For the first time ever, Paul Rickard asked me a question in our Boom Doom Zoom show about what’s going on with the stock market and I wasn’t sure what my answer should be. This market confuses me and this week was a case in point.

US March quarter earnings can excite the market, as we saw with Meta’s 17% rise in one session after reporting. As AMP Capital’s Shane Oliver pointed out: “Earnings look on track to rise around 11% year-on-year, which is up from initial expectation for a 4.3% year-on-year gain. And earnings growth in Europe and Asia is averaging slightly faster”.

That’s great for stocks and reinforces my case that we should remain long stocks. Shane also told us that “Chinese lockdowns are likely to be relatively short and more stimulus looks to be on the way”.

He also says President Xi is signalling a step-up in infrastructure spending, which is good news for commodity prices. “So while Australian shares and the $A are a bit vulnerable to lower commodity prices in the near term, their relative outperformance is likely to resume on a 6-to-12-month horizon.”

This is good for stocks and for those who have hedged their overseas investments.

Against these positives is a growing chorus of US experts tipping a recession in the US. The likes of JPMorgan Chase’s CEO Jamie Dimon warning the Fed could tighten too fast and create a recession partly explain why positivity can’t be sustained for US stock market indices. “You’ve got two other very large countervailing factors which you guys are all completely aware of,” Dimon told analysts, naming inflation and quantitative tightening (which is the reversal of Fed bond-buying policies). “You’ve never seen that before. I’m simply pointing out that those are storm clouds on the horizon that may disappear, they may not.”

This explains why in the short term we’re seeing confusing negativity one day followed by confusing positivity the next. The last two days on Wall Street are another case in point. This is what Shane Oliver wrote about US trading on Thursday: “A positive quarterly report from Meta Platforms (Facebook) lifted technology stocks and offset concerns about a contracting economy. Shares in Meta rose 17.6% with Amazon up 4.7% and Apple up 4.5%”.

Then on Friday, US-time, this is how CNBC headlined the fall in stocks: “Nasdaq slides about 3% led by Amazon as benchmark heads for worst month since 2008”. This is why I’m short-term confused but long-term happy to punt on an upside for stocks, along with Shane. And this from him helps our case: “The good news for central banks is that inflationary pressures may be peaking – as evident in our US Pipeline Inflation Indicator, which is continuing to show signs of having peaked”.

If inflation turns out to be less scary than what media headlines are doing with negative economists’ predictions, then fears about how many interest rate rises, how quickly they come and the recession they might create dissipates. And that would make stocks more attractive and I suspect tech stocks, which look over-smashed, would suddenly find they have more friends.

All this will take time and in the interim period, I expect this short-term confusing stock market behaviour to continue.

This from BMO Wealth Management’s Yung-Yu Ma sums up my story neatly: “The markets are trying to wrap around a lot of different cross-currents, with the Fed raising rates and all the uncertainties that the global economy is facing, it’s hard to get excited about paying the multiples that currently prevail in a lot of places in the market”. (CNBC)

And it has been tech stocks and of course, the Nasdaq that has really felt the pain of April, which has been the worst month since 2008. Amazon fell over 15% on Friday and gave up 26.2% for the month. You can blame recession fears around rising interest rates and quantitative tightening for that.

By the way, the Nasdaq Composite sits in bear market territory, roughly 23% below its intraday high.

The only plus from the occasional surges for tech stocks is that it says some smarties believe the sector is oversold and they’re happy to buy on the basis they have time to wait until they’re proved right. But they could be wrong for some time. The great economist J.M.Keynes once told us: “Markets can stay irrational longer than you can stay solvent”.

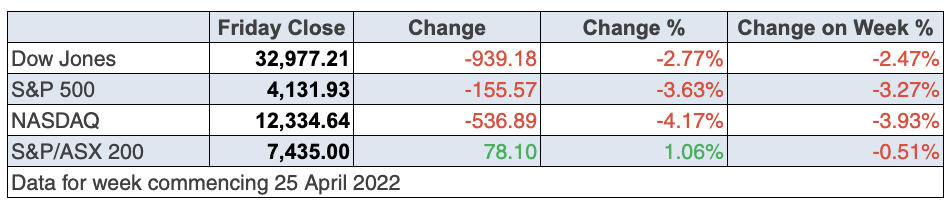

If the US Fed gets its rate rise act right, US stocks should rebound and add to the good story our stocks have used to outperform Wall Street. Year-to-date, the US-based S&P/ASX 200 is down 2%, while the S&P 500 is off 13%.

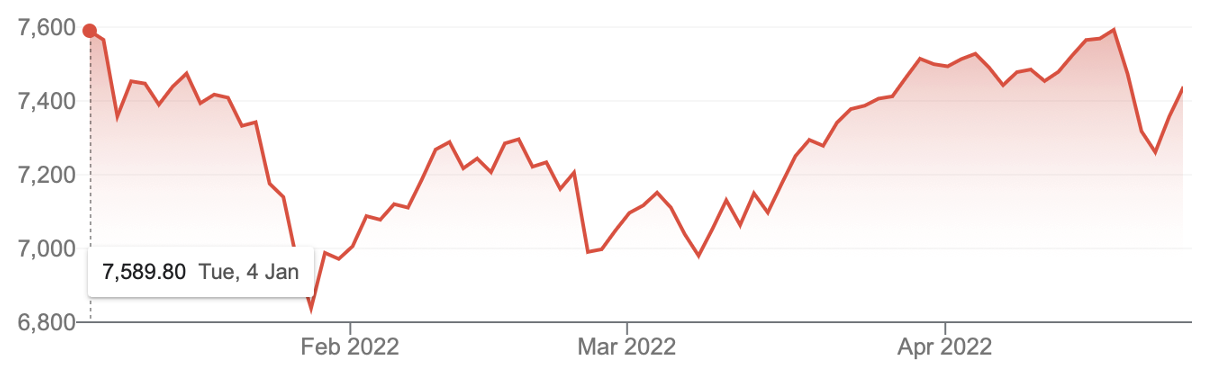

S&P/ASX 200

By the way, European shares are off about 12% and Japanese shares are down 7%.

Let’s stick with Shane and see if he agrees with my argument that we should remain positive about stocks in 2022 and 2023. “Our base case for investment markets remains that US, global and Australian recession will be avoided over the next 18 months at least and this will enable share markets to have reasonable returns on a 12-month horizon,” he wrote on Friday. “However, the past week provided a reminder that short-term risks around inflation, rate hikes, the war in Ukraine and Chinese growth remain high, which of course saw more volatility in share markets with US shares falling back to their March low and Nasdaq and Chinese shares making a new low.”

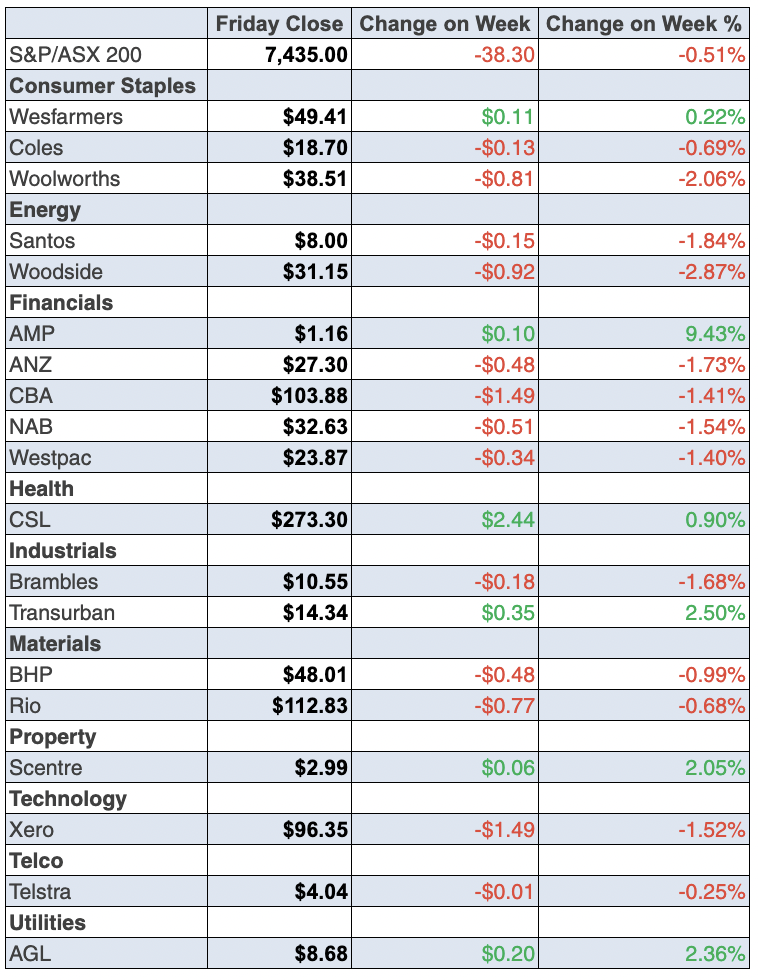

To the local story and Friday was a relief rally, with the S&P/ASX 200 up 1.1% to 7435, however, we lost 0.5% for the week, with the whys and wherefores still making me scratch my head.

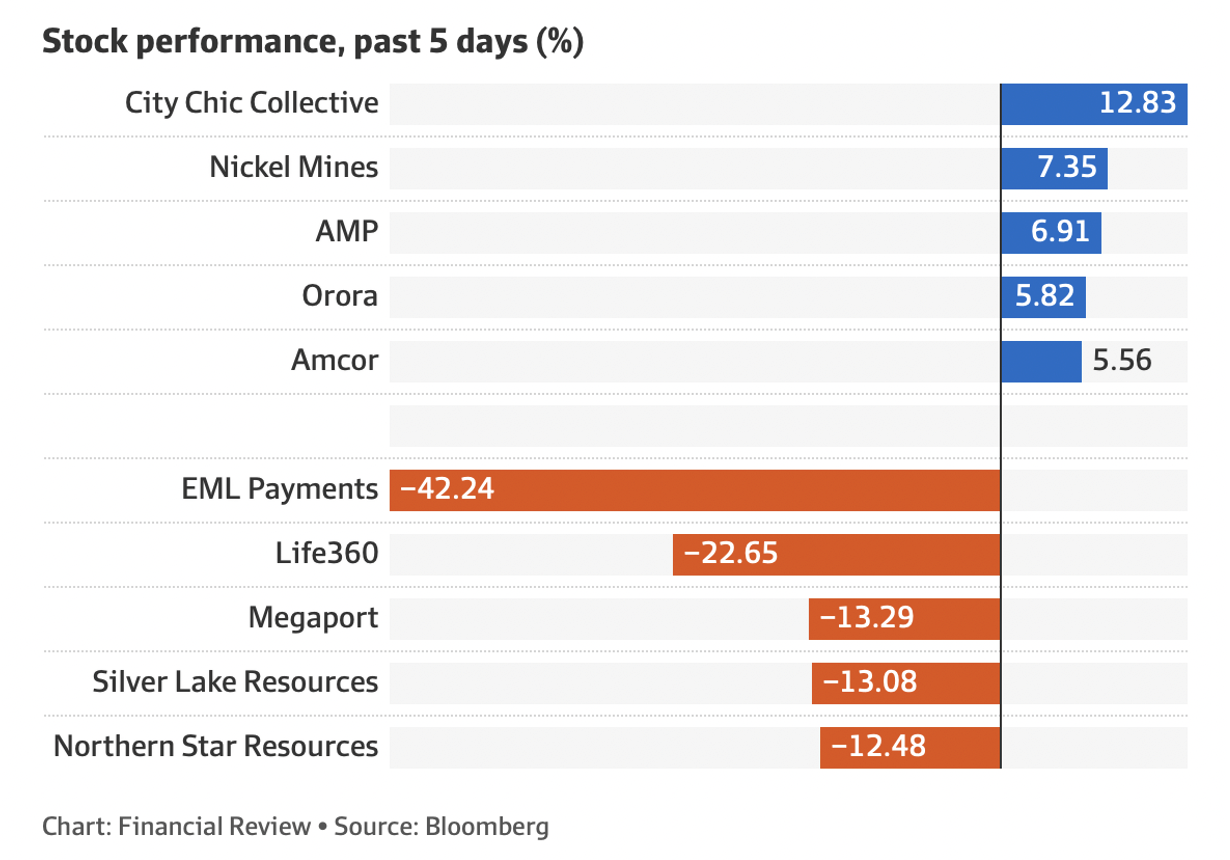

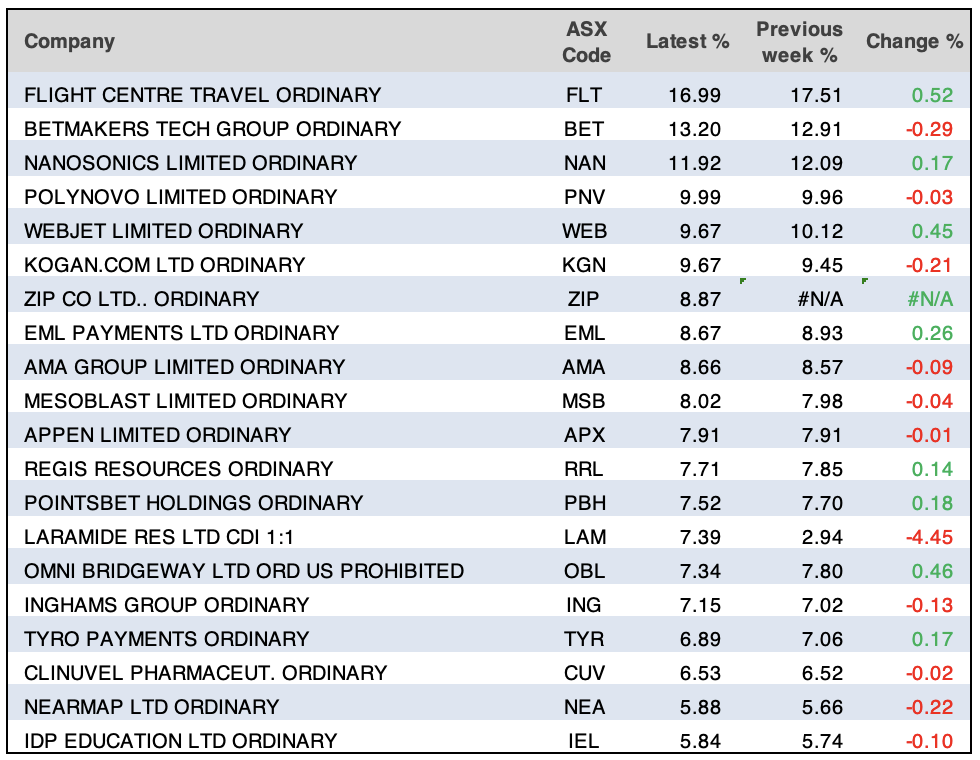

Here are the 4-day winners and losers:

Interestingly, the good report from Facebook (Meta) helped our local tech stocks on Friday, after another disastrous week at the ‘office’. For example, EML lost 42% for the week but gained 4.92% on Friday, and Tyro put on 6.36% on Friday but for the week was down 9.39%. At least this reaction spurred along by Meta makes me believe that when the Yanks start forgiving and buying tech stocks again, a lot of the current prices for our tech and payments companies will look ridiculously low. But that’s going to take some time.

Making me hesitant to be bullish now was the fact that CBA lost 3.81% for the week to end at $103.88, while BHP gave up about 1% to end at $48.01. This followed a big sell off on Tuesday with news that China’s pandemic lockdown was worsening but if we can believe Shane’s analysis, this is now being revised to be less negative.

For the record, BHP went from $48.64 to $45.82 in a day, which was a 5.8% drop but I did like the rebound on Friday.

And in another confusing market sign for ‘punters’, especially those gambling on tech and payments companies, Pointsbet whacked on 10.7% on Friday, with a good turnover number, but for the week it was still down nearly 8%!

What I liked

- Private sector credit (effectively outstanding loans) rose by 0.4% in March to be up 7.8% on a year ago, just below February’s 7.9% pace – the strongest annual growth rate in 13 years (since November 2008).

- Business credit lifted 0.3% in March – the slowest pace in 11 months but it is up a solid 9.4% over the year.

- Deposits from households increased by $17.7 billion (or 1.4%) in March to a record $1,261.6 billion, up by 12.3% on a year ago. Households accumulated $272.4 billion worth of savings during the pandemic.

- The prices of exported goods lifted by a record 18% in the March quarter (since the stats were collected in the September quarter 1974). Export prices soared by 46.7% through the year to March – the strongest annual growth rate in 13 years (since the December quarter 2008).

What I didn’t like

- The Consumer Price Index (CPI), which is the main measure of inflation in Australia, rose by 2.1% in the March quarter (consensus: 1.7%). The annual rate of the CPI rose from 3.5% to a 21-year high of 5.1%. It was the largest lift in headline CPI since the introduction of the goods and services tax (GST) but it still looks small compared to the US at 8.54%.

- The ‘underlying’ or trimmed mean CPI rose by 1.4% in the quarter (consensus: 1.2%), with the annual growth rate lifting from 2.6% to a 13-year high of 3.7% (consensus: 3.4%). This exceeds the ceiling of the Reserve Bank’s 2-3% target range and we do have to watch this, as it will be a big driver of how many rate rises we get from the RBA and how fast they come.

- The prices of imported goods rose by 5.1% in the March quarter to be up by 19.3% on the year, also the strongest annual growth rate in 13 years (since the December quarter 2008) and these are big drivers of our inflation rate.

- In its latest “Business Conditions and Sentiment” survey, the Australian Bureau of Statistics (ABS) reported that 57% of all businesses experienced increased business costs over the three months to April 2022. Of these, 48% have completely or partially passed on increased costs to their customers.

- The “final demand” component of producer prices (business inflation) rose by 1.6% in the March quarter (the most in 13½ years) to be up 4.9% on a year ago, the strongest annual growth rate in 13½ years.

- The US economy, as measured by GDP, contracted at a 1.4% annual pace in the March quarter (survey: 1.1%) but economists say it’s not an early recession sign because it was caused by a surge in imports to feed the US economic boom. Here’s Shane on the numbers: “The fall was driven by trade, which detracted 3.2 percentage points from growth and inventories, which detracted 0.8 percentage points but real final domestic demand grew at a solid 3% annualised rate with consumption up 2.7%, business investment up 9.2% and housing up 2.1%.”

- Ukraine and what Russia is doing!

US earnings news

With about half of the S&P 500 companies reported so far, FactSet says about 80% of S&P 500 companies have beaten quarterly earnings expectations. These companies are in good shape. If inflation has peaked and the Ukraine war is settled in some way ASAP, China is actually getting on top of its pandemic problem and the likes of the Fed (as well as the RBA) tightening sensibly, then we could see better stock market numbers later this year.

Overnight, Bank of America’s equity and quant strategist, Savita Subramanian, cut the price target on the benchmark index to 4,500 from 4,600 on Friday. The Index is now around 4157 so that means Savita is thinking US stocks can rise 8.2% from here, which is interesting given she said this after she lowered her S&P 500 end-of-year target: “What’s changed since January 1? War, GDP cuts, Fed on steroids,” she wrote. “We weren’t forecasting a war, and the Russia/Ukraine conflict exacerbated commodity price inflation and also hit [Europe’s] GDP hard. The Fed (and other central banks) have shifted to a far more hawkish stance.”

That’s some pretty positive negativity!

The week in review:

- This week in the Switzer Report, Tony Featherstone notes that weaker-than-expected Chinese growth is terrible for iron ore and other commodities. BHP Group tumbled 5.8% on Tuesday; Rio Tinto tanked 4.6%; and Fortescue sank almost 7%. But guess what? That’s an opportunity for long-term investors!

- There are always companies in the resources world on the ASX moving down the chain from exploration to development to mining and actual production – and this week James Dunn looks at three of the very best on offer across a range of commodities.

- In our “HOT” stock column, Michael Gable, Managing Director of Fairmont Equities, explains why CSL is a buy.

- In Buy, Hold, Sell – What the Brokers Say, there were 2 upgrades and 3 downgrades from the 7 stockbrokers monitored by FNArena this week.

- In Questions of the Week, Paul Rickard answers your queries about whether REITs are a hedge against inflation; Is South32 a buy?; Is it wise to buy more BHP shares to pick up the in-specie dividend of Woodside shares? What is the last day to buy BHP shares to get the Woodside entitlement? Paul also provides an in-depth explanation of the BHP/Woodside merger and how investors should best play their hands.

Our videos of the week:

- Why air-pollution is one of the biggest health issues in the planet | The Check Up

- What in the hell is going on in the stock market? + what in the hell happened to inflation today? | Mad about Money

- This fund manager loves these travel stocks! + Are payment companies dead or buying opportunities? | Switzer Investing

- Boom! Doom! Zoom! | 28 April 2022

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday May 2 – CoreLogic national home price index (April)

Monday May 2 – ANZ job advertisements (April)

Monday May 2 – Melbourne Institute inflation gauge (April)

Tuesday May 3 – Weekly consumer confidence (May 1)

Tuesday May 3 – Reserve Bank Board policy meeting

Wednesday May 4 – New vehicle sales (April)

Wednesday May 4 – Retail trade (March & March quarter)

Wednesday May 4 – Lending indicators (March)

Thursday May 5 – International trade (March)

Thursday May 5 – Building approvals (March)

Friday May 6 – RBA statement on Monetary Policy

Overseas

Monday May 2 – US Construction spending (March)

Monday May 2 – US ISM manufacturing index (April)

Tuesday May 3 – US Factory orders (March)

Tuesday May 3 – US JOLTS job openings (March)

May 3-4 – US Federal Reserve policy meeting

Wednesday May 4 – US ADP employment change (April)

Wednesday May 4 – US Balance of trade (March)

Wednesday May 4 – US ISM services index (April)

Thursday May 5 – China Caixin services index (April)

Thursday May 5 – US Challenger job cuts (April)

Thursday May 5 – US Nonfarm productivity/labour costs (March quarter)

Friday May 6 – US Nonfarm payrolls/employment (April)

Food for thought: “Chase the vision, not the money, the money will end up following you.” – Tony Hsieh

Stocks shorted:

NOTE: No new data released by ASIC this week. Change on Week data reflects stocks shorted between Thursday 14 April 2022 and Friday 22 April 2022.

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

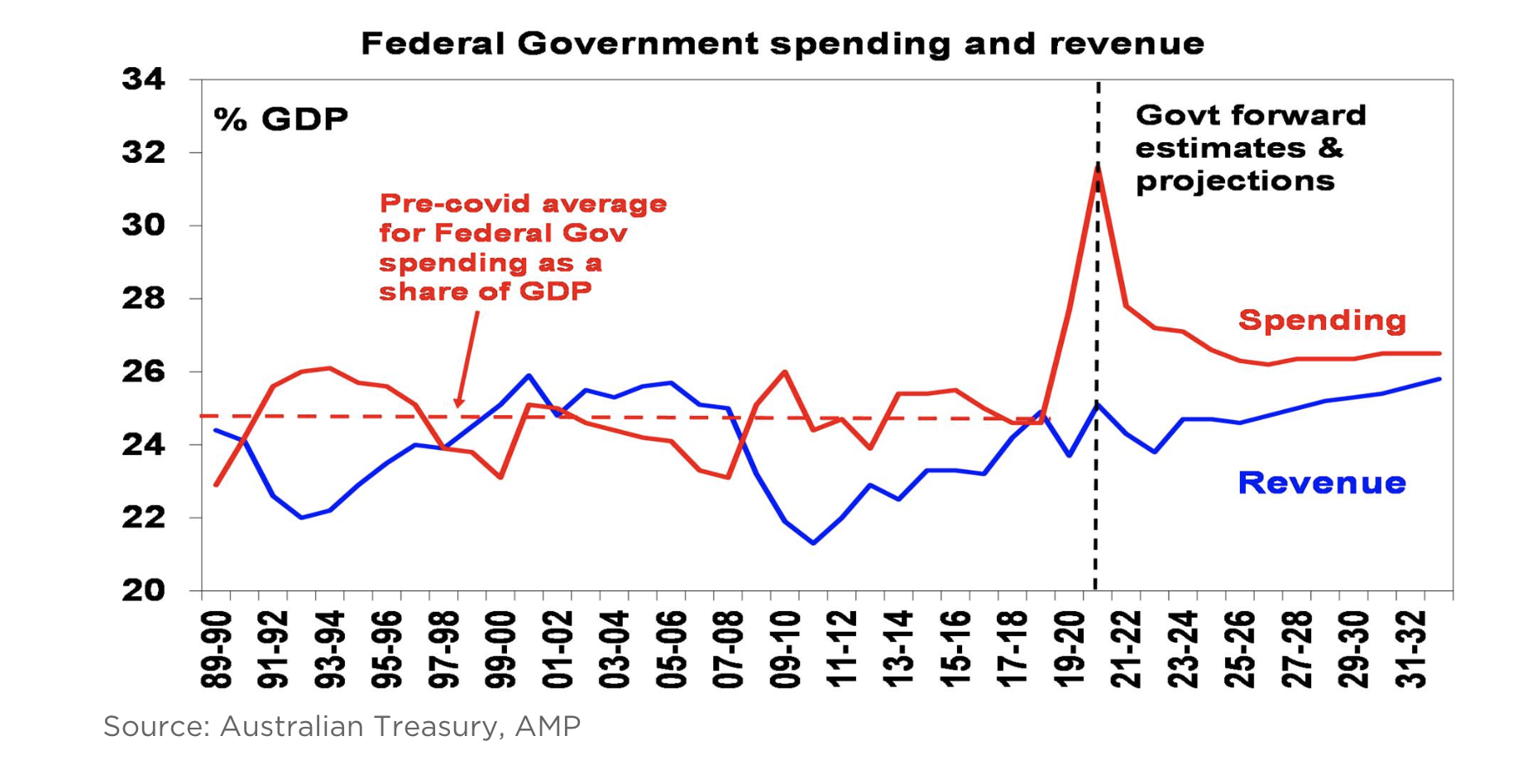

Chart of the week:

Our chart of the week looks at federal government spending and revenue over the last 30 years, returning to AMP’s Shane Oliver who breaks down the economic policy differences between both parties this election.

“The policy differences this time around are a non-event compared to the more left-wing reconstruction Labor proposed in the 2019 election, which offered the starkest choice seen since the 1970s. In the 2019 election, the ALP offered a radically different policy agenda focussed on a significant increase in the size of government (particularly via more spending on health and education) financed by a significant increase in taxation. The latter included a 2% tax increase for high income earners, restricting negative gearing to new residential property, halving the capital gains tax discount, stopping cash refunds for excess franking credits and a 30% tax on distributions from discretionary trusts. Following its defeat at that election, with the tax agenda taking much of the blame, the ALP has adopted a less left leaning agenda going into this election,” Oliver said.

“Oddly enough we have ended up with bigger government anyway with a huge surge on the back of pandemic spending and the March Budget projecting that Federal spending will settle at around 26.5% of GDP from 2025 onwards due to higher spending on health, the NDIS, the aged and defence. This is well above the pre-covid average of 24.8%. In the meantime, the budget deficit is much higher, even after pandemic spending is wound down.”

Top 5 most clicked:

- Merging BHP’s petroleum assets with Woodside – Paul Rickard

- 3 cracking new, or almost new, miners – James Dunn

- Opportunities arise with large miners – Paul Rickard

- “HOT” stock: CSL – Maureen Jordan

- Questions of the Week – Paul Rickard

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.