With US recession fears now on the rise, it’s timely to say, ‘be careful of what you wish for’! Economists and market influencers have been wanting an economic slowdown in the US to see rate cuts happen to give another leg up for stocks, but have they wished too hard?

However, I’m not spooked as I can feel another buying opportunity looming, even if we have to deal with a few weeks or even months of volatility.

These recession fears coincide with the worst months of the year colliding with a controversial US election.

In case you missed it, some economic data out this week powered fears over a possible recession. Now the pundits are arguing that the Federal Reserve could be too late to start cutting rates. By the way, my favourite US academic, Professor Jeremy Siegel from the Wharton School of Business at the University of Pennsylvania, has been calling for cuts for a few months now.

First it was a jump in initial jobless claims that rose the most since August 2023. Then the barometer of factory activity called the ISM manufacturing index, came in at 46.8%, which was worse than expected. This told the market that maybe the wanted soft landing economic contraction was worse than had been tipped.

Then along came Friday’s jobs report, which showed that non-farm payrolls grew by a smaller-than-expected 114,000 in July, which was down from June’s 179,000. This was a long way from the 185,000 that economists in the Dow Jones survey forecasted. Also, unemployment hit 4.3%, which was the highest since October 2021.

Managing director for global market insights at R.J. O’Brien and Associates, Tom Fitzpatrick got it right with the following: “The data we have got since the Fed meeting signals all of a sudden that people are now worrying that maybe it isn’t a soft landing, and the Fed has vacillated too long.”

He rightfully pointed out that the bond market is now saying the Fed is behind the curve, which means the September meeting will bring the first rate cut, but others are now arguing they should have done it this week!

Importantly, you need to remember this is probably short-term overreaction, which US markets always are up for. I like this from UBS’s Chief Investment Officer Americas, Solita Marcelli, who wrote this as this late week sell-off started: “Market sentiment and positioning had become extended — making a pullback more likely. But market fundamentals remain positive, and we continue to expect the S&P 500 to recover and end the year higher at 5,900…”

That index finished overnight at 5346.56, which suggests a 10.3% rise is on the cards, if Solita is on the money. Unsurprisingly, I think she’s spot on, remembering the December quarter is historically the best for stocks. Also, a post-election bounce for Wall Street often happens, and given what we’ve seen this week, the Fed is bound to be throwing a few rate cuts at the US economy, which will help that bounce happen.

For the record, the Dow dropped 1.51% on Friday, the S&P 500 gave up 1.84% and the Nasdaq lost 2.43%. The latter index now has lost nearly 7% over the month, while the Dow is actually up 1.03%, underlining that the rotation out of big tech stocks into other stocks that should benefit from lower rates is on well and truly.

To the local story and the S&P/ASX 200 Index lost a big 171 points (or 2.11%) on Friday to finish at 7943.20 but we were up 0.28% for the week. On Friday, the SMH had headlines such as “Bloodbath: ASX suffers $50b wipeout after Wall Street dives” but on Thursday it ran with “ASX closes at record high on rate cut hopes.”

I’d argue that the Friday story might be a tad dramatic for anyone with a long-term view on investing.

The big four banks copped it as the table for how our top stocks fared shows. BHP, Rio and Fortescue were beaten up on Friday, but Rio was up for the week, while BHP lost only 0.59%, though FMG was smashed by 8.4%.

Energy companies such as Woodside was up 1.48% for the week, and Santos was up 0.77% with Middle East concerns pushing up oil prices.

Sleep apnoea device business ResMed lost 1.82% on Friday but ripped up 4.71% on a higher sales report defying the diet drugs threat to their operation. Pilbara Minerals had a great Thursday, up 4.4%, but Friday and US recession talk led to a 4.76% drop for the week.

Meantime, the Olympics helped Qantas rise 0.16% as the link to athletes has to be a marketing plus but the demise of REX means it’s no longer that small threat to Qantas and Virgin.

Defence tech dealer DroneShield had another shocker losing 18.28% for the week, but those good CPI numbers helped Harvey Norman jump 2.17% to $4.71. And Ramsay Health still struggles with a 3.22% drop to $45.32.

What I liked

- The Olympics!

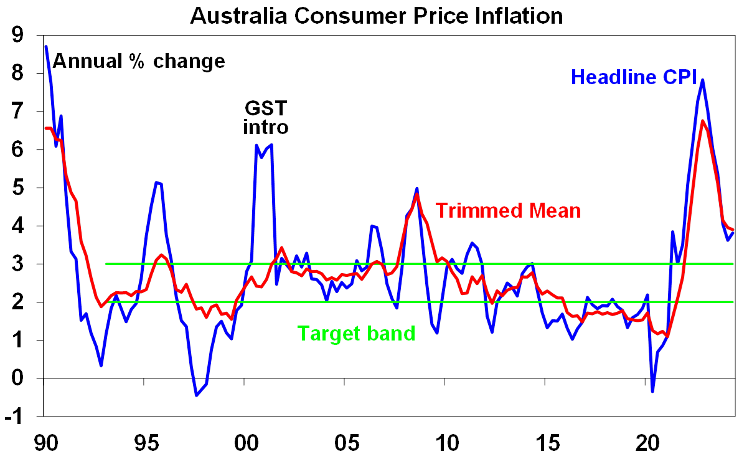

- The CPI reading: trimmed mean down from 1% to 0.8% and the annual number dropped from 4% to 3.9%.

- Westpac and CBA economists talking about a Cup Day rate cut!

- Retail sales rose solidly in June but as in May this was due to a stronger-than-normal boost from cash strapped consumers taking advantage of end of financial year sales, suggesting a pullback in July. This will be good for inflation and eventual rate cuts.

- Eurozone June quarter GDP growth was stronger than expected at 0.6% year-on-year.

- Shane Oliver of AMP says: 74% of US S&P 500 companies have now reported June quarter earnings. The results are good but proving more mixed and weaker than hoped for from tech stocks. 79.1% have beat earnings expectations, which is above the norm of 76% but below the experience of the last reporting season. Consensus expectations for earnings growth are now 8% year-on-year, up from 7.8% at the start of the reporting season.”

What I didn’t like

- Excessive recession fears in the US. The Yanks overdo everything — fear and greed!

- This data created recession concerns: “US labour market still clearly slowing. Jobs related data was also soft with job openings, the quits rate (workers quitting for new jobs) and the hiring rate all down and the manufacturing ISM employment index falling to its lowest since 2020. All are pointing to lower jobs growth ahead.” (Shane Oliver)

- Weak Chinese business conditions PMIs but no new policy stimulus from the Politburo meeting.

- Policy stimulus in China looks like remaining modest and incremental – maybe just enough to keep growth ticking along around the 5% growth target, but with the risk that it’s not enough or too late. This is adding to commodity price weakness, which isn’t good for BHP, Rio and FMG.

Gold medal commentary

Cate Campbell wins an individual gold medal for the best observation by a commentator covering the Paris Games. Talking to Nine’s Karl Stefanovic she said this after Cam McEvoy booked his spot in the 50 metres freestyle final: “Cam McEvoy is trying to change this theme we’ve got going in the Australian team at the moment, where if you want to win an Olympic gold medal you have to have a uterus.” Given McEvoy’s gold win, he clearly must be in touch with his feminine side.

For the record, Cate won six medals (four gold, one silver and one bronze) in relay events at the Olympic Games. She also has two individual Olympic medals to her name but was very unlucky at previous Olympics. And she held the world record for the 100 metres short-course freestyle event, which few people in the world could boast about! She also broke world records in several relays.

Switzer This Week

Switzer Investing TV

- SwitzerTV Investing: Jun Bei Liu names her top 5 stocks for the year ahead + dump the Heaven Eleven stocks?

- BOOM, DOOM, ZOOM: Peter Switzer & Paul Rickard answer your questions on APA,ANZ,MIN & more

Switzer Report

- Two small-cap property trusts worth considering at current valuations.

- HOT stock: Pro Medicus (PME)

- Questions of the Week

- The rotation plays say to look away from the Heaven Eleven stocks

- Is Macquarie a buy over $200?

- HOT stock: Mineral Resources Ltd (MIN)

- 4 cancer fighting stocks

- Buy, Hold & Sell, What the Brokers Say…

Switzer Daily

- Who are the gold medal countries for rewarding their medal winning athletes?

- Great news on inflation KOs rate rise talk

- Does the economic scorecard say rates should rise or not?

- A bank behaving brilliantly by beating scammers. Yahoo!

- Will our kids eventually bankroll us?

- Is Labor set to lose power in the Northern Territory? – by Malcolm Mackerras

The Week Ahead

Top Stocks — how they fared

Most Shorted Stocks

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before

Quote of the Week

From the chief economist at Westpac, Luci Ellis and a former Assistant Governor of the RBA, who is tipping a rate cut on Cup Day, which is something I’ve been speculating on for some months now. This is what she said after Wednesday’s CPI: “Inflation in the June quarter was in line with our expectations, and a shade below on some key measures. With the disinflation on track, we affirm our view that rates are on hold until November and likely to decline from then.” Go Luci!

Chart of the Week

It had to be our better-than-expected inflation reading! Follow the red line, which shows the falling trimmed mean reading of the CPI.

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.