Wall Street was down overnight but the S&P 500 was up a solid 5% plus for the month — the best month since November — and it underlines the importance of President Joe Biden’s spending and the success of the vaccination program in the States.

This week we learnt that consensus expectations for March quarter earnings per share growth in the US have jumped from 21% year-on-year at the start of the current earnings reporting season to 42% now. And if you have doubts about this economic surge in the US, just take this on board about the Dow Transport Index, which has had 13 straight weeks of gains. This hasn’t happened in over a century of record-keeping!

So what? Well, this is what Investopedia says on the subject: “The Dow Jones Transportation Average is closely watched to confirm the state of the U.S. economy, especially by proponents of Dow Theory.”

And what’s Dow Theory? “The Dow theory is a financial theory that says the market is in an upward trend if one of its averages (i.e. industrials or transportation) advances above a previous important high and is accompanied or followed by a similar advance in the other average.”

In contrast, the impact of poor infection fighting and disappointing political leadership was underlined with the news overnight that the Eurozone fell into a double dip recession! The overall collective GDP dropped 0.6% in the March quarter, meaning it’s the second technical recession in one year!

Surprisingly, Europe’s STOXX 600 was down only 0.3% but stock markets are forward-looking. Let’s hope they’re seeing the economic, infection and vaccination future clearly.

Also, the bad recession news was for the March quarter but AMP’s Shane Oliver says “…the latest Eurozone economic confidence reading rose sharply in April to an historically very strong level, with gains in both business and consumer confidence suggesting optimism regarding vaccines and reopening and a strong recovery ahead.”

To Wall Street, and it was a down day on what has to be profit-taking after a strong month, with the S&P 500 Index off 30 points (or 0.72%) to 4181.17, despite good economic data and solid earnings news. Even the once non-profit making Amazon reported a record profit of $US8.1 billion. Is this a good company or what? Its earnings per share was tipped to be $9.54, which is pretty good, but actually came in at $15.79, which is over-delivering on steroids!

On the US economy and annualised growth came in at 6.4% and the economic comeback is faster than the rebound out of the GFC, which the Yanks call the Great Recession. “Consumer spending rose 2.6 percent in the first three months of the year, with a 5.4 percent increase in purchases of goods accounting for most of the growth,” the New York Times reported this week. “Spending on services, which has slumped throughout the pandemic, rose by 1.1 percent.”

For those wondering if there’s any growth room left for the US economy, this take from the New York Times’ Nelson D. Schwartz is worth noting: “Even if economic output is back to where it was before last year, as Mr. Greg Daco, chief U.S. economist at Oxford Economics, estimates, it is short of where it would be without the pandemic. What’s more, economists say it is likely to take until sometime next year for employment to regain the ground it lost as a result of the pandemic.”

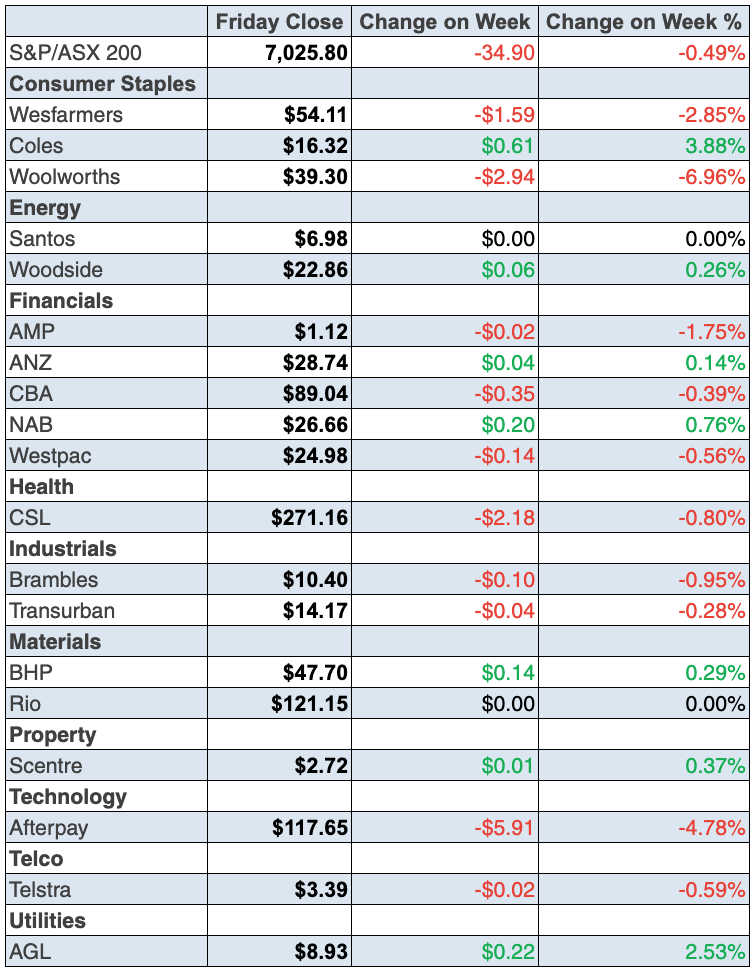

To the local story and the S&P/ASX 200 Index gave up nearly 35 points over the week (or 0.5%), but as the AFR’s William McInnes calculated, it was seven months of rises on a trot!

April was a beauty, rising 3.5%. And even though there’s that old “sell in May” warning out there, if it happens, I’m sure there’ll be a lot of ‘buying the dippers’ out there joining me in picking up bargains that are bound to go higher over the next 12 months or more.

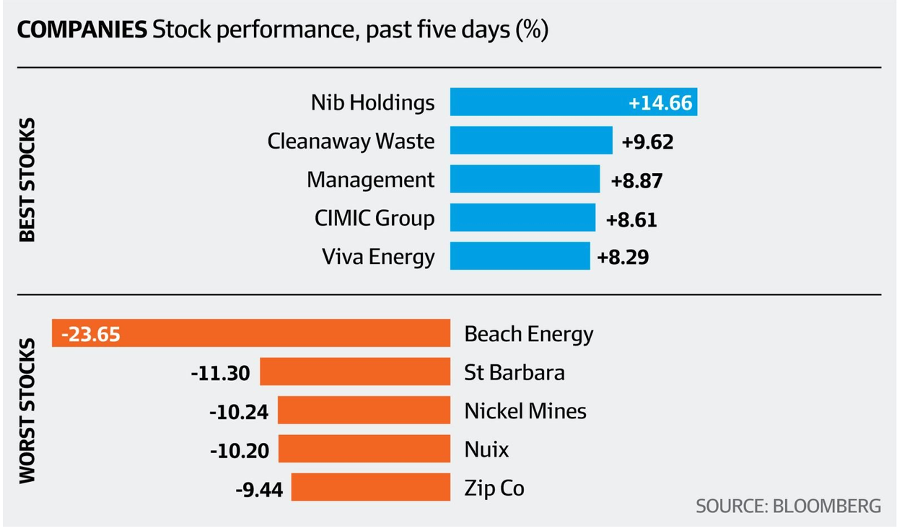

Here are the big winners and losers, with Zip Co sticking to its volatile up and down pattern. This was a $2.22 stock a year ago and is now $8.06. Nuix has been on a downer for some time and has to be getting into “buy” territory for the patient long-term investor.

Think about it. Nuix made its debut on 4 December 2020, with an IPO price of $5.31. It spiked on the bell and by close of day, had stormed up 50% to $8.01. For a month it kept going higher to $11.86. If this once over-loved business can get back to its IPO price, that’s a 28% gain!

The big story of the week was Richard Murray leaving JB Hi-Fi for Premier Investments. It cost the retailer 7.7% but there’s also a bit of ‘rotation into other sectors’ stuff in that price drop.

Those of us who trust ResMed’s management wondered why its share price lost 3.5% but this was linked a $US78.5 million loss because of an ATO problem that could cost it $255 million.

What I liked

- The CommSec daily commodity index has lifted 5.3% so far in 2021, while the Aussie dollar has lifted just 0.6%.

- Import prices rose by 0.2% in the March quarter but were down by 6.2% on a year ago. Export prices rose by 11.2% in the quarter to be up by 8.6% on the year. The terms of trade probably rose by around 9-11% in the March quarter.

- US GDP grew at a 6.4% annual rate in the March quarter (survey: 6.1%).

- After about 60% of the S&P 500 companies had reported on Thursday, 87% had beaten earnings expectations by an average 24% and 72% had beaten expectations on revenue.

- Strong company earnings results in the EU.

- This from Shane Oliver on vaccinations: “So far around 8% of the global population has now received one dose of vaccine – with 44% in advanced countries and 6% in emerging countries. Within developed countries, the UK is leading the charge at 51%, the US is at 44%, Europe is at 23%, with Australia well behind at around 8% (but picking up).”

What I didn’t like

- The Consumer Price Index (CPI), which is the main measure of inflation in Australia, rose by just 0.6% in the March quarter (consensus: 0.9%).

- The double dip recession in the Eurozone.

- In the US, durable goods orders rose by a less-than-expected 0.5% in March (survey: 2.5%).

- India’s struggles with the Coronavirus.

Read on if you want to make money

Below is our week in review and if you’re looking for investing ideas, it’s the best collection of views and takes on stocks that investors really care about right now. And Tony Featherstone’s assessment of ETFs to get alpha out of Asia is a must read.

The week in review:

- One of my jobs is to pinpoint underestimated or undervalued stocks that have a promising future. Given the economic boom ahead, I want to be invested in stocks that are leveraged to a big, new age future. And this means tech stocks. Here’s my success equation.

- Will Nuix (NXL) follow history and wallow over the next 12 months like other IPO darlings that ‘bomb’ on the first real occasion, or is it a buy now? This is Paul Rickard’s view.

- James Dunn looked at three ‘real’ tech stocks, each offering what looks to be good share price value: Computershare (CPU), Appen (APX) and Altium (ALU).

- Tony Featherstone put forward three emerging market ETFs to consider over the next three months: BetaShares Legg Mason Emerging Markets Fund (EMMG), VanEck Emerging Income Opportunities Active ETF (EBND) and ETFS-NAM India Nifty 50 ETF (NDIA).

- Julia Lee from Burman Invest selected Fletcher Building (FBU) as a “HOT” stock this week, and Michael Gable from Fairmont Equities selected Money3 Corporation (MNY).

- 5 upgrades and 10 downgrades made up the first Buy, Hold, Sell – What the Brokers Say this week, and there were 5 upgrades and 5 downgrades in the second edition.

- In Questions of the Week, Paul Rickard answered questions about the best ETF to get exposure to the Aussie sharemarket, the Magellan Global Fund (MGF), whether there is an ETF that tracks the Shanghai Compisite and the meanings of ‘mandatory escrow’ and ‘voluntary escrow’.

- And in our weekly Boom! Doom! Zoom! session, we discuss JB Hi-Fi (JBH), Kogan (KGN), Woodside (WPL), Bapcor (BAP) and more.

Our videos of the week:

- Boom! Doom! Zoom! | April 29, 2021

- We pressure-test: ALU, NXL, UWL, AR9, SUN & Z1P | Switzer Investing

- Hot ASX stock: AD8 & is JB Hi-Fi a buy? + Magellan’s Hamish Douglass shows why he’s a top fund manager | Switzer Investing

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday May 3 – Purchasing managers’ indexes (April)

Monday May 3 – CoreLogic home value index (April)

Monday May 3 – ANZ job advertisements (April)

Tuesday May 4 – Weekly consumer sentiment (May 2)

Tuesday May 4 – International trade (March)

Tuesday May 4 – Lending indicators (March)

Tuesday May 4 – Reserve Bank Board meeting

Wednesday May 5 – Building approvals (March)

Wednesday May 5 – New vehicle sales (April)

Wednesday May 5 – IHS Markit services index (April)

Thursday May 6 – Reserve Bank Deputy Governor speech

Friday May 7 – Statement on Monetary Policy

Friday May 7 – AiGroup Performance of services index (April)

Overseas

Monday May 3 – US ISM manufacturing index (April)

Monday May 3 – US Construction spending (March)

Tuesday May 4 – US International trade (March)

Tuesday May 4 – US Factory orders (March)

Wednesday May 5 – US ISM services index (April)

Wednesday May 5 – US ADP employment change (April)

Thursday May 6 – US Challenger job cuts (April)

Friday May 7 – China Caixin services index (April)

Friday May 7 – China International trade (April)

Friday May 7 – China Current Account Balance

Friday May 7 – US Non-farm payrolls (April)

Food for thought:

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.” – Charlie Munger

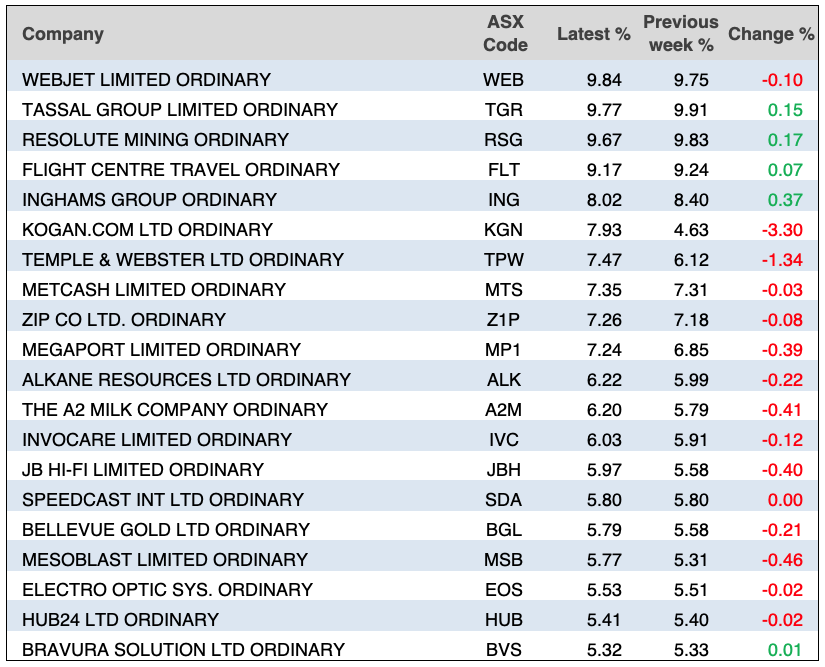

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

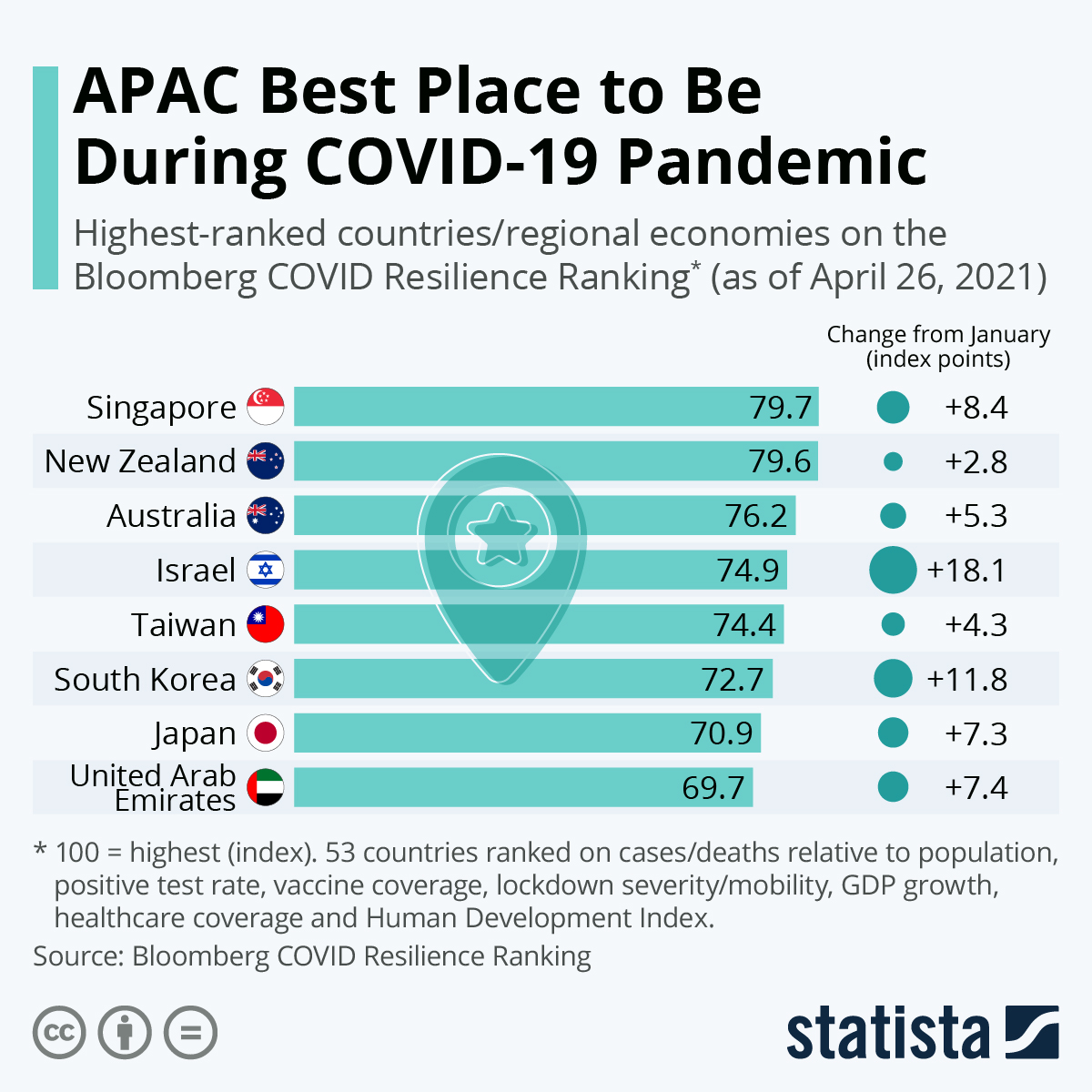

Chart of the week:

The Asia-Pacific region remains the best place to be during the pandemic according to Bloomberg’s latest Covid Resilience Ranking. Singapore ranks first followed by New Zealand and Australia, with Taiwan, South Korea and Japan also ranking in the top eight as seen in this chart from Statista:

Top 5 most clicked:

- Want to know my 12 stock winning formula? – Peter Switzer

- 3 ‘real’ tech stocks – James Dunn

- Is Nuix a buy? – Paul Rickard

- 3 emerging markets opportunities – Tony Featherstone

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

Recent Switzer Reports:

- Monday 26 April: My 12 tech stars in for a big future

- Thursday 29 April: 3 emerging market ETFs to consider

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.