Stock markets give insights or sneak previews of what might happen in the future. However, sometimes the short-term anxiety or exhilaration can blind us to what is actually on show. With Trump tariffs capturing the attitudes of investors right now, it’s timely to look at what nervous/defensive investors and confident/growth players should be thinking as a consequence of what has been happening.

For clarity, we’re in the pullback phase I told you to expect more than a few weeks ago. You might recall that AMP’s Shane Oliver tipped a 15% correction was on the cards. He’s still with this ‘guess’. Ultimately, what President Trump does with tariffs and what other economies do to retaliate will sustain the kind of uncertainty currently rattling markets. However, eventually we will know more. Markets will settle down. Buying opportunities will emerge. It’s why I’m not going full on defensive for my own portfolio or for our financial planning clients, unless they’re really wanting to rid themselves of Trump-created anxiety.

By the way, because many of our advice clients and, undoubtedly, many of you, have made good money over the past two years, banking it into defensive and/or income-oriented investments isn’t a bad strategy.

So, let’s start with the potential less aggressive approaches to dealing with the Trump-created uncertainty and sell-off of stocks.

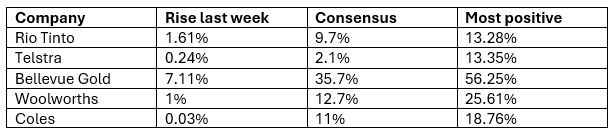

First up as a starting point, I want to look at the quality stocks that rose last week. Then I’ll check what the analysts think about these companies. Saturday’s Switzer Report always looks at How Top Stocks Fared and here they were in a week when most quality shares copped it:

What stands out is that these defensive plays potentially promise solid returns. Apart from Bellevue Gold, there’d be pretty good dividends to boot.

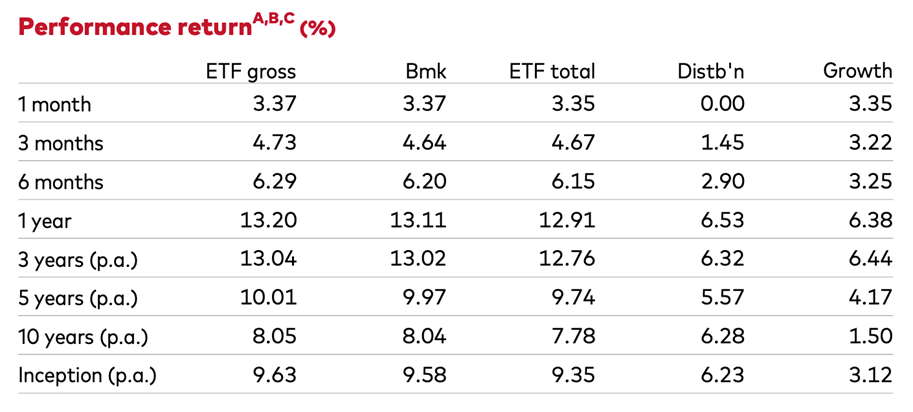

Source: Vanguard

If I was constructing a batten-down-the-hatches strategy, while still hoping for a bit of capital gain, I’d add these to an ETF such as Vanguard’s Australian Shares High Yield (VHY) that’s had a good track record for income and capital gain.

This has outperformed the Switzer Dividend Growth Fund on capital, but not income over the past year. While the current share price of SWTZ is $2.38, historically it has been a good rebounder to the issue price of $2.50. And when the market spikes, it tends to go higher. I’d expect a better year for capital growth after a negative year last year. Fortunately, income yield was 10.72%.

For the thrill-seekers, I’d wait at least until the end of this week, given March 12 is tipped to see the start of the Trump tariffs, which could hit Australia’s steel and aluminium industries. While these tariffs breed uncertainty, the actual economic effects could end up being less than expected in a broad macroeconomic sense and in a broad stock market sense.

There will be winners and losers but, right now, stock markets are selling first and asking questions later. If this week the Yanks get good CPI and PPI news on inflation, following a 151,000 job creation data drop for February when economists were expecting 170,000, it could set the scene for optimism about US interest rate cuts.

Add this to Trump’s promises about tax cuts and deregulation and the tailwinds for stocks could start to reassert themselves. And then there’s Artificial Intelligence (AI), whose impact could be a real sustainer for stocks even into 2026, when I’ve been expecting a real change in sentiment about stocks.

However, the AFR Business Summit last week has made me more optimistic about the course of stock prices. This is what Goldman Sachs CEO David Soloman said about AI: “These technologies are remarkable. They’re going to drive massive productivity gains. And we’re early in the cycle, not just of the technology’s development and acceleration, but also of its employee deployment, into businesses, into enterprise. Obviously, the first thing that happens with a technology like this is consumers can pick up an application and play with it. But the real power of this is how it gets deployed in enterprise, and how that creates productivity in business and allows flexibility for more investment, which obviously drives growth. I am a huge bull on that over the course of the next five years. Huge bull, but we’re very early in that cycle.”

Meanwhile, on tariffs and their inflationary effects, this is what the well-regarded US Treasury Secretary Scott Bessent said: “Well, we don’t know yet because it’s path-dependent, but what I can tell you is that I’m not worried about China. China will pay for the tariffs because their business model is exporting their way out of this inflation. They will eat any tariffs that go on,” he said.

He also argued that the inflation effect will be one-off, which wouldn’t impact core inflation.

For the thrill-seeker, tech stocks like Zip (61%), NextDC (48%) and Xero (18%) are likely to march higher. And when we get over Richard White’s dalliances, Wisetech (+48%) is likely to rise. (The numbers in brackets are the consensus rises tipped for these stocks by analysts for the year ahead.)

If you want to avoid stock picking, then EX20 remains a good play that’s bound to pick up the benefits of the rotation out of big cap stocks into smaller and mid-cap companies that will benefit from lower interest rates.

For the mega thrill seeker, GEAR, with its magnification effects, might be a goer. This is now $29.95. It topped out at just over $34 in December and then came again near that level in mid-February before tariff traumas took root. I got our financial planning clients out around $30 after many got in at very low levels. Personally, I wouldn’t play GEAR unless I see $27 or so. Either way, it remains a very risky speculative investment because who knows what kind of curve ball President Trump has in stall for us!