In our Boom, Doom, Zoom! webinar last Thursday, a subscriber asked me what stocks look like good value at the moment, or should be jumped on with a market pullback?

This prompted me to go looking for some companies that aren’t often talked about, but the analysts surveyed by FNArena and others see them as having potential.

- ARB CORPORATION LIMITED ((ARB)

The first one that I think fits the bill is ARB CORPORATION LIMITED ((ARB), which has historically been a great company, as the chart below shows.

ARB

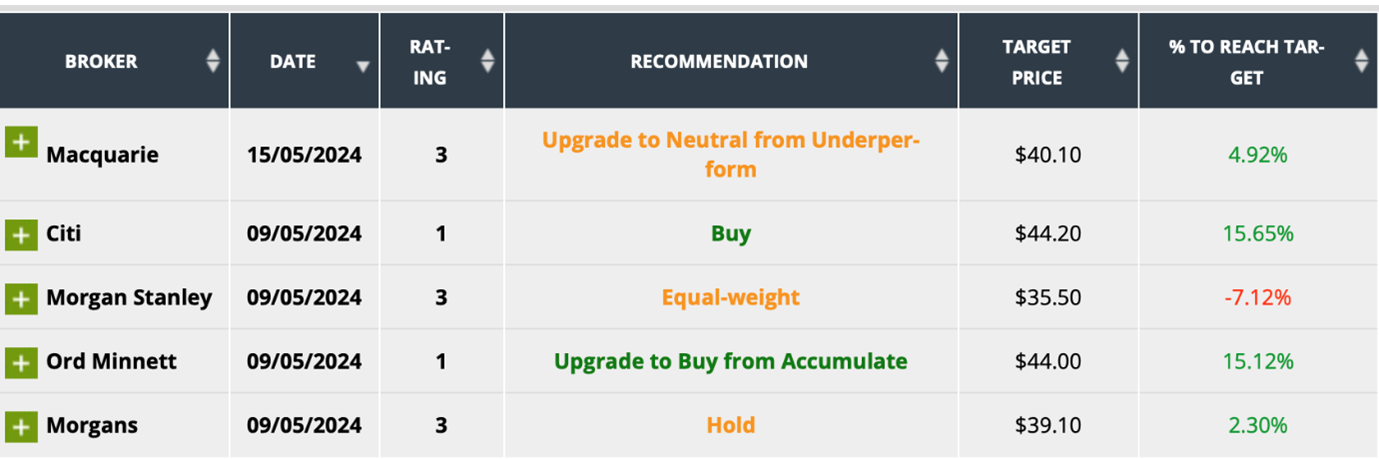

ARB still looks to be on an uptrend with the consensus call being a 6.2% rise ahead for a business that’s into design, manufacture, distribution and sale of motor vehicle accessories and light metal engineering works. It produces and sells more than bull bars, but the company is quite famous for these accessories for SUVs, Utes, and so on. On my old Sky Business TV show, Roger Montgomery used to call it “the bloke’s business”. Here are the views of the overall analysts on ARB:

By the way, the company recently reported, and the past performance and outlook quote excited the analysts who do the numbers on ARB.

- Super Retail Group (SUL)

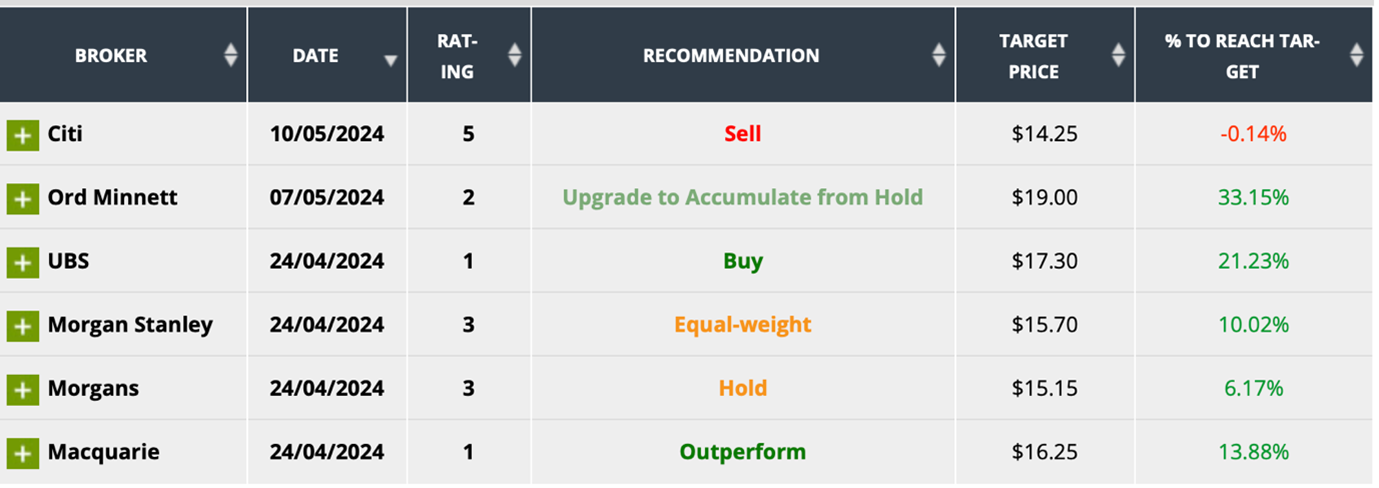

This one even surprises me, but Super Retail Group (SUL) has been given the thumbs up from analysts just when retail is feeling the pinch from 13 interest rate rises and a big spike in the cost of living. Paul Rickard and I think retail businesses will pick up when rates come down, but the first cut isn’t likely until Cup Day if interest rate sufferers are lucky. However, the market could move to buy retail stocks as soon as data starts pointing to an imminent cut. This could be in August or September.

The consensus call is a nice 10.6% rise. Four out of six analysts like the company, with some very positive on a business that owns Supercheap Auto, rebel, BCF and Macpac. Arguably, the tax cuts for lower income Australians and the $300 gift for energy bill payers could help these businesses, with Citi tipping a 43.4% share price rise, while Morgans went for a 32.08% spike.

- Brambles (BXB)

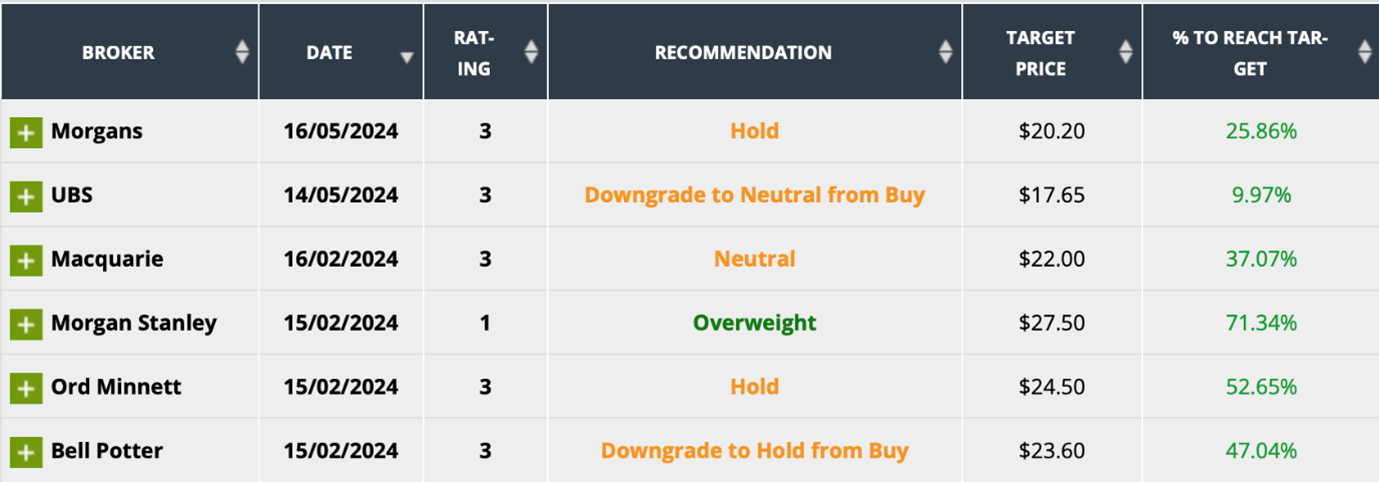

This one isn’t one of my companies but Brambles (BXB), which is the manager of the world’s largest pool of reusable pallets, crates, and containers, is specked to have 14% upside. That could easily coincide with the view that global interest rates are starting to fall, the world economic picture is looking more positive, and China’s outlook is on the up, with a big spending program announced on Friday.

Reuters reported the following: “China announced ‘historic’ steps on Friday to stabilise its crisis-hit property sector, with the central bank facilitating 1 trillion yuan ($138 billion) in extra funding and easing mortgage rules, and local governments are set to buy some apartments.”

This is what Rudi Filapek Van Dyck told us about the company recently: “A new analyst at Ord Minnett takes over the research on the company and expects a higher mid-cycle operating margin of 21%, up from the 16% previously forecast.

“The broker now assumes prices are increasing broadly with inflation, and volume gains will occur due to rising consumer spending, leading to market share gains in both existing and new markets. For the firm’s largest segment in the US, Ord Minnett predicts average volume growth of 2% (up from 1%) over the forecast period.”

Here is the table of analysts’ views on the company:

Note that the only negative view on the company was a mere 0.14% slip in BXB’s target price.

- IDP Education (IEL).

I can’t believe this ‘struggler’ that every analyst literally ‘loves’, that is, IDP Education (IEL). And I think it looks like the speculator that the thrill seeker has to have. This is a quality business, but the market has taken a set against it, as the chart below shows.

IEL 5-years

Since November 2021, the company’s share price has been smashed from $38.40 to $16.05, but if there is something wrong with this business, then the experts who are paid to assess these listed businesses, need to be given an education about what’s wrong with this education business!

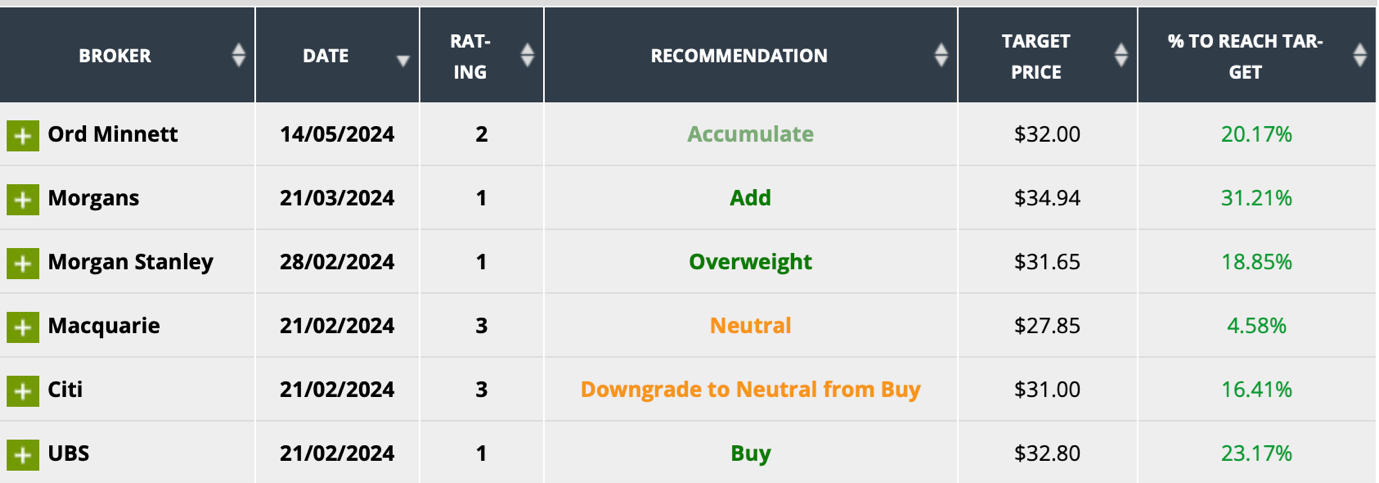

The expected consensus rise is 40.7%, and this table of the target prices of analysts makes you scratch your head.

Also, the 14 analysts surveyed by the US-based Trading View have a consensus view of $20.86 against the current price of $16.05. The maximum price from these guys is $25.50, while the most negative call was $15, which suggests that it could be time to take a punt on IEL.

- Sonic Healthcare (SHL)

My final off the radar stock worth thinking of having a punt on is Sonic Healthcare (SHL), where the consensus call is up 19.1%, with six out of six analysts liking the company. By the way, there are some big potential rises on the cards, if these people are on the money.

What’s worth noting is that five out of the six supporters of the stock see a 16% plus rise ahead for the business that has specialist operations in laboratory medicine/pathology, radiology, and general practice. Douglass Hanly Moir Pathology is owned by Sonic, and at a time when masks are getting a rerun because of new flu and respiratory viruses along with the resurgence of Covid problems, this business is likely to benefit from these new age challenges. I guess I could say that if there’s a pullback, any share price under $16 shouldn’t be sneezed at! Sorry, I couldn’t resist that!

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.