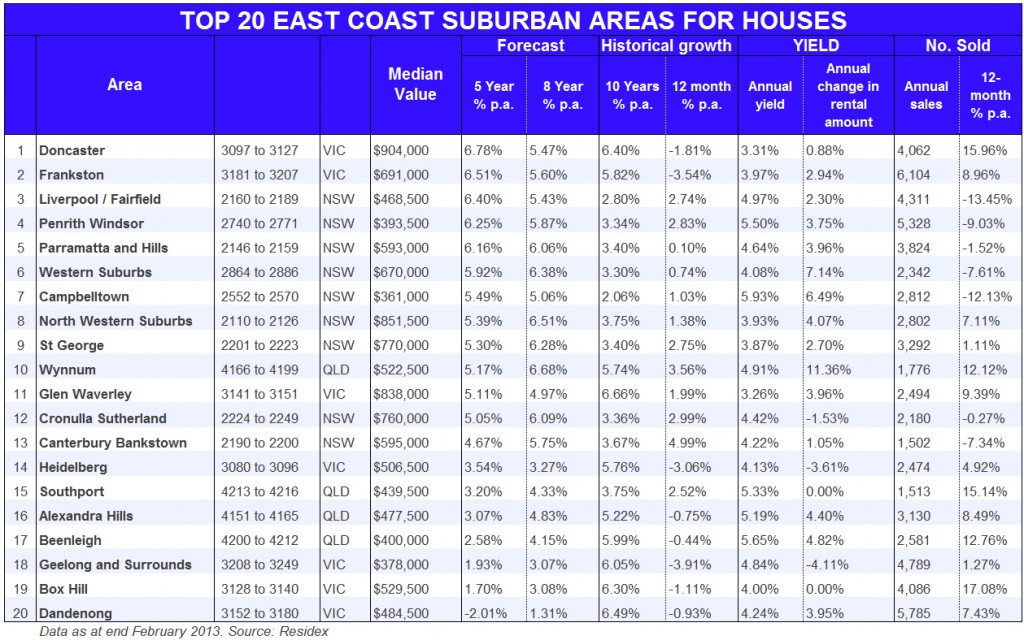

The table today ranks the top 20 suburban areas slated for growth for houses over the next five and eight years.

At the top of our list are houses in the Doncaster area in Melbourne in postcodes from 3097 to 3127.

According to the latest census data from the ABS, the Doncaster area reports a higher than average percentage of residents employed in professions – 29.5% versus a national average of 21.3% and 14.3% are managers compared to the national average of 12.9%.

For investors, there is a relatively solid percentage of Doncaster residents renting at 20%. Just under 50% of residents own their homes and 25.5% have a mortgage.

Residex bases its projections on analysis of historical data going back decades and looks at unemployment rates, interest rates and inflation, to calculate their impact on the property market and how that might affect prices in the future.

The top area in our table for NSW was for houses in Liverpool and Fairfield. There the median value is under $500,000 and the yield is relatively strong at 4.97%, with rents moving in line with inflation.

In the electoral district of Fairfield, the percentage of properties for rent at 39.3% is much higher than the national average. Just 27.3% of properties are owned outright and 29% are owned with a mortgage. The median monthly mortgage repayment as reported in the census was $1818 and quite affordable.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.

Also in the Switzer Super Report

- James Dunn: Don’t forget property related tax deductions

- Toby Bucks: Fundies favourite – Platypus Asset Management on Qube Holdings

- Ron Bewley: The telco sector – Telstra worth considering as a dividend play

- Gavin Madson: Ratings agencies shoot themselves in foot….again

- Paul Rickard: Question of the week – Transferring shares into an SMSF

- Tom Elliot: Plenty of takeover opportunities in a wavering market – Caltex and Envesta