Since October 3 we’ve seen a perfect setup for stocks to throw off many of the ghosts of 2022 that have haunted the share market. Hopes of China giving up on its zero-Covid policies have added positivity, while signs of lower inflation in the US even had Jerome Powell and some of his Fed mates implying smaller interest rate rises were ahead. The only unhelpful monster of a ghost i.e. Putin and his crazy war continues to spook, but even here his impact on oil and energy prices is waning, as this chart of oil from dailyfx.com shows.

All we needed overnight was a Goldilocks jobs report, which expected 200,000 new jobs created in November. A gain of 170,000 would’ve been good, which would’ve said the US economy is slowing, helping to push inflation down but not threaten recession. It’s an economy that’s not too hot, nor too cold, but just right!

Well, the Yanks didn’t completely pull it off, with 263,000 jobs created over the past month, which led to headlines of a “hotter-than-anticipated” jobs report.

Ahead of the close, stocks were down but not down dramatically but you never know what interpretations happen in the last hour before the closing bell. That said, if the report screamed this is terrible for inflation, a lot of the gains from October 3 would’ve been eaten quickly. Here’s that gain on the right of this chart below and today’s US labour market numbers now throw the big spotlight onto the Fed meeting and CPI data release across December 13-14.

S&P 500 (Six months)

That means another week of market anxiety lies ahead, with economic data such as US Purchasing Manager readings, factory orders, labour costs information, consumer sentiment and, importantly, producer prices likely to impact stock prices. But the main events will be the Fed’s rate decision and the inflation number. (Locally we have a big week, with Purchasing Manager data, household spending, our latest economic growth figure and unemployment stats, on top of China’s international trade report, which is important to us as it’s our biggest trading partner.)

So, let’s take a look at that jobs report, remembering that this week the US looked at the key inflation measure (the core PCE deflator) which the Fed thinks is the best inflation indicator, and they saw it lifted by 0.2% in October to be up 5% on the year.

Here it is in a nutshell:

- Non-farm payrolls increased 263,000 in November.

- A 200,000 increase was expected by economists polled by Dow Jones.

- Unemployment was unchanged at 3.7%.

- Average hourly earnings also came in above expectations.

- Treasury yields rose on the number, triggering a stocks sell-off.

This is one view of what the numbers mean from Michael Arone, chief investment strategist at State Street Global Advisors: “The supply of workers remains low, the demand for workers remains high, [and] that means wage inflation will remain sticky, and that’s a problem for stocks going forward because it’s likely to keep the Fed hawkish rather than dovish.”

Obviously, some commentators looked at the number and gave up on the expectation that the Fed will drop to a 0.5% rate rise in two weeks’ time and stick with the big 0.75% rises, which would cream stocks. This is why the data flow in the week ahead will create all kinds of buying but, more likely, it will lead to selling.

Also, more thoughtful analysts, who don’t overrate the headline numbers, actually see some good signs buried in the overall jobs report.

Interestingly, there’s a group of market bears who want to sell down stocks because they strongly believe the US is locked into a recession, but what do they do with this jobs number? They can only argue that this will force the Fed to go too hard and that will make their recession call look insightful.

Our wealth-building futures via stocks are primarily in the hands of Jerome Powell and, to a lesser extent, our own Dr Phil Lowe. (See my final point on him and the RBA below.)

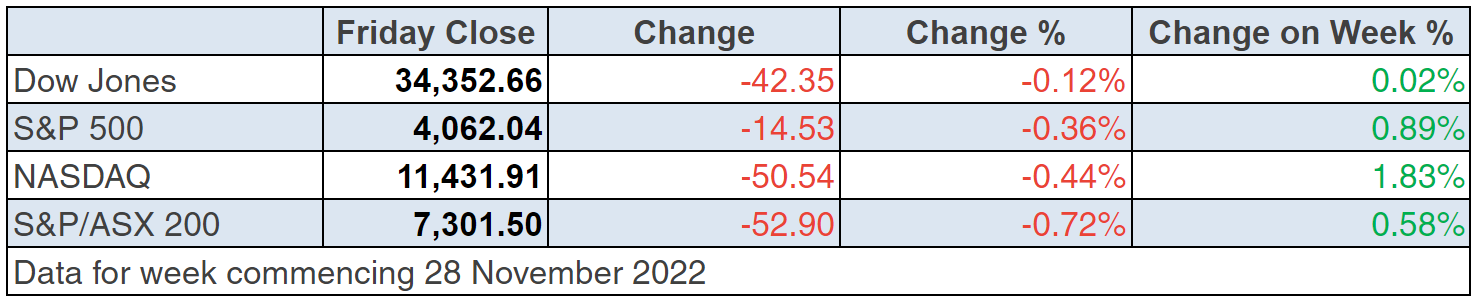

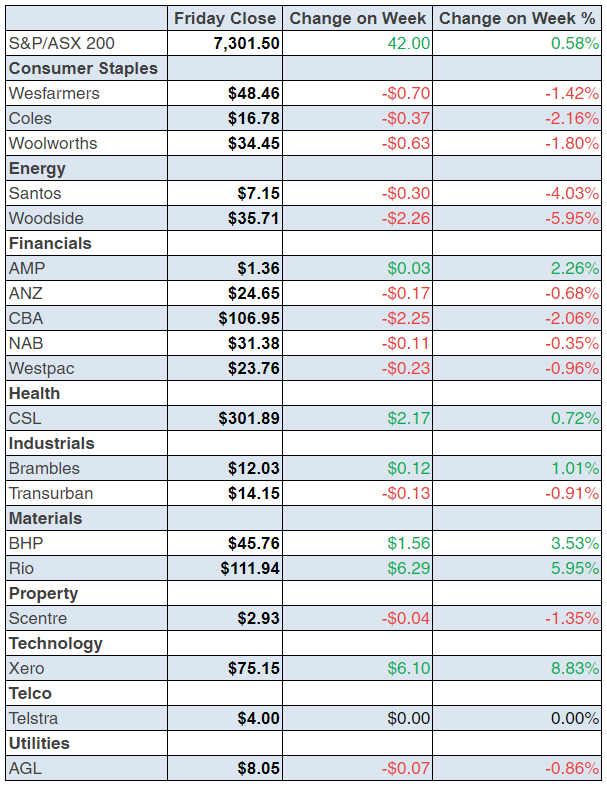

To the local story and the S&P/ASX 200 index rose 0.58% for the week (or 42 points) to finish at 7301.5. Santos lost an appeal to drill its Barossa gas project, which explains why its share price lost 3.77% on Friday to $7.15.

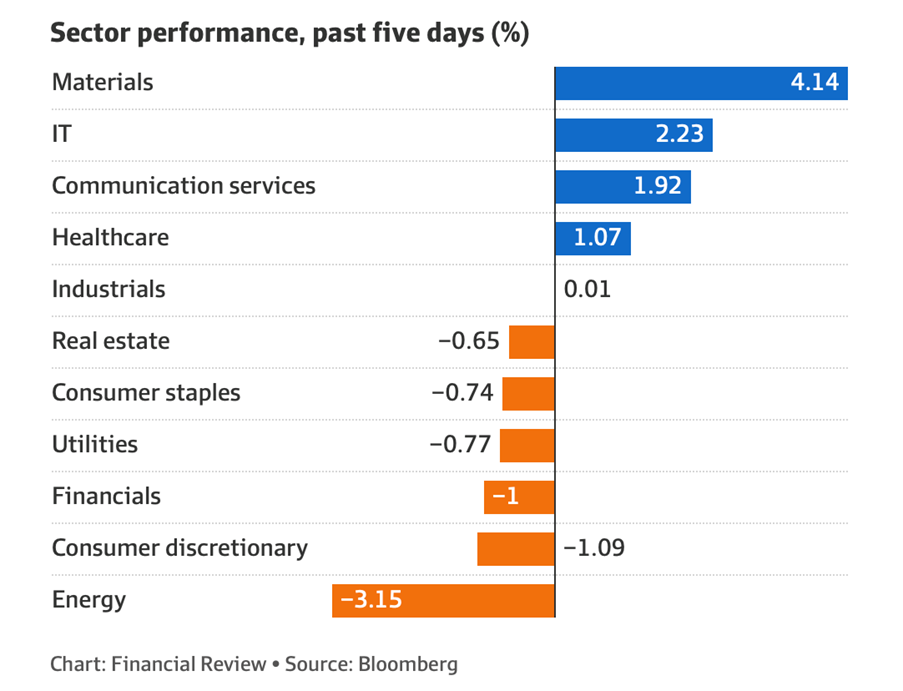

The AFR and Bloomberg looked at the winning and losing sectors, which could explain why some of your stocks rose or fell this week.

The better inflation news here and in the US, as well as Jerome Powell’s less aggressive interest rate talk, helped IT and other tech-related stocks.

Xero added 8.94% this week to $75.15, Megaport rose 4.5% to $6.97 and even Appen put on 7.37% to finish the week at $3.06, but it’s $40 price of August 2020 is a damn long way away!

And finally, CSL beat the $300 bogey with a 1.08% rise on Friday, while a profit-making tech business, REA, rose 4.73% to $127.13, maybe because tech had a better week or on news that house price falls were moderating and inflation was dropping. Interestingly, another profitable tech business, Carsales.com, also had a nice rise — up 4.92% for the week.

What I liked

- Consumer prices, as measured by the monthly CPI indicator, rose by 0.2% in October to be 6.9% higher over the year. Both the quarterly and annual pace of inflation slowed.

- Data showed retail trade fell 0.2% in October – the first fall in 2022.

- The value of new housing lending fell by 2.7% in October, the ninth consecutive monthly decline. This is good inflation-killing data and could end interest rate rises sooner than many expect.

- The total volume of capex fell by 0.6% in the September quarter — a small fall is OK given we’re fighting inflation while trying to dodge a recession.

- Dwelling prices fell by 1.1% in November across the eight capital cities combined, which was needed to help beat inflation and the pace of the fall is slowing, which is good.

- Ditto for building approvals, which fell by 6% over the month in October, driven by an 11.3% fall in multi-unit approvals.

- Private sector credit rose by 0.6% in October. The pace of business credit growth eased to a still solid 0.8% for the month.

- The US economy grew by 2.9% in the year to September, which is good for slowing inflation and avoiding a recession.

- The Conference Board consumer confidence index fell from 102.2 to 100.2 in November (survey: 100), which a moderate fall.

- EU investors were encouraged by news of an easing of Covid.

restrictions in two of China’s bigger cities, Guangzhou and Chongqing.

- In Europe, there were signs that price pressures were easing substantially, with German inflation unchanged in November.

- US 10-year Treasury yields fell by 11 points to near 3.64%. US 2-year Treasury yields fell 14 points to 4.33%.

What I didn’t like

- Total construction work done rose by 2.2% in the September quarter, with gains across all segments. This is a pro-inflation sector and needs to slow to bring prices down.

- Consumer sentiment rose by 1.8% in the past week – the third straight week of gains. We have to be careful about being too confident as it could make the RBA raise rates too many times.

Watch these 4-Ps

The Reserve Bank Governor fronted the Senate Economics Legislation Committee this week and CommSec reported that Governor Lowe is optimistic that Australia could pull off a “soft landing” of the economy. That’s great to hear for jobs, profits and stock prices but Dr Phil’s forecasting reputation isn’t beyond reproach but I do think he’s right but it will be his future rate rises that will determine the validity of his and my calls! On the plus side, I liked that Craig James said this: “Today’s data reinforces our view that inflation will likely peak in Q4, 2022. The RBA will welcome the news that inflation decelerated in October, but the path from here for inflation is uncertain and is contingent on how energy prices evolve”.

The 3 Ps i.e. Putin, Powell, Phil and prices will be important to the wealth we build from stocks and bonds this year.

The week in review:

- In this week’s Switzer Report, I talk about diversified assets and how you could profit off investing in them for this upcoming year: If you’re prepared to invest for at least a year (even longer), you could make 15% in one year by putting your money in a diversified asset, containing some of the best Aussie businesses. Let me tell you more…

- Paul Rickard shares his 3 stock tips and a roughie for 2023: If the market pundits are to be believed, there is an increasing consensus that inflation in the US has peaked and interest rate increases are nearing an end.

- Tony Featherstone talks about two small caps he thinks you should watch for 2023: There’s a good chance more small caps will be acquired next year, largely because they currently trade at undemanding valuations. Here are two Tony thinks you should watch out for.

- James Dunn discusses Lynas and other rare earth stocks in his two-part article, James looks at a number of rare earth sticks that he likes.

- In our “HOT” stock column today, Raymond Chan, Head of Asian Desk at Morgans, tells us why he likes Aristocrat Leisure (ALL) plus Michael Gable, Managing Director of Fairmont Equities, tells us why he thinks United Malt Group (UMG) is a buying opportunity.

- In Buy, Hold, Sell – Brokers Say, there were 5 upgrades and 10 downgrades in the first edition and 1 upgrades and 7 downgrades in the second edition.

- And finally, In Paul’s (Rickard) Questions of the Week, Paul answers your queries on if Medibank is in awful trouble – should you lock in your profit and bale out? Ramsay Healthcare shares have not moved for many years – should you sell? Xero doesn’t make a profit, so why should you continue to hold? When do the major banks pay their dividends?

Our videos of the week:

- Experts share their favourite stocks for next year – Dominos, AD8, MP1, JBHiFi, Xero & more! | Switzer Investing (Monday)

- What will the inflation read today tell us? + should we worry about China lockdowns and protests? | Mad about Money

- Boom! Doom! Zoom! | 1 December 2022

- Is inflation close to peaking?! Is the worst of the house price fall behind us? | Switzer Investing (Thursday)

Top Stocks – how they fared:

The Week Ahead:

Food for thought: “Time in the market, beats timing the market.” – Ken Fisher, founder of Fisher Investments.

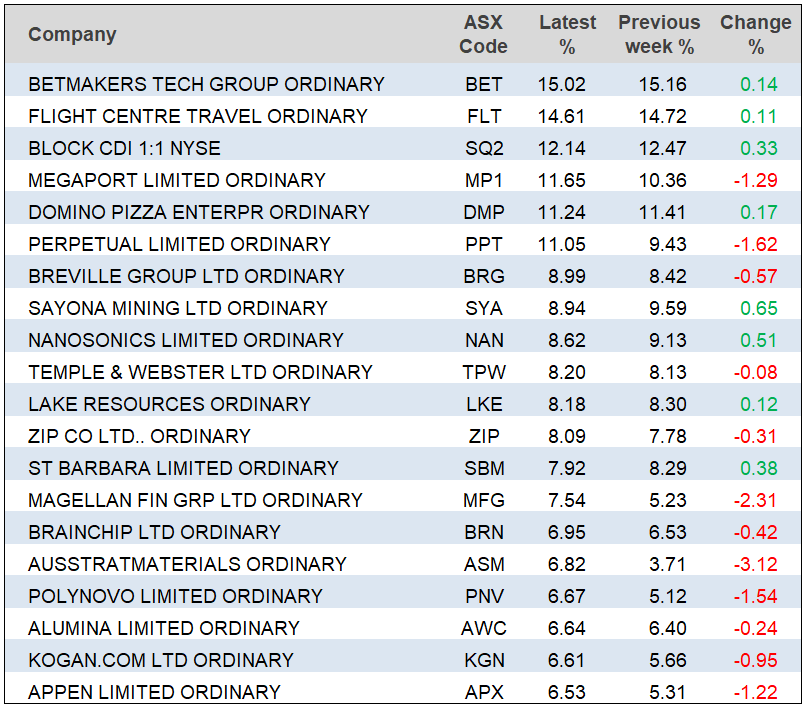

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

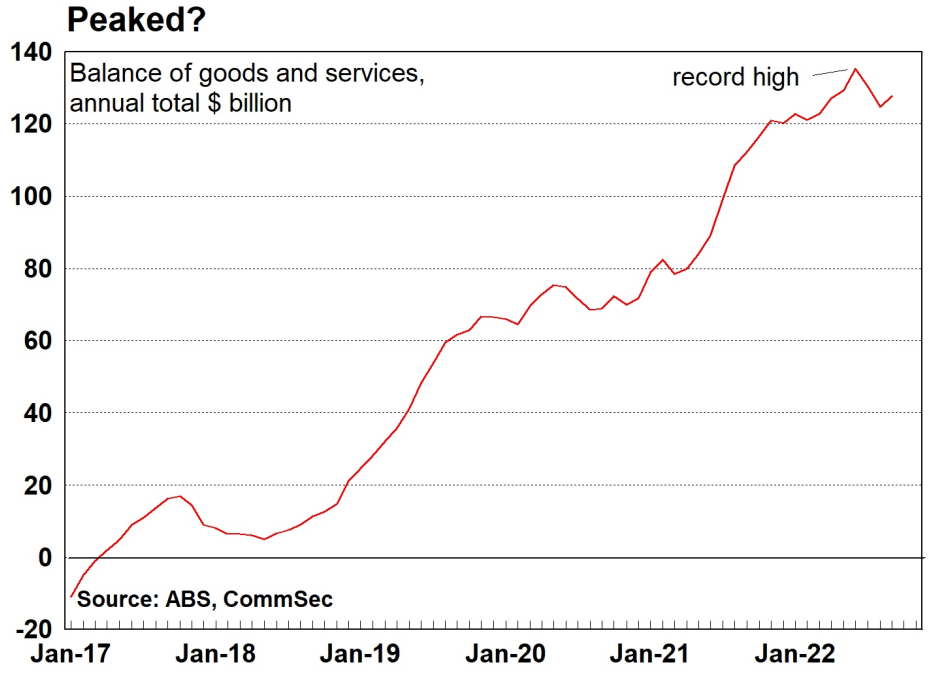

Chart of the week:

Australia: Last big week of economic data for 2023

Well the economic reporting season hits its peak in the coming week. Not only does the Reserve Bank Board meet but economic growth data is issued. The week kicks-off on Monday with Business Indicators issued by the Australian Bureau of Statistics (ABS). The data covers profits, sales, stocks and wages. Also on Monday, the Melbourne Institute Inflation gauge is issued and now the monthly data takes on particular importance with the focus on inflation. There is an eclectic mix of economic data on ‘Super Tuesday’. CommBank releases its Household Spending Intentions index. ANZ and Roy Morgan release the weekly consumer confidence survey and Westpac and the Melbourne Institute release the monthly consumer confidence report. NAB issues its Business Survey publication. And the ABS releases Government Finance, Balance of Payments (broad trade measure), Value of Dwellings and the Household Spending Indicator. The government and trade data are inputs to the economic growth calculation. – Craig James, Chief Economist – Commsec

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances