A third consideration for US stock players has joined the two big preoccupations of recent times, which are when will inflation be beaten and when will interest rates start to fall? The third one is this: has this rally gone too far and too fast? The overnight release of the February jobs report in the States hasn’t helped settle these key issues.

Frankly, I think the S&P 500 and the Nasdaq are overbought for the short term, though I expect they will trend higher over the year, despite some pullbacks, but the employment story didn’t help make that happen.

Unemployment rose from 3.7% to 3.9% and wages growth was cooler than expected, which should help the Fed think about cutting rates sooner rather than later. However, the actual jobs created i.e. 275,000 was a lot higher than the 198,000 number that economists predicted! So, these numbers don’t make it easy for the Fed to risk cutting rates too soon.

Ultimately, it will be inflation readings in coming months that will determine when US investors see the first cut, which will add justification for the rally they’ve created since October last year. By the way, we could be looking at the softest of soft economic landings from rate rises and the reason could be that inflation is falling, while job losses haven’t been terrible, which in itself could be the subject of an ‘enlightening’ PhD paper and a book or two in coming years.

This is how George Mateyo, chief investment officer at Key Private Bank, saw the data: “In sum, people will be able to take away whatever message they want to from today’s reports, however, we think the data skews positive and should provide sufficient confidence to the Fed that a modest adjustment to interest rates is appropriate.”

If this becomes the prevailing market view, then we are in for another positive week for stocks, though I think this from astute market historian Sam Stovall, from CFRA Research, suggests that profit-taking fund managers could look at their new year gains and say: “I want to finish the quarter looking like a huge winner.”

But that’s not to say they won’t return in April. Stovall, who looked at Nvidia’s small sell-off as a sign that a tech pullback is on the cards, counselled us with this:

“It doesn’t mean that the longer-term upside potential is over—it just says that maybe we’ve gotten ahead of ourselves.”

Yep, it looks like an overbought situation, where smarties take some profits, but if Sam joins the likes of Ray Dalio to argue there is more potential upside for the market over 2024, at least then (as I said last week) “I’m a believer!”

By the way, if you want an interesting indicator for the enthusiasm for stocks this year, CNBC reports that this “…monster rally has added more than $1 trillion to market cap value in just the new year alone”, which of course is huge.

Over that time, the S&P 500 was up around 8%, while the Nadaq put on over 9%, but in contrast our S&P/ASX 200 was up only 2.87%. You can blame China and its lower demand impact on our miners and also the fact that we don’t have big AI companies like the Yanks do with those Magnificent Seven stocks, such as Nvidia, Microsoft, Alphabet and so on. This AI development plus the belief that tech companies are in debt and lower interest rates will be good for their bottom line, explains why the Nasdaq Composite Index is up a whopping 39% for the past 12 months!

Nasdaq Composite

One of the enduring reasons why I think stocks can go higher is that there’s a huge number of companies in the US market as well as ours that haven’t been overbought. And as interest rates fall, without resounding recession warnings being pumped out, this will help power another leg up for the overall share market. The overbought stocks could lose some ground or their stock prices could just grow slower than smaller and once-ignored companies.

Helping that happen here will be eventual rate cuts, which more economists are tipping to happen in the mid-year to September (See below my quote of the week from CBA Head of Australian Economics). And a bounce-back for the Chinese economy will be another plus for our economy and market, so I have a big watch on Beijing and what it can conjure up.

AMP’s chief economist Shane Oliver agrees with me, this week saying: “Stretched valuations and increasingly positive investor sentiment mean share markets remain at risk of short-term volatility even though the broad environment of mostly OK economic and earnings news, ongoing expectations for rate cuts and enthusiasm for AI points to a continuing rising trend”.

There will be ‘thrills and spills’ for stock players in 2024 but I’m betting we see a winning year.

To the local story and the S&P/ASX 200 gained 101.40 points (or 1.31%) for the week to finish at 7847.00.

Helping our index roll higher has been the surprising rise in the prices of bank stocks but our expert market storyteller Tony Featherstone explained this in his article for this Report last Thursday (see the link below) by spelling out that if we buy an ETF for the overall market, you help the share prices of the big banks and miners head higher because they’re so huge in the Index.

I’ve been doing exactly that for my financial planning clients — buying VAS to benefit from a rise in the top 300 stocks as rate rises stop and eventually head down this year.

This week the AFR reported that “…investors piled into Commonwealth Bank shares, sending Australia’s largest lender up 1.8 per cent on Friday to an all-time high of $121.45 and lifting the S&P/ASX 200 Index 1.1 per cent to 7847 points.”

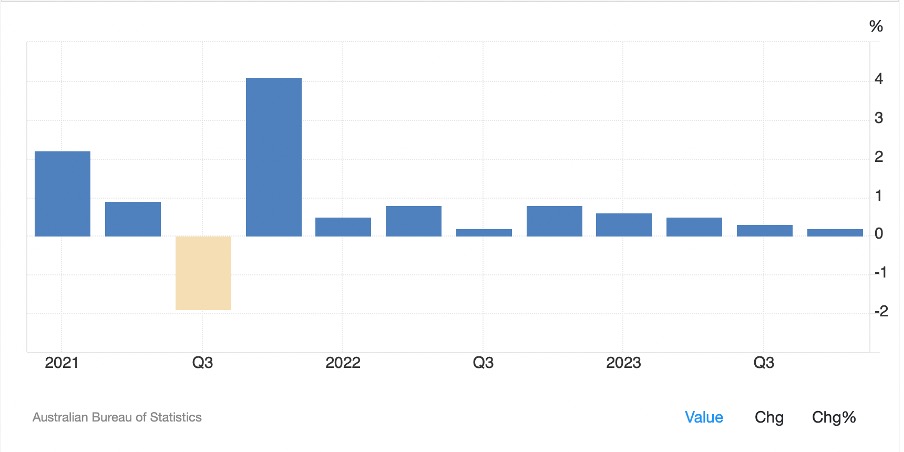

Helping our market were slower economic growth numbers—1.2% for the year to December. And now interest rate cuts are expected earlier than economists tipped.

Here are the winners and losers for the week:

Behind the huge 34% gain foe Virgin Money (VUK) is a $5.7 billion cash takeover bid from British lender Nationwide. This is a sign of things to come, as eventual falling interest rates will make some companies that were out-of-favour when rates were rising become more attractive.

What I liked

- Real GDP rose by a weak0.2% in quarter four last year, to be up 1.5% on year ago levels. I wouldn’t normally like a slow economy, but this should stop the RBA from giving us more rate rises and push us closer to the first cut.

- Real household disposable income posted a welcome increase over the quarter but sits 0.6% lower over the year, which has been helped by falling inflation.

- The Melbourne Institute’s Inflation Gauge for February showed an ongoing slowing in inflation.

- CommSec’s Craig James sees three 0.25% cuts this year, starting in September.

- In his congressional testimony across two days, Fed Chair Jerome Powell seemed confident in a soft landing and saw disinflation remaining on track. While he said the Fed didn’t want to rush into rate cuts, he added that the Fed is “not far from” having enough confidence to start cutting rates and that rate cuts “can and will begin” this year.

- Australia’s trade surplus rose slightly to $11 billionhelped by continuing strength in exports and constrained consumer imports.

- Those US job figures I looked at above, which say the US is heading for a soft landing and rate cuts could happen in the not-too-distant future, which will be great for stocks.

- This from AMP’s Shane Oliver: “US and Eurozone shares rose to new record highs over the last week as the ECB and Fed provided dovish comments, flagging rate cuts ahead”.

What I didn’t like

- Household consumption inched higher but has gone significantly backwards on a per capita basis over the past year. I hope the RBA hasn’t over-egged the rate rises.

- Residential construction fell sharply and the supply and demand imbalance in the housing market has further widened. This isn’t good news for the economy and house prices.

- Home building approvals and housing finance both fell again in January. The former doesn’t augur well for Australian government plans to build 240,000 dwellings a year over the next five years, as approvals are currently running around 166,000 dwellings a year.

- ANZ job ads fell 2.8% in Februaryand are down 12.4% on a year ago, pointing to softer jobs growth ahead.

- The CBA economics team noted: “The business indicators results confirm persistent inflationary pressures, with wages up 0.9% in the December quarter to be 8% higher compared with a year ago. But sales volumes were up 0.2% in the quarter and profit margins still rose”.

Why bad news can be good news

A week or so ago, I made reference to the week’s data being one-sided, with “What I liked” smashing “What I didn’t like”, where I think I had only one “What I didn’t like” observation.

This week there’s the bad news that I have five “What I didn’t like” data drops, but this could end up being good news because the RBA can’t ignore the fact that our economy is slowing and rate cuts should come sooner rather than later.

So, should we be worried that the 13 interest rate rises will cause a recession? We can’t rule it out, but I do think the stage three tax cuts due in July will help the economy in the second half of 2024. And if rate cuts come in July or thereabouts, we could end up with a soft landing, like our buddies in the US.

We’re in the hands of Governor Michele Bullock and her board, so let’s hope her new team ends up being better than some of their predecessors!

Switzer This Week

Switzer Investing TV

- Boom Doom Zoom: Peter Switzer and Rudi Filapek-Vandyck your questions on CSL, AD8, NXT & more

- SwitzerTV Investing: A good tech company caller gives us his tech tips post-reporting season + is CSL yesterday’s hero stock?

Switzer Report

- Two private credit funds to consider

- “HOT” stock: Capricorn Metals (CMM)

- Questions of the Week

- My favourite 5 great potential companies

- Portfolios continue to outperform as market grinds higher

- HOT stock: Coles (COL)

- Two under-the-radar microcaps

- Buy, Hold, Sell — What the Brokers Say

Switzer Daily

- Behind closed doors attempts to improve economy

- Stop worrying about rate rises and your super

- Private health insurance premiums get government green light to go up

- Apple fined $3 billion for ripping off music fans

- Both sides to promise fewer immigrants next election

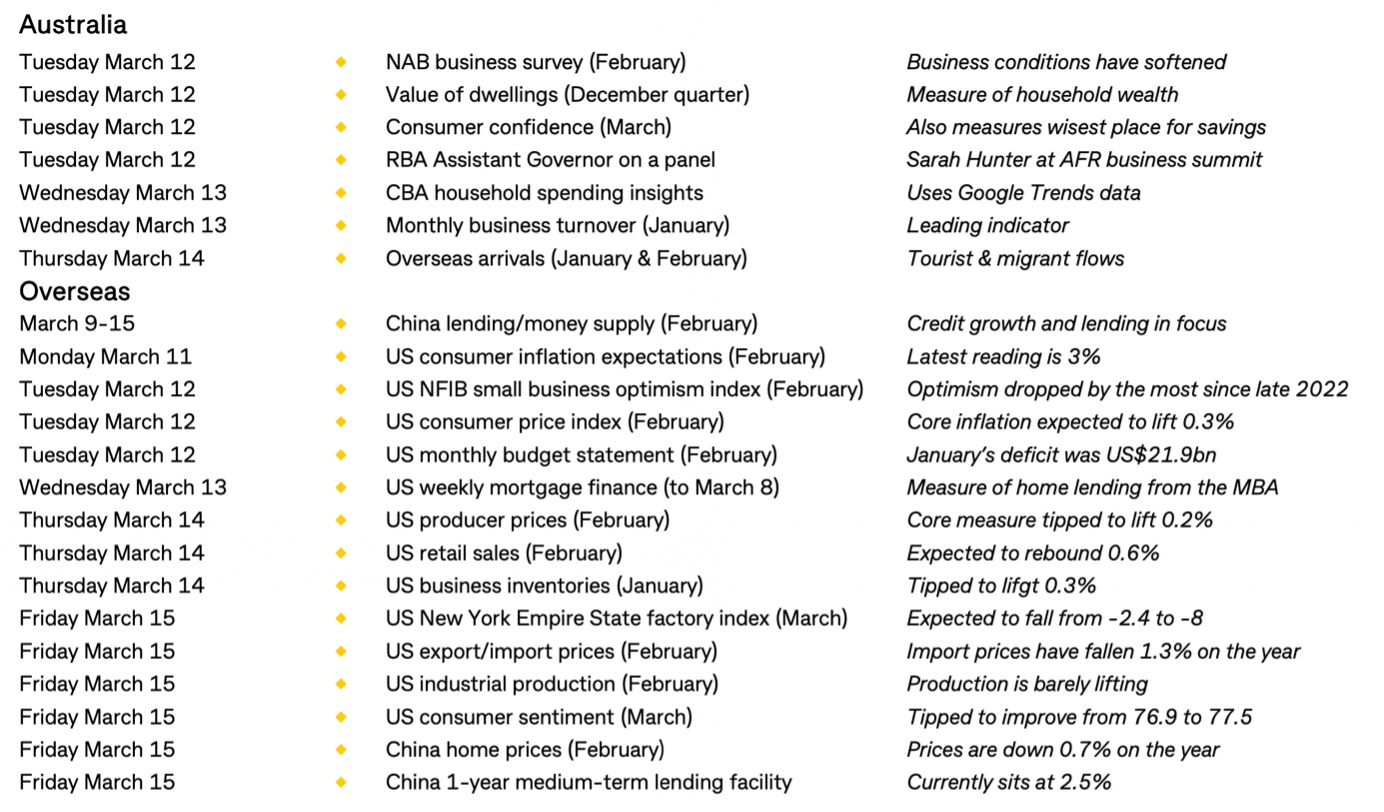

The Week Ahead

Top Stocks — how they fared

Most Shorted Stocks

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before

Quote of the Week

“Our base case sees the RBA commence an easing cycle in September 2024 (75 basis points of rate cuts by end-2024 and a further 75 basis points of cuts in H1 2025,” CBA head of Australia economics Gareth Aird said.

Chart of the Week

See hoe 13 interest rate rises hit economic growth with the December quarter at 0.2% and the annual figure at a low 1.2%. The RBA can’t ignore this.

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.