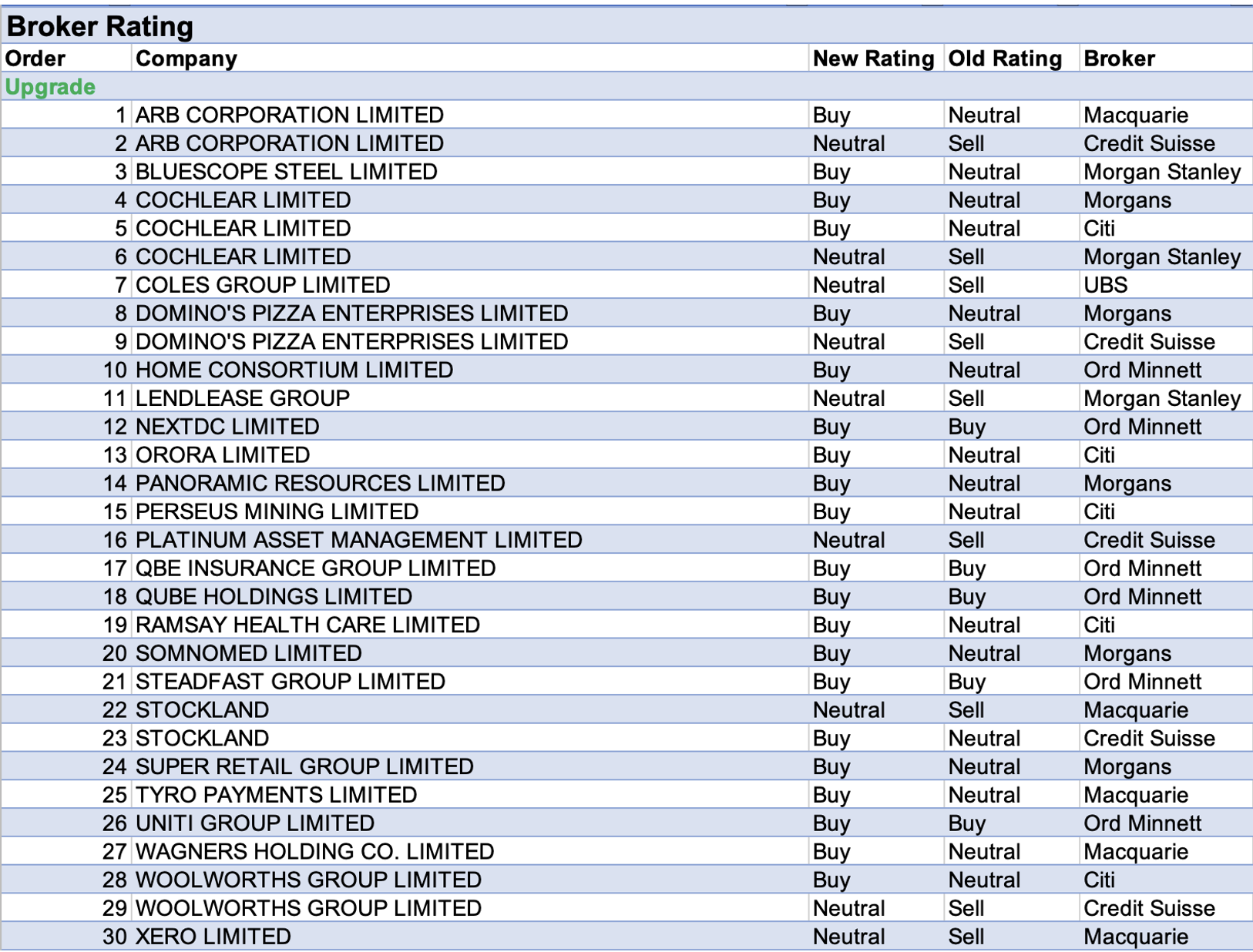

The week ending Friday February 25 was the busiest of the February reporting season, with 30 upgrades and 21 downgrades to ASX-listed companies covered by brokers in the FNArena database.

Cochlear received rating upgrades from three separate brokers following interim results that exceeded expectations. Morgans (Add from Hold) notes improving clinic access allowed for strong sales growth in the Services and Acoustics segments.

Morgan Stanley (Equal-Weight from Underweight) focused on margins that benefited from a reduction in operating expenses, as well as research and development costs. Meanwhile, Citi (Buy from Neutral) highlighted the 5% guidance upgrade, though notes the run-rate for the profit margin is currently running below the 18% long-term target for FY22 and FY23.

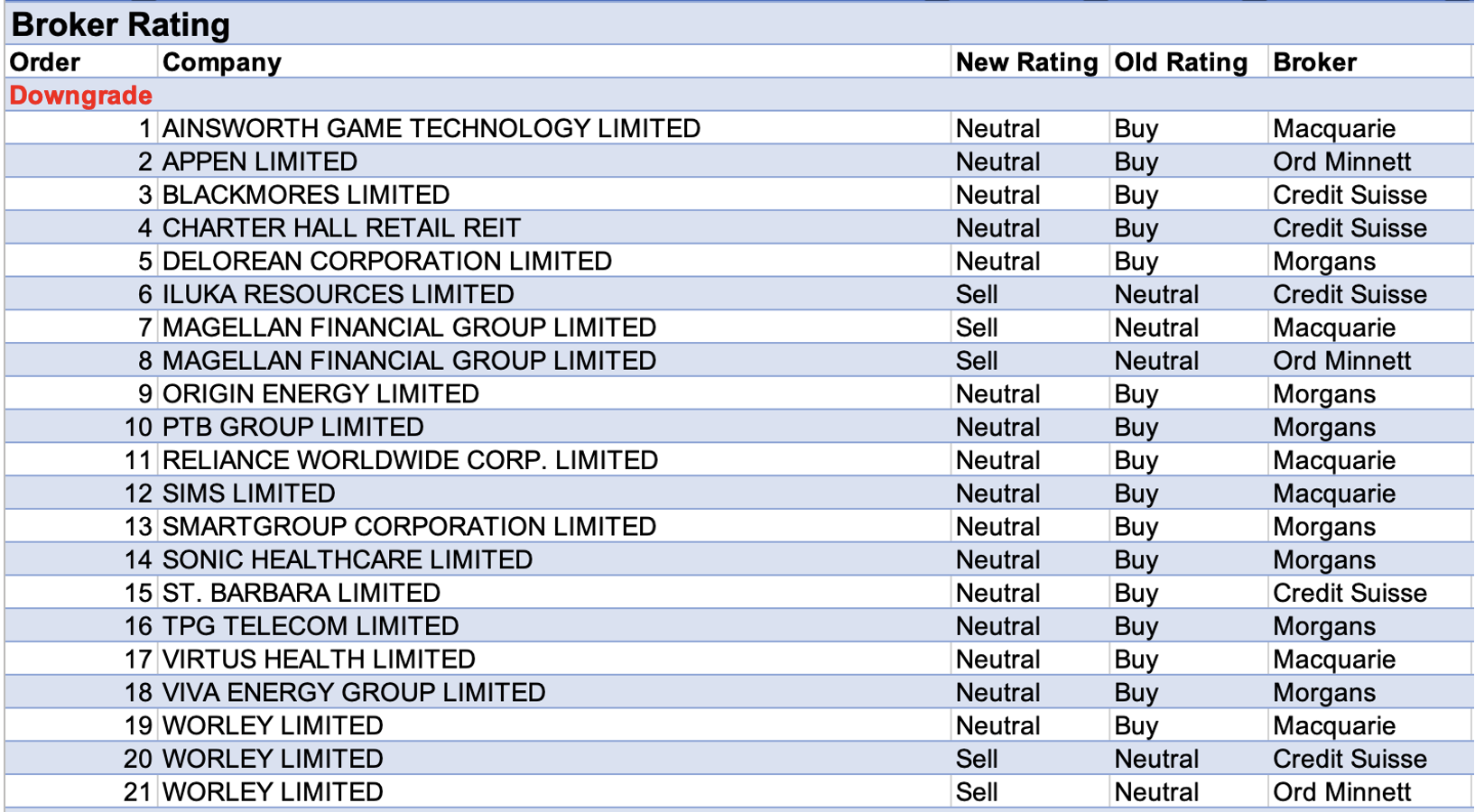

On the flipside, Worley received three downgrades after revealing generally in-line first half results. The company committed to spending -$100bn over three years in support of its strategy to increase sustainable business to 75% within five years from 32% currently.

Credit Suisse, which lowered its rating to Underperform from Neutral on valuation grounds, suspects the workflow from green energy may take longer than the market is anticipating. Macquarie (Neutral from Outperform) agrees on a too-high valuation following recent share price strength.

On the other hand, Ord Minnett (Lighten from Hold) appeared to have deeper concerns, citing that some projects will be deferred because of capital restrictions, staffing levels have increased and consensus estimates are too high. Nonetheless, all three brokers that downgraded ratings also set higher target prices, as did Citi, UBS and Morgan Stanley.

As a result, Worley topped the chart for the highest percentage increase in target price by brokers last week in the FNArena database. Alternatively, Tyro Payments had the largest percentage fall in target price.

The company experienced a softer gross profit margin for payments in the first half, and higher-than-expected operating costs. Morgans downgraded FY22-24 EPS estimates by more than -50% and Ord Minnett reduced short-term margin and growth assumptions. Meanwhile, Macquarie raised questions on how operating leverage could be generated in the competitive payments industry amid limited pricing power and elevated demand for technical staff.

Despite largely in-line first-half results, concerns linger around the GE Health transition and CORSIS commercial launch, according to Morgans. Also, Ord Minnett notes staffing shortages are likely to affect US ultrasound procedures and Nanosonics’ sales growth may be stymied even when the pandemic recedes.

Next was Crown Resorts. Following first half results, Ord Minnett pushes out the assumed commencement date for the Barangaroo gaming operations and notes increased near-term pressure from regulatory and wages costs. While Macquarie was also disappointed by the results, they are considered academic given there’s little risk the $13.10 takeover by Blackstone will not proceed.

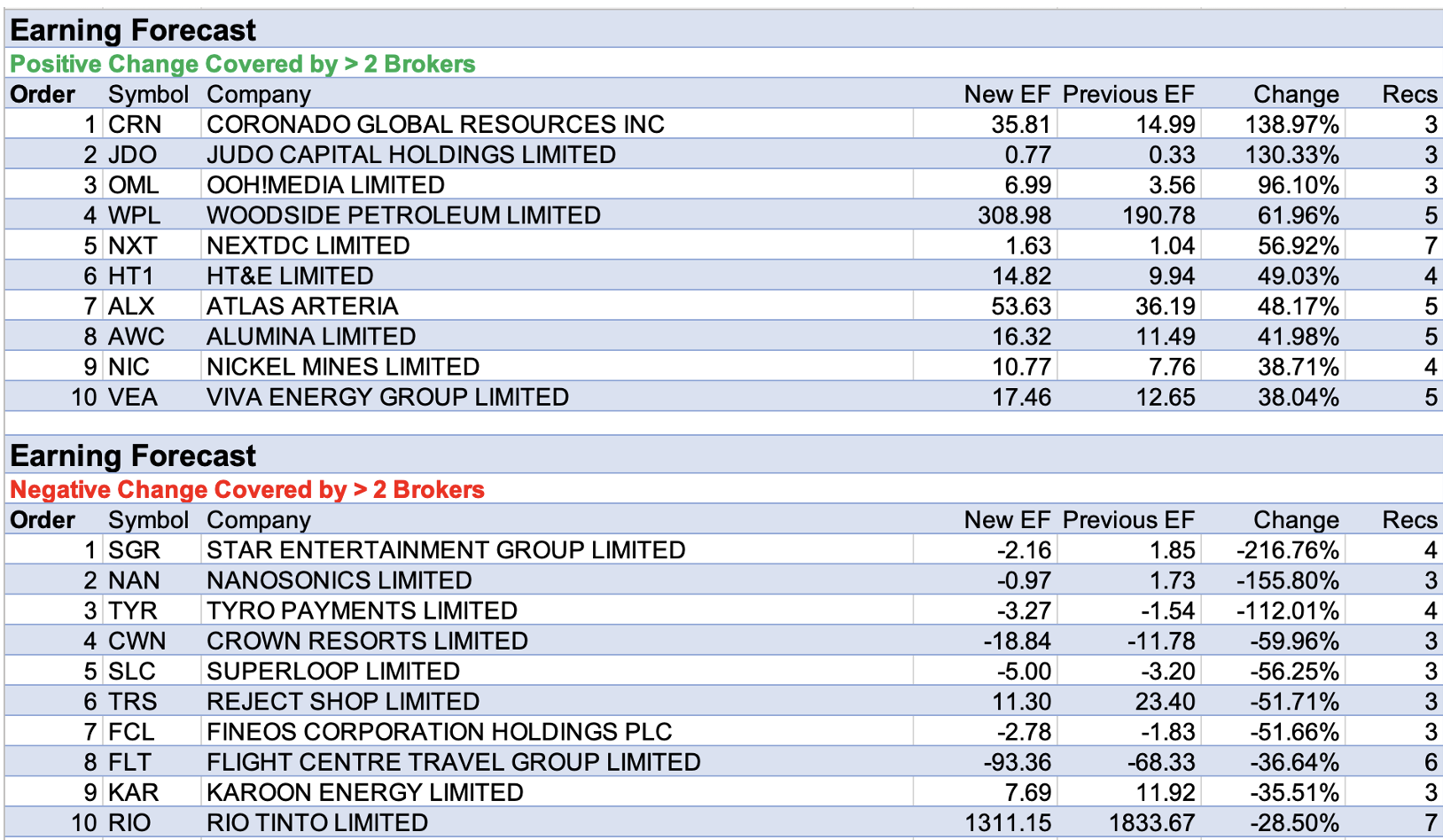

On the positive side of the ledger, Coronado Global Resources received the largest percentage increase in forecast earnings following FY21 results.

Higher-than-expected coal pricing drove Morgans forecast earnings upgrades, while the US$9cps (re-instated) dividend was a key surprise and 2022 guidance was better than feared. Macquarie also points out realised pricing, earnings and cash flow have increased materially into 2022, and are expected to continue through the year.

Next up was Judo Capital, which is on track to beat prospectus forecasts in FY22, according to Credit Suisse. Citi anticipates even larger earnings upgrades in FY23, as the RBA raises its cash rate and delivers a net-interest-margin windfall. However, like Citi, Macquarie retains its Neutral rating, as FY22 expenses are likely to be higher than the prospectus estimate.

Despite FY21 results for oOH!Media that were largely in-line with broker estimates, earnings were revised up. Ord Minnett incorporates a return to pre-pandemic levels in sales during 2022, while Fly/Locate will have to wait until 2024.

Apart from being a recovery play, Macquarie assesses structural tailwinds for the company over the longer term and forecasts stable dividends going forward.

Finally, NextDC had a lift in forecast earnings by brokers last week following first half results. Ord Minnett upgraded its rating to Buy from Accumulate after first half earnings came in ahead of forecasts, materially improving on the losses of a year ago.

It’s felt the business is positioned to benefit from the migration of IT work to the cloud and centralised data centres. The broker highlights operating leverage in the more mature data centres and notes the third facilities in Sydney and Melbourne remain on track and budget.

Credit Suisse, one of the seven brokers updated daily on the FNArena database, was less bullish on NextDC than the other six last week. The analyst sees a slower ramping-up for contracted and billing utilisation over the next couple of years and lowers estimates for contract gains.

Total Buy recommendations take up 58.26% of the total, versus 35.45% on Neutral/Hold, while Sell ratings account for the remaining 6.528%.

In the good books

DOMINO’S PIZZA ENTERPRISES LIMITED (DMP) was upgraded to Neutral from Underperform by Credit Suisse and Upgrade to Add from Hold by Morgans, B/H/S: 3/3/0

Credit Suisse noted a significant negative reaction to the results, with network sales ahead of forecasts but profit below.

The broker reduces the Asian segment margin and the main issue is whether the number of corporate stores that opened over the last three years in Japan will be sustainably profitable post the pandemic.

While costs have been a focus in Europe in particular, the company has indicated there are enough efficiencies and menu innovation to avoid price increases in FY22.

Credit Suisse upgrades to Neutral from Underperform as the stock has come within reach of valuation. Target is reduced to $87.80 from $89.24.

Despite an interim result that underwhelmed on operating margins, Morgans lifts its rating for Domino’s Pizza Enterprises to Add from Hold as the growth story remains intact. In addition, the share price has undergone a sustained period of weakness.

The broker’s earnings (EBIT) forecasts are lowered by -5% and -4% for FY22 and FY23. Profitability in Asia underperformed expectation, after a retracement of higher covid-induced margins from last year, though new corporate store openings should again improve margins, suggests the broker.

The target price falls to $115 from $135.

HOME CONSORTIUM LIMITED (HMC) was upgraded to Buy from Hold by Ord Minnett, B/H/S: 2/1/1

First half results were ahead of Ord Minnett’s forecasts, largely because of lower tax charges. Home Consortium plans to raise $500m in the second half and is selling the remaining five balance sheet assets, providing a net cash position and the ability to fund growth with debt across its funds’ platform.

Ord Minnett is backing management’s ability to source accretive opportunities. As the share price has pulled back over recent months, the current entry point is considered attractive and the rating is upgraded to Buy from Hold. Target slips to $7.40 from $7.80.

NEXTDC LIMITED (NXT) was upgraded to Buy from Accumulate by Ord Minnett, B/H/S: 6/1/0

First half earnings were ahead of forecasts, materially improving on the losses of a year ago. Ord Minnett highlights the operating leverage in the more mature data centres. Significantly, the third facilities in Sydney and Melbourne remain on track and budget.

Ord Minnett believes the business is positioned to benefit from the migration of IT work to the cloud and centralised data centres, upgrading to Buy from Accumulate. Target is reduced to $13.50 from $14.00.

PANORAMIC RESOURCES LIMITED (PAN) was upgraded to Add from Hold by Morgans, B/H/S: 2/0/0

Panoramic Resources’ headline profit in the half was a positive surprise for Morgans given six months of operations and only one concentrate shipment.

With two shipments now dispatched, payments received or on the way, and undrawn debt facilities, the miner’s finances appear in good shape to continue operational ramp-up. WA reopening suggests FY production is not impacted.

The broker remains positive on the stock, with nickel prices up 20% year to date and copper and cobalt credits remaining strong, while production is forecast to increase in the second half.

Target rises to 29c from 28c, upgrade to Add from Hold.

PERSEUS MINING LIMITED (PRU) was upgraded to Buy from Neutral by Citi, B/H/S: 3/0/0

First half results for Perseus Mining were better than expected and Citi likes the successful (so far) ramp up of Yaoure and the strategy to sustain 500kozpa.

The target price rises to $2.00 from $1.90. An interim dividend of 81cps was declared.

PLATINUM ASSET MANAGEMENT LIMITED (PTM) was upgraded to Neutral from Underperform by Credit Suisse, B/H/S: 0/3/2

First half results were ahead of estimates largely because of higher fees. Underlying earnings were broadly stable with the highlight being the expansion of management fee margins which the company attributed to a higher skew to retail.

The broker upgrades to Neutral from Underperform, noting fund performance to date is strong and the Asia fund has also improved.

Moreover, the stock has underperformed the market over the last year, providing more valuation support. Target is raised to $2.70 from $2.50.

QUBE HOLDINGS LIMITED (QUB) was upgraded to Buy from Accumulate by Ord Minnett, B/H/S: 3/2/0

Ord Minnett upgrades to estimates for earnings per share by 8% to reflect a strong start to the second half and the carry of grain volumes from a bumper harvest.

The broker believes the business is now a much cleaner integrated logistics company after the sale of Moorebank, and now has quality assets that will be difficult to replicate.

The broker envisages Qube Holdings is trading on a premium for the yet-to-be-deployed capital. Rating is upgraded to Buy from Accumulate and the target lifted to $3.45 from $3.40.

RAMSAY HEALTH CARE LIMITED (RHC) was upgraded to Buy from Neutral by Citi, B/H/S: 2/3/1

Post Ramsay Health Care’s H1 result, largely in-line with no guidance for FY22, Citi has decided to upgrade to Buy from Neutral while slicing -$1 off its price target to $75.

Costs are to remain higher than pre-covid and the return to “normal” continues to be pushed further out. Citi has concluded FY24 is the year to focus on; when conditions are expected to return back to (more) normal.

STOCKLAND (SGP) was upgraded to Outperform from Neutral by Credit Suisse and Neutral from Underperform by Macquarie, B/H/S: 4/2/0

First half results were in line although Credit Suisse notes a strong skew to the second half will be required to hit guidance. Lower residential and land lease settlement volumes are expected over FY22 but should be offset by higher margins.

The broker notes price increases appear to be offsetting cost pressures, with Stockland Group maintaining its operating profit margin of more than 18%.

Credit Suisse also believes the sale of the retirement business is a positive as it has been a drag on returns for many years. Rating is upgraded to Outperform from Neutral and the target reduced to $4.56 from $4.66.

Stockland Group’s December first-half result fell short of Macquarie’s forecasts, thanks to a larger skew to the second half.

Management narrowed guidance to the top of the range and operating margins improved.

The broker notes the company is making strong strategic progress, divesting retirement assets at book value and building joint ventures in land lease and M_Park, the net result being a reduction in gearing.

Macquarie expects deployment of funds should build recurring income streams from FY23 onward and improve asset allocation.

FY22 FFOPS forecast eases -1% given lower residential settlements and FY23 to FY24 forecasts rise 1%.

Rating upgraded to Neutral from Underperform. Target price edges up to $4.19 from $4.06.

WAGNERS HOLDING CO. LIMITED (WGN) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 3/0/0

Wagners Holding Co’s December first-half result proved a mixed bag, earnings (EBIT) outpacing Macquarie by 20% and net profit after tax disappointing.

The broker reports strong price traction and a positive demand outlook but the earth-friendly concrete and Composite Fiber Technologies reported losses.

Management is optimist, expecting price rises will triumph over cost inflation.

EPS forecasts are downgraded -4.6% in FY22, -4% in FY23 and are raised 1% in FY24.

Macquarie upgrades to Outperform from Neutral, expecting an improvement in the operating environment. Target price is $1.75.

WOOLWORTHS GROUP LIMITED (WOW) was upgraded to Buy from Neutral by Citi and Neutral from Underperform by Credit Suisse, B/H/S: 2/3/1

Woolworths Group’s H1 performance met guidance and forecasts and Citi observes underlying momentum for food sales seems to be improving.

As the broker sees an improved outlook on the horizon, small improvements have been made to forecasts. Target price increases by 3% to $40.30.

Rating is upgraded to Buy from Neutral.

Credit Suisse notes inflation is accelerating and while increasing shelf prices in January were a positive sign there could be problems if industry sales growth slows in the second half and the rate of cost growth does not reduce.

Moreover, the broker does not believe the implications of the drop in sales revenue from covid-induced peaks is fully appreciated.

Defensive stocks are preferred and the rating is upgraded to Neutral from Underperform, while the broker favours Coles (COL) under the forecast market scenario. The target is raised to $33.35 from $30.87.

In the not-so-good books

AINSWORTH GAME TECHNOLOGY LIMITED (AGI) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 0/1/1

While a big improvement on a year ago, Ainsworth Game Technology’s result was slightly short of Macquarie. Yet the revenue outlook continues to improve across key regions, which is also supported by the improving industry backdrop.

While the broker acknowledges high operating leverage to improving volumes within the land-based business, which is showing positive momentum, it is cautiously optimistic given previous false starts.

Downside risk is moderate but that upside is capped until there is greater confidence in the underlying business. Downgrade to Neutral from Outperform, target unchanged at $1.20.

APPEN LIMITED (APX) was downgraded to Hold from Buy by Ord Minnett, B/H/S: 1/2/1

2021 net profit was below forecasts amid slow growth in the new markets business. The company will no longer provide short-term guidance, instead focusing on its 2026 targets, which Ord Minnett observes require increased reinvestment.

Ord Minnett believes the target to double revenue is ambitious, given the track record. While the stock may have been oversold in the short term, the lack of visibility and heightened level of reinvestment keep the broker on the sidelines.

Rating is downgraded to Hold from Buy and the target lowered to $7.00 from $13.50.

BLACKMORES LIMITED (BKL) was downgraded to Neutral from Outperform by Credit Suisse, B/H/S: 0/4/1

Sales geography featured in Blackmores’ first half results, as impeded mobility drove weaker results in China and strong immunity product demand drove strength in Indonesia. Credit Suisse notes second half guidance requires sales momentum in China and Australia.

Updates to the company’s accounting have shifted software as a service investment to operational expenditure, previously capital expenditure, and driven a -10-15% reduction to Credit Suisse’s earnings forecasts and larger earnings per share downgrades.

Looking ahead, the broker expects the Indonesia joint venture can deliver 34% revenue compound annual growth rate through to FY25.

The rating is downgraded to Neutral from Outperform and the target price decreases to $90.00 from $100.00.

CHARTER HALL RETAIL REIT (CQR) was downgraded to Neutral from Outperform by Credit Suisse, B/H/S: 2/3/1

First half results were better than anticipated. FY22 operating earnings guidance is expected to be no less than 28.4c per security along with the distribution of no less than 24.5c.

Shopping centre portfolio occupancy has improved to 98.4%. Retail sales were also positive despite the impact of restrictions. Credit Suisse notes there is capacity for investment on the balance sheet and upside potential from unexpected incremental investments.

Yet the stock is not considered a “recovery play” and Credit Suisse envisages better value elsewhere, downgrading to Neutral from Outperform. Target is raised to $4.41 from $4.28.

DELOREAN CORPORATION LIMITED (DEL) was downgraded to Hold from Add by Morgans, B/H/S: 0/1/0

Delorean Corp reported a greater loss then Morgan’s had forecast, as covid continued to impact the Engineering division and Energy Retail faced tighter margins.

While the company will continue to experience a challenging operating environment in the second half, Morgans anticipates the worst could be behind it. The company’s balance sheet has also tightened with cash falling on significant operating outflows in the first half.

Delorean is positioned well in the green energy thematic and potentially has a long growth runway ahead of it, Morgans suggests, but near-term labour and material market tightness continue to present short term risk.

Downgrade to Hold from Add. Target falls to 20.5c from 27c.

ILUKA RESOURCES LIMITED (ILU) was downgraded to Underperform from Neutral by Credit Suisse, B/H/S: 1/3/1

Iluka Resources’ guidance for sizeable capital expenditure growth in the coming year has surprised Credit Suisse. Guidance for capital expenditure of $263m in FY22 is not only more than double the broker’s forecast but a notable increase on the $54m in capital expenditure in FY21.

Rutile pricing upgrades were overwhelmed by expenditure guidance, with the broker halving its FY22 free cash flow forecast and reducing forecasts -20-50% through to FY24. Higher capital expenditure expected for construction projects in FY23 and FY24 is increased.

The rating is downgraded to Underperform from Neutral and the target price decreases to $9.00 from $9.50.

PTB GROUP LIMITED (PTB) was downgraded to Hold from Add by Morgans, B/H/S: 0/1/0

Morgans downgrades its rating for PTB Group to Hold from Add, not in response to pre-released 1H results, but due to a recent strong share performance. A total shareholder return of around 7% is still expected over the next 12 months.

Nonetheless, the analyst sees a slowing in organic growth rates in the absence of further M&A and lowers the target to $1.23 from $1.27. FY22 guidance was reaffirmed. Morgans notes a strong 1H performance from the US segment.

BARBARA LIMITED (SBM) was downgraded to Neutral from Outperform by Credit Suisse,B/H/S: 1/3/0

First half operating earnings were ahead of estimates. Guidance has been removed, given the disruptions at Simberi as a third of workers are in isolation which has led to a slower ramping up after the plant was re-commissioned.

Credit Suisse is concerned about looming capital expenditure and timing of production. Further delays could result in concentrated expenditure in late FY23 and FY24.

The broker downgrades to Neutral from Outperform on the back of covid-related headwinds and uncertainty around the timing of growth, although over the longer-term value is perceived. Target is reduced to $1.40 from $1.70.

SIMS LIMITED (SGM) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 4/2/0

Macquarie lowers its rating for Sims to Neutral from Outperform after a positive share price reaction to interim results and after weighing-up geopolitical risk for Turkey (a key market for the company).

Turkey depends on Russia for natural gas and an energy crisis could materially affect scrap demand, explains the analyst. The $19.20 target price is unchanged.

TPG TELECOM LIMITED (TPG) was downgraded to Hold from Add by Morgans, B/H/S: 4/2/0

In a mixed result, TPG Telecom’s second half revenue and earnings (EBITDA) were down but cash flow was materially up, Morgans notes. Underlying earnings were in line but the I and DA above, and capex, impacted profit.

Momentum in the business continues to improve on synergy realisation, mobile customer additions and the NBN drag largely done, hence Morgans expects underlying earnings growth in 2022.

Cash flow will nonethless be compressed in the short term as the company invests for growth, which should create long term value, but for now the broker downgrades to Hold from Add. Target falls to $6.01 from $7.11.

WORLEY LIMITED (WOR) was downgraded to Neutral from Outperform by Macquarie, Underperform from Neutral by Credit Suisse and Lighten from Hold by Ord Minnett, B/H/S: 3/1/1

Worley’s December first-half result outpaced Macquarie’s forecast, but operating cash flow disappointed leading Macquarie to expect consensus EPS downgrades.

The factored sales pipeline grew 12% and the backlog also increased. Earnings (EBITDA) margins edged out the broker and management expect margins will hold into the June half despite an increase in operational expenditure.

Worley has committed to spending $100bn over three years to improve its sustainability capability to support its strategy of increasing sustainable business to 75% within five years from 32% now.

Management guides to a 7% to 14% increase in capital expenditure across renewables, gas, oil, chemicals and resources. The broker notes Worley is trading at a premium to global peers.

Macquarie cuts EPS forecasts -6% in FY22, -5% in FY23 and -4% in FY24.

Rating is downgraded to Neutral to Outperform given recent share price strength. Target price rises to $12.60 from $12.25.

First half results were mixed, with underlying EBITA in line but revenue a miss on estimates. Credit Suisse expects revenue will improve but the main issue is the pace of growth.

Worley requires more than 10% revenue growth and improved margins to meet expectations, and this appears to be a stretch.

The broker also suspects the workflow from green energy may take longer than the market is anticipating, and this could weigh on the business.

On valuation grounds, the broker downgrades to Underperform from Neutral. Target is raised to $10.60 from $10.40.

Ord Minnett has a more negative view of Worley now, believing consensus estimates are too high and will need to be reassessed. This is based on the likelihood projects will be deferred because of capital restrictions.

The broker considers the stock expensive and, while market conditions may be improving, staffing levels have increased. Moreover, backlogs and the factored-in sales pipeline are both substantially higher.

Rating is downgraded to Lighten from Hold. Target is raised to $10.80 from $10.50.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.