It’s easy to give up on stocks that burn you. After watching a company destroy wealth through incompetence or greed, you vow to never buy it again.

We’ve all been there. As hard as it is, investors need to do two things with losing stock positions. First, put our emotions aside and focus on what matters most: valuation. Our thesis for a stock might have been wrong, but how does it stack up at a sharply lower valuation?

Second, we have to own up to and learn from our mistakes, to become better investors. In my experience, we learn more about investing – and ourselves – from stocks that disappoint rather than the winners.

That’s been my experience with casino stocks in the past two years. Two stocks I favoured after share-price falls – Star Entertainment Group in Australia and SkyCity Entertainment Group in New Zealand – have been belted.

Some global casino stocks have also disappointed. One I favoured, Wynn Resorts, is down 12% over 12 months. Macau casino stocks, such as Wynn Macau and China Sands, are also down this year, disappointing investors who expected a stronger, more sustained recovery in Macau casinos after COVID-19.

Crown Resorts provided some relief in 2022 after Blackstone, a private equity firm, bought the integrated leisure operator. But it’s been a terrible period for local casino stocks after damning regulatory reviews and many other problems.

The easy option would be to move on to the next idea in this column, avoiding stocks that backfired. It’s important, however, to acknowledge when your view on a sector is wrong, learn from it, put emotion to the side and focus on valuation

I still like casinos as a long-term investment. My core thesis on the sector – rising property values underpinning higher casino valuations and greater interest in the sector remains intact. I still believe Macau casinos have good recovery prospects given the size of the market and the industry structure of that sector.

If anything, I like casino stocks more now after heavy valuation falls in the past few years. The S&P 1500 Casinos and Gaming Sub-Industry Index, a key barometer of global gaming stocks, is down 13% over one year.

After strong gains in the first half of 2023, the index has slumped. Fears about weaker consumer spending in the US and problems in China’s economy have weighed on casino stocks. Las Vegas Sands Corp, a US$34-billion casino stock, tumbled this month after missing its estimates for second-quarter earnings.

There’s no shortage of bad news right now for local casino stocks. Again, the key is focusing on company valuations and having a long-term perspective.

As I’ve written previously, taking advantage of short-term market volatility – when valuations fall too far due to irrational market sentiment – will be the key to delivering attractive real returns (after inflation) this decade. Put another way, investors will need a more active approach to capitalise on volatility.

As readers know, I hunt for badly out-of-favour sectors and stocks. I’m not big on investing labels, but one might describe this style as deep-value contrarian investing. Yes, it’s not easy buying deeply out-of-favour stocks that might well fall further before they improve. But that’s where the best value lies.

Here are two stocks for investors to consider. Each suits experienced investors who understand the dangers of buying fallen small-cap companies that have a high degree of uncertainty and potential for further price falls in the short term.

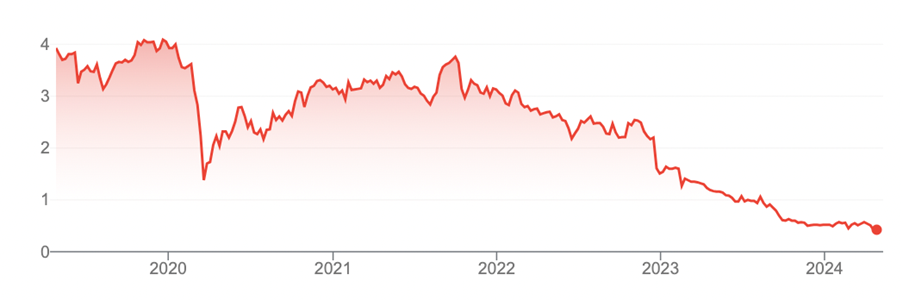

- Star Entertainment Group (ASX: SGR)

After trading above $5 in 2018, the Star has slumped to 39 cents and might fall further in this seasonally weak period for Australian shares. What a mess.

Morningstar has given the Star an ‘extreme’ uncertainty rating. That’s probably being kind. A second review of the Star’s Sydney casino could see its licence revoked. That’s 18 months or so after being fined $100 million, being found unsuitable to run a casino, management, and board changes, and having immense reputational damage that will take years to repair.

Last week, Star conceded it is unsuitable to operate a casino in Sydney and that there ‘is not a scenario’ that that it could run its casino unsupervised for months.

The message was clear: the Star is still near the start of complex recovery process that will take years. Investors must decide how much value is left in the Star and if its shares have bottomed after 90% fall from their peak. It’s impossible to know because so much depends on the Star keeping its casino license.

Beneath the regulatory uncertainty, it’s easy to overlook the likelihood of the Star losing market share to Crown Sydney and from heightened competition from clubs and pubs (in gaming machines). Whichever way one cuts it, there’s no good news – and plenty of potential further bad news – on the Star’s horizon.

Still, it can get through this hellish period, the Star should benefit this decade from the ramp-up of its massive Queen’s Wharf project in Brisbane and Gold Coast casino. As interest rates are cut next year, improving consumer confidence and spending could help the Star and its key casino properties.

Every stock has its price. At 39 cents, the Star is on a price-to-book ratio of 0.45 times. Morningstar values the Star at 90 cents a share. I’m not nearly as bullish but see some upside from here – provided investors are willing to tolerate the potential for price further falls and the risk of loss pending the regulatory review.

Clearly, the Star suits experienced speculators who view the stock for what it is right now – a recovery ‘punt’ after badly burning investors. There’s little need to buy early into a potential recovery.

A better strategy is watching and waiting for signs of progress at the Star, rather than rushing in. Building a small position, and adding it to as news improves, is another option for speculators. So, too, is prospective investors who buy being ready to cut losses early, if news on the Star deteriorates even further.

Chart 1: Star Entertainment Group (ASX: SGR)

Source Google Finance

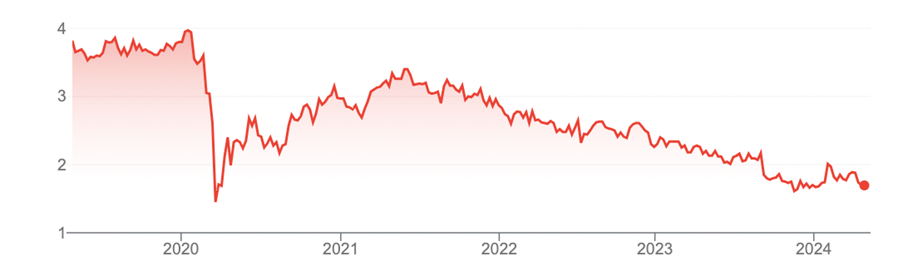

- SkyCity Entertainment Group (ASX: SKC)

Like the Star, SkyCity has disappointed investors over the past 12 months, albeit not to the same extent. Like Crown and the Star, SkyCity is expected to be hit with a large fine after a long-running investigation into alleged contraventions of money-laundering and counter-terrorism financing laws for its Adelaide casino.

SkyCity’s core casino assets are in Auckland and Adelaide, where it is the monopoly operator with long-date licences.

SkyCity has completed an upgrade to its Adelaide casino and a major upgrade to SkyCity Auckland is due for completion in 2025. Assuming both projects are successfully executed, SkyCity could have good earnings tailwinds from its upgraded casino properties from 2025 onwards.

Like the Star, SkyCity has regulatory and project-development risk. It, too, has high levels of uncertainty for investors and is not for the risk averse.

For investors who can see through SkyCity’s short-term challenges, there’s more to like about its medium-term prospects as the upgraded properties support higher earnings growth for what should be a highly cash-generative business.

SkyCity has halved from around $3.40 in June 2021 to $1.380. Some brokers have targets just above $3, suggesting SkyCity is materially undervalued at the current price. I’m not as bullish but see latent value in SkyCity for experienced long-term investors who understand the heightened regulatory risk of Australian casino stocks and earnings uncertainty.

For all the recent disappointments, SkyCity has monopoly casino assets and long-dated licences. These are valuable assets at the best of times, particularly after a halving of the share price in the past few years.

Chart 2: SkyCity Entertainment Group

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation, or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation, and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 26 April 2024.