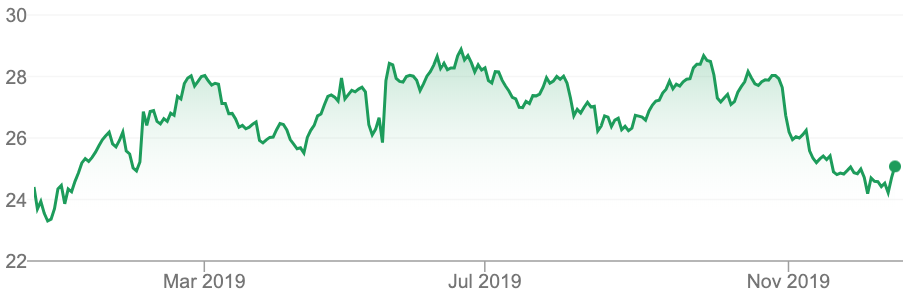

Michael likes ANZ Bank (ANZ). “The negative sentiment in the sector is weighing on ANZ’s share price,’ he says.

“However, ANZ acted ahead of its peers in re-shaping its business, and has a relatively clean bill of regulatory health. Assuming steady dividends, the cash yield is 6.6%, with franking it’s 8.5%,” he adds.

Source: Google

Michael doesn’t like Computershare (CPU). “The recent run-up takes CPU to a PE of around 18x – in my opinion, too rich given the unexciting underlying activity,” he says.

“The long-term risk from the introduction of block chain technology to share settlement systems could mean this is a good time for shareholders to depart,” he adds.

Source: Google

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.