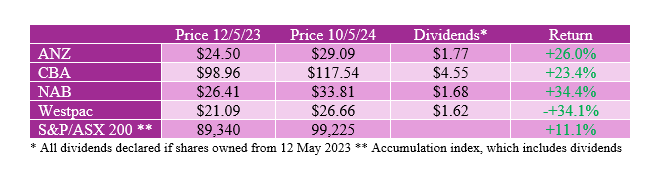

Over the last 12 months, the major banks have been star performers. They have each returned between 23% and 34%, massively outperforming the overall market’s return for that period of just over 11%.

The performance is somewhat staggering given that it corresponds with a period of declining bank earnings and seems to be inconsistent with classic share market theory that says share prices are ultimately determined by company earnings.

Perhaps banks were oversold a touch in May 2023, with the market expecting both pressure on net interest margins and increasing bad debts as the economy slowed. The former did eventuate (maybe not to the extent expected), but there has been no pick- up in bad debts. This may explain some of the outperformance.

My explanation goes to the composition of the market and the concentrated nature of the funds management/super industry. Because the two major sectors (financials and materials) are so big relative to the others, it is hard for our institutional fund managers to be too underweight these sectors. Further, if one sector is not firing (which has been the case for materials due to softer commodity prices), it is very hard to be underweight the other sector. Where would they invest the cash? And, in an environment where global equity markets are hitting all-time highs, there isn’t going to be any support for being “short” Australian equities.

I think the institutional fund managers have been “scared” to sell the banks. Add in a fairly stable outlook, nice dividend yield and less risk compared to some other stocks, it is an easy hold.

We are never going to know whether the explanations above hold water, or whether there were other driving factors. But the fact is that banks have been strong outperformers. So, is this going to continue, or is now the time to lighten?

Last week, each of the major banks reported half year profits (CBA provided a very limited third quarter trading update). Here’s my review of what we learnt, and my position in relation to the question about how to play the banks going forward.

Half-year profit reports

In summary, the reports largely met expectations. The themes were consistent: small falls in the net interest margin due to competition in the deposit and home lending markets, but not as bad as the deterioration in the last half; credit growth is weak, but some volume increase in business lending; bad debts still low by historical standards; expenses are being controlled but are pressured by inflation; and the banks are very well capitalised and in a position to conduct share buybacks. Looking ahead, flat (or very low single digit) earnings growth.

Profit for last half year (first half 2024)

ANZ: Cash profit $3.6bn for 1H24, down 1% on 2H23 and down 8% on 1H23.

NAB: Cash profit $3.5bn for 1H24, down 3% on 2H23 and down 3% on 1H23.

Westpac: Net profit of $3.5bn for 1H24, down 1% on 2H23 and down 8% on 1H23 (excluding notable items).

CBA for 3Q24: Cash profit of approximately $2.4bn for the March quarter, down 3% on quarterly average in 1H24 and down 5% on 3Q23.

Operating Performance for 1H24

ANZ: Underlying profit (before tax and bad debt provisions) of $5.1bn, down 2% on 2H23 and down 7% on 1H23;

NAB: Underlying profit of $5.5bn, down 1% on 2H23 and down 11% on 1H23;

Westpac: Underlying profit of $5.4bn, flat on 2H23 but down 8% on 1H23.1

Volumes

ANZ: Home lending portfolio grew by $10bn to $316bn. Business lending in Australia grew by $2bn to $62bn. New Zealand loans grew by NZ$2bn.

NAB: Home lending portfolio grew by $6bn to $344bn. Business lending in Australia grew by $6bn to $149bn. New Zealand loans grew by NZ$2bn.

Westpac: Home lending portfolio grew by $11bn to $486bn. Business lending in Australia grew by $2bn to $95bn. New Zealand loans grew by NZ$2bn.

CBA: Home lending grew by $5.3bn in the quarter to $587bn. Business lending grew by $2.7bn in the quarter.

Margins

ANZ: Group net interest margin (NIM) excluding markets fell by 2bp from 1.65% in the September 23 half to 1.63% in the March 24 half.

NAB: Net interest margin excluding markets fell by 3bp.

Westpac: Core net interest margin excluding markets fell by 3bp from 1.83% to 1.80%.

Expense Growth

ANZ: Expenses up 1.3% on 2H23.

NAB: Expenses up 1.6% on 2H23.

Westpac: Operating expenses, excluding notable items, rose by 2% on 2H23.

Bad debts

ANZ: Credit impairment charge of $70m compared with $112m in 2H23.

NAB: Credit impairment charge of $363m compared with $409m in 2H23.

Westpac: Credit impairment charge of $362m compared to $258m in 2H23.

Capital

ANZ: CET1 (Level 2) (Common Equity Tier One) is 11.85% (pro-forma, takes into account buyback and Suncorp acquisition).

NAB: CET1 (Level 2) ratio of 11.75% (pro-forma, takes into account additional $1.5bn buyback).

Westpac: CET1 (Level 2) ratio of 12.06% (pro-forma, takes into account buyback).

CBA: CET1 (Level 2) ratio of 11.9%.

Return on Equity

ANZ: 10.1%

NAB: 11.7%

Westpac: 10.5%

Dividend

ANZ: Interim dividend of 83c per share, up 1c on FY23 interim. New dividend only franked to 65%.

NAB: Interim dividend of 84c, up 1c on FY23 interim.

Westpac: Interim dividend of 75c per share, up 5c on FY23 interim. Also, a special fully franked dividend of 15c per share.

Strategic Differences

ANZ: New Zealand and Institutional Banking are relatively more important. In Australian retail, the Bank has high hopes for its new retail banking platform, ANZ Plus.

NAB: Market leadership in business and private banking. Aiming for disciplined growth in other businesses. Ubank for new customer acquisition.

Westpac: Strong in retail, putting more focus on institutional banking and business banking. Largely completed risk and compliance remediation program.

What do the brokers say?

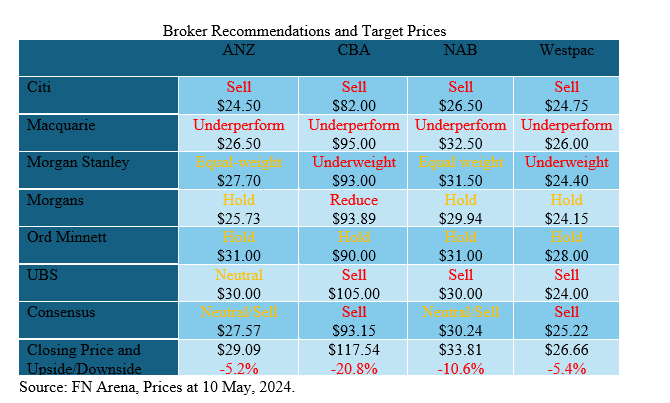

The major brokers are bearish on the banking sector. Within the sector, their picks are ANZ and Westpac.

The following tables list broker recommendations, target prices and forecast earnings for the 4 major banks (source: FN Arena). It highlights that the differences between the banks are very much at the margin. While strong conclusions are hard to draw, the following statements can be made:

- ANZ is seen as having the least “downside” potential, with a consensus target price of $26.66, 5.2% lower than the last ASX price of $29.09. CBA has the most downside potential;

- UBS prefers ANZ, saying that it is “least exposed to structural headwinds in retail banking”, whereas ANZ it is the third pick for Citi;

- All the brokers feel that CBA is over-valued;

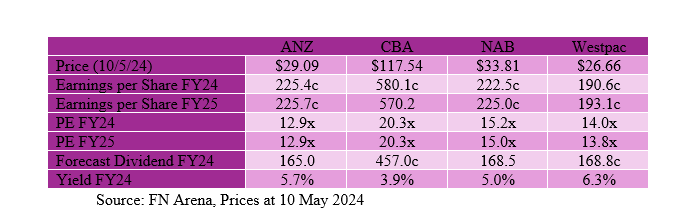

- On earnings and multiples, ANZ and Westpac are the “cheapest”, followed by NAB and then CBA;

- CBA at around 20 times earnings is at a material premium to the multiples for ANZ/Westpac which are around 13 to 14 times;

- The brokers forecast that earnings (profit) in FY25 will largely be flat on FY24; and

- Westpac has the highest forecast dividend yield at 6.3%.

Consensus Forecasts: Earnings, PE, Dividends and Yield

What’s the bottom line?

Unlike the last 12 months, I think banks will be underperformers. I don’t mean anything drastic, but they will lag the market if it goes up and won’t do much better if it goes down. A moderate re-weighting away from financials to other sectors is my recommendation.

At best, bank shareholders can look forward to flat profits and very small increases in the dividend. A more likely scenario is an increase in bad debts eroding any operating profit improvement leading to small profit declines and flat dividends.

In terms of the individual banks, I think Westpac has made headway with some of the key metrics (volume growth, expense management, return on equity and capital strength), and is starting to match it with the other banks. The headway, however, hasn’t been fully reflected in the share price.

Commonwealth Bank continues to be super expensive, but it is the stock that the institutions turn to first in any market crisis or downturn. It is the most “defensive” of the banks.

In reality, the differences between the major banks are small and it is arguably more important to get the sector allocation right rather than the individual bank. However, within the sector I fancy the barbell approach – the most expensive and one of the cheaper banks. I am going for CBA and Westpac.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.