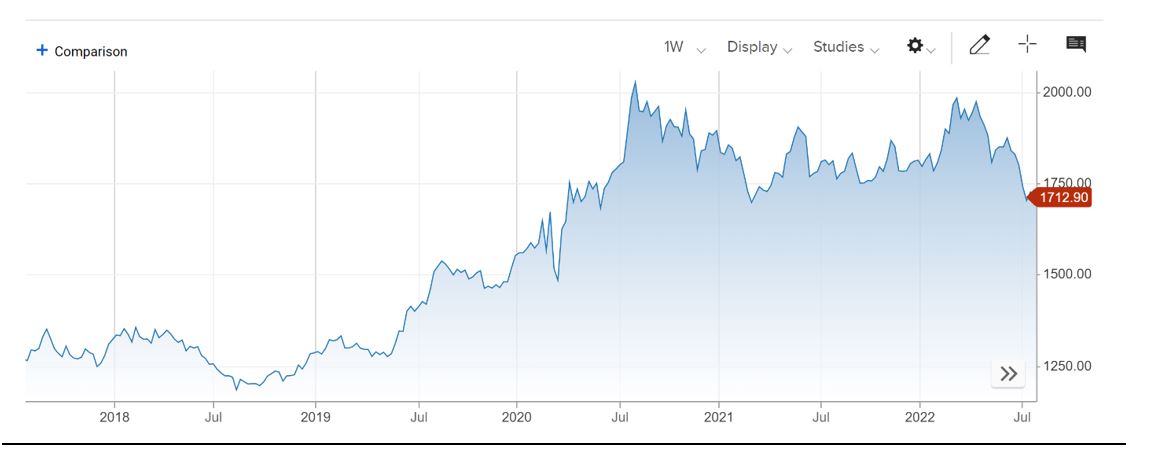

While I have never been a gold bug, I do keep a close eye on the gold price. After surging to over US$2,040 per oz immediately after the outbreak of the war in the Ukraine, it has steadily declined and lost more than 17% in value. Today, it trades around US$1,700 per oz.

For gold enthusiasts and others who maintain that gold is the ultimate “store of value”, this is a pretty disappointing outcome as it occurred when global share markets were being trashed. Normally, in times of market uncertainty and volatility, gold does well.

But 2022 is different. Rising US interest rates and a surging US dollar have wreaked havoc on the gold price. The US dollar is once again demonstrating that it is the global “reserve currency”.

Gold Price per ounce in US Dollars – 7/17 to 7/22

Source: cnbc.com

Source: cnbc.com

In Australian dollars, the gold price has fared relatively better over this period, losing about 12%. That’s because the aussie dollar has also weakened against the US dollar.

Gold Price per ounce in AUD – 7/17 to 7/22

Source: gold.org

Source: gold.org

But the rally in the US dollar can’t go on forever (it got to parity with the Euro last week), particularly as US Government debt and deficits continue to soar. Moreover, according to the bond market, US interest rates, while still on the way up, are getting closer to the peak.

I am not making a case to buy gold (yet), but it is something that I am thinking about. The argument that gold has “insurance value” remains sound, and potentially, an allocation of around 5% of my portfolio can be substantiated.

So, let’s explore how to buy gold. Essentially, there are three ways to get exposure to gold.

Firstly, you can buy physical gold through the Perth Mint or dealers such as ABC Bullion.

With the Perth Mint (www.perthmint.com/storage), you can buy gold coins or gold bars, and elect to take physical delivery of the bullion or have them store your gold securely under a custodial arrangement. The Perth Mint is backed by the WA Government.

You will need to open an account and undergo a mandatory ID check. If you open an account, you will probably want to open their Depository Online account. This allows you to trade gold online (potentially 24 hours a day), and generally has a tighter bid/offer spread than the phone or email service (known as their Depositary Program)

In addition to the bid/offer spread on the bullion, there are transaction fees. For the Depository Online account, they start at 1.0% on the value of a buy or sell transaction. For transactions over $1 million, the rate falls to 0.2%. Additionally, If you want the bullion specifically allocated to you (rather than unallocated), then the Mint charges a storage fee of 1% pa. Alternatively, you can elect to take physical delivery, in which case you will need to pay freight and insurance costs.

Exchange Traded Funds

An easier option for most investors is to buy units in an exchange traded fund (ETF). There are three exchange traded gold funds quoted on the ASX.

Gold ETFs

All the ETFs are backed by physical gold and have a strong record in tracking the gold price. BetaShares QAU hedges the currency exposure into Australian dollars, which means that it effectively provides exposure to the US dollar price of gold. The other two ETFs are unhedged, providing exposure to the price of gold in Australian dollars. They also allow for the units to be swapped back into physical gold.

Listed Gold Shares

Listed gold shares are highly leveraged to the Australian dollar gold price. Although some hedge part of their output and may have US dollar borrowings, most of their costs are in Australian dollars and tend to move in a narrower band. A small change in the equivalent Australian dollar gold price can have a huge impact on profitability and share price. For example, the second largest gold producer, Northern Star Resources (NST), has traded from a high of $11.59 in April to a low of $6.60 last week. Yesterday, it closed at $7.35.

On the whole, listed ASX gold shares have had a tough 12 months. Notwithstanding that the aussie dollar price of gold is largely unchanged over that period, gold company shares have lost in the order of 25% to 40% in value over the 12 months. Newcrest (NCM), for example, the largest producer, has shed 29.3%. The impacts of Covid and worker shortages on production, soaring production costs and overall negative market sentiment have been the drivers.

While there are scores of gold companies to choose from, many are gold explorers, and the sage old advice for investors is to look at high quality producers, particularly those with low production costs and strong reserves.

Listed below are the 5 largest gold miners by production and market capitalization. The table shows the consensus broker target price (source FN Arena) and the implied “upside potential” from the last ASX price. According to the major brokers, Northern Star (NST) has the most potential upside – the target price of $10.20 is 38.8% higher than the last ASX price of $7.35.

Leading Gold Miners – Broker Forecasts

Source: FN Arena, as at 27/7/22

Two important notes of caution. Firstly, target prices are highly sensitive to the brokers’ long term gold price forecasts. Secondly, the companies are not all pure gold miners (e.g. Newcrest also mines copper).

Broker recommendations (buy/hold/sell), or sentiment, is another guide. The consensus recommendation is quoted on a scale of -1.0 being the most negative to +1.0 being most positive. The brokers are most positive on Northern Star (all ‘buy’ recommendations) and least positive on St Barbara SBM).

For me, it is either Newcrest or Northern Star. Despite Newcrest not being a “pure play” miner and having some exposure to PN G (which I try to avoid), I am sticking with the leader.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.