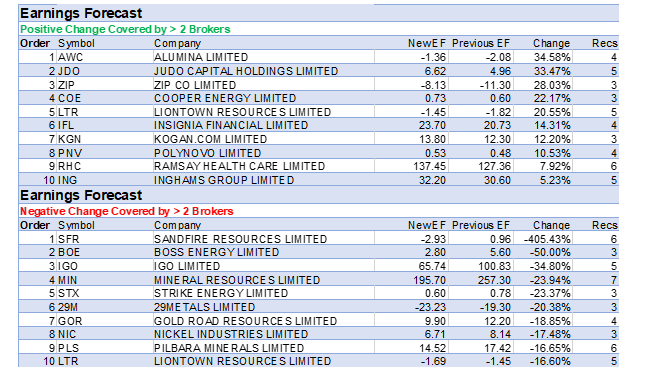

Percentage downgrades to average earnings forecasts were again greater than for upgrades, and this week the top-ten places in the earnings downgrade table below were all filled by companies in the resources sector.

Running counter to this negative trend for resources were uranium companies Paladin Energy and Boss Energy, which featured first and third, respectively, on the list for percentage increase to average target price.

Paladin received rating upgrades to Buy from Hold, or equivalent, from Bell Potter and Citi following the prior week’s quarterly cashflow and activities report.

The company’s Langer Heinrich mine moved closer to a restart in the December quarter, with management advising first ore had been fed into the mine’s beneficiation plant. First production is on track for around the end of the current quarter.

Citi also raised its uranium price forecasts in the expectation of a more imminent Russian nuclear fuel ban, and potential for ongoing mine development issues in both Niger and Kazakhstan.

This broker forecasts U3O8 will average US$101/lb and US$110/lb in 2024 and 2025, respectively, while the long-term forecast was raised to US$115/lb from US$87/lb.

Bell Potter noted Boss Energy is the most leveraged of stocks under coverage to a spot price increase. After reviewing second quarter operational results, forecasts for FY25 and FY26 were increased after the broker lifted short and mid-term uranium pricing, and anticipated a peak spot price of US$130/lb. However, the average FY24 forecast for Boss in the database fell, hence the company’s appearance in the earnings downgrade table.

Management announced the restart of the Honeymoon Uranium Project is 96% complete, with first “uranium in drum” expected in the current quarter. Macquarie suggested Boss is well positioned for the ramp-up, with a solid balance sheet, including cash and uranium inventory.

The average target prices for Credit Corp and City Chic Collective also rose by 17% and 10%, respectively, after second half updates.

While Credit Corp’s first half underlying profit missed the consensus forecast by more than -15%, Morgans FY25/26 earnings outlook remained largely unchanged. The Add rating was kept, but the broker cautioned trust is required in management’s execution in the US.

Macquarie noted Credit Corp is taking share in the A&NZ purchased debt ledger (PDL) market with purchasing guidance upgraded to $100-110m from around $50m prior.

As the weight of growth is shifting to the US, where competition is fierce, Ord Minnett predicted future returns on equity are likely to remain constrained. This broker forecasts lower profit growth in the five years ahead compared with the five years past. It’s felt the market is too optimistic and the shares are “expensive”.

City Chic’s second quarter gross margins were higher than the prior quarter, and remain on track to return to historical levels, according to Morgan Stanley.

The company logged a 10% rise in gross trading margins in the December quarter and management reiterated its expectations of a return to profitability in the June half.

Management is contemplating selling the North American business, which accounts for around 50% of group revenue.

The top-five (and material) reductions to average target prices (where there are at least three covering brokers in the FNArena database) were for the following resource companies: 29Metals, Liontown Resources, IGO Ltd, Gold Road Resources and Chalice Mining.

Chalice received an upgrade to Buy from Neutral after UBS identified value in the wake of an -83% share price fall since the company’s August-2023 scoping study for the nickel-copper-platinum group element (PGE) Gonneville project in Western Australia.

At the time of the scoping study, Morgans noted a more challenging path than previously expected for development of the project after misses on forecast average feed grades, expected recoveries, and estimated development capex.

Now, UBS can see the advantages of a smaller project including lower capital expenditure and reduced risks around funding, execution and permitting.

For 29Metals, December quarter copper and zinc production proved respectively -20% and -11% below Outperform-rated Macquarie’s estimates. Maiden 2024 copper and zinc production guidance also fell a little short of the broker’s forecasts. Morgan Stanley felt the -32% share price drop was overdone and retained an Overweight rating.

December quarter reports for Liontown Resources and IGO were negatively impacted by ongoing falls in lithium prices, with IGO receiving a double-whammy from declining nickel prices.

Hold-rated Morgans suggested Liontown was in a tricky situation with current spot lithium prices indicating a potential funding gap for the development of the Kathleen Valley project.

Without sufficient reason to be more positive on lithium prices, UBS downgraded its IGO rating to Neutral from Buy.

Seven brokers in the database issued new research last week on Mineral Resources resulting in lower average earnings forecasts, though four remained Buy-rated, or equivalent.

Mount Marion’s spodumene realised price declined by -61% in the second quarter, and Wodgina’s battery chemical realised price fell by -45%. Iron ore prices lifted by 20% quarter-on-quarter.

Macquarie noted beats for sales of iron ore and lithium, combined with the strong realised iron ore prices, were offset by the soft lithium pricing. Lower costs reported at both Mt Marion and Wodgina were, however, considered a key positive.

For the overall sector, Morgans feels the down cycle has largely played out, presenting some attractive value opportunities. From among stocks under coverage, it was suggested investors stick with quality: namely Mineral Resources and Pilbara Minerals, which are both assigned Add recommendations.

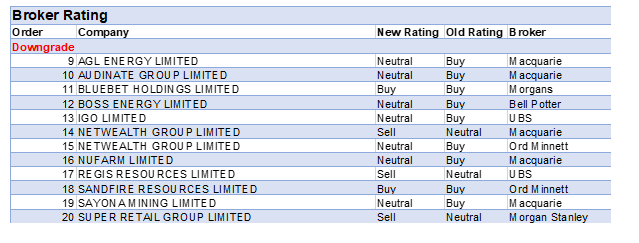

While earnings forecasts edged up last week for Netwealth Group after second quarter results, two brokers downgraded ratings. Ord Minnett downgraded to Hold from Accumulate on valuation, after recent share price appreciation, while Macquarie downgraded to Underperform from Neutral with the stock seen as “priced for perfection.”

In the good books: upgrades

ALTIUM ((ALU)) was upgraded to Buy from Neutral by Citi. B/H/S: 3/3/0

Citi suggests artificial intelligence provides a tailwind for Altium as it could increase revenue share of design tools, relative to designers.

However, the key reason the broker upgrades its rating to Buy from Neutral is because Altium365 expands the company’s total addressable market (TAM) into the Enterprise segment. This is achieved by building industry specific solutions/workflows on A365.

The greater TAM also increases monetisation of the existing user base and expansion beyond PCB designers, explains the analyst. The target price is increased by 21% to $56.60.

BAPCOR LIMITED ((BAP)) was upgraded to Add from Hold by Morgans. B/H/S: 2/3/1

Bapcor’s 1H trading update was overall in line with consensus expectations, according to Morgans. While earnings (EBITDA) in Retail were down -13% on the previous corresponding period, they were in line with the broker’s forecast.

Regarding the multi-year transformation program, management reconfirmed Better-than-Before (BTB) targets for the 2H.

Despite the broker’s lower EPS forecasts over FY24-26 and target price of $6.60, down from $6.95, the rating is upgraded to Add from Hold on valuation and potential earnings upside in FY25.

CHALICE MINING LIMITED ((CHN)) was upgraded to Buy from Neutral by UBS. B/H/S: 3/1/0

Chalice Mining is shaping up to be a smaller, higher-grade scenario than UBS had initially envisaged. The broker points out a smaller project brings the benefits of reduced capital expenditure and reduced risk around funding, execution and permitting.

The broker is now modelling the mine as a 2-4m tonne per annum open and underground pit project, with a ten year lifespan.

With the stock’s share price declining -83% since August the broker sees sufficient value to upgrade the rating, while the target price reduces given the smaller scenario.

The rating is upgraded to Buy from Neutral, and the target price decreases to $1.45 from $3.00.

IGO LIMITED ((IGO)) was upgraded to Buy from Neutral by Citi. B/H/S: 3/2/0

A shift to lagged monthly lithium pricing from lagged quarterly lithium pricing will see IGO’s Greenbushes offtake sell at closer to spot pricing.

For the March quarter, Citi now anticipates a realised price of US$1,007 per tonne, compared to the US$2,984 per tonne achieved in the December quarter. The broker expects the bulk of asset earnings downgrades from the company for the financial year are done.

The broker highlights the decision to continue building inventory does reduce profits for Greenbushes in the present but should see IGO with 50,000 tonnes of lithium carbonate equivalent in inventory by mid-2024.

The rating is upgraded to Buy from Neutral and the target price of $8.90 is retained.

See also IGO downgrade.

KEYPATH EDUCATION INTERNATIONAL INC ((KED)) was upgraded to Outperform from Neutral by Macquarie. B/H/S: 2/0/0

Keypath Education International’s pre-released first half result showed revenues up 14% compared to Macquarie’s 2% estimate. The broker has increased FY24 forecasts to the top of the target range, reflecting revenue and cost performance.

Keypath’s business transition continues, Macquarie notes. Management is targeting adjusted earnings profitability from the second half and holds sufficient cash to support the business.

Upgrade to Outperform from Neutral. Target rises to 46c from 45c.

MADER GROUP LIMITED ((MAD)) was upgraded to Buy from Hold by Bell Potter. B/H/S: 1/0/0

Outperformance from Mader Group’s Australian operations, delivering revenue of $141m, went some way in offsetting a weaker December quarter for the North American segment, which delivered $45.7m in revenue.

North American revenue represented a -6% quarter-on-quarter decline, with Bell Potter explaining the result was due to the timing of workforce redeployment.

The company closed out the quarter with $35.3m in net debt, down from $40.4m at the end of the previous quarter and continues to target zero debt over the medium term.

The rating is upgraded to Buy from Hold and the target price increases to $7.30 from $7.05.

PALADIN ENERGY LIMITED ((PDN)) was upgraded to Buy from Neutral by Citi and to Buy from Hold by Bell Potter. B/H/S: 4/0/0

Following last Thursday’s quarterly cashflow and activities reports, and higher uranium price forecasts by Citi, the broker upgrades its rating for Paladin Energy to Buy from Neutral. The target is also increased to $1.45 from $1.05.

Citi raises its uranium forecasts in the expectation of a more imminent Russian nuclear fuel ban and potential for ongoing mine development issues in both Niger and Kazakhstan.

The broker forecasts U3O8 will average US$101/lb in 2024 and US$110/lb in 2025, while the long-term forecast is raised to US$115/lb from US$87/lb.

The analyst highlights from the quarterly results first ore feed into the Langer Heinrich processing plant occurred on January 20, with first commercial production still due at the end of Q1 this year.

Paladin Energy’s Langer Heinrich mine moved closer to a restart in the December quarter, with the company closing out the period with the announcement that first ore had been fed into the mine’s beneficiation plant.

The company aims to remain on track for first production around the end of the third quarter.

Bell Potter estimates a further US$40m in capital expenditure ahead of the restart, and with Paladin Energy closing out the quarter with US$61m in cash and a debt facility of US$150m, the company should be left with a liquidity buffer of US$170m.

The rating is upgraded to Buy from Hold and the target price increases to $1.60 from $1.31.

In the not so good books: downgrades

AUDINATE GROUP LIMITED ((AD8)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 2/2/0

In updating its model for Audinate Group, Macquarie notes Pro AV market growth is GDP-linked due to the timing of equipment-upgrade cycles. The broker raises terminal penetration to reflect the structural trend of analogue to digital networking.

Although Audinate is dominant in the audio hardware market, this is 16.5% of Macquarie’s estimated terminal total addressable market and Video & Software opportunities are early stage.

The broker continues to like Audinate, with delivery on its strategy of growing the Dante-enabled network. However, with well-flagged M&A on the horizon and associated execution and reinvestment risks, Macquarie downgrades to Neutral from Outperform.

Target rises to $15.80 from $13.50.

AGL ENERGY LIMITED ((AGL)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 2/3/0

Electricity forward curves since December have not improved, Macquarie notes, with the summer surge not emerging. The broker anticipates this will limit AGL Energy’s trading opportunities in FY24 around additional unhedged base load power and the renewable portfolio.

The retail operating environment indicates higher churn across major markets of NSW and Victoria.

The broker has revised its target down to $9.30 from $10.89, reflecting the softer electricity pricing. Upside is volatility is re-emerging, Macquarie adds. Downgrade to Neutral from Outperform.

BLUEBET HOLDINGS LIMITED ((BBT)) was downgraded to Speculative Buy from Add by Morgans. B/H/S: 2/0/0

Commenting on 2Q results for BlueBet Holdings, Morgans remains optimistic about medium-term earnings growth in Australia.

Both Gross and Net Win metrics had impressive increases in the quarter of 15% and 18%, respectively, due to a significant reduction in customer acquisition costs, explains the broker.

Over in the US, operations continue to scale nicely, according to the analyst, with more details awaited at interim results.

The rating is downgraded to Speculative Buy from Add given BlueBet’s higher-risk nature and substantial risk/reward profile. The 70c target is maintained.

BOSS ENERGY LIMITED ((BOE)) was downgraded to Hold from Buy by Bell Potter. B/H/S: 1/2/0

A busy second quarter from Boss Energy, as per Bell Potter, saw the company commence an infill and scout drilling program at Jasons, secure its first long-term offtake with a US utility.

Boss Energy also reported the successful flushing of the first wellfield in preparation for the introduction of ferric in the pregnant leach solution.

According to Bell Potter, Boss Energy is the uranium stock most leveraged to continued spot price momentum. The broker has lifted short and mid-term uranium pricing, anticipating a peak of US$130 per pound, driving earnings upgrades to FY25 and FY26.

The rating is downgraded to Hold from Buy, and the target price increases to $6.41 from $5.69.

IGO LIMITED ((IGO)) was downgraded to Neutral from Buy by UBS. B/H/S: 3/2/0

IGO continues its business reset, as per UBS, with the company this morning announcing its Cosmos site would be going into care and maintenance. The company has trimmed its full year nickel guidance accordingly.

The broker considers spodumene pricing and a sales volume ramp up from Greenbushes to be IGO’s key value drivers at this point but showed concern around downside to its forecasts given spot pricing and an undersupply coming out of the market.

Without sufficient reason to be more positive on lithium prices, UBS downgrades to Neutral from Buy, and the target price decreases to $8.30 from $9.50 accounting for downgraded nickel and lithium valuations.

See also IGO upgrade.

NUFARM LIMITED ((NUF)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 4/3/0

Nufarm’s AGM update warned of a weaker first half than previously expected. Macquarie highlights the earnings skew moving closer to a more normal 55/45%, implying first half earnings down significantly year on year on tough comparables, rebounding in the second half.

While improving seasonal conditions in Australia are positive, North America and Europe are Nufarm’s largest profit regions and remain challenged, Macquarie notes.

The stock has had a good run off its October lows so the broker downgrades to Neutral from Outperform. Target falls to $5.73 from $5.80.

NETWEALTH GROUP LIMITED ((NWL)) was downgraded to Underperform from Neutral by Macquarie and o Hold from Accumulate by Ord Minnett. B/H/S: 2/3/1

Netwealth Group’s Dec Q custodial net inflows of $2.6bn were ahead of Macquarie’s expectations of $2.0bn. Market movements of positive $3.4bn (up 4.7%) were a tailwind.

Gross outflows continued to moderate and are now closer to trend levels, the broker notes.

The percentage of cash balances held has continued to decline, lured away by term deposit rates. Netwealth has announced measures to offset this, but Macquarie suggests higher rates and improved equity market sentiment will likely keep cash at lower levels.

Improved flows and market movements see the target rise to $14.80 from $14.20. But with the stock “priced for perfection”, downgrade to Underperform from Neutral.

Following a higher than expected 2Q funds under management (FUM) number for Netwealth Group, Ord Minnett raises its target to $16.50 from $14.70. FUA (administration) at the end of the period of $78.0bn marked an 8.4% rise over the quarter.

In a sign the threat posed by term deposits is easing, suggests the broker, gross outflows fell, and gross inflows increased. However, the group’s valuation is now considered demanding following recent share price appreciation, and the broker’s rating is downgraded to Hold from Accumulate.

REGIS RESOURCES LIMITED ((RRL)) was downgraded to Sell from Neutral by UBS. B/H/S: 4/0/2

Production and costs (AISC) in the 2Q for Regis Resources were in line with forecasts by consensus and UBS, while FY24 guidance for both was unchanged.

Following an around 20% share price rally in the past two months, the broker downgrades the rating to Sell from Neutral, and also suggests there are better alternatives within the Gold sector.

The target rises to $1.90 from $1.86.

SANDFIRE RESOURCES LIMITED ((SFR)) was downgraded to Accumulate from Buy by Ord Minnett. B/H/S: 3/3/0

While Ord Minnett assesses another solid quarterly (Q2) result for Sandfire Resources, a 23% share price rally since October results in a rating downgrade to Accumulate from Buy.

Slight lower 2Q copper production than the analyst expected was offset by a beat for zinc production following re-sequencing at Magdalena.

The Matsa-owned Aguas Tenidas in Spain also experienced positive grade reconciliation and improved recoveries from low-pyrite poly ore, explains the broker.

Management’s copper production guidance is unchanged.

The target rises to $7.50 from $7.10 as Ord Minnett rolls-forward the financial model, which captures higher near-term cash flows.

SUPER RETAIL GROUP LIMITED ((SUL)) was downgraded to Underweight from Equal weight by Morgan Stanley. B/H/S: 1/2/3

Morgan Stanley downgrades its rating for Super Retail to Underweight from Equal weight.

More generally, the broker remains Underweight the Discretionary Retail sector, with stocks under coverage trading above mid-cycle valuations, with only limited potential for significant earnings upgrades.

The target rises to $13.20 from $11.50. Industry view is In-Line.

SAYONA MINING LIMITED ((SYA)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 0/1/0

Sayona Mining’s solid Dec Q production was offset by soft sales and weak realised prices, Macquarie notes. Operating costs in the quarter were 22% higher than the broker’s estimates, with an optimisation review underway.

The company is at a crossroads, Macquarie suggests, to balance its cash flow, organic growth and meeting its offtake commitments. Cost optimisation remains a key focus in the near term.

The broker’s production and sales forecasts are both at the lower end of guidance. Target falls to 4c from 9c, downgrade to Neutral from Outperform.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.