Stocks rose overnight, with all three most-watched market indexes strongly higher, despite the Fed boss Jerome Powell not declaring victory with the fight against inflation. Even though it would have been nice to see the winners flag waved (which will get stock prices racing), a money-pinching cautious central banker would never do that. That’s especially so when the US economy is performing in a pretty healthy way, despite 11 rate rises in 17 months.

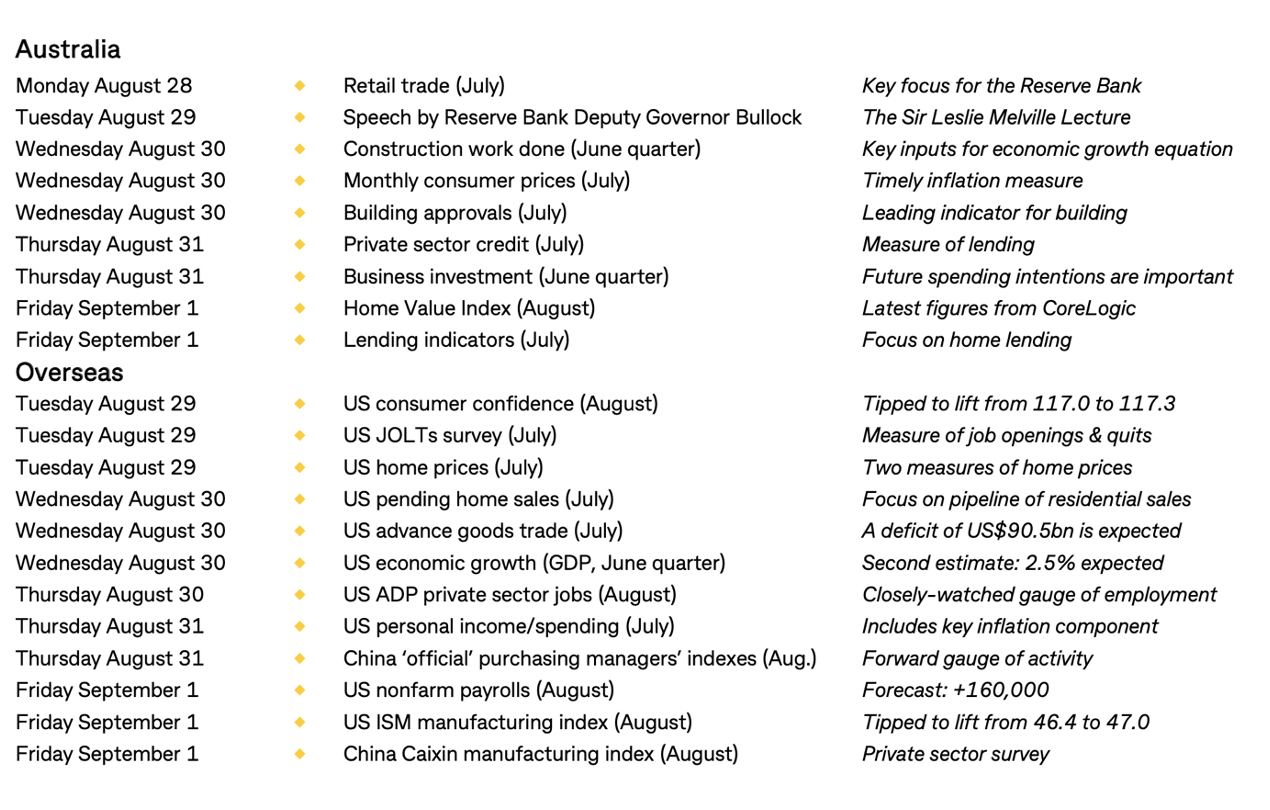

In fact, next week will give us a good snapshot on the strength of the US economy, with June quarter growth and August job figures bound to capture the interest on key market influencers, who’ll be trying to work out what the numbers say about inflation and, ultimately, rates.

On Powell, at the famous central banker symposium at Jackson Hole, Wyoming, the Fed boss didn’t give a clue either way about what happens with rates. However, he did say he was prepared to raise rates if the inflation story justified it. Meanwhile, his Fed colleague from Chicago, Austan Goolsbee, was emphatic that the central bank team wasn’t saying they’d beaten inflation yet.

This comes as the bond market has shot up yields, which can be interpreted two ways. First, it means it expects inflation to stay sticky and not get down to 2%, where Powell wants it to be. Or second, the economy is too strong to see the Fed get well away from its interest rate lever.

Interestingly, these yield moves by the bond market help the Fed do their job and may delay any possible rate rises. “Regardless of the reason that yields move higher, what they do is that they tighten financial conditions by themselves because the cost of capital goes up,” said Quincy Krosby, chief global strategist for LPL Financial.

Despite these two reasons to believe that rates could go higher, Wall Street threw off the negativity of the past two days. This reinforces my view (that I’ve consistently shared with you) that sell-offs look like buying opportunities.

Next week’s run of economic data will determine if I roll up my sleeves and do some serious buying for gains that should start to bear fruit in the December quarter and into 2024.

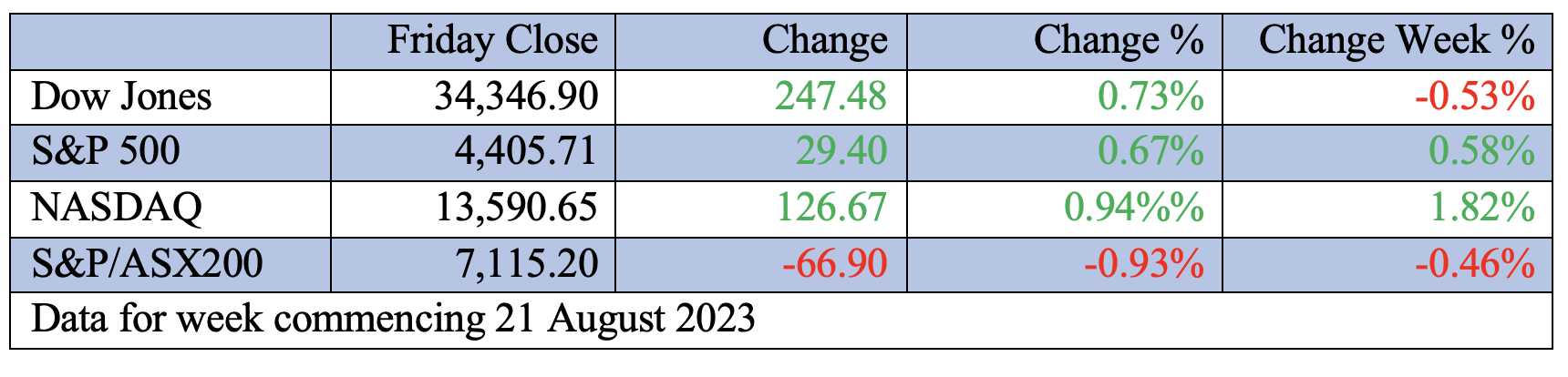

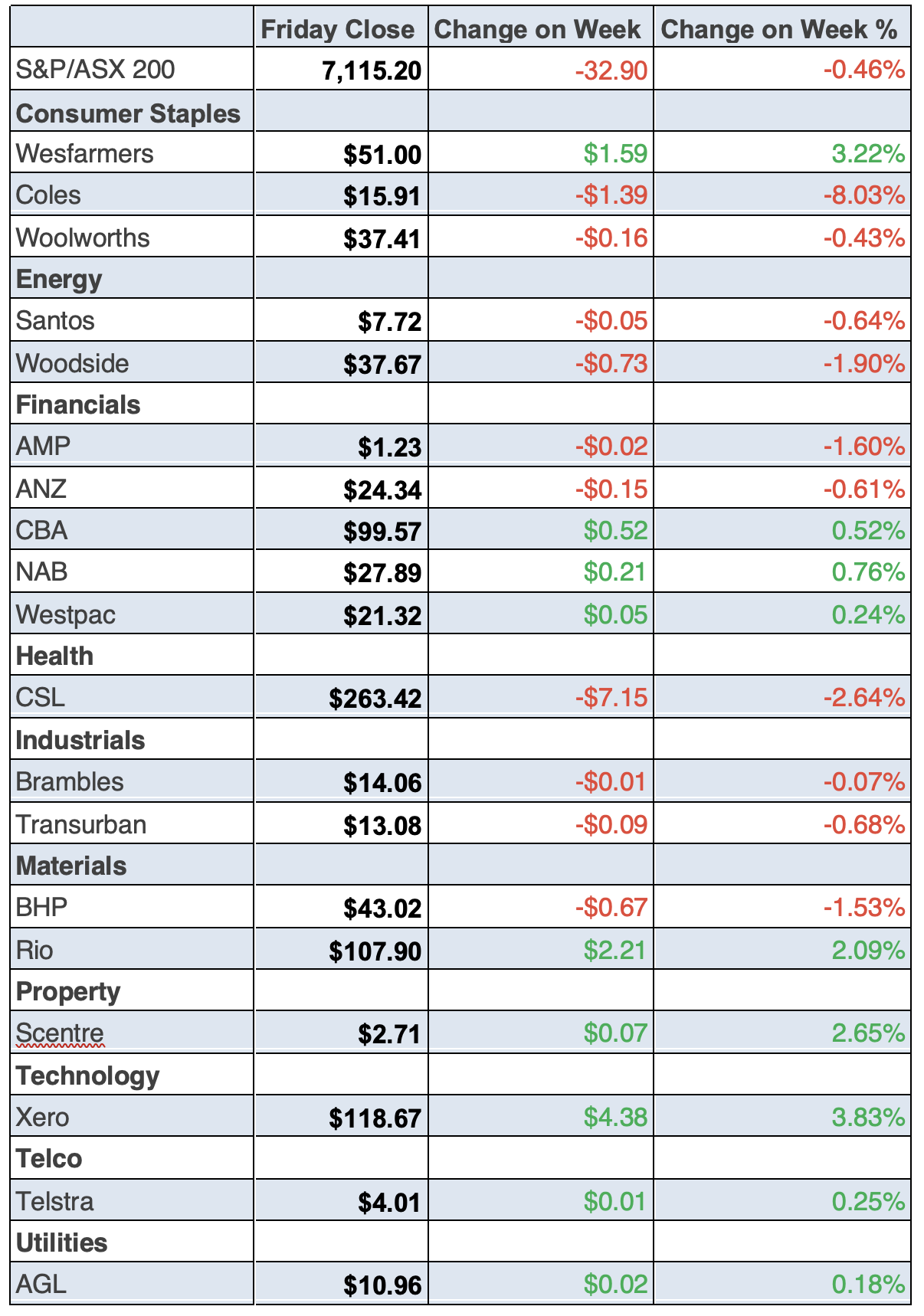

To the local story and the S&P/ASX 200 Index had an ‘up and down’ week. On net, however, the market indicator was down 32.9 points (or 0.46%) to 7115.20, showing the lack of confidence we have about what the Fed will do.

Local influences are operating, such as the softness of China, the possibility that the RBA might be over rate rises and the better-than-expected company reporting here and in the US. But ultimately, Wall Street is still the biggest driver of our market.

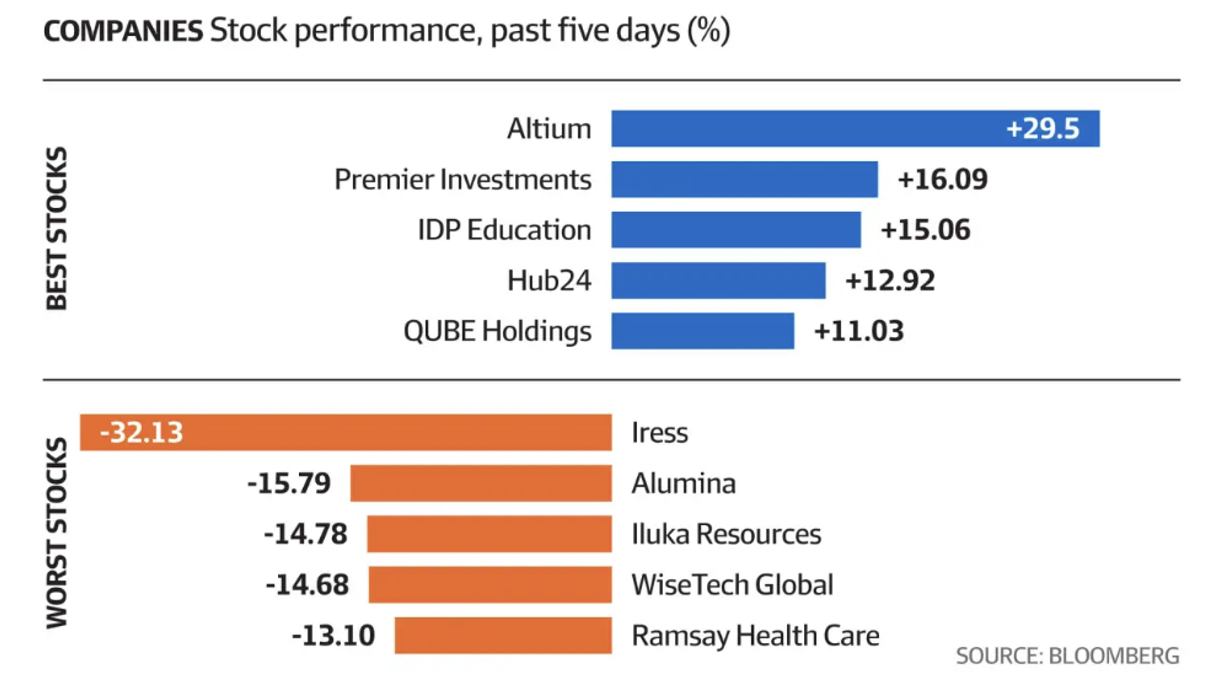

Surprising the market was the nearly always unsurprisingly great company, Wesfarmers. It rose 3.2% to $51 beating the market’s guess with a $2.6 billion full-year profit. A higher dividend of $1.91 helped, which represented a 6.1% rise. In a softer retail environment because of higher rates, this result shows the benefit of the company’s diversification.

In contrast, the one-trick pony business called Pilbara Minerals had a shocker, losing 8% to drop to $4.70, despite the lithium supplier seeing a full-year jump in profit by a factor of five, taking it to $3.4 billion!

What? That’s how a normal investor might react but while the result was good, market honkies wanted a great result. The miner posted a 242% increase in revenue to $4,064 million and a 329% jump in underlying profit after tax to $2,276.3 million, but analyst expected more. (I’ll look at this intriguing company and the market’s take on it, on Monday.)

What I liked

- Purchasing Managers Indexes are softening here and that’s good for keeping the RBA and other central banks on hold with rates.

- AMP’s Economic Activity Trackers “are still not providing any decisive indication of recession (or a growth rebound)”. The former is good news, but the latter is predictable.

- Another AMP observation from Shane Oliver: “…the downswing in business conditions, pricing pressures are well down from their 2021-22 highs and are continuing to recede”.

- Australian company reporting has been better than expected, which is a plus for believing that we can dodge a recession, despite 12 rate rises.

- Last week’s US economic data from jobless claims to home sales and mortgage applications all point to a softening economy that should see lower inflation.

What I didn’t like

- China’s economy remains a worry and Beijing’s rescue policies still look underwhelming. The Chinese central bank eased monetary policy further – cutting its 1-year prime rate by 0.1% to 3.45%. However, this was by less than expected. It left its 5-year prime lending rate unchanged at 5.2%.

- The high risk of another US Government shutdown from 1 October if Congress doesn’t agree on how US public debt is to be reduced.

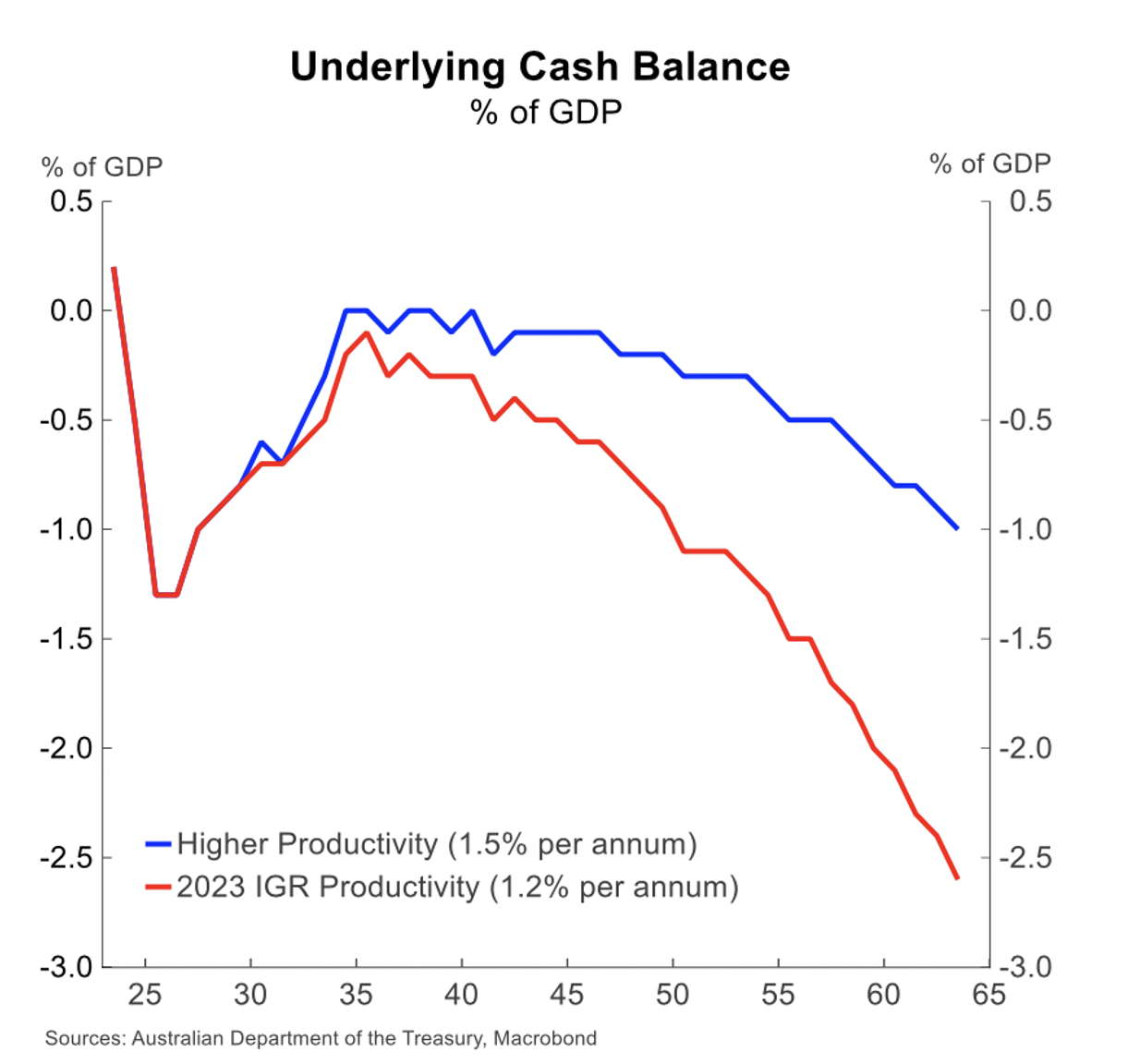

- Excessive pre-occupation with the Intergenerational Report that is a ‘guess’ about our 2063 economic future when we can’t even confidently work out what will happen to inflation in the next year!

- New home sales (as surveyed by the Housing Industry Association) remain depressed, with the 3-month average to July running down 33% year-on-year, consistent with depressed building approvals in pointing to slower home building activity ahead. (This is good for keeping the RBA at bay with rate rises, but there will come a time when a slowing economy could become a concern.)

A quiet data week but that will change…

I’m expecting a lot more clarity about the course of US inflation and what the Fed might do with rates. The run of economic data is huge for both the US and us here in Oz, which in turn will be market impactful. We even get to see the latest monthly inflation reading, which is bound to attract headlines. I’ll be looking to work out my timing for a decent crack at this recently sold off market.

We’re down 3.8% in a month, which is another reason why I’m looking to be a buyer, and next week’s data could be helpful for my timing. So watch this space!

The Week in Review

Switzer TV

- Switzer Investing: SwitzerTV Monday 21st August 2023

- Boom Doom Zoom: 24th August 2023

Switzer Report

- What I like in the childcare space

- “HOT” stock: IGO Limited (IGO)

- Questions of the Week

- Gear yourself up for another buying opportunity?

- Telstra: a safe bet in a choppy market

- HOT stock: Orora Ltd (ORA)

- Two top food stocks

- Buy, Hold, Sell — What the Brokers Say

Switzer Daily

- Expert report predicts decades of doom & gloom. Bah humbug!

- Company profit reporting isn’t boring. Let me prove it.

- Top tax public servant’s son jailed for tax fraud

- AI is coming for a million peoples’ jobs

- How secure is our email address?

The Week Ahead

Top Stocks — how they fared.

Chart of the Week

This is the budget deficit guess/forecast by the economists who put together the Intergenerational Report. By 2063 all of their negative outlooks possibly turn into a Treasurer’s nightmare. (My Switzer Daily story on Friday puts this all into context:

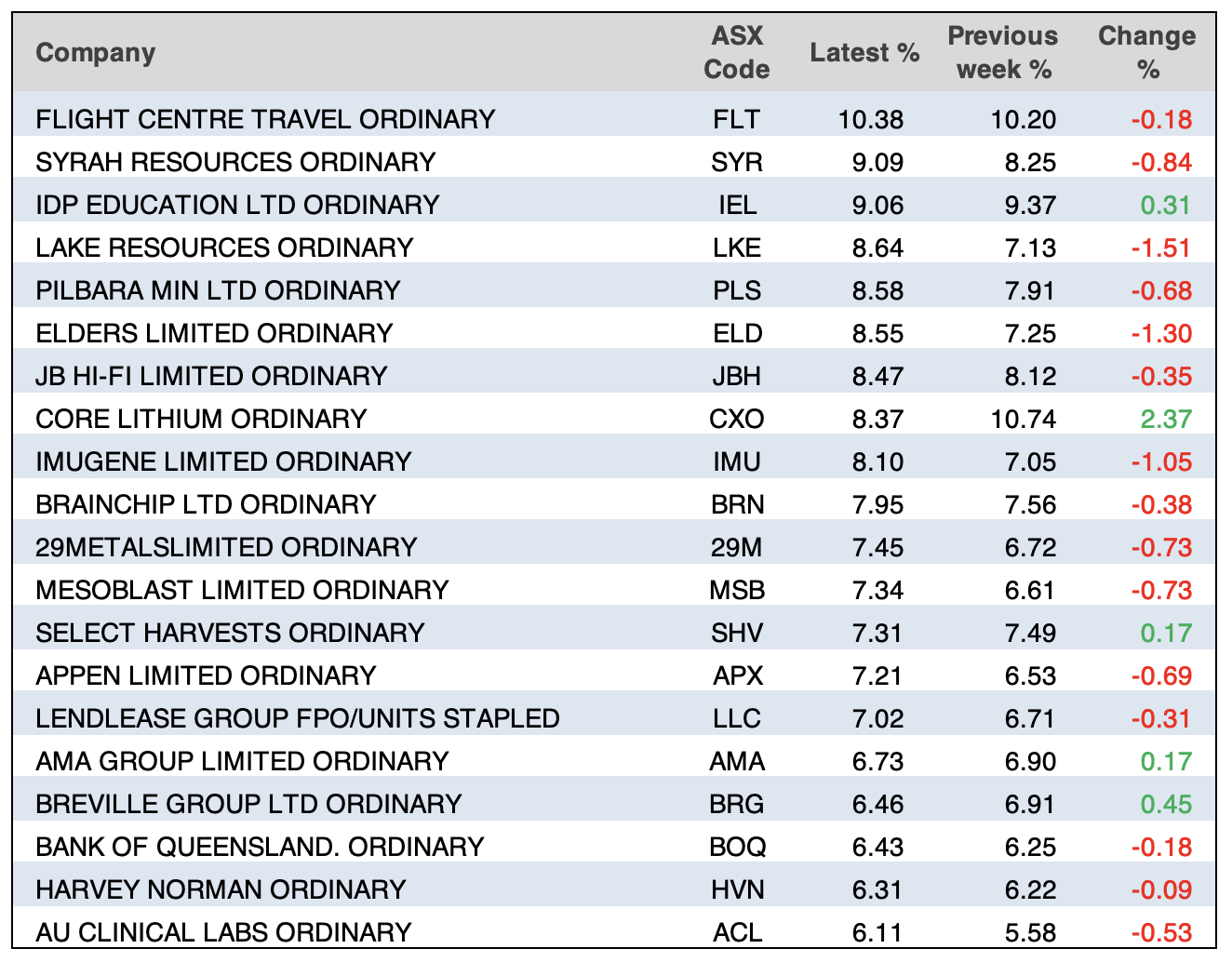

Stocks Shorted

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before

Quote of the Week

This is for the tech-stock believers for 2024, when rate rises stop and turn to cuts:

““The tech story is coming back, which is ironic because normally when real yields go up, valuations get hit and the more richly valued stocks do worse,” said Carson Group director and macro strategist Sonu Varghese said, adding that his firm balances its tech holdings along with cyclical stocks, such as small to mid-cap sized industrials and energy names. “We think the economy is actually running fairly resilient right now.” (CNBC)

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.