It’s music to my ears, with positivity reigning on Wall Street overnight with the Yanks less worried about the bond market, following a better-than-expected inflation number. And so the reopening trade stocks were back again driving share prices and market indices higher, except for the tech-laden Nasdaq. Gotta love those optimistic Americans!

There was also good consumer confidence news, with the University of Michigan’s index of consumer sentiment coming in at 84.9 in March, which was up from the 76.8 reading in February. And this was higher than the 83.7 forecast from economists in a Dow Jones survey.

All this has been good for cyclical and value stocks such as energy, commodities, construction and the like, which have trended higher. This means that the former rock star stocks, i.e. tech, have to cope with less buyer attention.

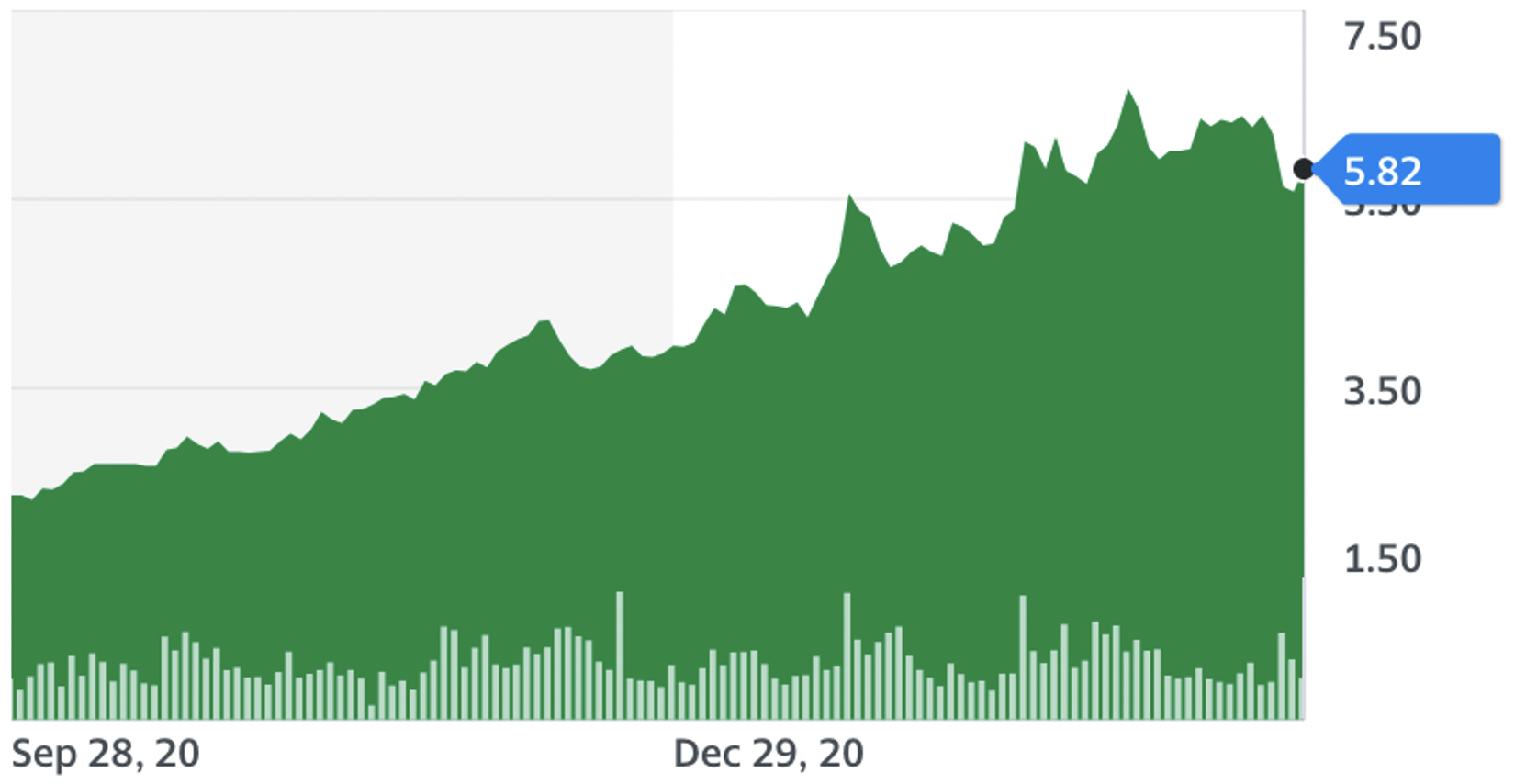

Interestingly, ETFs in the now popular areas of robotics, clean energy and other thematic tech areas are being pursued. Though Lynas was down for the week, it did rise 4.3% on Friday to $5.82. And have a look at its new-found popularity over the past six months!

Lynas (LYC) 5 years

And did you see the kick in the pants for Chinese stocks from Wall Street this week? The smarties might be seeing Beijing and its meddling and bullying becoming too much of a risk, with Tencent Music down 15% this week, Baidu off 12% and Vipshop smashed by nearly 20%. Western countries are putting sanctions on China. Of course, Beijing is returning fire and I look at this issue below.

Financial stocks got a lift, with the Fed saying they could resume buybacks and raise dividends as of June. There were pandemic-fear restrictions on banks, which were supposed to go by March. Given the announcement, the clarity was a plus for financial stocks.

Another plus for positivity was testimony by the Federal Reserve chair Jerome Powell, who on the economic recovery said that it “…has progressed more quickly than generally expected.”

Backing that up were claims for unemployment benefits, which dropped to a one-year low. Also, President Joe Biden’s announcement of his new goal to administer 200 million Covid-19 vaccine doses in his first 100 days in office, was what the stock market wanted to hear, as it raises expectations that normalcy for business and the economy will be closer than was expected. This kind of news is great for stocks.

The home of bad market news was Europe over the week, with Germany extending a lockdown to April 18, which weighs on economic recovery prospects and expectations for the broader EU region.

The Europeans are really stuffing up their approach to beating the Coronavirus and the global recovery and stocks will pay the price.

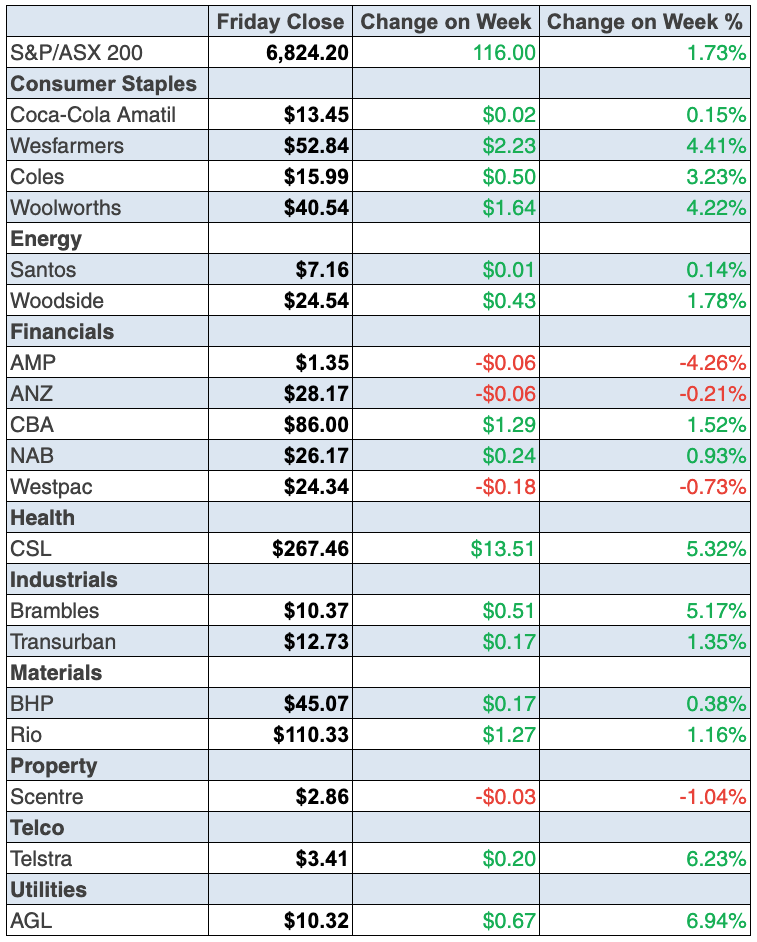

To the local story and the S&P/ASX 200 actually had a good week, rising 1.7% to finish at 6824. And that was the best week since the start of February.

S&P/ASX 200 5-days

Let’s recap:

- On Monday, the market was up 0.66%

- Tuesday it was down 0.1%

- Wednesday’s market was up 0.5%

- Thursday up 0.17%

- Friday was a nice finish, up 0.5%!

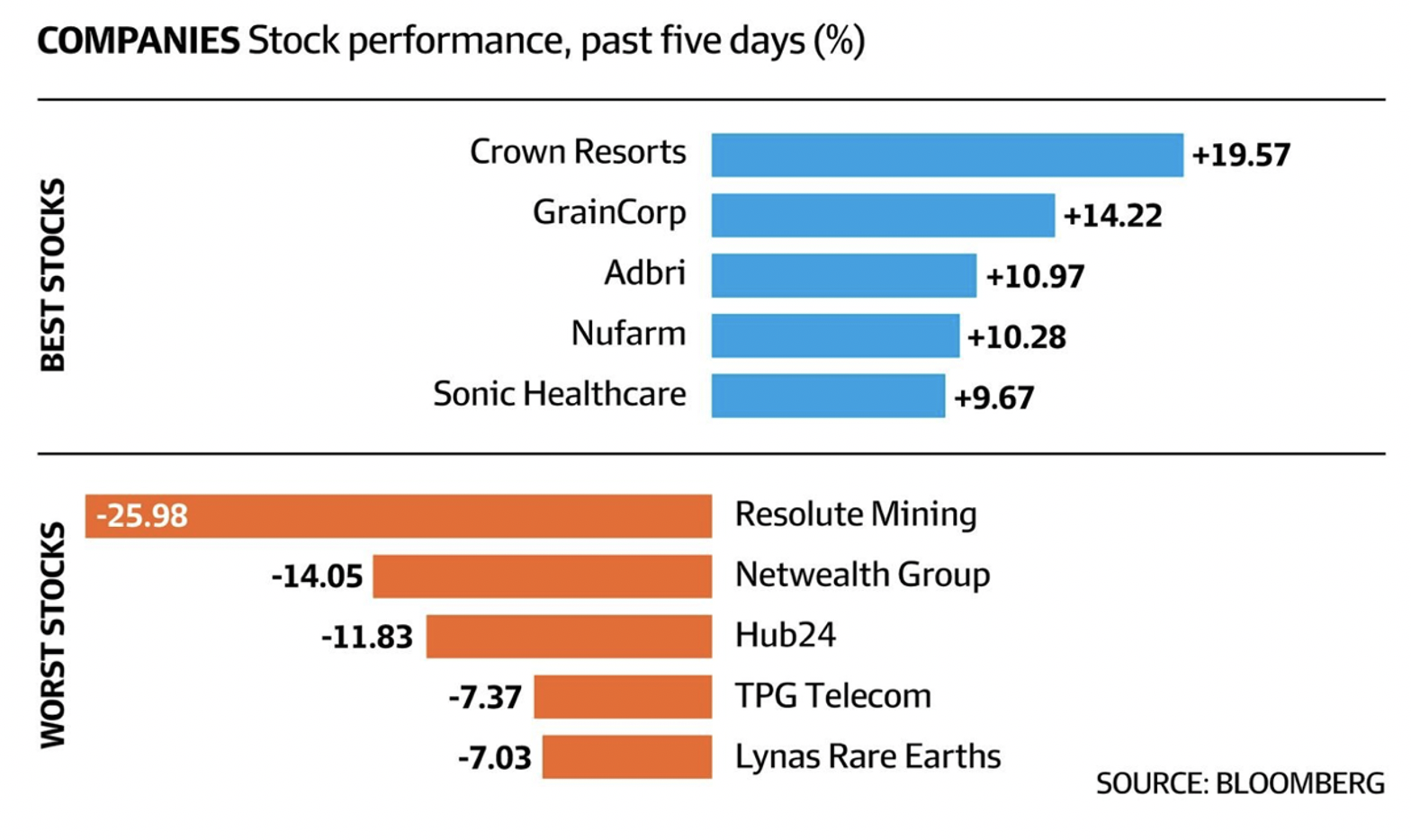

The ‘star’ performer was Crown Resorts but it wasn’t because of what they did right but more the opposite, which has led to a takeover offer from Blackstone.

This has saved embattled shareholders who were bracing for share price losses because of the upcoming Royal Commission — but that’s stocks.

In case you missed it, in a nutshell, here are the winners and losers for the week, thanks to Bloomberg and the AFR.

A curve ball story was David Teoh leaving TPG, which saw the company’s share drop around 7%, taking about a billion off the value of the company.

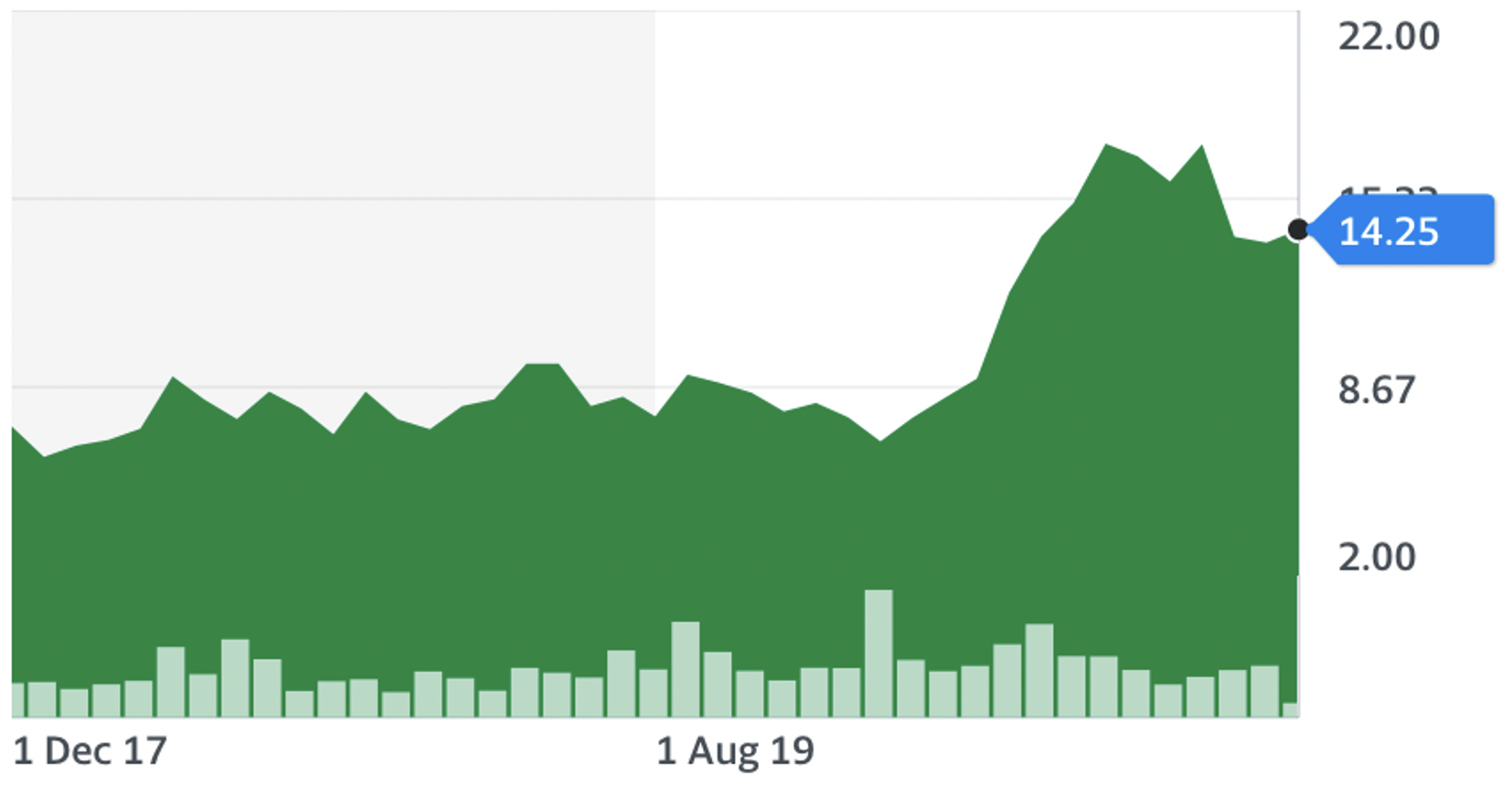

Netwealth had a bad week but has had a good year, as the following chart shows, with the share price climbing from around $6.75 in early March to hit a high of $18.71 before slipping back to the current price of $14.25. This is a stock that looks like a victim of over-buying and now profit-taking, as the rotation trade encourages momentum players to look for reopening stocks in the value and smaller cap space.

Netwealth (NWL)

Finally, the Resolute Mining story explains why I worry about miners in African precincts, with the Ghanian Government terminating the company’s lease at the Bibiani Gold Mine. The stock lost nearly 26% on the news!

What I liked

- Total household wealth (net worth) rose by 4.3% to a record high $12,033.5 billion in the December quarter, to be up 7% on a year ago. It was the biggest quarterly gain in wealth in 11 years.

- The National Skills Commission reported that skilled internet vacancies rose by 7% in February to be up 24.8% on the year. Vacancies are at 9-year highs.

- The IHS Markit ‘flash’ PMI for manufacturing rose from 56.9 in February to 57 in March. The services business activity PMI rose from 53.4 to 56.9 in the month. The composite PMI rose from 53.7 to 56.2. Readings above 50 indicate an expansion in activity.

- Imports of cars soared 24% in February. Cereal exports hit record highs, underpinned by a 20% lift in wheat exports.

- The Commonwealth Bank (CBA) measure of household card spending in the week to March 19 was up by 19% on 2019. CBA is now using 2019 as the base of comparison, rather than 2020, noting it was a more “normal” year for spending.

- The US economy (as measured by GDP) rose at a 4.3% annual pace in the December quarter (survey: 4.1%).

- Investors responded to the positive testimony by the US Federal Reserve chair Jerome Powell and Treasury Secretary Janet Yellen to the Senate Banking Committee on Wednesday.

- The Markit manufacturing index for the US rose from 58.6 to 59 in March (survey: 59.3) and the services index rose from 59.8 to 60 (survey: 60).

- The composite purchasing managers index for the EU rose from 48.8 to 52.5 in March, indicating expansion of activity. A gauge of consumer confidence also rose.

What I didn’t like

- A mega-ship blocking the Suez Canal, which carries 12% of world trade through it! Supply chains are already hurt by lockdowns and the pandemic, so this was a curve ball we didn’t need to have.

- The weekly ANZ-Roy Morgan consumer confidence rating fell by 0.5% to 110.4 (long-run average since 1990 is 112.6). But I do like that confidence is still up by 69.1% since hitting record lows of 65.3 on March 29 last year (the lowest since 1973).

- The Chicago Federal Reserve national activity index fell from 0.75 to -1.09 in February (survey: 0.71).

- Talk of more lockdowns in Europe!

A big like on China

The Guardian reported that “Britain and the EU have taken joint action with the US and Canada to impose parallel sanctions on senior Chinese officials involved in the mass internment of Uighur Muslims in Xinjiang province in the first such western action against Beijing since Joe Biden took office.”

Of course, predictably, Beijing returned fire, even stooping to encouraging the boycott of US and European brands such as Nike, Lacoste, Puma, H&M and many others.

“The move also marked the first time in three decades that the UK or the EU had punished China for human rights abuses, and both will now be working hard to contain the potential political and economic fallout,” The Guardian story revealed that “China hit back immediately, blacklisting MEPs, European diplomats and thinktanks.”

The day China becomes a cooperative, corporate global citizen, the world economy and stocks will be big beneficiaries.

Compared to Donald Trump, Joe Biden’s China plays might become a very significant part of the new President’s historical legacy. Let’s hope it’s a damn good one!

The week in review:

- Last week, my long-time friend Mark Bouris questioned whether it was time to go long gold. Here’s my response to Mark’s potential move and I give you my honest take on whether the market is spooking me right now.

- Here are Paul Rickard’s 4 dividend picks from outside banking and mining: Charter Hall Long WALE REIT (CLW), APA Group (APA), Medibank Private (MPL) and Telstra (TLS).

- For the first time in 2021, here’s another batch of ‘Five Under 50 cents’ selections from James Dunn: Jervois Mining (JRV), ReadCloud (RCL), Aurelia Metals (AMI), Adveritas (AV1) and archTIS (AR9).

- Tony Featherstone wrote this week that he likes renewable energy stocks and clean-energy investing. For conservative, income-focused investors, he prefers the big New Zealand renewables utilities that are dual-listed on the ASX: Meridian Energy (MEZ) and Mercury NZ (MCY).

- We had two “HOT” stocks this week: Julia Lee from Burman Invest selected Virgin Money (VUK) and Raymond Chan from Morgans selected NextDC (NXT).

- In Buy, Hold, Sell – What the Brokers Say this week, there were 7 upgrades and 4 downgrades in the first edition, and a further 7 upgrades and 4 downgrades in the second edition.

- And in Questions of the Week, Paul Rickard answered questions about Fortescue Metals Group (FMG), Computershare (CPU), CBA’s new hybrid issue and Magnetite Mines (MGT).

Our videos of the week:

- Boom! Doom! Zoom! | March 25, 2021

- Stocks being dumped that are long term buys : CSL, DMP, JBH & 4 great income stocks | Switzer Investing

- 6 TOP ASX STOCKS from fund manager and broker + house price boom exaggerated? | Switzer Investing

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday March 30 – Weekly consumer sentiment index (March 28)

Tuesday March 30 – Weekly payroll jobs & wages (March 13)

Wednesday March 31 – Engineering construction (December quarter)

Wednesday March 31 – Private sector credit (February)

Wednesday March 31 – Building approvals (February)

Thursday April 1 – Purchasing managers’ indexes (March)

Thursday April 1 – CoreLogic home value index (March)

Thursday April 1 – Job vacancies (February)

Thursday April 1 – International trade (February)

Thursday April 1 – Retail trade (February)

Thursday April 1 – Lending indicators (February)

Overseas

Monday March 29 – US Dallas Fed manufacturing index (March)

Tuesday March 30 – S&P/Case-Shiller home prices (January)

Tuesday March 30 – US FHFA house price index (January)

Tuesday March 30 – US consumer confidence index (March)

Wednesday March 31 – China purchasing managers’ indexes (Mar.)

Wednesday March 31 – US ADP employment change (March)

Wednesday March 31 – US Pending home sales (February)

Thursday April 1 – China Caixin manufacturing index (March)

Thursday April 1 – US Challenger job cuts (March)

Thursday April 1 – US Construction spending (February)

Thursday April 1 – US ISM manufacturing index (March)

Friday April 2 – US Non-farm payrolls (March)

Food for thought:

“You can’t predict, but you can prepare.” – Howard Marks

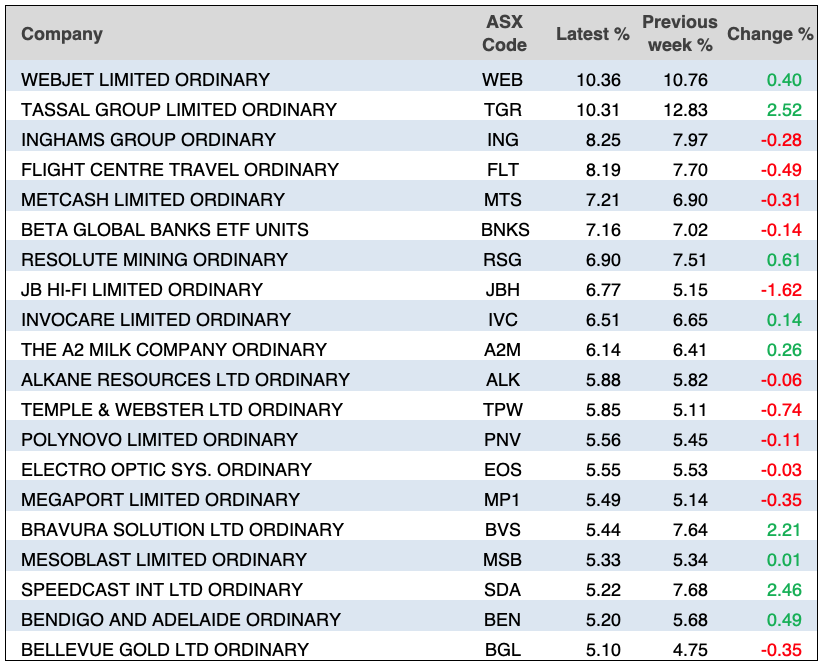

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

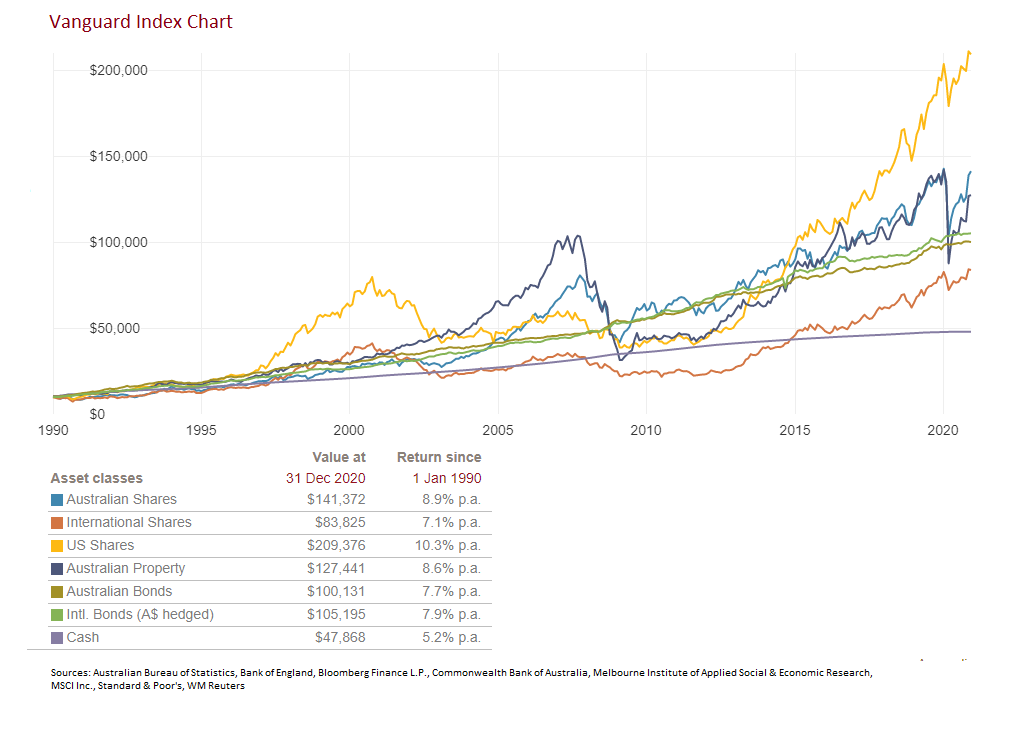

Chart of the week:

This week, Vanguard published a new version of their index chart looking at the returns on a $10,000 investment made in 1990 as of the end of 2020. Even with the GFC crash and the COVID crash, a $10,000 investment in Australian shares was worth $141,372 at the end of last year, with an average annual return of 8.9% p.a.:

Top 5 most clicked:

- Am I staying in stocks or going for gold? – Peter Switzer

- My 4 dividend picks – Paul Rickard

- 5 stocks under 50 cents – James Dunn

- My “HOT” stock: VUK – Maureen Jordan

- 2 Kiwi renewable energy stocks – Tony Featherstone

Recent Switzer Reports:

- Monday 22 March: Shares or gold?

- Thursday 25 March: 2 renewable energy stocks

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.