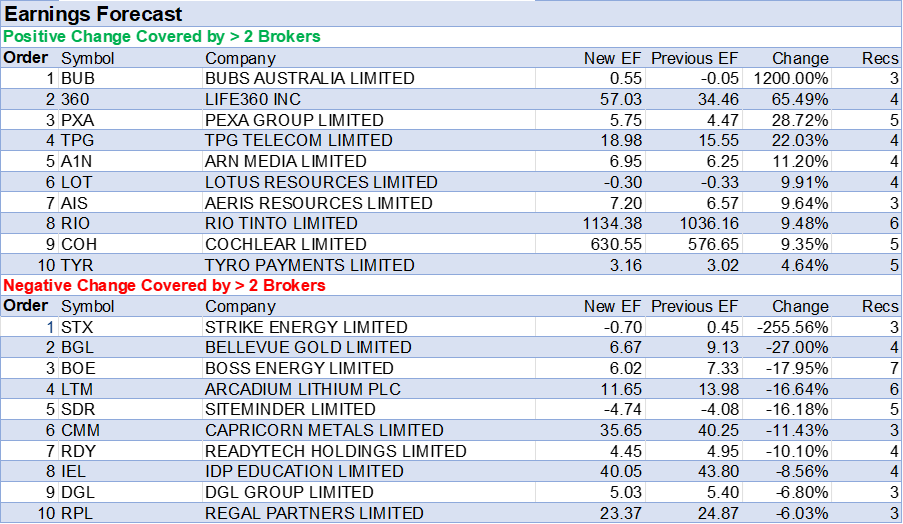

Standout rises in average targets for Generation Development Group and Life360 matched earnings beats, while the largest percentage fall in average target for IDP Education can be traced back to the company’s interim result disappointing (‘miss’).

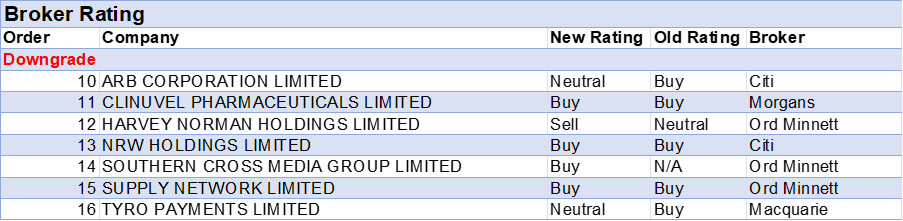

On the other hand, Tyro Payments received the second largest fall in target, but results were mostly in line, with management maintaining FY25 guidance.

Life360 also appeared second on the earnings upgrade table behind Bubs Australia. The latter’s interim result was broadly in line with brokers’ expectations and the large percentage increase in average earnings resulted from the very small forecast numbers involved.

While appearing fourth on the earnings upgrade list, TPG Telecom’s FY24 result slightly missed expectations, with the key disappointment for analysts being a fall in postpaid mobile subscriber numbers. Brokers remain cautious on TPG, yet a new regional expansion deal could double cash flow in 2025, according to management.

Turning to falls in average earnings forecasts, here most listed in the table below corresponded to earnings disappointments in February, apart from an in-line interim result from second-placed Bellevue Gold.

Separately, Bellevue’s average earnings forecast benefited last week from a post results season review by Ord Minnett of stocks under coverage in the Mining sector, which included increased forecasts for gold and silver prices. Focusing on gold mining at its Bellevue Gold Project in Western Australia, Bellevue was most impacted by Ord Minnett’s increase in gold price forecast across 2025 to 2029 to US$2,900/oz from US$2,700/oz, and the increase in the long-term price forecast to US$2,500/oz from US$2,300/oz. As a result of these changes, the broker’s EPS forecasts for Bellevue Gold increased across 2025-27 by 11.8%, 18.4%, and 20.3%, respectively.

Arcadium Lithium’s average earnings forecast fell by -17% after Citi revised its forecasts, though its fourth quarter net loss is largely irrelevant given the company was recently acquired by Rio Tinto.

Following a first-half revenue miss against the consensus expectation, SiteMinder suffered a -16% fall in average earnings forecast from brokers last week. Analysts still anticipate a boost from new products and maintain faith in the company’s longer-term strategy.

IN THE GOOD BOOKS: UPGRADES

AUSTRALIAN FINANCE GROUP LIMITED ((AFG)) was upgraded to Outperform from Neutral by Macquarie. B/H/S: 2/0/0

Australian Finance Group reported 1H25 cash EPS which declined -6%, and missed Macquarie’s forecasts by -11%, due to higher operating expenses and a -73% drop in Thinktank earnings. Residential lodgements rose 26% year-on-year in January, with AFG Securities settlements up 31%, offsetting a -7% decline in AFG Home Loan lodgements, the broker details. AFG’s loan book grew 23% to $5.1bn, with net interest margin improving. The analyst upgrades the rating to Outperform from Neutral, citing positive earnings momentum and stabilising margins. Target price increases -2.4% to $1.68, with valuation supported by circa 7% dividend yield and an attractive valuation.

BELLEVUE GOLD LIMITED ((BGL)) was upgraded to Hold from Lighten by Ord Minnett. B/H/S: 3/1/0

Bellevue Gold’s operational challenges in 2024 appear resolved, prompting Ord Minnett to upgrade its rating to hold from lighten and raise the target price to $1.20 from $1.15. The broker notes improved underground development since September, following new ventilation installations, suggesting stronger production from the March quarter onwards. Ore grades in January indicated an exceptional 5.0g/t, though confirmation is needed over the next two quarters before revising model assumptions. Bellevue has the ability to produce over 200,000oz annually at an all-in-sustaining-cost of $2,000/oz, generating $350m in cash flow at a $4,500/oz gold price. Ord Minnett raises EPS forecasts by 0.7% for FY25 and 0.2% for FY26-27.

COCHLEAR LIMITED ((COH)) was upgraded to Buy from Neutral by Citi. B/H/S: 1/4/0

Citi raises its target for Cochlear to $300 from $290 and upgrades to Buy from Neutral following a -14% decline in share price following the 1H results miss and guidance downgrade. While acknowledging uncertainty pending the launch of new devices by mid-2025, the broker raises its outer-year EPS estimates by 1-2% on a higher margin outlook, keeping FY25-26 unchanged.

INTEGRAL DIAGNOSTICS LIMITED ((IDX)) was upgraded to Buy from Neutral by Citi. B/H/S: 4/0/0

Citi upgrades its rating for Integral Diagnostics to Buy from Neutral following a -25% share price slump, citing a compelling valuation relative to transactions in the sector. The broker is expecting strong revenue growth and margin improvements in FY26 partly due to de-regulation of partial MRIs, which should drive industry growth, and potential synergies after the merger with Capitol Health. The analyst also references a material potential lung cancer screening contract win. The $2.70 target is unchanged.

NEWMONT CORPORATION REGISTERED ((NEM)) was upgraded to Buy from Accumulate by Ord Minnett. B/H/S: 4/1/0

Ord Minnett has reviewed mining sector coverage post-results season, the broker explains, with changes to gold and silver forecasts and assumptions. The gold price forecast for 2025 to 2029 lifts to US$2,900/oz from US$2,700/oz, and the long-term forecast rises to US$2,500/oz from US$2,300/oz. The silver price forecast for 2025 to 2029 lifts to US$42/oz from US$30/oz, and the long-term price rises to US$30/oz from US$27/oz. Ord Minnett names Newmont Corp as the preferred gold stock, along with Capricorn Metals and West African Resources. The analyst raises EPS forecasts by 20.4%, 21.1%, and 22.2% for 2025 to 2027. The stock is upgraded to Buy from Accumulate, with a higher target price of $92.50 from $77.

PALADIN ENERGY LIMITED ((PDN)) was upgraded to Buy from Neutral by UBS. B/H/S: 6/1/0

Through multiple sector updates, UBS analysts have expressed their bullish view, longer term, for the uranium sector. Price target for Paladin Energy has been lowered, shorter term, to $9.70 from $10. Forecasts have received the chainsaw treatment. Rating has been upgraded to Buy from Neutral.

RESMED INC ((RMD)) was upgraded to Buy from Neutral by Citi. B/H/S: 5/0/0

Citi raises its target for ResMed to $44 from $41, while leaving forecasts unchanged, and upgrades to Buy from Neutral. The broker cites a “reasonable valuation”, strong EPS growth and free cash flow (FCF) generation, along with no debt by the end of FY25. GLP-1s have had no impact on the company’s business as yet highlights the broker, and management continues to believe both GLP-1s and wearables will gradually bring more patients into the funnel.

SERVICE STREAM LIMITED ((SSM)) was upgraded to Buy from Hold by Ord Minnett. B/H/S: 3/0/0

Service Stream secured an extension of its contract with NBN Co for $1.9bn over five years and has now rolled over all major and material customer agreements, Ord Minnett highlights. The broker had assumed the NBN contract in its forecasts, so the confirmation is a de-risking event. The broker reckons the company’s earnings trajectory is positive for the 2H and into FY26. Target price rises to $1.94 from $1.78. Rating upgraded to Buy from Hold.

STRIKE ENERGY LIMITED ((STX)) was upgraded to Speculative Buy from Hold by Bell Potter. B/H/S: 2/1/0

Bell Potter lowers its target for Strike Energy to 26c from 27c following interim results and upgrades to Speculative Buy from Hold after recent share price weakness. The company reported a first half result weaker-than-expected by the broker, with underlying earnings (EBITDAX) of $15.6m, missing the broker’s estimate of $23.5m, and a net loss of -$15.5m, compared to a forecast profit of $10.2m. This discrepancy was largely driven by a non-cash -$20.1m depletion and depreciation charge related to the acquired Talon Energy interest in Walyering, explain the analysts. The company ended the half with cash of $33m and net debt of $16m. Bell Potter notes Strike is leveraged to the Western Australia energy market where prices are expected to remain supportive.

IN THE BAD BOOKS: DOWNGRADES

ARB CORPORATION LIMITED ((ARB)) was downgraded to Neutral from Buy by Citi. B/H/S: 3/2/1

Citi lowers its target for ARB Corp to $39.54 from $51.20 and downgrades to Neutral from Buy on increasing near-term caution after February’s Australian new car sales data revealed an acceleration in the rate of decline relative to January. The new data are negative for the company’s 2H Australian Aftermarket sales, and the broker’s new forecasts assume weakness will persist over 2025. Additionally, the BYD Shark 6 is taking material share of the 4×4 category, highlights Citi.

CLINUVEL PHARMACEUTICALS LIMITED ((CUV)) was downgraded to Speculative Buy from Add by Morgans. B/H/S: 2/0/0

Clinuvel Pharmaceuticals posted a first half result that was largely in line with forecasts. Material costs were wound down to almost zero, Morgans notes, delivering net profit that was ahead. The broker fails to find much in the results to fire up investors and the stock falls short of “set-and-forget”, given the risk around alternative therapies as a potential generic competition. While there is no immediate threat to cash flow in the next few years, Morgans believes investors should expect competition to rear up in the next decade. Target is reduced to $15 from $17 and the rating is downgraded to Speculative Buy from Add.

HARVEY NORMAN HOLDINGS LIMITED ((HVN)) was downgraded to Lighten from Hold by Ord Minnett. B/H/S: 3/1/1

Harvey Norman reported 1H25 earnings slightly above market expectations, with an interim dividend exceeding consensus, Ord Minnett observes. Australian franchise margins benefited from lower lease depreciation, while property earnings were strong due to portfolio revaluations. Trading conditions improved in early 2H25, with like-for-like sales growth accelerating from 2.1% in January to 7% in February. Among international stores, Ireland and Asia saw strong profit growth, while Croatia, Slovenia, and the UK underperformed. The broker lowers EPS forecasts by -3% for FY25, -1% for FY26, due to franchise gains, higher depreciation, UK losses, and further property revaluations. Target price increases to $4.50 from $4.40, but the broker’s rating is downgraded to Lighten from Hold, citing better opportunities elsewhere and continued market share losses to JB Hi-Fi ((JBH)) and Wesfarmers’ ((WES)) Officeworks.

NRW HOLDINGS LIMITED ((NWH)) was downgraded to Buy, High Risk from Buy by Citi. B/H/S: 3/1/0

NRW Holdings faces a challenging near-term outlook due to the ongoing OneSteel administration process, highlights Citi, with around $106m in overdue receivables, expected to impact market sentiment. Management remains cautiously optimistic about recovering some of these amounts through secured guarantees and first-ranking security, explains the broker. Despite this uncertainty, the analysts note the company’s earnings growth trajectory remains intact, with 95% of its FY25 revenue secured and a solid order book. The broker’s target falls to $3.85 from $4.05, reflecting lower earnings. The rating is downgraded to Buy/High Risk from Buy.

SUPPLY NETWORK LIMITED ((SNL)) was downgraded to Accumulate from Buy by Ord Minnett. B/H/S: 1/0/0

Supply Network’s 1H25 result confirmed the company is gaining market share, with 17.8% y/y sales growth well above competitors Maxiparts ((MXI)) and Bapcor ((BAP)) who reported 4% and 0.8% respectively. Operating margin rose 150bps y/y and operating cash flow was strong, resulting in a fall in gearing to 6.1% from 9.3% in June. The broker notes the company expects to achieve $350m in sales in FY25 vs $171.2m in 1H, one year ahead of its three-year plan. Target price rises to $36.3 from $33.0. Rating downgraded to Accumulate from Buy following share price gains.

SOUTHERN CROSS MEDIA GROUP LIMITED ((SXL)) was downgraded to Accumulate from Buy by Ord Minnett. B/H/S: 1/2/1

Following “relatively solid” interim results for Southern Cross Media, which owns the Triple M and HIT networks and the LiSTNR digital business, Ord Minnett downgrades its rating to Accumulate from Buy on valuation grounds, while retaining a 70c target. The company is now an audio-only business following the divestment of its TV assets to the Paramount-owned Network 10 and Australian Digital Holdings, explains the broker. Ord Minnett lowers its EPS forecasts across FY25-27 by -36%, -22% and -15%, respectively, to reflect the sale of the company’s

TV assets.

TYRO PAYMENTS LIMITED ((TYR)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 3/1/1

Macquarie observes Tyro Payments’ 1H25 result was slightly above the broker’s expectations, with gross profit exceeding by 2.3% and earnings (EBITDA) by 5%. The analyst believes the company can achieve FY25 guidance, and management reiterated the Rule of 40 target for FY26. Macquarie lifts EPS forecasts by 18% for FY25 and 11% for FY26, but medium-term earnings are downgraded by -15% to -20% due to higher customer loss assumptions and competitive pressure on margins. The stock is downgraded to Neutral from Outperform. Target price falls to 82c from $1.40.

EARNINGS FORECAST

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.