The Australian exchange traded fund (ETF) market has come along in leaps and bounds in recent years, and investors now have a wide choice of cheap and highly diversified listed investments from across the world to select from.

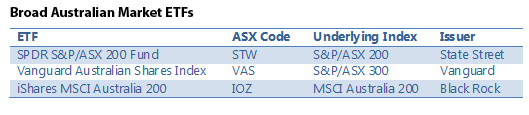

But if you want to keep things simple, investors need look no further than the ETFs providing broad coverage of the Australian market. There are now, in fact, three competing ETFs to choose from, and each provides exposure to the top several hundred blue chip companies in Australia by market capitalisation. So how can we choose between them?

Note: each ETF’s investment benchmark is slightly different – but for practical purposes, that doesn’t matter much. Vanguard’s ETF covers the S&P/ASX 300 top companies, whereas State Street’s covers the S&P/ASX 200 – so the former includes more of what are called ‘small cap’ stocks. Yet, as the top 200 stocks account for more than 95% of the market capitalisation of the top 300 index, the two indices tend to move in virtual lockstep.

Note: each ETF’s investment benchmark is slightly different – but for practical purposes, that doesn’t matter much. Vanguard’s ETF covers the S&P/ASX 300 top companies, whereas State Street’s covers the S&P/ASX 200 – so the former includes more of what are called ‘small cap’ stocks. Yet, as the top 200 stocks account for more than 95% of the market capitalisation of the top 300 index, the two indices tend to move in virtual lockstep.

Similarly, the MSCI 200 index, followed by the iShares ETF, only includes listed companies that are registered in Australia – so compared to the S&P/ASX 200 index, it excludes, most notably, News Corporation. But again, the differences in relative performance are tiny.

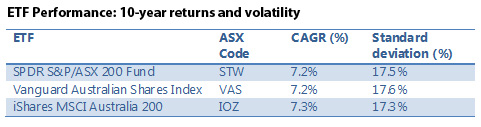

Over the past 10 financial years, for example, the relative returns and volatility of each underlying benchmark have been virtually identical. This is reflected in the compound annual growth rates (CAGR) in the table below.

We also can’t really distinguish between these ETFs on the basis of the size and experience of the ETF issuer. All three companies – State Street, Vanguard, and iShares – are major players in the global ETF industry, with billions under management.

We also can’t really distinguish between these ETFs on the basis of the size and experience of the ETF issuer. All three companies – State Street, Vanguard, and iShares – are major players in the global ETF industry, with billions under management.

Each provider also aims to match its benchmark in similar ways – by buying underlying securities, and using derivatives (futures) only minimally to manage cash flows. Neither group engages in securities lending, nor offer dividend reinvestment programs.

That said, State Street has been operating in the local ETF market the longest, with its SPDR S&P/ASX 200 – listed in August 2001 – being the oldest and largest ETF in the Australian market place. On the other hand, iShares only listed IOZ in December last year, while Vanguard listed VAS in May 2009.

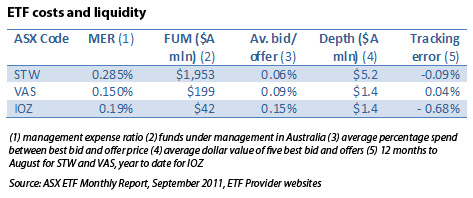

As a result, one key distinguishing characteristic is that State Street’s ETF retains moderately better liquidity. As seen in the table below, STW has by far the greatest funds under management and has average bid-offer spreads marginally lower than VAS and IOZ. STW has the greatest market depth. Tracking error – or the ability of the ETF to stick close to its benchmark – has tended to be very close for STW and VAS over time, though IOZ still appears to have had a few teething problems in its first months of operation.

That said, due to their unique structure, provided ETFs are carefully purchased, investors should be able to buy at prices quite close to their net asset value – though the above analysis suggests STW may retain greater liquidity in times of market volatility.

That said, due to their unique structure, provided ETFs are carefully purchased, investors should be able to buy at prices quite close to their net asset value – though the above analysis suggests STW may retain greater liquidity in times of market volatility.

Of course, State Street also makes investors pay for the privilege of potentially better liquidity, with a management expense ratio (MER) above those of its peers. The difference between MERs could account for up to 1% on performance every ten years.

Income investors should also note that STW only pays dividends semi-annually, whereas the other two are quarterly.

All up, active investors might prefer the liquidity benefits of STW, despite higher management fees, because of its higher liquidity and tighter spreads, while more passive longer-term investors should choose Vanguard’s ETF because it is cheaper. The iShares ETF is relatively new, though the company’s strength is mainly in the range of international ETFs it offers Australian investors. If you’re still undecided between the three, I’d go with STW.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.

Also in the Switzer Super Report

- Peter Switzer: It’s just like punting on horses

- Paul Rickard: Do Woolworths’ hybrid notes offer good returns?

- Charlie Aitken: How great is the upside for Australian iron ore stocks?

- Tony Negline: Should you have income protection insurance?