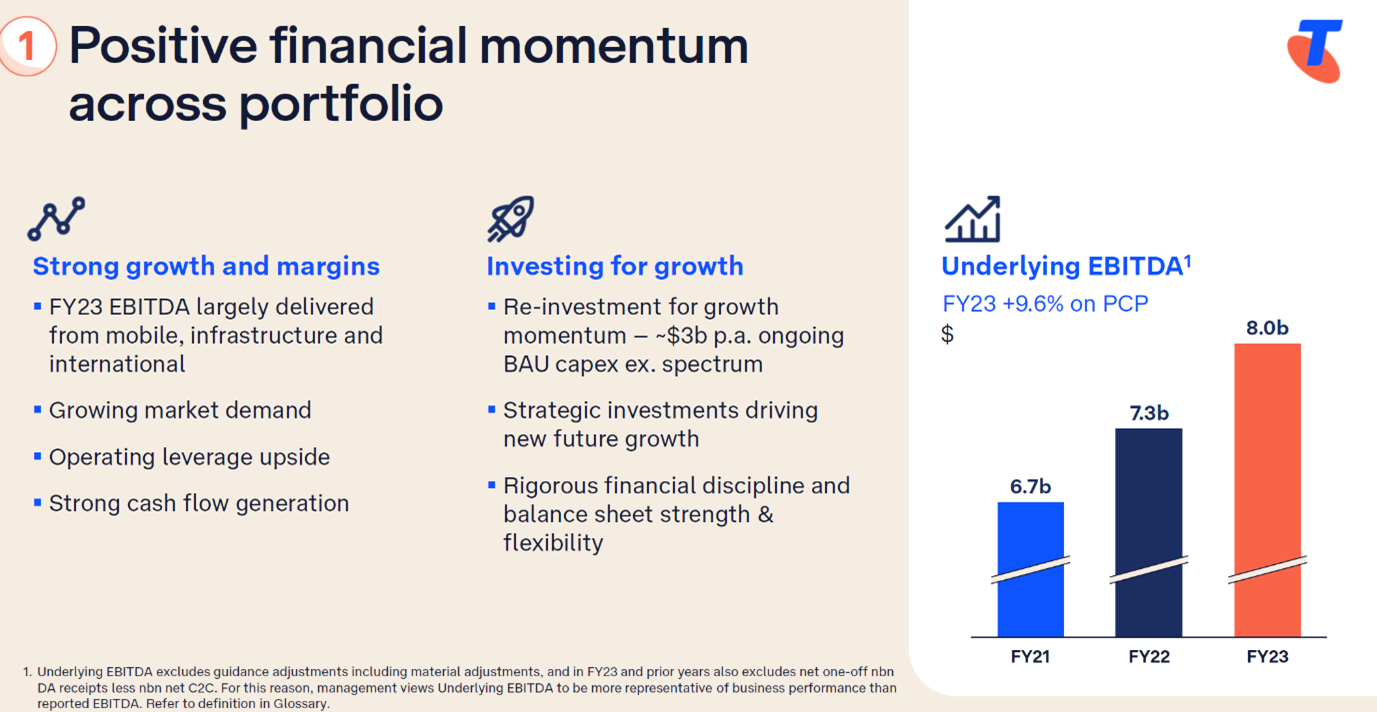

The fall this year is harder to explain. Telstra is not a growth stock, although it has managed an increase in underlying EBITDA over the last two years from $6.7bn in FY21 to $8.0bn in FY23 (see slide below). For FY24, it has guided to $8.2bn to $8.4bn.

Telstra’s first half result for FY24 (released in February) of underlying EBITDA of $4.0bn came in a pretty much as expected. Mobiles continued to power ahead, with Telstra adding both subscriber and ARPU (average revenue per customer) growth. The mobiles division generated almost 63% of Telstra’s earnings. But there were missteps, with a very disappointing result from Telstra’s enterprise division with revenue down 3% and earnings down 67% to just $71m. Its NAS (network application services) business which supports enterprise customers with managed services, cloud resale and professional services, barely broke even.

Telstra reconfirmed guidance but narrowed the EBITDA range for FY24 to $8.2bn to $8.3bn. The interim dividend was increased by 0.5c to 9.0c per share.

Since February, there has been no further news from Telstra and few developments externally with the telecommunications market or with Telstra’s competitors. Optus and TPG (Vodafone) striking a deal to share mobile towers in the bush was a bit of a setback for Telstra, but not market shaking.

Whatever the reasons, Telstra hasn’t been enjoying much love.

What do the brokers say?

The major brokers are quite positive on Telstra, with five out of the six having a “buy” recommendation. Most considered the February half year report to be reasonably strong, with mobiles, Amplitel and infrastructure performing well, offset by a weaker NAS.

Target prices are all comfortably above the current ASX price, with a range of $4.00 to $4.75 and a consensus of $4.38, about 19.3% higher than the last ASX price of $3.67.

Bell Potter, who upgraded to a “buy” in March, commented:

“While the growth outlook for Telstra Group is not as strong as some comparable companies, the stock is starting to look more reasonable. The broker anticipates mid to high single digit earnings growth over FY25, coupled with a dividend yield of 5.0%.

Telstra Group also retains the option of selling part or all of its infrastructure business, which it believes would unlock value. Further, Bell Potter sees little risk in the company not making FY24 guidance. “

On multiples, the brokers have Telstra trading on a multiple of 20.1x forecast FY24 earnings, falling to 18.5x FY25 earnings. Full year dividends of 18c, rising to 19c per share, are forecast for FY24 and FY25.

What’s the bottom line?

I think Telstra looks good value around $3.67. I don’t pretend that the market is suddenly going to “fall in love” with Telstra, but eventually, the market will recognize the value. Income seekers alone will start comparing Telstra’s fully franked dividend yield of almost 5.0% to a forecast 4.9% for NAB and 3.8% for CBA.

If interest rates start to tick down later this year (as we expect), Telstra will be a winner. Accumulate.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.