In case you’re reading this first ahead of other media, I have to inform you that the legend of cricket, Shane Warne, has passed away aged 52 from a suspected heart attack. Australians and Shane’s family, as well as the cast of thousands of friends and millions of fans, will be devastated today, and my heartfelt thoughts are with them all.

To money news and the Yanks pulled off a strong jobs report but stocks were down with three hours to trade. I must confess we live in confusing times when it comes to reading economic data, so let me explain.

First, a jobs report, which says 678,000 positions were created in February should be a sign that growth and company profits should be assured going forward, which should be good for stocks.

However, second, the great growth of jobs could mean more interest rate rises lie ahead, which is bad for tech and growth stocks, which have taken markets down since January.

And third, the Ukraine conflict has been spooking investors and hurting certain sectors. such as consumer discretionary and travel, with the likes of United Airlines down 13.7% for the month. War in Europe will do that! And this week a stock like Ralph Lauren was off 10.33% and LVMH is down 11.2% for the week and 19.3% for the month.

As the singer, Edwin Starr once sang: “War, what is it good for? Absolutely nothing!” That said, energy, commodity and defensive stocks argue with that belief.

Finally, the fear of war has created a flight to safety, which means 10-year US bond yields have fallen, which should be a plus for stocks.

It looks like the fear of what Vlad could create or destroy plus the apparent strength of the US economy and its likely impact on interest rates, once this war is over, is keeping stock market indices negative. But who knows what the story could be next week?

Did I say we live in confusing times? Yep, I think stock markets are often hard to understand, and then even harder to invest in successfully. But wars, where you don’t know how long they’ll go on for and what will stop them, along with a pandemic that hopefully is on the wane, really raises the high jump bar for comprehension, even for someone like me.

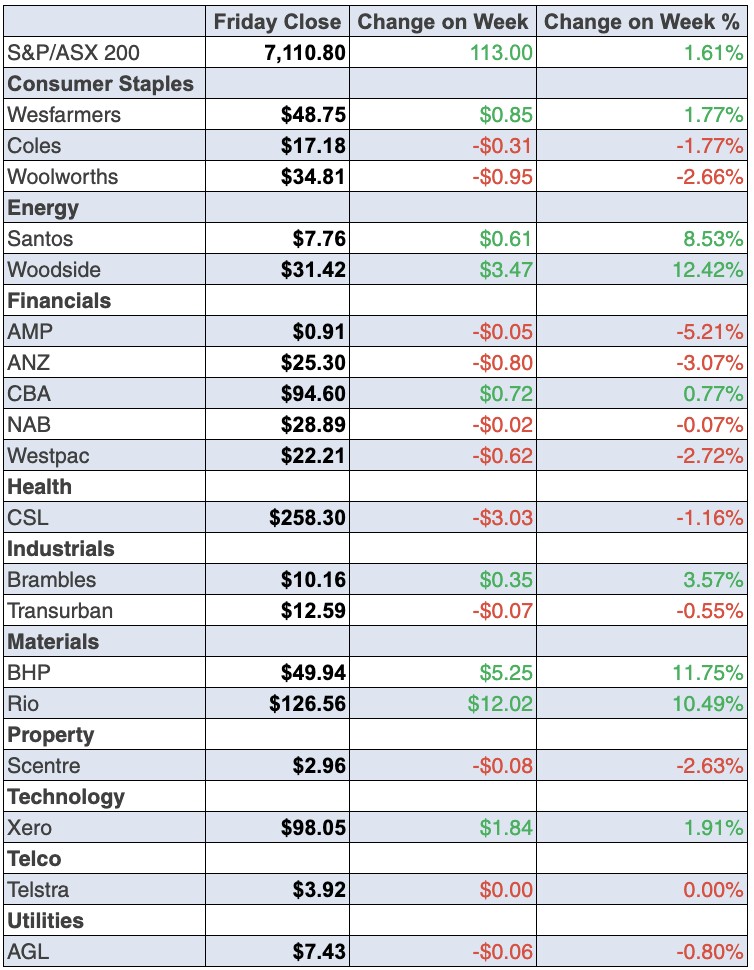

To the local story and a fire in a nuclear facility in Ukraine ruined what was a positive week for stocks, but the 0.6% fall of the S&P/ASX 200 Index on Friday couldn’t stop it from rising 1.6% for the week.

News later explained the fire was in a training block and the market regained 1.2% before the close, with tech stocks really copping it, which followed a trend coming out of Wall Street.

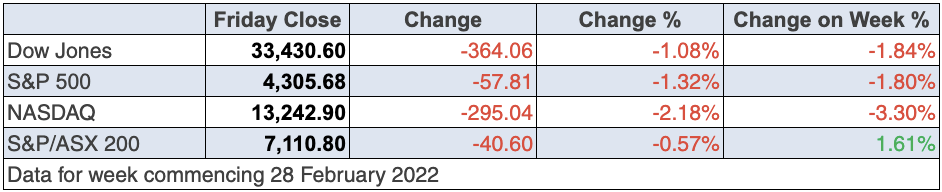

This table says it all:

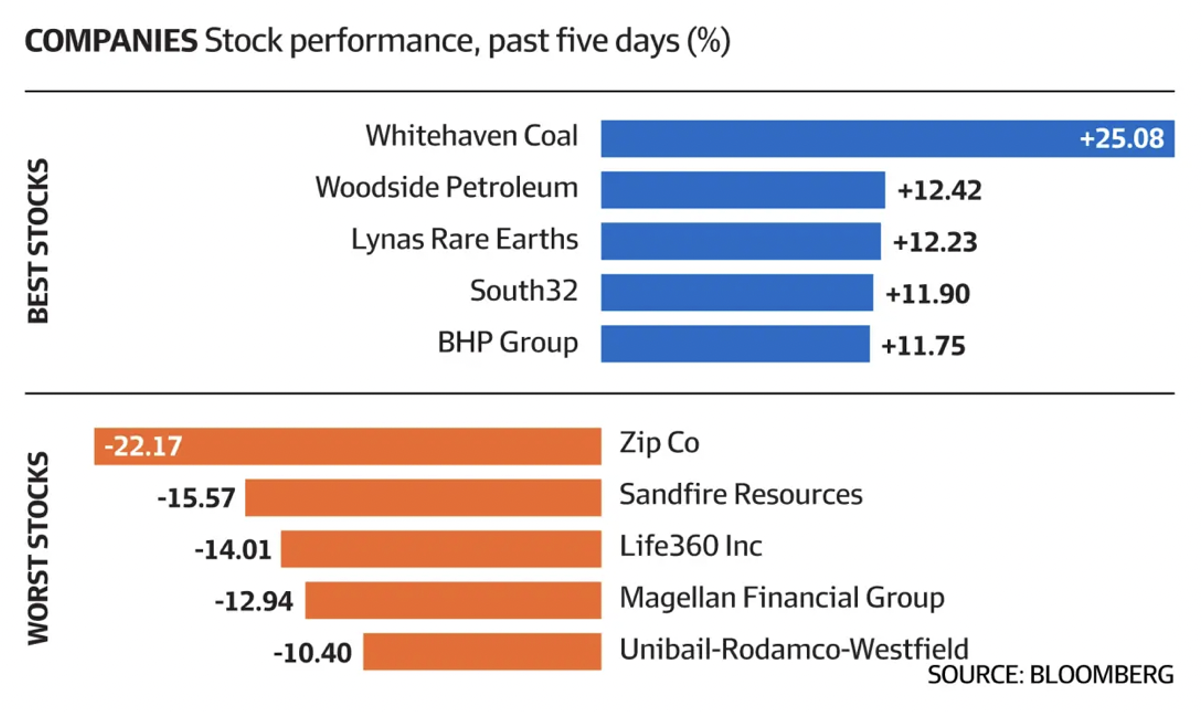

The war in Ukraine has been positive for mining stocks and other commodities, such as wheat, with Graincorp up 7% to $8.67 over the week.

Tyro Payments gave up 5.4% to $1.59 after a better week where the loss was only 2.75%. But Zip’s merger with Sezzle hasn’t helped the company’s share price, as the table above shows. Those interested in Zip’s future should see my interview with the company’s founder and CEO, Larry Diamond, which I did for Thursday’s TV show.

Magellan is still struggling, down 3.25% on Friday to $15.48, meaning it lost 12.7% for the week! On the other hand, defensive stocks, such as WOW, were up 2% on Friday, though it was down 1.4% for the week. If this war continues to worry the market, consumer staple stocks will get re-loved. Not surprisingly, energy stocks had a good week, with the oil price at about $US112 a barrel, so Woodside was up 9.72% to $31.42, while Santos put on 4.72% to $7.76.

What I liked

- The Australian economy (as measured by gross domestic product or GDP) grew by 3.4% in the December quarter – the strongest gain since the March quarter of 1976. The strong growth followed a 1.9% contraction in the September quarter, reflecting lockdowns. The economy is up 4.2% for the year.

- The CoreLogic Home Value Index of national home prices rose by 0.6% in February, the slowest monthly gain in 16 months. Home prices are up 20.6% over the year, easing from the fastest pace in 32½ years. Good to see moderation creeping in.

- The AiGroup Australian Performance of Manufacturing Index (PMI) rose by 4.8 points to 53.2 in February. And the final IHS Markit Australia Manufacturing PMI lifted from 55.1 to 57 in February. Readings over 50 denote an expansion in activity.

- New home loans rose by 2.6% in January to a record high of $33.2bn. The value of owner-occupier loans lifted by 1%, with investor loans up by 6.1%.

- The current account surplus fell by $9.3bn to $12.7bn (2.3% of GDP) in the December quarter. It’s a fall but it’s still a good surplus.

- According to the Federal Chamber of Automotive Industries, new vehicle sales totalled 85,340 units in February, up 1.6% on a year ago. It was the best February sales since the pandemic began.

- Eurozone unemployment fell to a record low of 6.8% in January.

- In testimony to the Senate Banking Committee, US Federal Reserve chair Jerome Powell said that the Fed will effectively use the tools to bring inflation down.

- He also said that he will support a 25-basis point rate hike at the March 15 meeting.

- In the US, Challenger reported that job cuts fell from 19,064 to a 25-year low of 15,245 in February (survey: 20,000).

- In the US, the ISM services purchasing managers index (PMI) fell from 59.9 to 56.5 in February (survey: 61). The Markit gauge rose from 51.2 to 56.5 and any number over 50 means expansion.

- ADP reported that private sector employment rose by 475,000 in February (survey: 388,000).

- In the US, the ISM manufacturing purchasing managers index (PMI) rose from 57.6 to 58.6 in February (survey: 58). The Markit manufacturing PMI rose from 55.5 to 57.3 (survey: 57). Construction spending rose by 1.3% in January (survey: 0.2%).

What I didn’t like

- The investing uncertainty that this war escalates.

- Supplier deliveries data in the US ISM report this week showed the supply chain problems are not easing yet. This will be a closely-watched data point in coming months.

- Local dwelling approvals fell by a record 27.9% in January to a 19-month low of 12,916 units. Approvals are down by 24.1% on a year ago. These plunged 27.9% in January, the biggest monthly percentage decline since records began in July 1983. Council approvals to build private sector houses dropped 17.5% in the month, the most in 21½ years (since June 2000). Private sector dwellings excluding houses – primarily apartments – plunged 43.6% – the most in 9½ years.

- CommSec says: “Of course, Omicron-virus related disruptions and summer holidays likely contributed to the slump in residential building approvals. In fact, the Housing Industry Association reported: ‘The absence of council workers, private certifiers and building business staff will have weighed on the ability to process approvals.’”

- The ANZ-Roy Morgan consumer confidence index fell by 2.6% to 99.2 points last week. The war could not have helped but I will be less interested in weekly confidence numbers as the economy throws off the virus concerns and normalcy starts coming back.

Is this war a buying opportunity?

I liked this from Jeff Mortimer, director of investment strategy at BNY Mellon Wealth Management: “I think the market perhaps is in a bottoming process, but it’s very hard to map or model these types of geopolitical issues,” he told CNBC. “History is full of teachings that you buy during periods of conflict … but every war and situation is different”.

My best guess is that the war eventually concludes, interest rates rises in the US will be slower than was once predicted and rebounding global growth will be great for stocks.

This is just a guess, but I’m investing on it for now.

The week in review:

- This week in the Switzer Report, I try to piece together a domestic portfolio of companies/businesses/investments that might be seen as a Buffett-style collection for Australia. Here’s the group I came up with – quality companies that I keep adding to my portfolio.

- Paul (Rickard) likes Ramsay, Australia’s leading operator of private hospitals. Paul goes into great detail as to why he thinks Ramsay is a long-term buy at a certain price. Paul also gets the lay of the land with the war in Ukraine, oil price surge, and news of the Fed potentially scaling back its short-term rate hike, to assess whether we will see the share market go higher in March.

- James Dunn goes through five stocks that impressed during this reporting season, that he’d be happy to buy on the basis of their strong showing.

- Tony Featherstone has long argued that investors shouldn’t buy companies on the basis of takeover speculation. The goal should be to find companies that are good investments, with or without a takeover. However, Tony says this form of deep-value investing is usually a good basis for takeovers because eventually, predators pounce when assets are mispriced for too long. In his article today, Tony gives a snapshot of three large-cap and two small-cap potential takeover targets.

- In our “HOT” stocks column, Michael Gable, Managing Director of Fairmont Equities, explains why he thinks BlueScope Steel (BSL) is a buy.

- In Buy, Hold, Sell — Brokers Say, the week ending Friday February 25 was the busiest of the February reporting season, with 30 upgrades and 21 downgrades to ASX-listed companies covered by brokers in the FNArena database. In the second edition, there were 13 upgrades and 11 downgrades.

- And finally, in Questions of the Week, Paul Rickard answers subscribers’ queries about how you can invest in the ANZ and CBA Capital Note issues; how many Woodside shares will you receive when the BHP demerger is completed?; Should you follow Macquarie into Betmakers? Kogan and Soul Pattinson – are they buys?

Our videos of the week:

- ‘Don’t treat cholesterol, treat risk,’ | The Check Up

- How will the Russian invasion affect our experts’ investing & what stocks look hot after reporting? | Switzer Investing

- Marjan Mikel from Respiri (ASX: RSH) | The CEO Masterclass

- How will Putin’s play hurt global growth and the stock market? | Mad about Money

- The CEO of Zip on why Zip bought Sezzle + 3 stocks to buy following reporting season | Switzer Investing

- Boom! Doom! Zoom! | Thursday 3 March

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday March 7 – Job advertisements (Feb)

Tuesday March 8 – NAB Business survey (Feb)

Tuesday March 8 – CBA Household spending intentions

Wednesday March 9 – Speech by Reserve Bank Governor

Wednesday March 9 – Consumer confidence (March)

Thursday March 10 – Weekly payroll jobs and wages (Feb 12)

Friday March 11 – Speech by Reserve Bank Governor

Overseas

Monday March 7 – US Consumer credit (Jan)

Monday March 7 – China International trade (Jan)

Tuesday March 8 – US NFIB Business optimism (March)

Tuesday March 8 – US Economic optimism (March)

Wednesday March 9 – US JOLTs job openings (Jan)

Wednesday March 9 – China inflation (Feb)

Thursday March 10 – China lending data (Feb)

Thursday March 10 – US Consumer prices (Feb)

Friday March 11 – US Consumer sentiment (March)

Friday March 11 – US Monthly Budget Statement (Feb)

Food for thought: “You get recessions, you have stock market declines. If you don’t understand that’s going to happen, then you’re not ready, you won’t do well in the markets.” – Peter Lynch

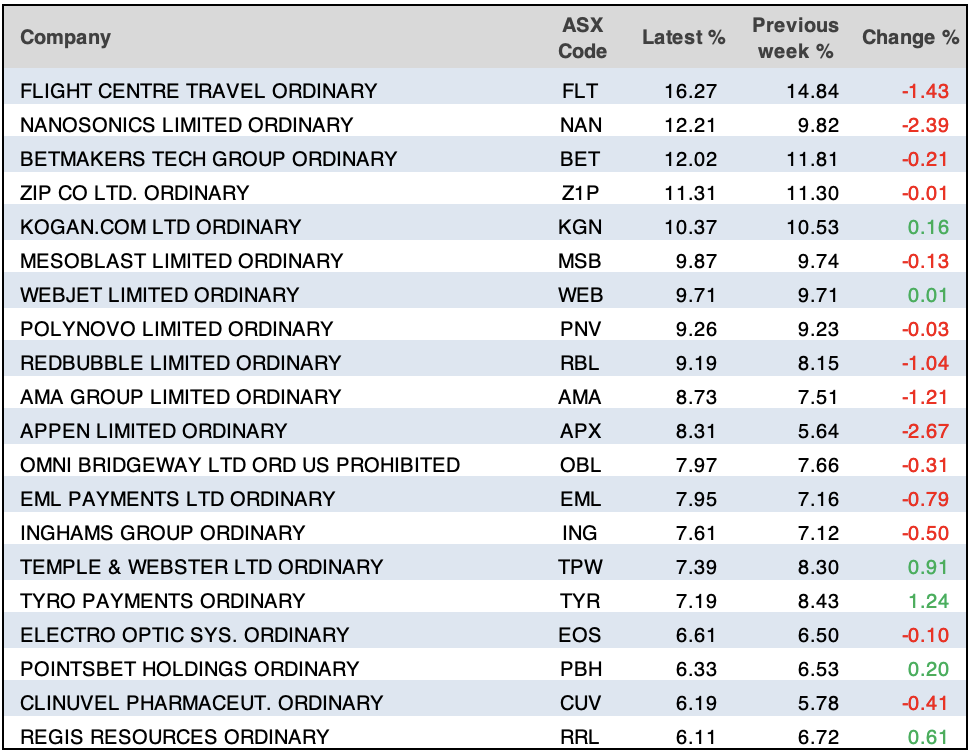

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart(s) of the week:

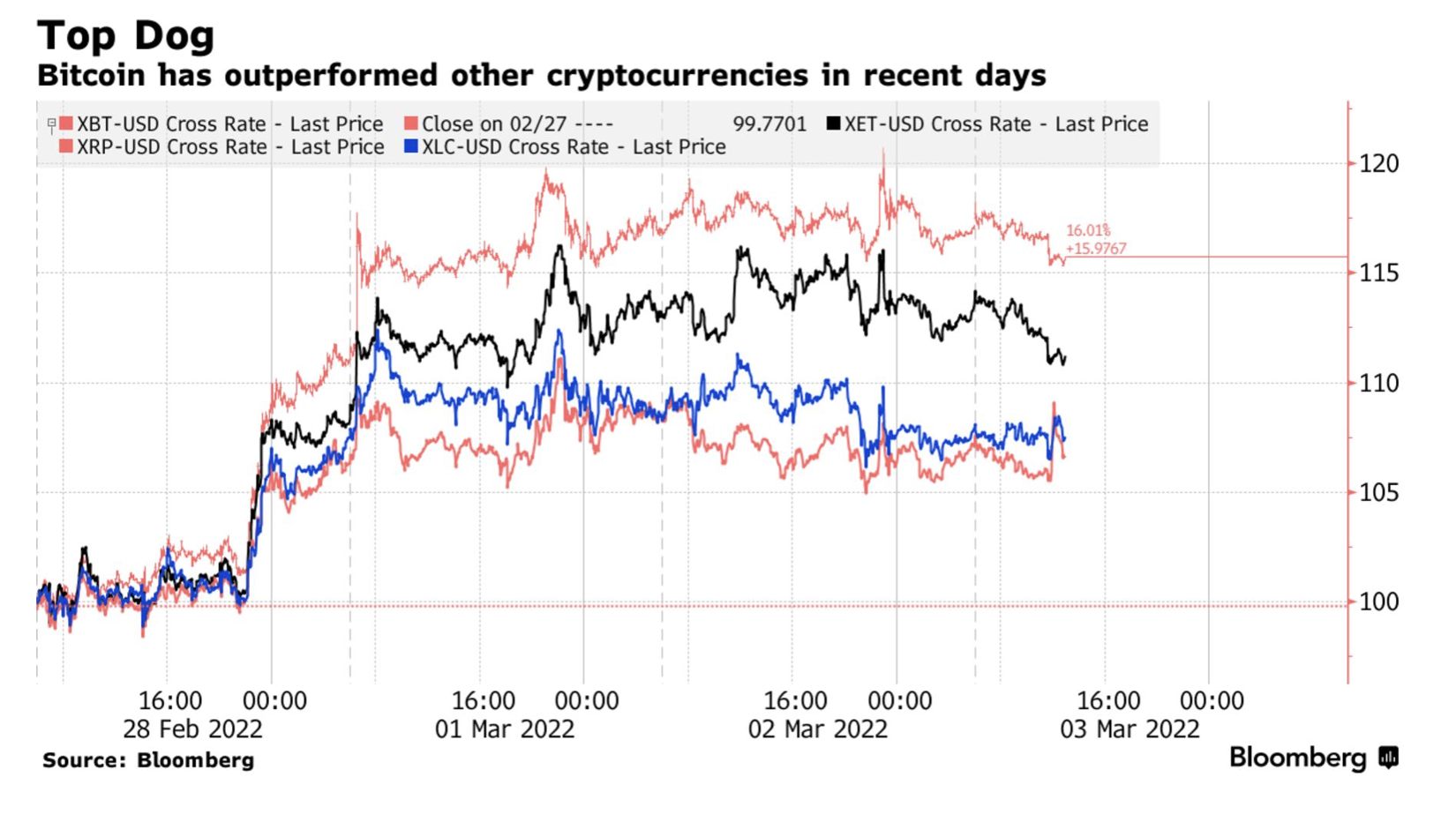

I’m sure our chart(s) of the week is likely to ruffle some feathers, as it showcases how legacy cryptocurrency Bitcoin (BTC) reasserted itself within the crypto market since the escalation of Russia’s invasion into Ukraine. While one side argues that BTC is a speculative asset, backed by nothing, with the other claiming it is the superior hedge against inflation, earlier this week it outperformed many of the higher-ranked cryptos such as Ethereum (ETH) amidst the current economic uncertainty, seeing a 16% spike over four days as of Thursday.

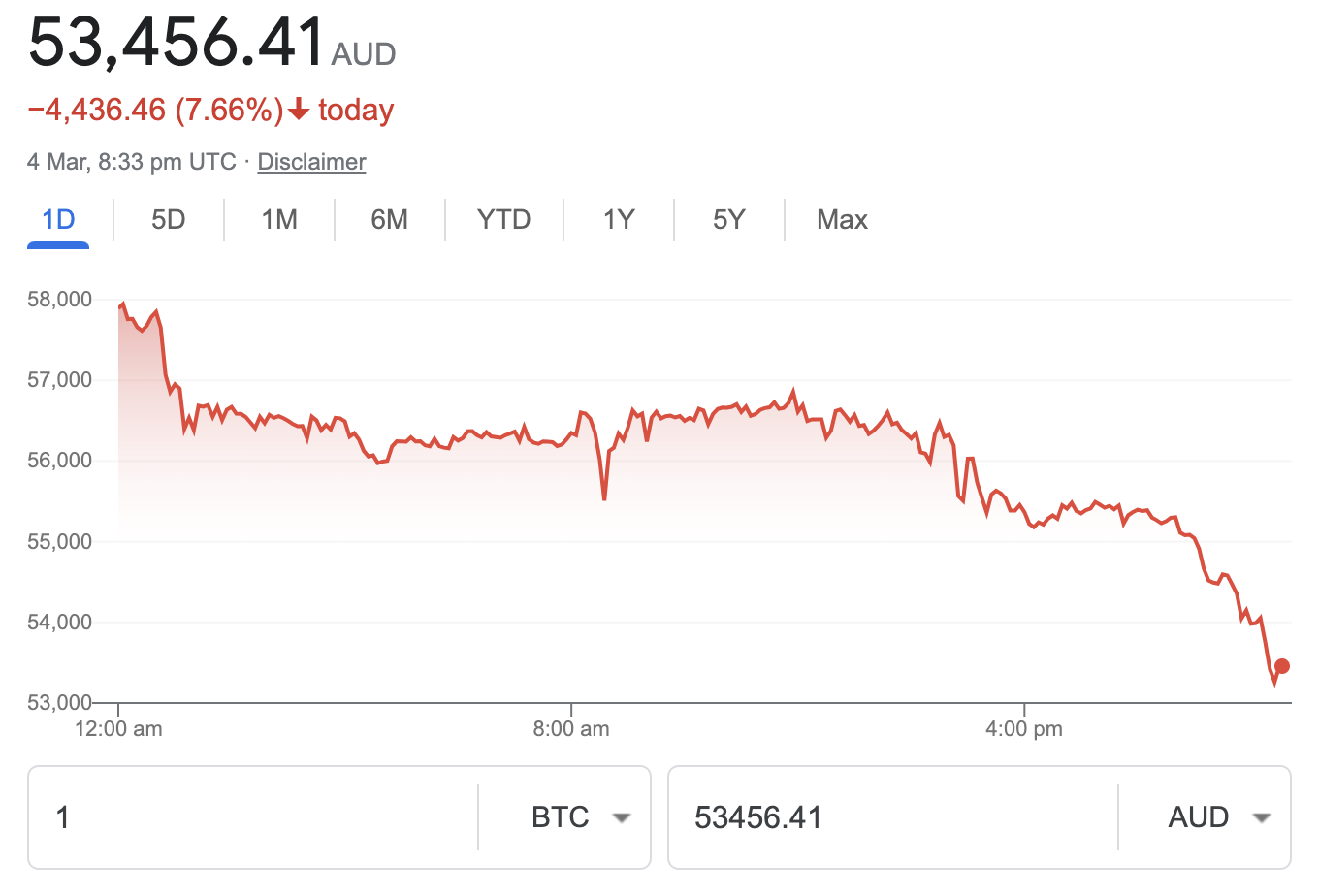

However, Bitcoin has already plummeted from this rally (down 7.66% over the last 24 hours alone), again shedding light on the disconnect between its purported use case as an inflation hedge and its sheer volatility. Despite this, JPMorgan strategists led by Nikolaos Panigirtzoglou say, “Bitcoin enjoys a special status in the current juncture as it represents the only cryptocurrency that is perceived as a substitute to gold and thus as a hedge to a catastrophic scenario”.

Top 5 most clicked:

- 11 Aussie stocks that pass Warren Buffet’s test – Peter Switzer

- 5 stocks to buy out of reporting season – James Dunn

- Ramsay – a “blue chip” recovery stock – Paul Rickard

- 5 takeover targets – Tony Featherstone

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.