I continue to maintain the view that the commercial banks are expensive, largely ‘ex-growth’ and that an inevitable rotation will occur into other sectors, most likely resources. However, institutional fund managers remain reluctant to move out of the banks, in part because of an uncertain outlook for commodity prices.

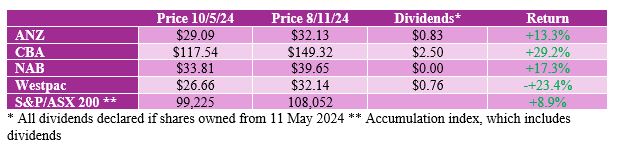

While the pace of outperformance by the banks has slowed over the last couple of months, over 6 and 12 months, the commercial banks have been clear outperformers. Looking at the table below, even the laggard of the group, ANZ, has returned almost 13.3% since May, compared to the market’s overall 8.9%. Commonwealth Bank has starred with a return of almost 30%.

In May, I looked at the major banks following their half year profit results. I concluded (see https://switzerreport.com.au/where-do-the-major-banks-go-now/ ):

In terms of the individual banks, I think Westpac has made headway with some of the key metrics (volume growth, expense management, return on equity and capital strength), and is starting to match it with the other banks. The headway, however, hasn’t been fully reflected in the share price. In reality, the differences between the major banks are small. However, within the sector I fancy the barbell approach – the most expensive and one of the cheaper banks. I am going for CBA and Westpac.

The barbell approach has certainly been working!

Last week, three of the major banks reported full year profit results (CBA will provide a first quarter trading update on Wednesday). Here’s a review of what we learnt and my position in relation to the question about how to play the banks going forward.

Full year profit reports

In summary, the reports largely met expectations. The themes were consistent: the net interest margin had stabilized and marginally improved over the previous half; credit growth remained weak with small volume increases; bad debts are low by historical standards although the forward indicators point to an increase in arrears; expenses are being controlled but are pressured by inflation; and the banks are very well capitalised and in some cases in a position to conduct share buybacks. Looking ahead, flat (or very low single digit) earnings growth.

Profit for the year

- ANZ

Cash profit $6.8 billion for FY24 (excl. Suncorp), down 8% on FY23.

- NAB

Cash profit $7.1 billion for FY24 down 8% on FY23.

- Westpac

Net profit of $7.2 billion down 3% on FY23. Excluding notable items, net profit of $7.4 billion down 3% on FY23.

Operating Performance for 2H24 (excluding bad debts) compared to 1H24

- ANZ

Operating profit in banking (before provisions and excluding Suncorp) of $4.8 billion in 2H24, down 0.1% on 1H24.

- NAB

Underlying profit of $5.4 billion in 2H24, down 1.8% on 1H24.

- Westpac

Pre provision profit $5.4 billion in 2H24, up 0.4% on 1H24.

Volumes

- ANZ

Home lending portfolio grew in half year by $11 billion to $327 billion (excluding Suncorp). Business lending in Australia grew by $1 billion to $65 billion. New Zealand loans grew by NZ$1 billion.

- NAB

Home lending portfolio grew by $2 billion to $353 billion. Business lending in Australia grew by $6 billion to $155 billion. New Zealand loans grew by NZ$2 billion.

- Westpac

Home lending portfolio grew by $8 billion to $503 billion. Business lending in Australia grew by $5 billion to $102 billion. New Zealand loans grew by NZ$1 billion.

Margins

- ANZ

Group net interest margin (NIM) rose by 2 basis points from 1.56% in 1H24 to 1.58% in 2H24. Also, a 2 basis points increase excluding impact of Suncorp and markets.

- NAB

Net interest margin fell by 2 basis points from 1.72% to 1.7%. Flat excluding impact of markets and treasury.

- Westpac

Core net interest margin excluding markets rose by 3 basis points from 1.8% to 1.83%.

Expense Growth (2H vs 1H)

- ANZ

Expenses (excluding Suncorp) up 2.4% on 1H24.

- NAB

Expenses up 1.6% on 1H24.

- Westpac

Operating expenses, excluding notable items, rose by 2.9% on 1H24.

Bad debts

- ANZ

Credit impairment charge of $92 million (excluding Suncorp) compared to $70 million in 1H24.

- NAB

Credit impairment charge of $365 million compared to $363 million in 1H24.

- Westpac

Credit impairment charge of $175 million compared to $362 million in 1H24.

Capital

- ANZ

CET1 (Level 2) (Common Equity Tier One) is 12.24%.

- NAB

CET1 (Level 2) ratio of 12.21% (pro-forma, takes into account outstanding $0.6 billion of share buyback).

- Westpac

CET1 (Level 2) ratio of 12.11% (pro-forma, takes into account an extension of current share buyback by $1 billion to $1.7 billion).

Return on Equity

- ANZ

9.7% for FY24

- NAB

11.6% for FY24

- Westpac

11% for FY24

Dividend

- ANZ

Final dividend of 83 cents per share, franked to 70%. Same as interim dividend, but down from final dividend for FY23 of 94c (which arguably included a special component of 13 cents).

- NAB

Final dividend of 85c, up 1c on FY24 interim and FY23 final.

- Westpac

Final dividend of 76c per share, up 1c on FY24 interim and 4c on FY23 final dividend

Strategic Differences

- ANZ

New Zealand and Institutional Banking are relatively more important. In Australian retail, the Bank has high hopes for its new retail banking platform, ANZ Plus. Suncorp acquisition now being digested.

- NAB

Market leadership in business and private banking. Aiming for disciplined growth in other businesses. Ubank for new customer acquisition.

- Westpac

Strong in retail, putting more focus on institutional banking and business banking. Completed risk and compliance remediation program. Project UNITE is key effort to rationalise systems.

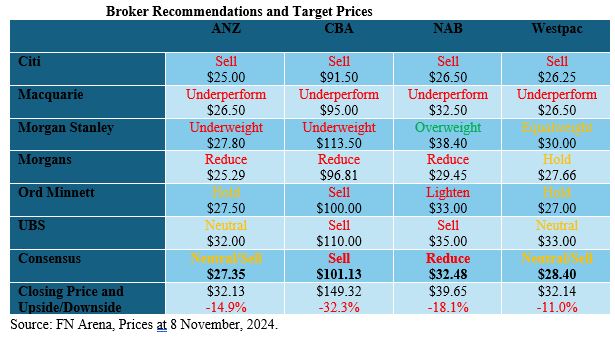

What do the brokers say?

The major brokers are bearish on the banking sector. Within the sector, their picks are ANZ and Westpac. The following tables list broker recommendations, target prices and forecast earnings for the major banks (source: FN Arena). It highlights that the differences between the banks are very much at the margin.

While strong conclusions are hard to draw, the following statements can be made:

- Westpac is seen as having the least “downside” potential, with a consensus target price of $28.40, 11% lower than the last ASX price of $32.14. CBA has the most downside potential.

- Morgan Stanley prefers NAB.

- Morgans marginally prefers Westpac.

- All the brokers feel that CBA is over-valued.

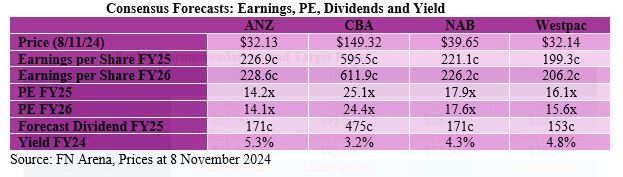

- On earnings and multiples, ANZ and Westpac are the “cheapest”, followed by NAB and then CBA.

- CBA at around 25 times earnings is at a material premium to the multiples for ANZ/Westpac which are around 14 to 16 times.

- The brokers forecast that earnings (profit) in FY26 will be largely flat on FY25 (small increase).

- ANZ has the highest forecast dividend yield of 5.3%, although this is only expected to be partly franked (about 70%).

What’s the bottom line?

As I said at the outset, I continue to maintain that the commercial banks (Macquarie excluded) will be underperformers. I don’t mean anything drastic, but they will lag the market if it goes up and won’t do much better if it goes down. A moderate re-weighting away from financials to other sectors is my recommendation.

At best, bank shareholders can look forward to a marginal increase in profits and very small increases in dividends. More likely, an increase in bad debts will erode any operating profit improvement and lead to flat dividends.

In terms of the individual banks, I think ANZ is starting to look interesting. Three things are driving this:

- It is now the cheapest.

- It seems to be doing better on volumes.

- The integration of Suncorp may be quicker than forecast and lead to a stronger outcome.

Against this, it has to manage the migration of its customers (including Suncorp) onto the ANZ Plus Platform and also the transition to a new CEO. There is also the ASIC investigation into the bond trading, but my sense of this is that it is pretty well factored in.

CBA continues to be super expensive, but it is the stock that the institutions turn to first in any market crisis or downturn. It is the most “defensive” of the banks.

In reality, the differences between the major banks are small and it is arguably more important to get the sector allocation right rather than the individual bank. However, within the sector I fancy the barbell approach – the most expensive and the cheapest. I am going for CBA and ANZ.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.