While I can’t use the f-word, I’d like to after the US at long last got a downbeat jobs report, to which I say: “At long, freaking last!” Yep, that’s got it out of me, and as I’ve been predicting, the market liked it because now the bad employment number puts interest rate cuts back on the table for 2024, which in turn helps stocks head higher.

By the way, it will take some wind out of the sails of those economists calling for rate rises here, as this message from the US labour market reminds them that monetary policies from central banks work, but with a lag, which can be longer than expected.

Right now, Fed boss Jerome Powell looks like a genius and the money market ‘experts’ look like dopes, again. But there’s only one problem — it’s only one month’s data. The new double data drama will be: “Is this a one-off drop in the jobs market or could this be the start of a much harder landing for the US economy?”

This is the proverbial ‘wall of worry’ that Wall Street climbs but with a different set of worries to be nervous about. For now, however, let’s just take this result for all its positive worth and check out the unexpected details.

First up, while 175,000 jobs were created in April, economists expected 240,000. Second, the unemployment rate rose from 3.8% to 3.9% and third, wage figures were softer than tipped by economists, which helps create the belief that inflation will keep sliding.

Emily Roland, co-chief investment strategist at John Hancock Investment Management, told CNBC the following after the report was released: “It’s really eased investors’ fears that the economy may be overheating or reaccelerating, and it’s reviving hope for rate cuts — that’s why rates are falling, bonds are rallying, and equity markets are up. Bad news for the jobs market means the Fed may be able to start cutting later this year.”

That’s it in a nutshell, and it’s why our market is tipped by SPI Futures to open 22 points higher on Monday, but I reckon that will only be the start of something better. Helping is the new money market bet that the Yanks have a 72% chance of seeing two cuts by year’s end, when last week it was only 50%, which is all good news for stock players and tech/growth stocks.

Reinforcing the upbeat outlook for stocks has been the US reporting season, with the likes of Apple up 7% overnight following better-than-expected reporting on both its top and bottom lines and also because of a $110 billion share repurchase plan.

On the important subject for stocks i.e. company reporting, US March quarter earnings have been impressive. After 80% of S&P 500 companies having reported so far, 79% have beaten expectations, against a norm of 76%. And earnings growth expectations for the quarter have increased to 8.3% year-on-year from 4.1% three weeks ago. AMP’s Shane Oliver says it “looks likely to end around +10% year-on-year, and that’s impressive!”,

To the local market and the S&P/ASX 200 ended the week 42 points higher on Friday, which meant it was a 53.1-point gain over the week (or 0.7%) to finish at 7629. Helping the gains were tech stocks, which piggybacked off Apple’s after-the-bell report on Thursday, with the likes of Pro-Medicus and Wisetech starring. The former was up 2.77% for the week to $113.52, while the latter went up 1.16% to $92.27 on Friday alone.

And on that day, Afterpay’s owner Block had another stunner, adding 9.83% on Friday to reach $116.44 on good news for sales and outlook. Sticking with the good news, the AFR’s Tom Richardson reported that “…lithium miners rose as prices for the battery metal firmed. Pilbara Minerals climbed 3 per cent to $4.18 and IGO added 1.9 per cent to $7.92”.

From the bad news department and Macquarie fell 2.2% to $183.83 after a 32% slide in profits for the 2024 financial year, with its bets on the future of green investments, which have been slow to grow, colliding with lower commodity prices.

What I liked

- US Fed chair Jerome Powell downplaying the prospect of rate hikes at this week’s policy decision in Washington.

- Activity in the U.S. services sector contracted in April for the first time since December 2022, according to an Institute for Supply Management report Friday. The ISM services index fell to 49.4, down 2 points from March and below the Dow Jones estimate for 52. (Slower economic news is good for interest rate cuts.)

- Goldman says these global stocks will soar on an $857.5 billion electrification boom!

- This AFR headline: Oil set for biggest weekly drop since February as war risk fades.

- The rising Aussie dollar, which is good for my hedged plays such as HNDQ and IHVV, and it helps lower inflation.

- Retail sales fell more than expected in March, which is good for lower inflation.

- Building approvals rose less than expected in March with the housing shortage worsening. (Terrible news for those wanting to buy a property and house price rises, but good for lower inflation.)

- Shane Oliver noted: “Both retail sales and the Household Spending Indicator point to real per person spending going backwards by 2.5% year-on-year or more as cost-of-living pressures and high rates continue to impact.” (Another data revelation that the RBA will be influenced by to not raise rates.)

- I can’t believe I’m saying that I like the fact that the trade surplus fell again in March with lower commodity prices and stronger imports, but trade looks likely to be a big detractor from March quarter GDP growth, possibly by as much as 1 percentage point and a slower growing economy is good for inflation.

- The ECB remains on track to start cutting in June.

- The Beijing Politburo meeting signalled more policy support, particularly for property. This suggests more easing ahead but in recent times policy stimulus has been less than flagged. (China’s growth is important for the outlook for our miners and their stock prices.)

What I didn’t like

- “Rates might rise” talk here, however, it will scare consumers and probably help lower inflation!

- Home prices rose 0.6% in April.

- Housing finance had a stronger-than-expected rise in March.

- Chinese business conditions PMIs were mixed in April. Manufacturing conditions were little changed, whereas services fell.

Trump trumped, again!

I know Donald has fans but he’s enduring more trouble with CNBC reporting that: “…the auditing firm for Trump Media and the auditor’s owner were charged Friday with “massive fraud” by the U.S. Securities and Exchange Commission for work that affected more than 1,500 SEC filings, the federal regulator announced.”

Trump Media shares fell 5% on the revelation and it follows question marks over the company’s reporting, which saw CBS report the following: “Trump Media & Technology Group also posted a loss of $58 million in 2023, compared with a profit of $50 million in the prior year. Additionally, it noted that its accountant flagged that the company’s losses raise doubts about its ability to continue operating.”

But it’s not all bad news, with its stock price up 4.15% for the month since that ‘loss’ story was reported. For the past six months, with Donald facing multiple court cases, the stock is up 220%! Only in America.

Switzer This Week

Switzer Investing TV

- SwitzerTV Investing:The bitcoin questions you were always afraid to ask – answered! Plus Michael Gable pinpoints stocks the charts say “buy me!”

- BOOM, DOOM, ZOOM:Peter Switzer and Paul Rickard answer your questions on QUB, SHL,NEM & more

Switzer Report

- Two cash ETFs to consider

- “HOT” stock: Macquarie Group (MQG)

- Questions of the Week

- Do tech stocks have legs going forward?

- Changes to super: how they’ll impact you!

- HOT stock: Resmed (RMD)

- Two more tailwind stocks

- Taking a gamble on casinos

- Buy, Hold, Sell — What the Brokers Say

Switzer Daily

- Powerful Treasurer handouts coming but will they push up inflation?

- Do we need to help the RBA create a recession?

- Treasurer Chalmers wants foreign money but not from every country

- SUSSAN economics: job losses go with rate cuts. But how many and when?

- Will unions and rising interest rates crush Albo’s re-election plans?

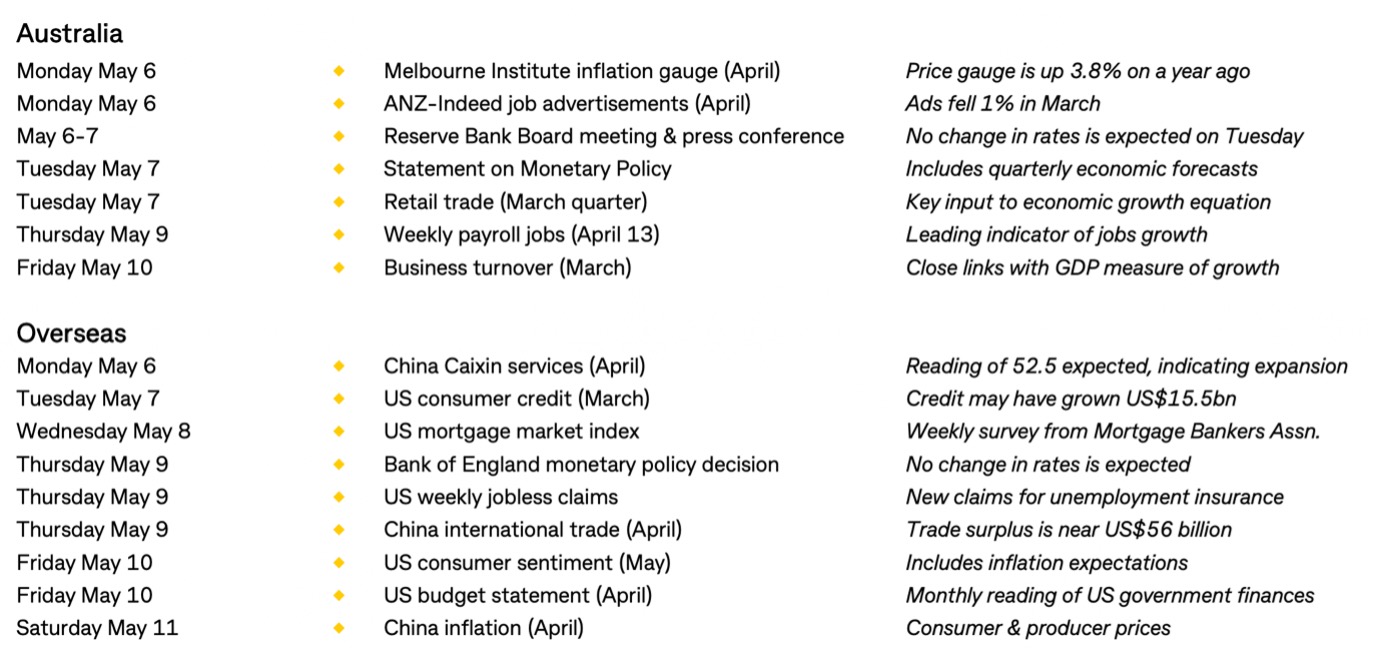

The Week Ahead

Top Stocks — how they fared

Most Shorted Stocks

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before

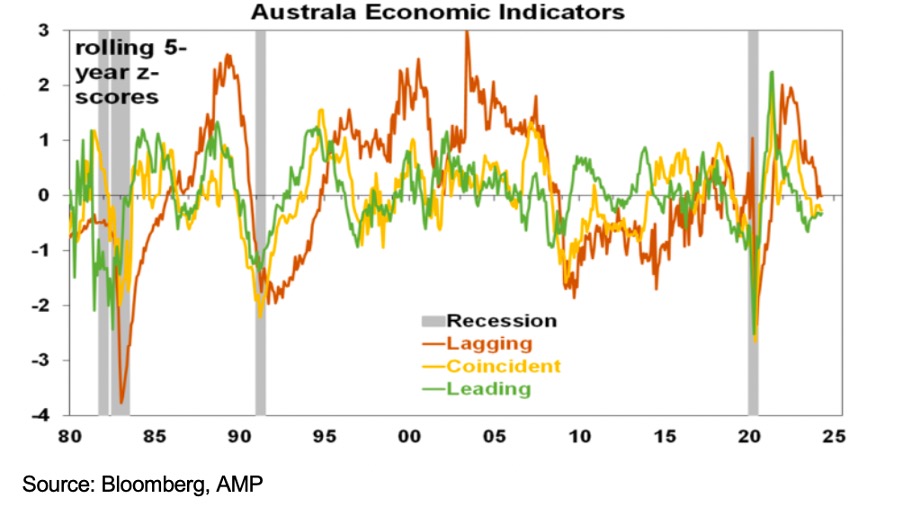

Chart of the Week

AMP’s Shane Oliver showed this chart and said: “There is not much evidence of an upswing in the Australian economy justifying further rate hikes.”

Quote of the Week

Fed boss, Jerome Powell, told the market that an interest rate rise is not the subject of his current thinking and on the question of stagflation, he said: “

“I don’t really understand where that’s coming from,” Powell said. “I don’t see the ‘stag’ or the ‘-flation’.”

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.