At the start of 2024, I moved Woolworths (WOW) out of our model portfolios and replaced it with Coles (COL). This was largely on the basis that Coles was too cheap compared to Woolworths, and the gap between the two companies was starting to narrow.

This year, I went back the other way, replacing Coles with Woolworths as the gap had narrowed considerably. On an earnings multiple basis, Woolworths was trading at a premium of around 15% to Coles, which by historical standards, was towards the bottom of the range.

But my call was too early because in the recent profit reporting season, Woolworths got whacked and Coles initially rallied. On a multiple’s basis, the premium has narrowed to less than 10%.

The chart below shows their share prices over the last 12 months. Using a common base, Coles (in blue) is up by 15.2%, while Woolworths (in purple) has lost 11.3%. That’s a swing of 26.5%.

Coles (blue) vs Woolworths (purple) – last 12 months

Source: nabtrade

Historically, Woolworths has traded on a higher multiple (chiefly the price/earnings multiple) than Coles. It’s bigger, has better positioned stores, is the market leader and until recently, earned a bigger margin than Coles. Investors reward leadership and typically pay a big premium to invest in the “no 1” rather than the “no 2”. Think of CBA vs the other major banks or REA vs Domain.

So, with the gap having narrowed, is now the time to go back to Woolworths or is it best to stick with Coles? Let’s have a look at their recent earnings and sales reports, and what the brokers have to say.

Let’s go to Woolworths first

Woolworths earnings for the half year (EBIT) fell by 12.8% to $1,451 million and NPAT by 20.6% to $739 million. The interim dividend was cut by 17% from 47 cents per share to 39 cents per share.

The impact of industrial action in December plus the cost of incremental supply chain commissioning and dual-running costs reduced EBIT by an estimated $136 million. Adjusting for this, EBIT fell by around 6.2%.

In the all-important Australian Food, EBIT fell by 12.8% (or an adjusted 5%) to $1,391 million. While sales grew by 2.7% (or an adjusted 3.7%), Woolworths margin got crunched (down 93bps to 5.2%) as the cost of doing business increased and Woolworths shaved prices. Commenting on their customers, Woolworths said they were seeing “value seeking behaviours” (implying that some of Woolworths items were too expensive and shoppers were going elsewhere).

In the comparable store sales measure (which is the one of the key measures to compare the performance of Woolworths and Coles), Woolworths recorded (in Australian Food) an increase of 1.7% for the half year. For the same period, Coles grew comparable store sales by 3.4%.

Woolworths other trading divisions (Big W, B2B Food and B2B, New Zealand Food) had mixed performances. Big W continued to struggle, earning just $29 million, B2B Food increased EBIT by 9.9% to $78 million and NZ Food delivered an improved performance to $82 million.

Looking ahead, Woolworths CEO Amanda Bardwell said that earnings in the second half for Australian Food would reflect a “mid-single digit decline” on the second half of FY24. This includes an additional $50 million cost for supply chain commissioning and dual running costs, implying that underlying earnings from Australian Food would be slightly negative as Woolworths feels the pressure on pricing. BigW is expected to lose around $40 million in the second half.

For the first seven weeks, Woolworths Australian Food sales are up by 3.3%. Coles, which is cycling a strong comparable period in FY24, is up by 3.4% for the same period.

Woolworths announced a program to take out $400 million of head office and administrative costs. It also alluded to a review of the Group’s portfolio of assets.

Let’s now switch the story to Coles…

Underlying EBIT rose by 8.9% to $1,209 million for the half year and underlying NPAT by 6.4% to $666 million. The interim dividend was increased by 1 cent from 36 cents to 37 cents per share.

Supermarkets drove the profit increase with an 11% lift in EBIT to $1,169 million. This was on the back of a 3.4% increase in comparable store sales and improvement in underlying margin by 34bpts to 5.7%. The latter was achieved in part due to a reduction in loss from theft/shrinkage and efficiency gains for its “Simplify and Save to Invest” program.

But it wasn’t all smooth sailing for Coles. Its liquor division (which includes Coles Liquor, Liquorland and Vintage Cellars) saw EBIT decline by 20.2% to $67 million. Comparable store sales were down by 1.3%.

Looking ahead, Coles CEO Leah Weckert didn’t provide any earnings guidance, but said supermarket sales were up by 3.4% for the first seven weeks. Liquor sales were up by 3.8%.

Both companies will be watching for actions arising from the ACCC’s review and report on supermarkets, the contents of which were recently handed to the Government.

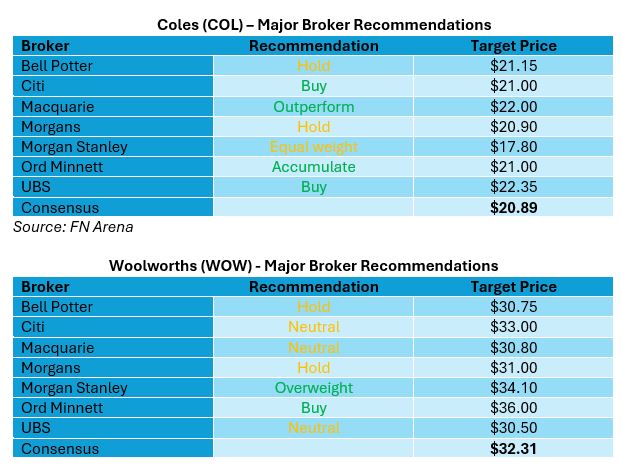

What do the brokers say?

The major brokers feel that Coles is executing better than Woolworths in a difficult retail environment. Coles is deriving the benefits from its investment in automated distribution centres and its Simple and Save to Invest program. Woolworths is also feeling a little more pressure on pricing.

While the recommendations favour Coles over Woolworths (see below), in terms of price upside, the brokers see marginally more upside with Woolworths. According to FN Arena, the consensus target price for Woolworths is now $32.31, 12.7% higher than Friday’s ASX closing price of $28.66. For Coles, the consensus target price is $20.89, 10.9% higher than the last ASX price of $18.82.

Some brokers feel that there is downside risk to Woolworths as it seeks to regain momentum and also from regulatory oversight. Others are looking to the cost savings and possible upside, if it rejigs its portfolio of businesses.

On multiples, they have Woolworths trading at 24.4 times forecast FY25 earnings and 21.1x forecast FY26 earnings. Coles is trading at 22.6x forecast FY25 earnings and 19.8x forecast FY26 earnings. The premium is about 7%.

What’s the bottom line?

I’m going to stick with my position on “leadership” and say that a 7% premium isn’t enough. Woolworths is cheap relative to Coles, and cheap relative to the overall market. This is placing quite a degree of faith in Amanda Bardwell and her team to execute, because if Woolworths loses its leadership position, Coles will continue to find support with investors.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.