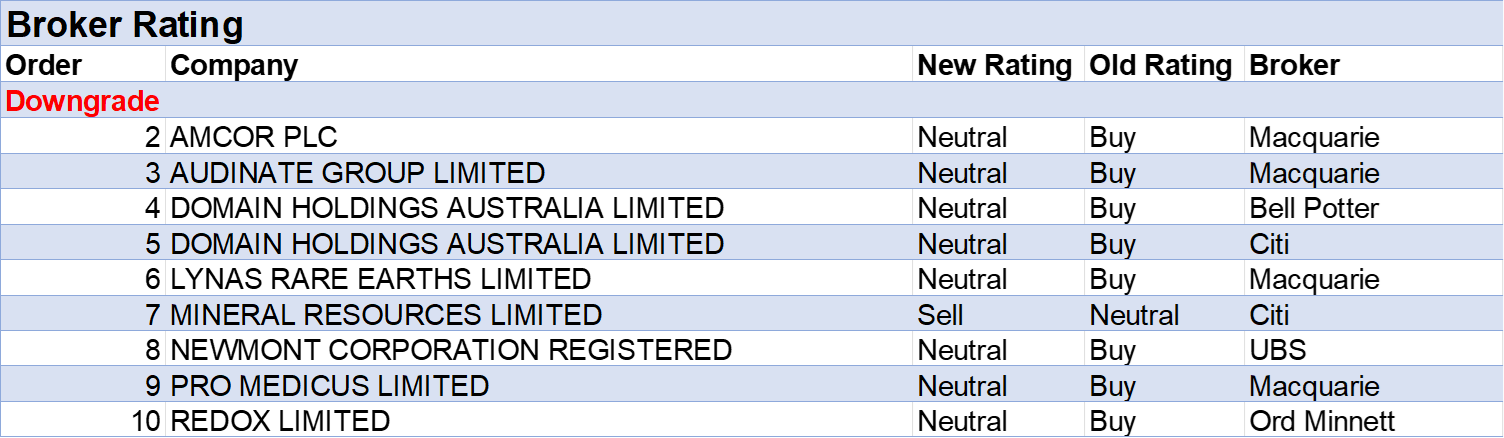

For the week ending Friday November 8, 2024, FNArena recorded just the one upgrade and nine downgrades for ASX-listed companies by brokers monitored daily.

The positive tables for both earnings and targets were headlined by Sigma Healthcare while Audinate Group featured atop both negative lists.

Morgans raised its target for Sigma Healthcare to $2.21 from $1.23 and retained a Hold rating after the “transformational merger” with Chemist Warehouse Group received ACCC approval.

While the store network continues to grow in Australia, Citi (target up to $2.50 from $1.40) also noted prospects for further international expansion, and highlighted more overall growth potential than other large-cap peers inside the Australian retail sector. Following the clearance of several additional hurdles, including shareholder and court approvals and prospectus preparation, the broker suggested the merger will complete early in 2025.

Suggesting “things are getting worse before they get better’, Macquarie (the sole broker in the FNArena database updating research on Audinate Group last week) lowered its target by -30% to $10.20 and downgraded to Neutral from Outperform.

While the analyst could see value on a three-year view, for the time being end-user demand for the company’s products is softening. Unfortunately for investors in Audinate, long-term structural growth is irrelevant to price action in periods of cyclical weakness, explained the broker.

For the first time in the last four weeks, Resource stocks did not dominate the table for negative change to average earnings forecasts, but Mineral Resources again featured prominently in second place.

Upon news Managing Director Chris Ellison will step down over the next 12-18 months and the Chairman will exit before the FY26 AGM, Citi lowered its target by -$15 to $35 and downgraded to Sell from Neutral. Highlighting negative ESG implications for many investors with concerns around culture and any other undisclosed matters, Citi analysts also felt the slow pace of leadership change will weigh on the stock price.

Bell Potter agreed, noting potential for ongoing volatility in the company’s share price for some time due to the chance of further allegations and the long-dated nature of the leadership transition.

On the flipside, Syrah Resources came in second on the positive change to earnings forecast list following third quarter operational results. Morgan Stanley raised its target for Syrah to 35c from 30c after EPS forecasts benefited from a reduction in loss-making volume estimates for the Balama Graphite operation in Mozambique and the Vidalia Active Anode Material Facility in the United States.

During the third quarter, no production occurred at Balama as management sold down inventory, while the broker doesn’t expect sales at Vidalia until the June quarter next year. A ramp-up of Vidalia production, an improvement in the overall graphite market demand (particularly ex-China), and a recovery in graphite prices will be key for ramping Balama production, explained the analysts.

Beginning the week above $3.00, the Domain Holdings Australia share price slumped to $2.68 by Friday after Citi and Bell Potter downgraded their ratings to Hold (or equivalent) from Buy following a disappointing first quarter trading update. Bell Potter noted strong listings growth, offset by soft yield due to a shift in sales strategy. Controllable yield of 6.4% comprised a 7.5% price increase but a -1.1% drop in depth. The latter was a function of pushing depth downgrades to the vendor to maintain the listing, rather than experience churn, explained the analysts.

Digital revenue growth of 9% year-on-year in the first quarter missed Citi’s 15% forecast due to weaker-than-expected Residential yield growth. Domain Insights revenue declined year-on-year due to termination of a data supply agreement and lower implementation revenue compared to the broker’s estimate for the first half.

While lending volumes have remained strong in the key Sydney and Melbourne markets (despite elevated interest rates), Bell Potter cautioned delayed interest rate cuts may negatively impact along with policy uncertainty prior to next year’s Federal election.

In the good books: upgrades

- BARBARA LIMITED ((SBM)) was upgraded to Outperform from Neutral by Macquarie. B/H/S: 1/1/0

Macquarie observes St. Barbara is raising $100m at 38c per share, with the proceeds expected to be used for the development of the Simberi Sulphide Project.

Management aims for first gold production at the project in the first quarter of FY28, with expected capex of -US$258m, while the broker estimates -US$300m.

Following the -22% decline in the share price, the stock is upgraded to Outperform from Neutral. The target price remains at 49c.

In the not so good books

Downgrades

AMCOR PLC ((AMC)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 0/5/0

Macquarie notes Amcor’s Q1 FY25 results met expectations, with EPS rising 5% on a constant currency basis. The analyst anticipates cost and volume comparisons will be less challenging in 1H25 than in 2H25. Healthcare showed early signs of de-stocking in 1H25, with volumes increasing in both rigids and flexibles by 3%.

Management has retained its FY25 guidance.

Macquarie lowers EPS forecasts by -3% for FY25 and FY26, mainly due to lower sales expectations. The target price is reduced to $16.30 from $16.50, Rating is downgraded to Neutral from Outperform, reflecting reduced upside potential for the company’s future earnings.

AUDINATE GROUP LIMITED ((AD8)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 1/3/0

Macquarie downgrades Audinate Group to Neutral from Outperform, with the broker stressing the outlook has scope to deteriorate further, with negative EPS “momentum” expected before financials improve.

The analyst’s longer-term positive view is overshadowed by near-term negatives, including a soft macro backdrop and weak user demand, as evidenced in the latest trading update, where gross profits were down -28% at the midpoint of guidance.

New product launches in 2H25 are expected to underpin some half-on-half revenue growth, though the contribution is forecast to be in the low to mid-single digits.

Macquarie lowers EPS forecasts by -1228% in FY25 and -93% in FY26. Target price falls by -30% to $10.20 from $14.60.

DOMAIN HOLDINGS AUSTRALIA LIMITED ((DHG)) was downgraded to Neutral from Buy by Citi and to Hold from Buy by Bell Potter. B/H/S: 1/4/1

Citi downgrades Domain Holdings Australia to Neutral from Buy, with a target price decline of -12% to $3.20 following the company’s 1Q25 trading update. The broker notes management is balancing listings coverage and the consumer experience with yield growth.

Citi observes pressure from REA Group’s strong price increases has impacted vendor marketing budgets. This has been a negative for Domain, despite an 8% year-on-year rise in listings share, which was in line with the broker’s forecast.

The analyst highlights lower-than-expected revenue growth and has reduced the forecast for cost growth to 9% year-on-year, with a decline in EBITDA gross margins of -20bps to 34.9% for FY25.

Bell Potter lowers its target for Domain Holdings Australia to $3.20 from $3.50 and downgrades to Hold from Buy after a 1Q trading update revealed soft yield due to a shift in sales strategy.

Strong underlying listings growth of 6% year-on-year provided a partial offset, notes the broker.

Management maintained FY25 opex guidance at high-single/low-double-digit growth and flat EBITDA margin guidance of 35.1%, flagging margin expansion in FY26.

Bell Potter lowers its EPS forecasts and reduces its assumed multiple for Core Digital.

LYNAS RARE EARTHS LIMITED ((LYC)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 1/3/2

Macquarie downgrades Lynas Rare Earths to Neutral from Outperform due to the valuation.

The company’s recent 1Q25 results were largely as anticipated, with management adjusting production rates to suit demand. Macquarie notes the Mt Weld expansion continued, with stage 1 concentrate de-watering commissioned, the analyst highlights.

Phase 2 construction is underway, with expected completion by the end of FY25. The broker highlights the delay in earthworks at the Seadrift site due to wastewater issues as one of the less positive updates from management.

The target price remains unchanged at $7.50. Neutral. The broker’s forecasts are adjusted by less than 1%.

MINERAL RESOURCES LIMITED ((MIN)) was downgraded to Sell from Neutral by Citi. B/H/S: 3/2/2

Upon news that the Managing Director will step down over the next 12-18 months and the Chairman will exit before the FY26 AGM, Citi downgrades its rating for Mineral Resources to Sell from Neutral.

The analyst believes the slow pace of change will likely weigh on the stock price.

The target also falls by -$15 to $35 after the broker lowers its DCF-based valuation to 0.75x from 1.0x on an upcoming ASIC probe. Also, it’s felt there are negative ESG implications for many investors with concerns around culture and any other undisclosed matters.

NEWMONT CORPORATION REGISTERED ((NEM)) was downgraded to Neutral from Buy by UBS. B/H/S: 2/2/0

UBS downgrades Newmont Corp to Neutral from Buy and lowers the target price to US$54 from US$67, citing a “loss of confidence” in the company’s ability to meet guidance and restore market trust.

The broker reduces 2025 gold production estimates by -10% to 5.6moz and raises ongoing capex to -US$1.8bn from -US$1.5bn, resulting in higher all-in-sustaining costs of US$1,450/oz.

UBS also cuts 2025 EPS forecasts by -17% and reduces free cash flow estimates by -30% for 2025/2026.

The report highlights Newmont has struggled to regain confidence in its operational performance, increase cash returns, and lower costs.

PRO MEDICUS LIMITED ((PME)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 0/3/2

Macquarie downgrades Pro Medicus to a Neutral rating from Outperform.

The broker notes recent share price gains have been driven by multiple expansion, largely reflecting anticipated contract wins and renewals.

US market share, critical to the stock’s valuation, is projected to grow to 15% by FY30 and 30% by FY35 at current valuation and target price levels.

Macquarie indicates potential growth could be driven by AI developments and new offerings in cardiology.

The target price increases to $180.50 from $152.50 due to a change in the discount rate, raising the valuation.

REDOX LIMITED ((RDX)) was downgraded to Hold from Accumulate by Ord Minnett. B/H/S: 1/1/0

Redox announced “resilient results,” Ord Minnett highlights, in what the analyst views as a challenging environment.

Due to recent changes in the Chinese chemical PPI and the Shanghai containerised freight index, Ord Minnett expects pricing may shift to a “headwind” in 4Q25. The analyst forecasts relatively flat EBITDA on a forex adjusted basis for FY25.

Robust volume growth is anticipated to be offset by pricing and more normalised gross margins.

Ord Minnett raises earnings forecasts by around 2% to 3% for FY25-FY27 due to the structurally attractive industry. The target price increases to $3.15 from $3.08. The stock is downgraded to Hold from Accumulate, as the broker believes it is fully valued.

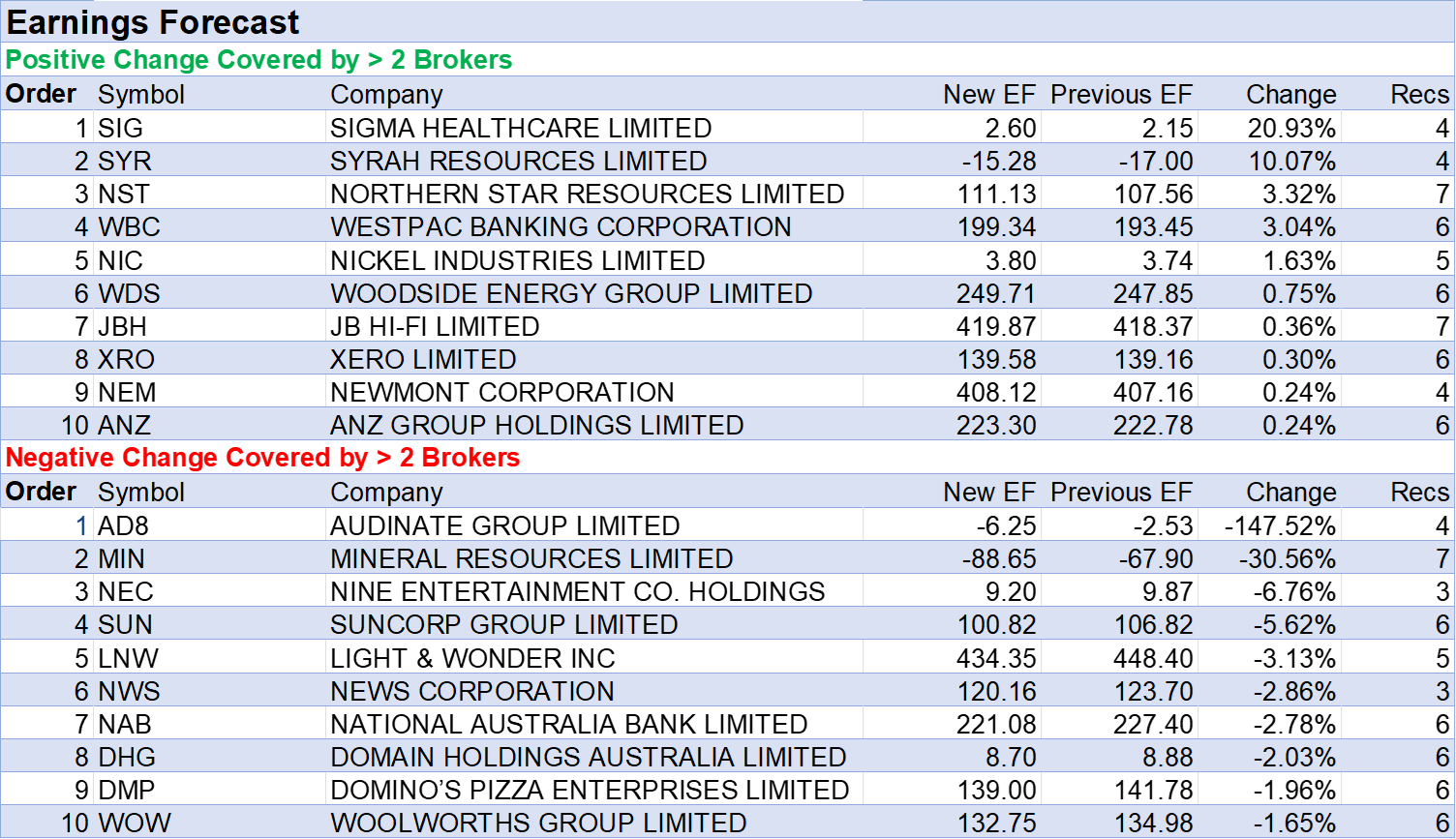

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.