Beijing kept up its ‘bull in a China’ economy game, delivering a shock to cryptocurrency players with a ban declaring the currency illegal! WOW! That hit the tech sector overnight, while other market indices were up, despite Evergrande not stumping up its second interest repayment on the US-denominated debt.

This was a big watch after the company came good with the Chinese debt obligation, which did settle market nerves.

But here’s a piece of news that could explain why the market is relaxed about the non-payment (so far) of the $83 million due. The company actually has 30 days before it technically defaults, which buys the market some time to look at other worrying or possibly positive matters.

Influential stock players are pondering what an Evergrande failure could mean for supply issues and the threat of a slowing US economy. And then there’s what it might do to a Chinese economy that’s already slowing.

That said, this from Edward Moya at Oanda in the US sums up the majority take on the threat of a default by China’s second biggest property developer. “If Evergrande fails, the exposure outside of China appears limited” and it’s believed that “the government will do whatever it takes to contain it.” He then told CNBC: “If China is successful, global risk appetite may not be dealt that much of a blow.”

So future market sentiment is in the hands of Beijing and how it chooses to handle the Evergrande challenge. And if they play ball and don’t derail the optimism that’s linked to the view that 2022 will be good for global economic growth, then US expert analysts tip that cyclical stocks (such as energy, financial, industrial and tourism-related companies) will be winners.

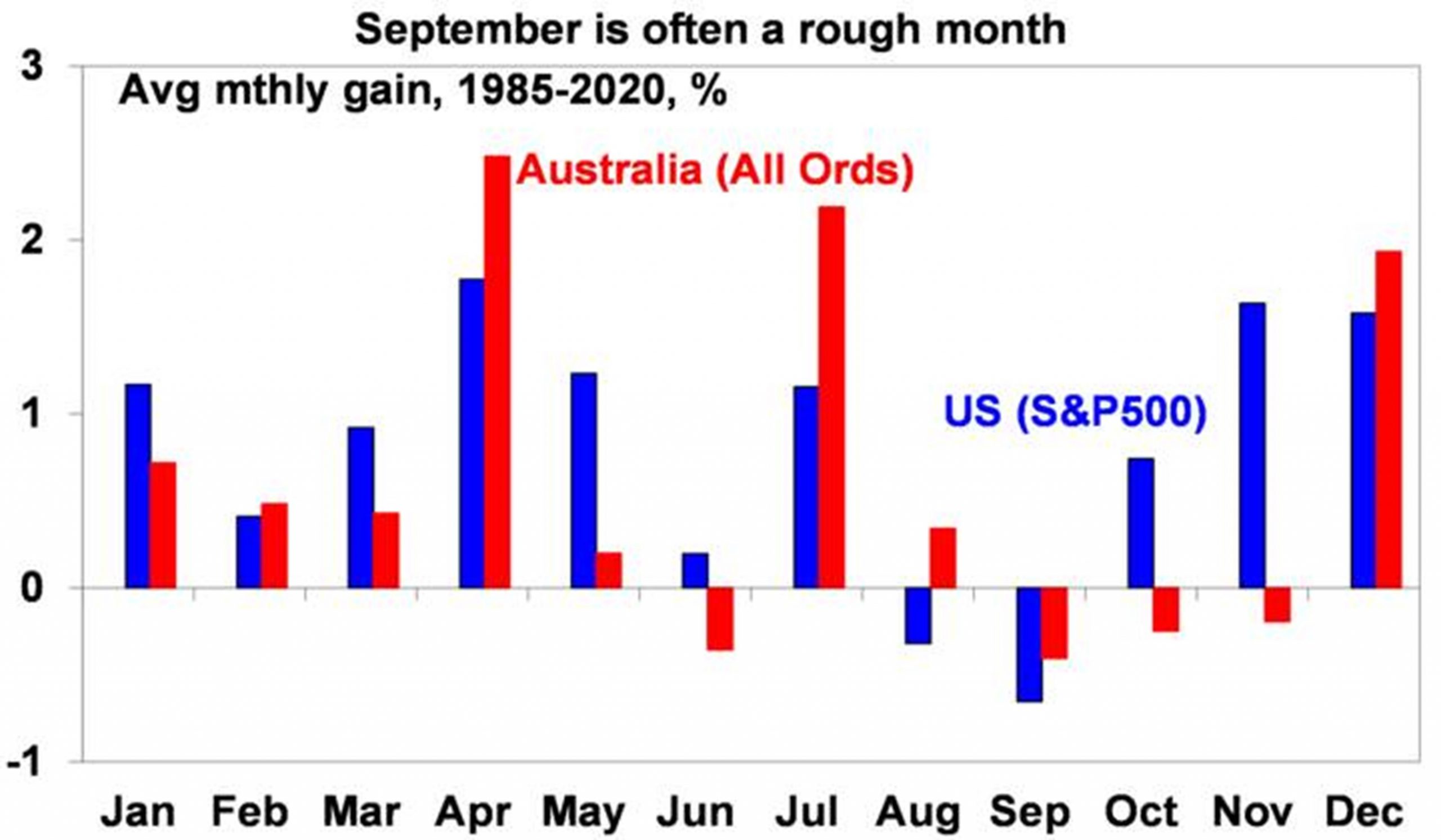

For those a little spooked by what happened this week, remember this is September. Last year in the US, this scary month for stocks actually fell 10%, then had a 9% rally, and fell 7% in October before a huge 36% rally to where the market is today.

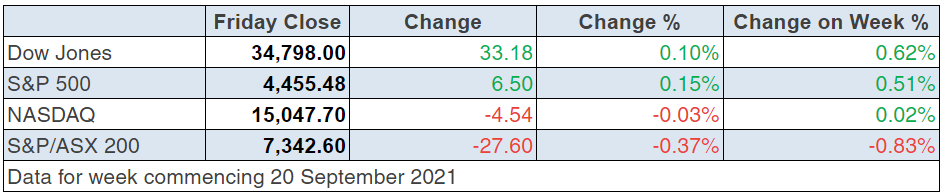

S&P 500

We followed Wall Street but our rally was only good for 24%. Given my view on the world and our economic outlook, any sell offs in the near future should give way to pretty good rallies over 2022.

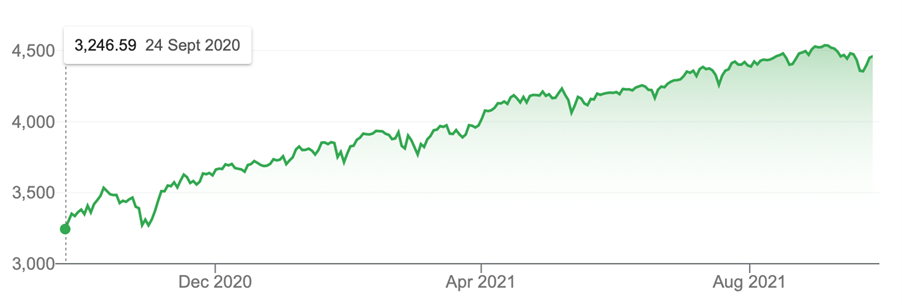

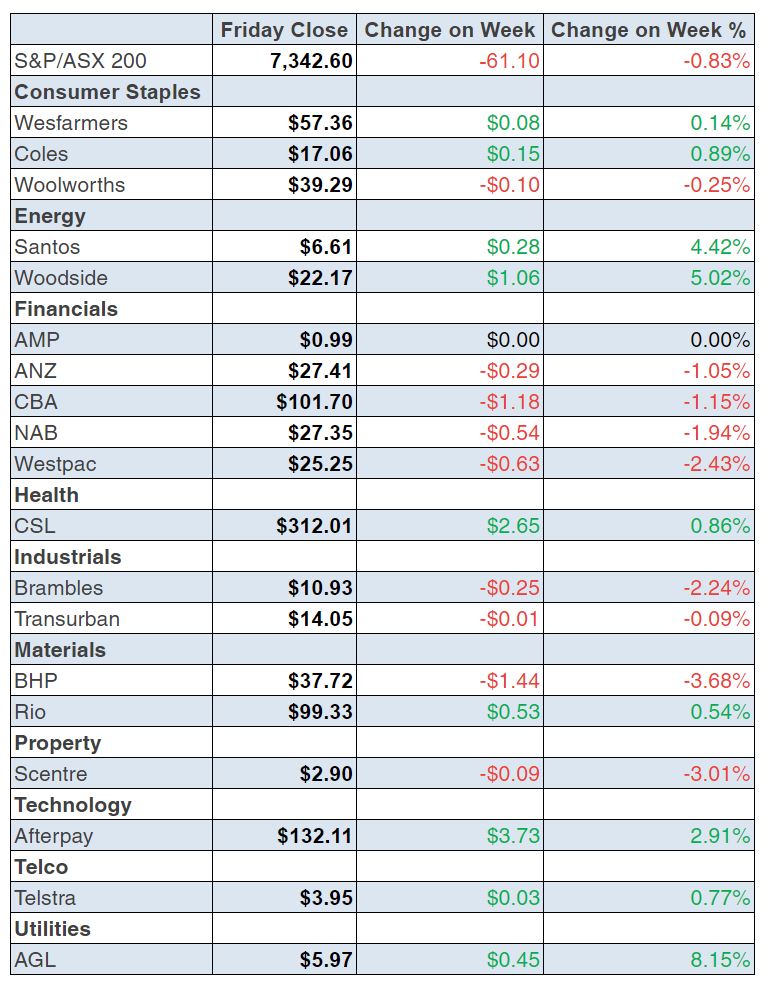

S&P/ASX 200.

If you’re doubting our potential to rally next year, remember that if you take the top of the market before the Coronavirus crash and compare it to the level we’re at today (i.e. 7342.6), we’re only 3% higher! If we had no lockdowns, the index would be more elevated today. And as international borders open and CBDs come back to life (albeit hurt by the work-from-home types), company profits and stock prices will go higher.

If my optimism is proved wrong, it could be because Beijing decides to play hardball to rattle the West via some stock market sell offs. But that could not be in their interest, as they’re biggest lender to the US. Also, if the Fed raises interest rates faster than is currently expected, then that could surprise and shock markets.

Right now, half of the Fed state governors, who vote on interest rate changes, think rates will rise in 2022. The other half say 2023, which is good news for stock market investors and speculators!

To our local story and despite a comeback for stocks helped by the payment of interest to its Chinese lenders, our market still gave up 61.6 points (or 0.8%) to finish at 7342.6.

Predictably, the miners had a weird week, with BHP only losing 0.29% to finish at $37.72 but Rio surprisingly was up 3.21% to $99.33, while Fortescue was up 8% to $15.34.

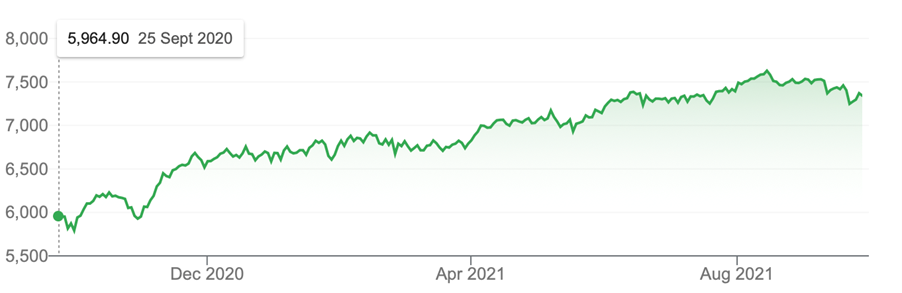

Here are Bloomberg’s big winners and losers for the week. Gold miners dropped on a lower gold price and Lynas was due for some profit-taking. The rare earths miner is up 191% over the past year!

Meanwhile, it was an uneventful week for banks, with the CBA down 0.09% to $101.7, NAB lost 1.26% to $27.35, Westpac was off 1.52% to $25.25 and gave up 0.4% to $27.41, despite small rises on Friday.

Interestingly, real estate companies seem to fall in sympathy with Evergrande!

Centuria Industrial REIT dropped 6% to $3.77 and Charter Hall gave up 3.1% to $18.40.

What I liked

- The weekly ANZ-Roy Morgan consumer confidence rating rose by 0.2% to a 9-week high of 103.3 (long-run average 112.5). Sentiment surged 7.3% in Queensland and lifted by 6.7% in South Australia last week.

- The ‘flash’ Markit purchasing managers’ index (PMI) for manufacturing eased from 61.1 to 60.5 in September (survey: 61). The services PMI fell from 55.1 to 54.4 in September (survey: 54.9) and any number over 50 means expansion.

- Total household wealth (net worth) rose by a record $735 billion (or 5.8%) to a record high of $13,433.7 billion in the June quarter. Wealth is up 19.7% on a year ago – the strongest annual gain in over 11 years.

- The preliminary Australian IHS Markit Manufacturing Purchasing Managers’ index (PMI) rose from a 14-month low of 52 in August to 57.3 in September.

- The Services PMI lifted from a 15-month low of 42.9 in August to 44.9 in September. The combined or composite PMI rose from a 15-month low of 43.3 in August to 46 in September. Although the number is under 50, the rise with lockdowns in Sydney and Melbourne is a positive.

- Despite recent falls in job ads for lockdown reasons, recruitment activity is still up 28.4% (or around 47,800 ads) when compared to pre Covid-19 levels.

- The OECD expects the global economy, as measured by GDP, to expand by 5.7% in 2021 and 4.5% in 2022. The Australian economy is tipped to expand by 4% in 2021 and 3.3% in 2022, which I think is a low-ball number! We will grow faster than that.

- US Federal Reserve left its target range for the federal funds rate unchanged at 0% to 0.25%. Chair Jerome Powell said the central bank could begin tapering asset purchases “as soon as the next meeting [November 2-3]” and complete the process by mid-2022, which says he’s happy with the USA’s economic growth trajectory.

What I didn’t like

- The ANZ reading on consumer confidence saw it falling by 4.9% in NSW and 1.1% in Victoria due to prolonged lockdowns, but it’s still not a dramatic fall.

- Commonwealth Bank (CBA) Group economists reported that household home buying, travel, entertainment and education spending intentions were all down in August due to lockdowns in NSW, Victoria and the ACT.

- Skilled job vacancies fell by 5.6% (or 12,828 jobs ads) in August to stand at 216,031 available positions. It was the biggest monthly fall in job ads in 16 months and the third successive decline after available positions hit 12½-year highs of 240,349 ads in May.

- The RBA Board signalled that the cash rate is unlikely to lift “before 2024” as it doesn’t expect to meet the conditions necessary to achieve a return to full employment or its 2% to 3% inflation target until then. I think and hope that they’re wrong. If rates don’t move until 2024, then our economy will be slower than I expect.

Good & bad news on Christmas retail

Recent research from the Australian Retailers Association and Roy Morgan showed that Aussie consumers are expected to spend a massive $11 billion on Christmas presents this year, with 48% purchased online. But CommSec economist Ryan Felsman says “this may not be good news for Australian shopping mall REITs, such as Scentre Group and Vicinity Centres, which are both primed for an eventual re-opening of both the NSW and Victorian economies.”

Of course, stir-crazy locked up citizens of the country’s two biggest cities might be so desperate to get out that the thought of going shopping in the real not virtual world might be unbelievably appealing.

In the late 1990s, US churches were designed to look more like shopping centres to win over what was called the “mall majority”.

This from The LA Times in 1997 summed it up: “This new wave of modern-day temples seeks to attract what clerics call the unchurched,’ people who have abandoned organized worship. Religious leaders are actively competing for the souls of Sunday sports fans, couch potatoes, golfers, moviegoers and weekend gardeners.”

Our attraction to shopping centre borders on the religious and this from The LA Times is a ripper: “When architect David Gilmore drew up plans for a new West Covina church, he left out a few key items: crosses, stained glass windows, flying buttresses, altars and wooden pews. Instead, he replaced them with food kiosks, water fountains, cappuccino carts, convenient parking lots and a shopping mall feel.” I’m tipping a big migration back to the malls after lockdowns end, especially on Sunday!

The week in review:

- Read my article on whether you should buy, hold or sell A2 Milk (A2M), Appen (APX) & Altium (ALU).

- While Paul Rickard does not think Telstra (TLS) will get back to $5, he can see it going higher and here’s why.

- While producers are wary about the market, James Dunn explains that the ASX uranium stocks have skyrocketed. Here are some of the 12-month price rises.

- In his article this week, Tony Featherstone focuses on two companies that provide services for teenagers and twentysomethings: think movies, theme parks, gyms and thrill-seeking adventures that are likely winners when Covid exits.

- For our “HOT” stocks this week, Michael Gable from Fairmont Equities talks about CSL Limited (CSL) and Raymond Chan from Morgans explores why he likes Telstra (TLS)

- In Buy, Hold, Sell – What the Brokers Say this week, there were 2 upgrades and 5 downgrades in the first edition, and in the second edition there were 6 upgrades and 2 downgrades.

- And in Questions of the Week, Paul Rickard answered questions from subscribers about Transurban (TCL), the Commonwealth Bank (CBA) share buyback, copper stocks and Deterra Royalties (DRR)

Our videos of the week:

- Boom! Doom! Zoom! | September 23, 2021

- 4 experts and their best stock for the year! | SwitzerTV Investing

- Is this Evergrande market blow up a buying opportunity? + stocks in the buy zone — RHC, NWS & more | Switzer Investing

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday September 28 – Weekly consumer sentiment index (Sep.26)

Tuesday September 28 – Retail (August)

Wednesday September 29 – Engineering construction (June quarter)

Thursday September 30 – Job vacancies (August)

Thursday September 30 – Building approvals (August)

Thursday September 30 – Private sector credit (August)

Friday October 1 – CoreLogic home value index (September)

Friday October 1 – Purchasing manager indexes (September)

Friday October 1 – Lending indications (August)

Overseas

Monday September 27 – US Durable goods orders (August)

Monday September 27 – US Dallas Fed manufacturing index (Sep.)

Tuesday September 28 – China Industrial profits (August)

Tuesday September 28 – US Goods trade balance 9August)

Tuesday September 28 – US S&P/Case-Shiller home prices (July)

Tuesday September 28 – US FHFA house price index (July)

Tuesday September 28 – US Consumer confidence (September)

Wednesday September 29 – US Pending home sales (August)

Thursday September 30 – China Purchasing managers (September)

Thursday September 30 – US Economic (GDP) GROWTH (June quarter)

Friday October 1 – US Personal spending & income (August)

Friday October 1 – US ISM manufacturing index (September)

Friday October 1 – US Construction spending (August)

Food for thought:

“Never invest in any idea you can’t illustrate with a crayon” – Peter Lynch

Stocks shorted:

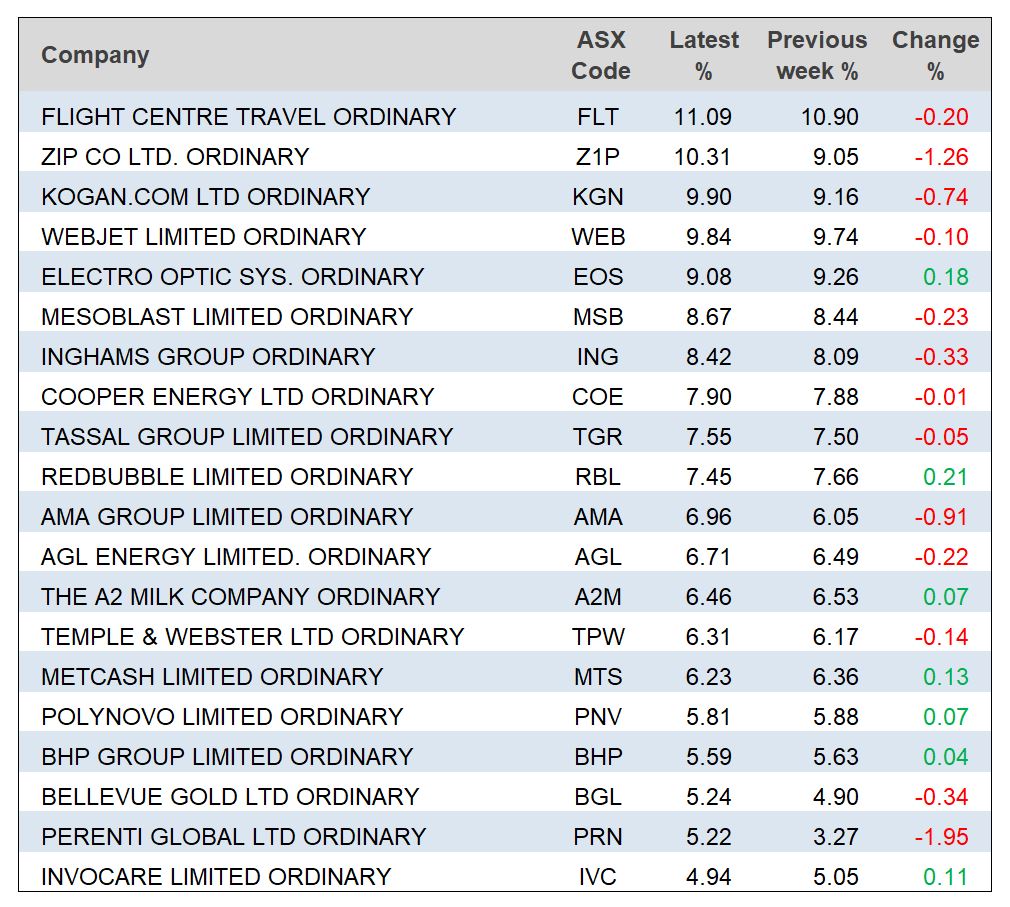

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

Shane Oliver from AMP Capital shared the following chart this week and wrote: “US shares have fallen in five of the last 10 Septembers and the Australian share market has fallen in seven of the last 10, with both falling in September last year.”

Top 5 most clicked:

- Should you buy, hold or sell A2 Milk, Appen & Altium? – Peter Switzer

- 2 stocks likely winners when Covid exits – Tony Featherstone

- Questions of the Week – Paul Rickard

- Will Telstra get to $5? – Paul Rickard

- Uranium stocks have skyrocketed – James Dunn

Recent Switzer Reports:

- Monday 20 September: Should you buy, hold or sell A2 Milk, Appen & Altium?

- Thursday 23 September: 2 stocks likely winners when Covid exits

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.