If ever you needed convincing that the brewing market forces are set to deliver a period of positivity, then the reaction of Wall Street on Friday should reinforce the likelihood that 2024 should be a good one for investors.

In case you missed it, the Yanks got a better-than- expected jobs report with 353,000 jobs showing up, when economists expected 180,000. Meanwhile unemployment stayed at a low 3.7%. This should have hurt stock prices, given what we saw from early 2022, when a strong economic reading meant more inflation, more rate rises and more pain for investors in tech and growth stocks.

But that was then. This is now.

While the news KO’s a March cut in rates, which would be another stimulus for more rises in stock prices, the prevailing view is that the run of economic data of late says the following:

1. The US isn’t heading for a recession, so buy stocks.

2. Inflation is falling, as the latest Personal Consumption Expenditure (PCE) reading showed and rates will be cut in 2024, so buy stocks.

3. The jobs report said productivity remains strong and that’s good for profits, so buy stocks!

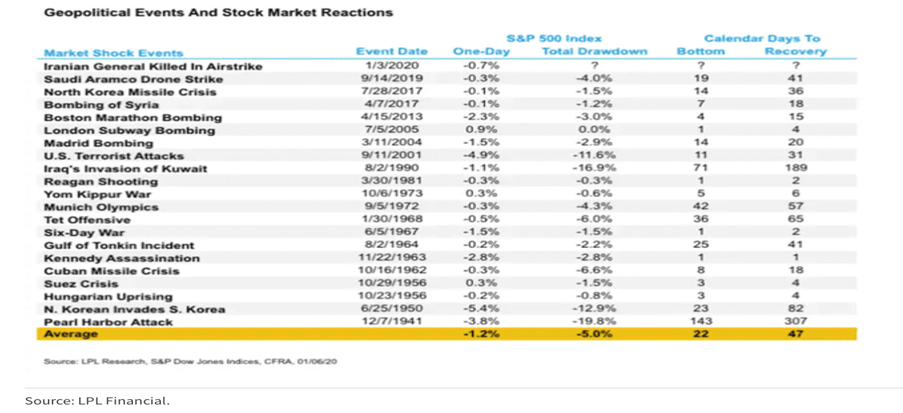

Sure, Russia, China and the Middle East could throw curve balls, but I’ve shown you before that markets tend to overreact on initial news of a geopolitical crisis but then rebound pretty quickly.

This table below shows how markets react to hot war conflicts and has always made me less negative about what will happen to my investments when drama strikes.

Keeping my confidence up is the history of the fourth year of a US Presidency, which has proved to be the second best year for Wall Street. And the fact that a lot of US growth companies haven’t had the gains of some of the huge tech stocks such as the so-called Magnificent Seven companies (namely Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla). These had collectively risen nearly 117% by late January, far outpacing the performance of the other 493 companies in the S&P 500.

To add to my argument, Forbes reported that “the Equal Weight Index only earned 12% last year but without the Magnificent Seven, the index would have risen only 8%!

That’s why I think the US market, powered by eventual rate cuts, no more rate rises and no recession fears, should keep Wall Street giving us a good lead-in each week of trading in 2024.

Also, our market is up only 2.1% for the past 12 months, while the S&P 500 has spiked 20.6% but a lot of that has been Magnificent Seven driven.

So, what should do well this year?

In simple terms, those companies that were smashed because of rising inflation and interest rates. I’ll search for a few of these in moment but in a general sense, if I want to make money out of a rising market, these Exchange Traded Funds look useful:

1. Vanguard Australian Shares Index ETF for our top 300 stocks.

2. IHVV: iShares S&P 500 (AUD Hedged) ETF. This is hedged for a rising Oz dollar.

3. HNDQ: NASDAQ 100 ETF Currency Hedged from BetaShares. This Index comprises 100 of the largest non-financial companies listed on the NASDAQ market and includes many companies at the forefront of the new economy. This also hedged for a rising $A.

4. GEAR from BetaShares, which is a hedge fund with a magnification effect for a rising and a falling market. This is risky and the current unit price is $27.48, and given the all-time high was just under $30 in August 2021, it’s a much riskier play than when I first wrote about it last year, when it was $21. I suspect we’ll see a new all-time high, but it is for the thrill seeker, so be warned!

5. If you want growth and income, the Vanguard Australian Shares High Yield ETF has been a good performer. And if you want diversity, you could mix it with another income/growth fund, such as the Switzer Dividend Growth Fund.

Looking for stocks that will be in sectors that should get re-loved, let’s try tech companies first.

For a safe one, Next DC (NXT) has a 5.7% consensus rise ahead, if you believe analysts, but UBS thinks it could be 20.28%, while Macquarie says 18.88%. Many of our good tech companies have been snapped up, with Xero (XRO) up 38.92% for the past 12 months, while my favourite Megaport (MP1) has put on 118%!

REITS are expected to benefit from falling interest rates, but you do have to be careful of the vacant office block issue. The good ones such as Goodman (GMG) and Charter Hall CLW have losses or small gains ahead but the riskier plays such as LendLease (LLC) might be one for the courageous. The consensus rise is 36.4% but the most positive is Ord Minnett with a 97% higher call than its current share price of $9.99.

In the healthcare space, I still like Resmed (RMD), despite its 36% rise since late October. The consensus guess is 16.3% higher but Ord Minnett can see a 32% rise ahead. Even if this is too ambitious, I’ll be surprised if RMD doesn’t deliver a 10% gain this year.

And if you want to play biotech, Jun Bei Liu likes Telix (TLX) because she says it’s like a fund management business that searches for businesses with good potential. The analysts tip a 16.5% rise ahead this year and both UBS and Bell Potter agree on the same expected rise.

Biotech is risky but JBL says this is a good way to play it, and she has a lot of confidence in the founder, Christian Behrenbruch.

There’s both my pretty safe way of playing 2024 via funds, and more risky plays of backing companies that look to benefit from being growth companies in a falling inflation and interest rate environment.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.