Another day of trade deal optimism has helped the Dow Jones to an eight-day winning streak, taking the famous index close to record highs. The actual record high on an intraday basis is 27,398.36 and the Dow finished at 27,219.52, up 37 points.

The kind of stocks that go up on trade deal positivity, such as Caterpillar and Boeing, were again winners. And in case you think I’m making too much of the trade-driver effect, CNBC has others who agree. “If anybody had any doubt about what was moving markets, it’s the trade war,” Brent Schutte, chief investment strategist for Northwestern Mutual Wealth Management told the US business TV channel.

The ‘new’ news on the trade front was a New York Times breaking story telling us that China plans to exempt some US farm products, such as soybeans and pork, from their tariffs. These are serious concessions from China and important products for its citizens.

And global optimism has been helped by the European Central Bank’s stimulus package and rumours of a deal ahead of the Brexit drama at the end of October. But this has been hosed down by No.10 Downing Street, The Guardian reports.

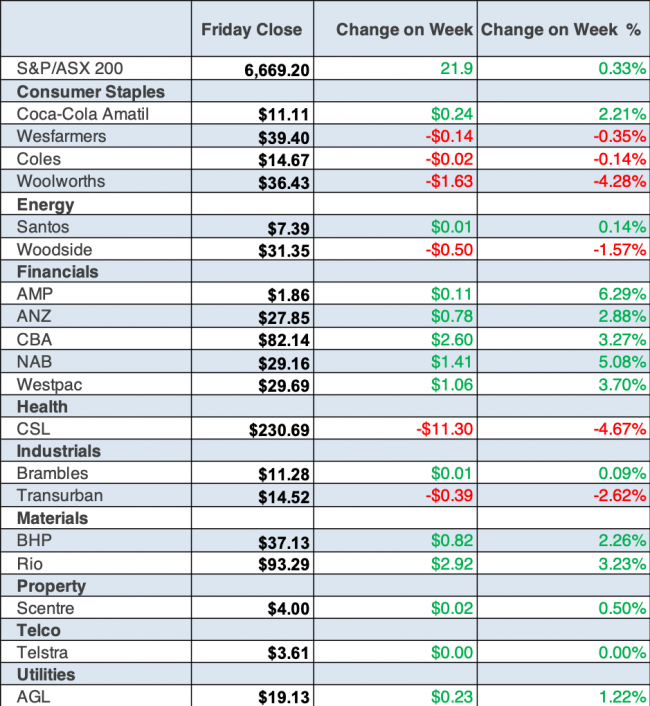

To the local story and the S&P/ASX 200 Index put on a measly 14 points to end the week at 6669.20. But that makes it a four-week gain for the Index. The run of potentially positive trade deal news has kept it positive and now the October 1 trade pow-wow is becoming a huge event for the stock market.

In case you missed it, the political ping pong game between China and the USA (or Xi Jinping and Donald Trump’s respective teams) has become less of a ‘play the big shot’ for a winner to more a game of concessionary rallies.

Over the week, the US agreed to delay increased tariffs on billions worth of Chinese goods for two weeks after China exempted tariffs on a basket of U.S. imports and promised to buy more U.S. agricultural products. Investors loved the news that China had exempted 16 types of US goods from tariffs and The South China Morning Post reported that China will offer to buy more agricultural products from the US.

And then Donald really showed more of his “let’s make a deal” side, saying this to reporters on Thursday US-time. “If we’re going to do the deal, let’s get it done. A lot of people are talking about it, I see a lot of analysts are saying an interim deal – meaning we’ll do pieces of it, the easy ones first. But there’s no easy or hard. There’s a deal or there’s not a deal. But it’s something we would consider, I guess.”

This is Donald giving ground and it has raised the market’s hopes that a deal of sorts could surface in October. That would add some certainty, which would help stocks resist gravity and go higher.

Adding to the positivity was the European Central Bank’s “bazooka” stimulus, which helped EU markets rise about 0.4% on Thursday. But the reasons why the ECB needs to do this growth-boosting package can’t easily be ignored.

In case you missed it, the ECB has promised to purchase government bonds at a pace of €20 billion ($32 billion) a month for as long as necessary! And the official rate of interest for the bank was cut by 10 basis points to negative 0.5%!

A related good news development was the better bond market story, with yields across global markets rising through the week amid hopes for a trade deal and strength in domestic-focused parts of the US economy.

The AFR says “the financial sector was the best performing over the week, climbing 2.7 per cent. Commonwealth Bank climbed 2.9 per cent over the week to $81.85, NAB jumped 4.9 per cent to $29.11, Westpac gained 3.5 per cent to $29.62, and ANZ edged 2.6 per cent higher to $27.77.”

This is making Paul Rickard and yours truly happy that we stuck with the much-maligned big four banks.

The following chart from the AFR is a ripper to show you what a possible trade deal can deliver. It’s interesting to see what sectors have won and those that have copped it, as the chances of a trade deal increased over the week. Of course, you never know with Donald J. Trump but certainly the market is giving us a sneak preview of what might happen if a deal is struck.

The leg-up for resource stocks was helped by the Chinese announcing new stimulus measures. BHP put on 2% over the week to $37.03, Fortescue rose 7.1% to $9.06 and Rio Tinto was up 3.3% to $93.35.

The high tech darlings of recent times had a hard week, with Wisetech down 9.1% and Appen off 16.6%. Meanwhile, for those looking for an AMP leg-up, the AFR’s Elouise Fowler says “AMP shares firmed this week, advancing 6.3 per cent to $1.86. A number of directors bought into the company’s share purchase plan this week, while chief executive Francesco De Ferrari was given performance rights shares on Thursday worth more than $11 million.”

What I liked

- The CommSec index of luxury marques rose again in August, up by 0.6%. Previously in July (and for the first time in two years), rolling annual luxury vehicle sales rose (lifting 0.4%), coinciding with a lift in home prices.

- Since July, ASX 200 companies have paid out around $5 billion in dividends to shareholders. But dividend payouts really start to ramp up in mid-to-late September. Overall, around $29.2 billion will be paid out to shareholders from July to December, little changed from $29.4 billion in the February 2019 earnings season but up from $26 billion in the August 2018 reporting season.

- Around $23 billion will be paid out by listed companies to their shareholders in the next four weeks.

- Excluding refinancing, the value of owner-occupier home loans rose by 5.3% in July, with investment loans up 4.7%. The number of owner-occupier loans lifted by 4.2%. In trend terms, the share of first-home buyers in the home lending market hit a 7½-year high of 29.1%.

- The European Central Bank (ECB) cut its deposit rate by 10 basis points (0.1 percentage point) to -0.50%. The ECB will also restart bond purchases of 20 billion euros a month from November.

- The US annual core rate of inflation rose from 2.2% to 2.4%.

- The German finance minister raised the prospect of significant fiscal stimulus to counter a significant slowdown of the economy.

- US consumer credit rose by US$23.29 billion in July (forecast up US$16.1 billion) – the fastest pace of borrowing in two years.

What I didn’t like

- The Westpac/Melbourne Institute survey of consumer sentiment index fell by 1.7% to 98.2 in September.

- The NAB business confidence index fell from +3.8 points in July to +1.4 points in August. The long-term average is +5.9 points. And the business conditions index fell from +2.6 points in July to a near 5-year low of +0.5 points in August. The long-term average is +5.8 points.

- The 12-month moving average of the NAB trading conditions index fell to a 4-year low of +10.1 points in August, down from +11.5 points in July. The long-term average is +11.3 points.

- The 12-month moving average of the NAB profitability index fell to a 4½-year low of +3.5 points in August, down from +5 points in July. The long-term average is +4.6 points.

- In seasonally adjusted terms, the value of personal fixed loans (to households) for motor vehicles fell by 3% to a 4-year low of $1.165 billion in July to be down 9.1% over the year.

- The NFIB small business optimism index in the US eased from 104.7 to 103.1 in August.

It would drive a finance commentator to drink!

With Donald’s form well-known, no one can 100% believe a trade deal is near – you can only hope. Given what he and other politicians like Bill Shorten have put us through, it’s no surprise that data out this week told us that total alcohol consumed in Australia lifted slightly from 55-year lows of 9.48 litres per capita in 2016/17 to 9.51 litres per capita in 2017/18. However, beer consumption remained near 74-year lows at 3.71 litres per capita. Wine consumption hit 14-year lows of 28.26 litres per capita in 2017/18, which suggests Donald and Bill have sent us to the hard stuff!

The week in review:

- Has driving in the fast lane with P.O.T.U.S. Donald J. Trump been a profitable experience? If so, will it continue to be one?

- Here’s Paul Rickard’s Product Road Test on the Centuria Diversified Property Fund, an open-ended unlisted property fund that invests in multiple properties/funds and provides a limited liquidity facility.

- What’s likely to happen next? Which asset classes could win in the next round as aggressive investors hunt yield and defensive investors seek shelter? Read Percy Allan’s analysis in his article this week.

- Tony Featherstone sees years of growth ahead for travel companies exposed to online bookings, and this week put forward two global travel stocks that look interesting at current prices.

- After looking at some of the ASX’s major agricultural stocks including Ruralco (RHL) and Elders (ELD) back in June, this week James Dunn checked out how they’re travelling and looked at 4 more interesting rural candidates

- Whitehaven Coal was the Hot Stock of the week from CMC Markets’ Chief Market Strategist Michael McCarthy, while Burman Invest’s Julia Lee highlighted Nanasonics.

- Stockbrokers issued six upgrades and six downgrades in the first Buy Hold Sell – What the Brokers Say, and in the second edition there were three upgrades and three downgrades.

- In Questions of the Week, Paul Rickard and I answered queries about which NTA to use when looking at a listed investment company (LIC), comparing managed funds, the bond market’s bounce and whether CSL is expensive.

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday September 17 – Reserve Bank Board minutes

Tuesday September 17 – Residential property prices (June quarter)

Tuesday September 17 – Weekly consumer confidence

Thursday September 19 – Population estimates (March)

Thursday September 19 – Employment/unemployment (August)

Thursday September 19 – Reserve Bank Bulletin

Overseas

Monday September 16 – China monthly data (August)

Monday September 16 – US Empire State index (September)

Tuesday September 17 – US Industrial production (August)

Tuesday September 17 – US NAHB housing market (September)

Tuesday September 17 – China House prices (August)

September 17/18 – US Federal Reserve meeting

Wednesday September 18 – US Housing starts (August)

Thursday September 19 – US Philadelphia Fed survey (September)

Thursday September 19 – US Existing home sales (August)

Thursday September 19 – US Leading index (August)

Food for thought:

“The big money is not in the buying and selling, but in the waiting.”– Charlie Munger

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

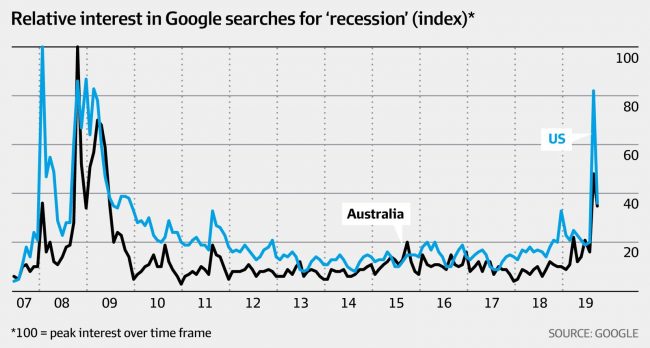

Chart of the week:

This week, the AFR’s Patrick Commins shared a chart of Google searches in Australia and the US for the word ‘recession’ since 2007. It showed that searches spiked in August during news of the US yield curve inversion:

Source: Google, AFR

Top 5 most clicked:

- Will there be a crash or a switch in stocks? – Percy Allan

- Stock outcomes hinge on this current P.O.T.U.S. – Peter Switzer

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

- Our “HOT” stocks – Maureen Jordan

- Commercial property via a fund paying monthly income – Paul Rickard

Recent Switzer Reports:

Monday 09 September: Stock outcomes hinge on this current P.O.T.U.S.

Thursday 12 September: Bears, bulls and travel titans

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.