US stock market indexes have finished strongly positive this week. I always told you tech stocks would get re-loved and it looks like it’s happening earlier than I expected. Once again, this shows timing the market is never easy and this week should be a test to see if this is a bear market rally SR US in the most unheralded recession ever!.

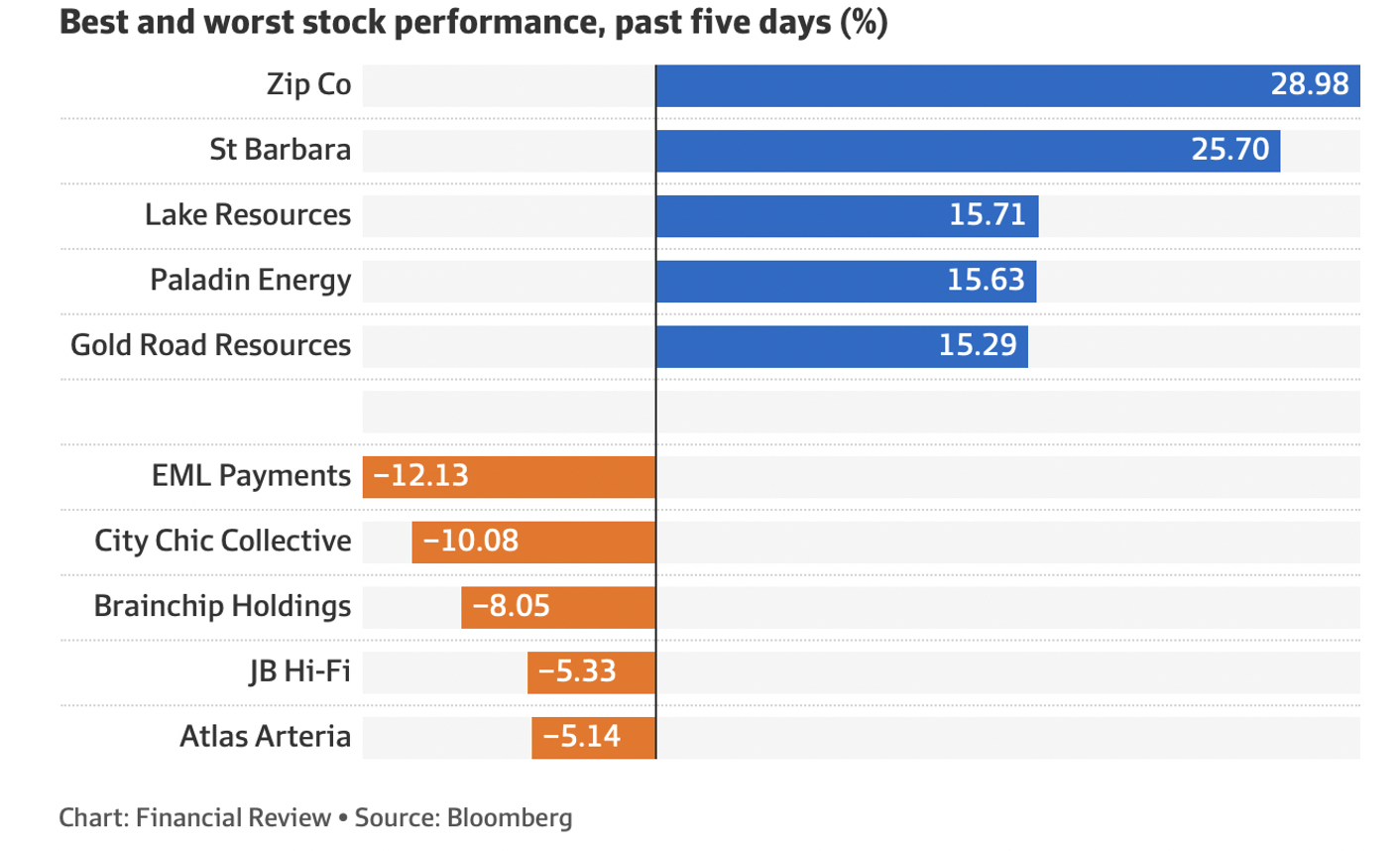

That said, the rebound of Zip Co, though volatile, looks convincing, despite a 25% fall on Friday! However, it was up 35.12% for the week and, wait for it, 157.95% for the month!

These are volatile times, which can be great and bad for risk-taking traders, but long-term investors can either take the punt early going long growth stocks (as some already have) or they still can wait for the uptrend to be more entrenched.

Overnight, both JPMorgan and Wells Fargo were telling their clients that growth stocks were looking “more interesting”.

Around August 10, it might be easier for the nervous to believe where stocks are heading. On that day, the US gets the July inflation number. If it’s falling, combined with the rising recession concerns, it will make the case for the Fed to ease up on big interest rate rises. It was this thinking that has helped tech stocks kick up this week.

When Fed chairman Jerome Powell said the central bank would “slow the pace of interest rate hikes at some point”, the stock market lapped it up and bought tech stocks in the US and then here. This happened in a week when the US economy went into the most unheralded and least feared technical recession in my economic lifetime.

As I’ve argued many times, this time it is different! In fact, US Treasury Secretary Janet Yellen articulated how different it is now and this is how CNBC reported it: “Recession is a ‘broad-based weakening of our economy’ that includes substantial layoffs, business closures, strains in household finances and a slowdown in private sector activity. ‘That is not what we are seeing right now,’ she said during an afternoon news conference at the Treasury.”

The real GDP reading for the US fell 1.6% in the first quarter and then 0.9% in the second quarter. I’ve been arguing since March 2020 (when the pandemic led to something unfathomable like a closure of the global economy and a national lockdown) that usually believable economic readings were going to be unreliable.

Yep, things are certainly different when some economic statistics say the US is in recession, but as Yellen pointed out, that doesn’t make sense when the economy is creating 400,000 jobs a month! Anyway, the best bit is that the stock market is lapping up the prospects of less interest rate rises than the over-the-top ‘experts’ have been predicting. And that’s something I’ve been warning you about — when the interest rate fear and anxiety dissipates, stocks would be bought again.

Getting back to August 10 and the likelihood that we should know if it’s time to buy stocks or remain careful by then, around that time we’d have a pretty good handle on how Aussie companies have reported and US reporting would’ve been well and truly over.

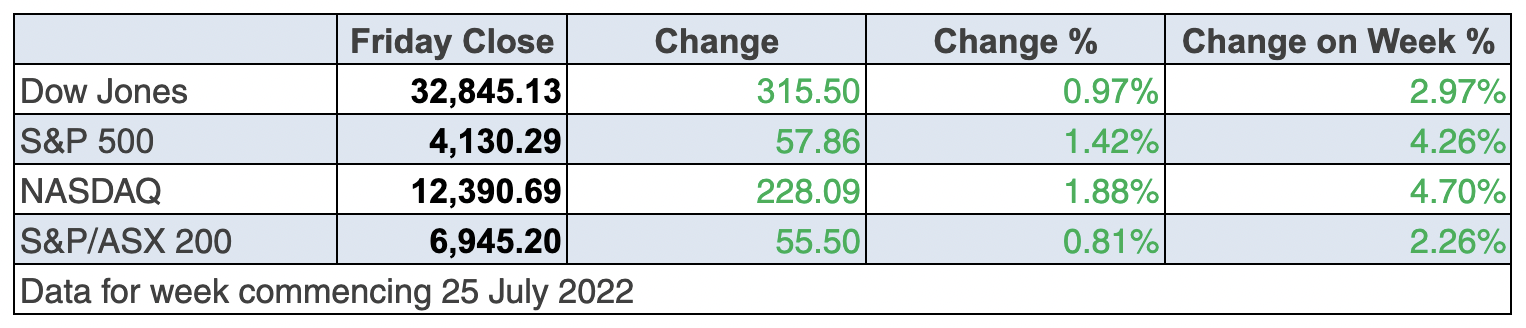

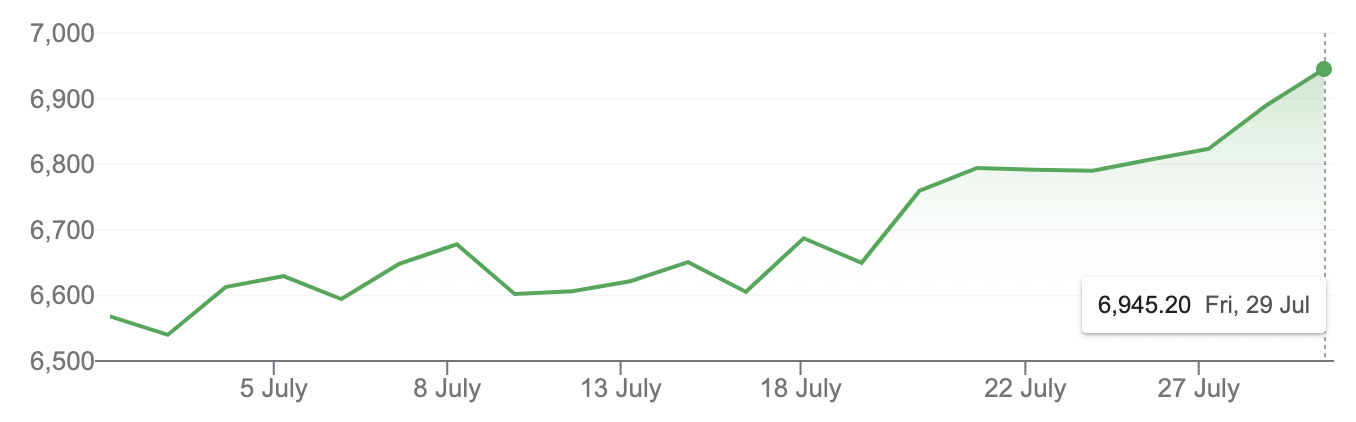

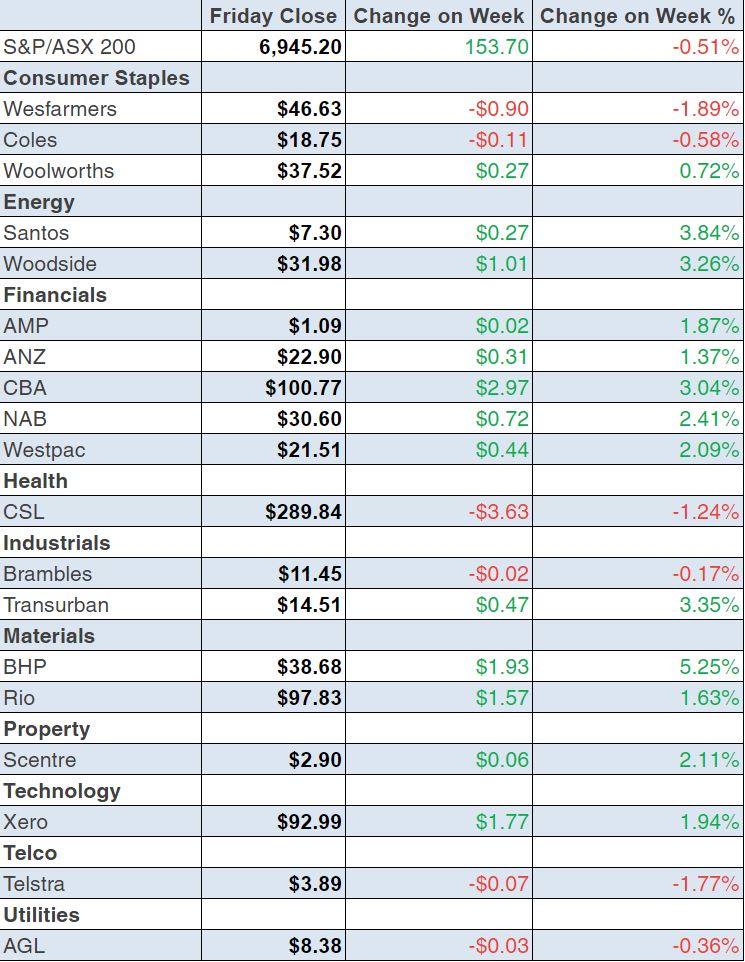

To the local story for the week, and the S&P/ASX 200 was up 153.7 points (or 2.26%) for the week and 5.74% for the month.

S&P/ASX 200

The recovery from the worst of the 2022 sell-off was an 8% gain, which has been the pay-off for the true believers and risk takers. In coming weeks, we should see if this rebound is the start of a solid bounce-back for stocks.

Here are the big winners and losers:

Buy now pay later stocks like Zip and Sezzle have had a volatile week but the market is liking their new commitment to being profitable rather than great revenue growers. Also, the prospect of fewer interest rate rises ahead is a plus for these businesses.

Gold miners had a good week, with the US dollar dipping on the potentially lower (or less high) interest rate news. As a rule, when the dollar depreciates relative to other currencies worldwide, the price of gold tends to rise in U.S. dollar terms. Why? Gold doesn’t pay interest like other financial assets, therefore, it competes with interest-bearing assets. As investors chased high interest rate bonds in the US over the past year, they dumped gold. The opposite is now happening.

The miners had a good week, with BHP up 5.6% to $38.68, FMG was 1.78% higher at $18.34 and Rio rose 1.38% to $97.83, despite it halving its dividend this week, following a 29% fall in profits caused by lower commodity prices, but it still made $US8.63 billion for the six months!

Meanwhile, the banks defied their critics, with the CBA now at $100.77, which is a 2.95% gain for the week. NAB put on 2.14% to $30.60, while ANZ was up 1.33% to $22.90 and Westpac rose 2.23% to $21.51.

And it looks like lithium is back in favour after its June dumping. Allkem went from $14.10 to $9.52 over six weeks but now it has risen 18% since 12 July to finish Friday at $11.28.

What I liked

- US Fed Chair Jerome Powell said the central bank will slow the pace of interest rate hikes at some point, while adding that officials would refrain from offering “clear guidance”on the size of their next move.

- On Friday, investors also got the final reading of the University of Michigan Consumer Sentiment Index, which came in at 51.5 for July. That’s a slight improvement over the preliminary reading and up from the June all-time low of 50, which isn’t bad for an economy in a recession!

- Local private sector credit (broadly, outstanding loans) rose by 0.9% in June to be up 9.1% on the year.

- Business credit rose 13.2% in the year to June – the strongest annual growth rate in 13½ years.

- According to the Australian Institute of Petroleum (AIP), the national average unleaded petrol price fell by 11.2 cents to 192.9 cents a litre (c/l) last week after falling 8 cents a litre the previous week. The wholesale price fell by 9.2 cents a litre after falling by 14.3 cents the previous week.

- Retail trade rose by 0.2% in June. While it was the weakest monthly increase in six months, sales are up by 12% on a year and up 23.2% on pre-pandemic levels (February 2020). The subdued rise in retail is a good sign for fighting inflation and the success of the interest rate rise policy.

- US durable goods orders rose by 1.9% in June (survey: – 0.4%) showing why many economists don’t think the US has a real recession — just a technical one.

- The Kansas City Federal Reserve manufacturing activity rose from 12 to 13 in July (survey: 4).

What I didn’t like

- The Fed’s closely watched personal consumption index for June in the US climbed 6.8% on a 12-month basis. This isn’t good but no-one expected a June number to be anything but high. Most economists think July will bring lower inflation numbers.

- The US Federal Reserve hiked its target range for the Federal Funds rate by 75 basis points for a second straight meeting (the most aggressive policy tightening since the 1980s) to a target range of 2.25-2.50%. Fed Chair Jerome Powell said policymakers were “strongly committed” to reducing inflation. I hope he hasn’t gone too hard!

- The main measure of inflation in Australia i.e. the Consumer Price Index (CPI) rose by 1.8% in the June quarter (consensus: 1.9%). The annual rate of the CPI rose from 5.1% to 6.1% – equalling the annual rate in the June quarter 2001. Inflation was last higher than 6.1% in the June quarter 1990, which was 32 years ago.

- The ‘underlying’ or trimmed mean CPI rose by 1.5% in the quarter (consensus: 1.5%), with the annual growth rate lifting from 3.7% to 4.9% (consensus: 4.7%). Based on RBA data, it was the highest annual rate of trimmed mean inflation in 31 years (June quarter 1991).

- The “final demand” component of producer prices (business inflation) rose by 1.4% in the June quarter to be up 5.6% on a year ago, the strongest annual growth rate in 13½ years (since December 2008).

- The US economy, as measured by GDP, contracted at a 0.9% annualised rate in the June quarter (survey: 0.5%). That’s two quarters of contraction, which equals a technical recession!

The Treasurer’s tale

This week new Treasurer Dr Jim Chalmers gave it to us straight and said Treasury is forecasting global growth of 3.25% in each of the next three years, which is half a percentage point weaker in 2022 and 2023 than expected in the Pre-Election Economic and Fiscal Outlook.

Locally Dr Jim said real GDP grew by 3.75% in 2021-22, instead of 4.25%, as was estimated pre-election. The pre-election forecast for GDP growth in 2022-23 was 3.5%. This has now been revised down to 3% growth. And growth is expected to slow further in 2023-24, at 2% – down from the 2.5% previously predicted.

These are Treasury’s best guesses but Treasurers do pick the numbers they run with and history has shown that they select conservative forecasts, which makes them look good when better growth results show up.

I’d do the same if I was Treasurer, because if I was, I’d also be a politician who preferred to be in government.

The week in review:

- This week in the Switzer Report, I talk about how the last two weeks of rises for the All Ords has taken it 5.4% higher, so am I on the money with my numerous suggestions that stock markets are trying to bottom? I’d say ‘yes’. Given the instant inclination for traders to chase beaten-up tech stocks, my other tip that these tech spikes are a sneak preview of what happens when interest rate rises peter out as inflation falls, also looks like a good call.

- Paul (Rickard) on the other hand has never been a gold bug, but he does keep a close eye on the gold price. So, does Paul (Rickard) think it’s time to buy gold? Furthermore, he mentions how by law you’re required to properly manage the money within your SMSF. So, according to Paul (Rickard) are you doing a decent job?

- Tony Featherstone mentions how workers are resisting going back to the office for the full week. They want the flexibility of working when and where they want. That’s bad for Australian Real Estate Investment Trusts (A-REITs) that own office towers and face long-term structural challenges as more people work from home and spend less time in CBDs. So, if you want to buy A-REITs now, focus on those with defensive property assets and tenants who can better withstand rising inflation. Or A-REITs that have a sufficiently attractive valuation.

- With the gold price down 18% since March, the Australian gold miners have struggled. But analysts feel the sector looks over-sold, with valuations starting to show significant upside on analysts’ consensus price targets. Here are James Dunn’s top 3 gold stocks.

- In our “HOT” stock column today, Raymond Chan, Head of Asian Desk at Morgans, tells us why BHP’s share price looks attractive at current levels and why Morgan’s analyst holds an ADD recommendation on the Big Australian.

- In Buy, Hold, Sell – What the Brokers Say, there were 9 upgrades and 7 downgrades in the first edition and 7 upgrades and 2 downgrades in the second edition.

- And finally, in Questions of the Week, Paul (Rickard) has a look at whether ZIP Co, will recover to $2? How big will Woodside’s interim dividend be? Is a Challenger Fixed Term Annuity a good investment for a self-funded retiree? What is the last day to get RIO’s fully franked dividend of A$3.84 per share?

Our videos of the week:

- Why taking Vitamin D is so beneficial for our bodies | The Check Up

- Jun Bei looks at the tech stocks she really likes + Just how high are interest rates going to go? | Switzer Investing (Monday)

- What is the big inflation number going to tell us today & Is EML Payments DEAD? | Mad about Money

- What does the inflation rate mean for stock prices + are house prices set to fall 15% by Dec 2023 | Switzer Investing (Thursday)

- Boom! Doom! Zoom! | 28 July 2022

Top Stocks – how they fared:

The Week Ahead:

Food for thought: “History provides a crucial insight regarding market crises: they are inevitable, painful and ultimately surmountable.” – Shelby M.C. Davis

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

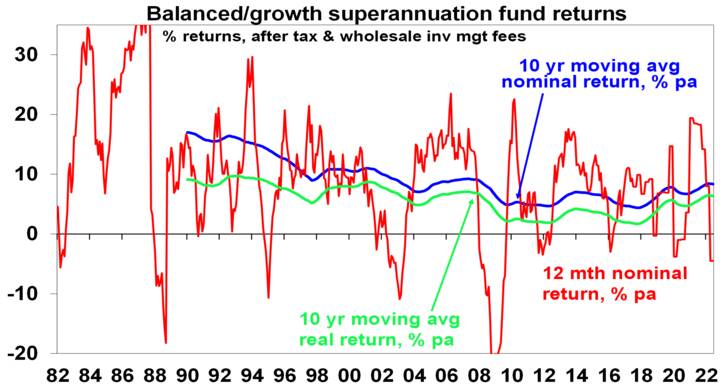

As Shane Oliver from AMP Capital reports, the start of this year has been painful for investors with sharp losses in shares and bonds, dragging most superannuation funds into negative returns for the last financial year. And yet despite this setback and rough patches in 2015, 2018 and in early 2020 with pandemic lockdowns, median balanced growth superannuation funds returned 8.4% pa over the 10 years to June after fees and taxes. While dull compared to the double digit returns of the 1980s and 1990s, it’s pretty good once low average inflation of 2% pa over the last decade is allowed for.

However, returns have been boosted for decades by a “search for yield” as interest rates collapsed with falling inflation. This pushed down investment yields (bond yields, earnings yields on shares, rental yields on property, etc) and so pushed up asset values. But the sting in the tail was that ever lower yields meant an ever lower return potential for when yields eventually stopped falling. The good news in the recent fall in markets is that it’s pushed potential medium term returns back up a bit.

Source: Mercer Investment Consulting, Morningstar, AMP

Top 5 most clicked:

Is now the time to buy stocks? – Peter Switzer

How did your super fund fare last year? – Paul Rickard

3 A-REITs and one ETF that I like – Tony Featherstone

Questions of the Week – Paul Rickard

Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.