In the good books: Upgrades

- A2 MILK COMPANY LIMITED ((A2M)) was upgraded to Add from Hold by Morgans and to Neutral from Underperform by Macquarie. B/H/S: 3/3/0

Under difficult market conditions, a2 Milk Co’s FY23 result was slightly better than Morgans expected. Execution was considered strong particularly for the China label infant formula (IF) and the English Label cross-border e-commerce (CBEC) IF products.

Guidance was conservative for China label IF, in the broker’s opinion, which results in material downgrades to Morgans forecasts. Both FY24 sales (low single digit growth) and margin (flat) guidance were lower than consensus was expecting.

Despite near-term uncertainties, the analysts believe decent growth will resume in FY25 and FY26 and upgrade the rating to Add from Hold. It’s noted the company has a strong brand and balance sheet and shares are trading on the lowest multiples in years.

The target falls to $5.40 from $6.05.

a2 Milk reported FY23 results in line with guidance, but FY24 guidance came in well below Macquarie’s forecast. The revenue outlook is

softer on expected category headwinds and label transition, while earnings guidance is -11-13% below consensus.

Margins are unlikely to lift in FY24, but FY25 should see improvement, the broker suggests, on improved ingredient prices.

Macquarie has cut earnings forecasts and its target to $4.40 from $4.65, but upgrades to Neutral from Underperform on improving valuation at 20x PE and more balanced risk/reward following reset FY24 expectations.

- ALUMINA LIMITED ((AWC)) was upgraded to Neutral from Sell by Citi. B/H/S: 1/2/1

Alumina Ltd posted a net loss of -US$38.7m, far larger than Citi anticipated. The company called out extended delays and continued uncertainty with permits in Western Australia plus lower quality bauxite.

The broker believes the business has enough financial headroom to avoid an equity raising with debt likely peaking in the first half of 2024 although tight AWAC capital management will be required.

While acknowledging the uncertainties regarding mining approvals in WA, Citi upgrades to Neutral from Sell. Target is reduced to $1.30 from $1.40.

- ACCENT GROUP LIMITED ((AX1)) was upgraded to Buy from Neutral by Citi. B/H/S: 2/2/1

Accent Group’s FY23 result revealed sufficient positives for Citi to upgrade its rating for the shares to Buy from Neutral. The broker mentions “demonstrated material progress” with management’s vertical strategy.

Part of the positive thesis is based on higher margins, now believed to be sustainable. Citi believes sales trends are better. Historical comparables do not get more challenging from here.

Estimates have been upgraded by 8% and 18% respectively for FY24 and FY25. Target price climbs 18% to $2.12.

- DATA#3 LIMITED. ((DTL)) was upgraded to Add from Hold by Morgans. B/H/S: 2/0/0

While FY23 profit (PBT) for Data#3 was an -8% miss compared to the consensus expectation, Morgans upgrades its rating to Add from Hold following share price weakness in reaction to the announcement.

Year-on-year, gross profit rose by 15% and EPS and DPS were up 22% in what the analysts consider a strong overall result. It’s also felt the outlook is positive with management aiming to deliver double-digit growth again in FY24.

Management’s confidence springs from structural tailwinds such as digitisation, cloud and generative AI, along with a resilient customer base in the current economic climate. The target slips to $6.50 from $6.70.

- IDP EDUCATION LIMITED ((IEL)) was upgraded to Add from Hold by Morgans and to Neutral from Underperform by Macquarie. B/H/S: 3/3/0

IDP Education’s FY23 results were in line with Morgans expectations with softer 2H IELTS volumes offset by stronger Australian student placement (SP). It’s thought SP will continue to drive strong compound growth to FY26.

Second half IELTS volumes were impacted by a market issue in Canada, stemming from visa delays, and some heightened competition, note the analysts.

Leads, Applications and Enrolments grew by 26%, 40% and 53%, respectively for SP in FY23. The broker explains system growth remained solid across all jurisdictions and the company’s Fastlane technology enabled market share gains, primarily in Australia.

The rating is upgraded to Add from Hold and the target rises to $27.90 from $27.70.

IDP Education’s FY23 result fell -1% shy of consensus but outpaced Macquarie’s forecasts by 9%.

The broker observes the company made strong market-share gains in student placements, and that this is more than offsetting competitive risks in the IELTS (international) market.

The company reported record margins of 23%. EPS forecasts rise 15% in FY24; 22% in FY25; and 24% in FY26.

Rating upgraded to Neutral from Underperform. Target price rises 24% to $26 from $21.

See also IEL downgrade below.

- IRESS LIMITED ((IRE)) was upgraded to Add from Hold by Morgans. B/H/S: 2/2/0

First half revenue for Iress was slightly ahead of Morgans forecast but earnings (EBITDA) were an around -8% miss on meaningful cost growth. Given the gearing level, the non-dividend payment was not unexpected.

Management anticipates a flat 2H earnings result and 5-10% growth in FY24 and believes the company will exit FY24 with a 20-30% run-rate.

The analyst anticipates gearing levels will improve via not paying a dividend, cost-out measures and the announced sale of the managed funds administration (MFA) business for $52m.

Morgans makes material downgrades to its earnings forecasts and lowers its target to $8.10 from $10.30. The rating is upgraded to Add from Hold on confidence in degearing the balance sheet and in a greater focus on core products.

- LOVISA HOLDINGS LIMITED ((LOV)) was upgraded to Neutral from Sell by Citi and to Overweight from Equal weight by Morgan Stanley. B/H/S: 5/2/0

Citi had downgraded its rating for Lovisa Holdings in June to Sell from Neutral on concerns declining foot traffic in general and weaker sales trends revealed by other retailers may impact.

The broker now argues that thesis has come to fruition with the retailer’s release of FY23 financials. Now the rating goes back up to Neutral from Sell. Target price climbs to $22.30 from $16.

Lovisa is still expanding at a rapid pace, the broker acknowledges, just not as fast as the market had been expecting. Better cost management sees the broker lifting forecasts.

FY23 results from Lovisa Holdings were a slight miss on Morgan Stanley’s forecasts. The broker was previously concerned about growth in store numbers, negative comparables and higher reinvestment yet now believes these issues are better understood.

The potential for long-term rolling out of stores continues and this is key to the share performance, even though the rate may decelerate, and Morgan Stanley lifts its terminal store count to around 18,000 implying an 8% compound growth rate.

The broker acknowledges comparables will likely remain negative throughout the first half of FY24 after cycling multiple years of re-opening tailwinds and price increases.

Rating is upgraded to Overweight from Equal-weight and the target lifted to $25.25 from $23.50. Industry View: In-Line.

- MONADELPHOUS GROUP LIMITED ((MND)) was upgraded to Outperform from Neutral by Macquarie. B/H/S: 2/2/0

Macquarie upgrades Monadelphous Group’s rating to Outperform from Neutral, following the FY23 result.

The company’s FY23 result met Macquarie’s forecasts, thanks to solid maintenance revenue and cash flow and a strong outlook for markets.

Margins disappointed at 5.8%, down from 6.1% due to weaker construction revenue on a steady headcount, and lower fixed cost absorption.

Management forecasts a steady rise in Engineering Construction revenue in FY24, which Macquarie expects will be skewed to the June half, and the broker expects a full recovery in FY25. Continued growth in Maintenance (71% of revenue) is also forecast.

EPS forecasts rise 0.2% in FY24; 1% in FY25; and fall -2.4% in FY26 (to reflect an uptick in depreciation). Target price rises to $14.50 from $13.48.

- MEGAPORT LIMITED ((MP1)) was upgraded to Outperform from Neutral by Macquarie. B/H/S: 3/3/0

Megaport’s FY23 result met the pre-release but FY24 guidance outpaced initial guidance, thanks to the full benefit of the cost out flowing through.

While FY24 guidance fell short of the broker’s forecast, Macquarie considers it to be conservative, citing strong revenue growth, rising sales headcount and demand for extra products.

EPS forecasts rise 39% in FY24; 13% in FY25; and 17% in FY26.

Rating upgraded to Outperform from Neutral. Target prices jumps 50% to $18 from $12.

See also MP1 downgrade.

- NANOSONICS LIMITED ((NAN)) was upgraded to Hold from Sell by Bell Potter. B/H/S: 1/1/1

Nanosonics’s FY23 result nosed out consensus off a low base, says Bell Potter.

The broker observes market penetration of Trophon in the US is rising, and nearing 50%, but that growth for new installations was flat to lower. US consumables grew 38% in total, thanks to the growth in the installed base and price rises.

The Federal Drug Administration requires the company to complete further testing of the CORIS device in the US, which the broker says is likely to delay US regulatory submissions until the March quarter, so management expects CORIS is likely to be launched in Australia and Europe first, in the June half. Nanoionics pegs a US launch after 2025.

Rating upgraded to Hold from Sell. Target price rises to $4.85 from $4.15.

- NATIONAL STORAGE REIT ((NSR)) was upgraded to Neutral from Underperform by Macquarie. B/H/S: 0/3/1

National Storage REIT’s underlying earnings were in line with Macquarie’s estimates in FY23 while FY24 underlying EPS guidance is 14% ahead of expectations.

Although there is limited evidence of distress, the company has indicated that vendors are considering asset sales as they become more cautious about the macro-economic outlook.

As gearing is at 20% following the equity raising in March, the broker believes the business is well able to take advantage of opportunities for acquisitions in the medium term. Rating is upgraded to Neutral from Underperform and the target lifted to $2.30 from $2.23.

- PERENTI LIMITED ((PRN)) was upgraded to Buy from Neutral by Citi. B/H/S: 2/0/0

Citi would not be surprised if there are multiple guidance upgrades throughout FY24 as Perenti, through its FY23 results, continues to demonstrate an ability to deliver improvements in productivity.

FY23 EBITA is considered to be an appropriate base and the broker forecasts $257m in FY24. Management’s FY24 guidance might have disappointed the market, but Citi believes it is likely to prove conservative.

The broker believes there are sufficient tailwinds to fuel growth in the business and on that basis believes the sell-off is overdone, upgrading to Buy from Neutral. Target is unchanged at $1.25.

- RAMSAY HEALTH CARE LIMITED ((RHC)) was upgraded to Equal-weight from Underweight by Morgan Stanley. B/H/S: 1/4/0

FY23 results missed expectations and margin recovery is now expected to be slower. Morgan Stanley observes challenges to the system have been emphasised by the pandemic and this is evident in the FY24 outlook.

Ramsay Health Care has indicated the operating environment has been more inconsistent than previously anticipated. Margin recovery continues to be dampened by labour shortages that restrict capacity utilisation.

Despite downgrading estimates, the broker believes expectations are now more reasonable and further downside in the near term to earnings is unlikely.

As the stock is now trading close to its bear case-weighted price target of $49.60, reduced from $53.60, the rating is upgraded to Equal-weight from Underweight. Industry view: In-Line.

- REGIS RESOURCES LIMITED ((RRL)) was upgraded to Add from Hold by Morgans. B/H/S: 4/1/1

Due to a FY23 realignment of the production and cost profile, Morgans lowers its target price for Regis Resources to $1.74 from $1.87 and upgrades its rating to Add from Hold.

The company posted a 10.4% rise in earnings compared to FY22, while total gold production of 458 koz at an all-in sustaining cost (AISC) of $1,805/oz was broadly in line with consensus.

Management anticipates improvements in cashflows as low-price hedges roll off. The hedge book reduced by -100koz to 120koz and is on track to be closed out by the end of FY24, notes the analyst.

- SITEMINDER LIMITED ((SDR)) was upgraded to Add from Hold by Morgans. B/H/S: 4/1/0

A strong 2H performance within FY23 results for SiteMinder was due to better-than-expected property additions, transaction product uptake, gross margins and unit economics, explains Morgans.

Overall, FY23 earnings and profit were in line with the analysts’ forecast, but below consensus. There was considered to be a material improvement in profitability during the 2H compared to the 1H, driven by operating leverage, scale and the company’s cost out program.

The broker upgrades its rating to Add from Hold and raises its target to $4.80 from $3.80. These changes also incorporate recently upgraded FY24 guidance for positive underlying earnings (EBITDA) and free cash flow brought forward to the 2H of FY24 from Q4.

- WOOLWORTHS GROUP LIMITED ((WOW)) was upgraded to Add from Hold by Morgans. B/H/S: 3/1/2

Woolworths Group’s FY23 results were in line with consensus and recorded earnings (EBIT) and underlying profit beats against Morgans forecasts by 2% and 3%, respectively.

The key positive surprise for the broker was strong earnings growth in Australian Food. The group earnings margin rose by 40bps to 4.8%. On the flipside, the outlook for Big W is considered challenging due to a broader slowdown in consumer spending.

Sales for the first eight weeks of FY24 have exhibited similar trends to the 4Q of FY23, according to management, with solid growth in the Food businesses, but lower Big W sales.

The broker’s target rises to $41.30 from $38.50 and the rating is upgraded to Add from Hold on rising population growth and a shift to in-home consumption, along with defensive characteristics suited to a tougher economic climate.

In the not so good books: Downgrades

- AMPOL LIMITED ((ALD)) was downgraded to Neutral from Buy by UBS. B/H/S: 1/3/0

Ampol’s first half results were ahead of UBS estimates primarily because of lower effective tax rates. The broker believes the convenience division is showing signs of strain.

The broker says the exit of the MetroGo partnership with Woolworths to convert the sites back to Foodary has moved the offering to an increasingly tiered approach in order to capture additional margin for premium stores.

UBS suspects the upside from the strategy is largely offset by sales pressure and now assumes limited shop margin growth.

There is potential for a fully franked special dividend at the end of the year yet the broker forecasts flat EBIT and downgrades to Neutral from Buy on valuation. Target edges down to $32.60 from $33.30.

- EAGERS AUTOMOTIVE LIMITED ((APE)) was downgraded to Hold from Buy by Bell Potter. B/H/S: 3/4/0

Eagers Automotive posted a first half result that was slightly ahead of expectations. Operating cash flow was strong and the interim dividend of $0.24 exceeded forecasts and was a record.

The company has indicated it is on track to exceed its 2023 revenue forecasts. Recent improvements have occurred in deliveries, and this is expected to continue into the second half.

Bell Potter makes little change to pre-tax profit forecast and increases revenue forecasts for 2023-25 by 3-7%, although this has been largely offset at the underlying operating profit level by higher forecast net interest expense.

Rating is downgraded to Hold from Buy, and the target raised to $15.25 from $15.15.

- COLLINS FOODS LIMITED ((CKF)) was downgraded to Neutral from Buy by Citi. B/H/S: 2/3/0

Citi is increasingly cautious about the margin outlook as Inghams Group ((ING)), one of four chicken suppliers, has signalled selling prices continue to increase and Collins Foods has remained disciplined in keeping menu price increases low relative to other quick service restaurants.

The broker’s view on the long-term growth potential in Europe is unchanged, but the rating is downgraded to Neutral from Buy, given the increased risk to margins over the short term.

The company warned at its FY23 conference call that it would not see any margin benefits in 2023 from the recent moderation of canola prices. Citi reduces the target to $11.25 from $12.80.

- COLES GROUP LIMITED ((COL)) was downgraded to Hold from Add by Morgans. B/H/S: 2/2/1

Morgans lowers its target for Coles Group to $16.90 from $19.95 and downgrades its rating to Hold from Add after FY23 results came in below expectations with margins impacted by cost inflation.

While product availability and volumes in Supermarkets improved over FY23, the earnings margin for this division fell by -20bps to 4.8%, explains the analyst. More positively, Liquor earnings were an 8% beat with strong 2H growth and margin improvement.

Total loss (including stock loss) in Supermarkets jumped by around -20%, while total capex on e-commerce is now going to be circa -$400m versus the -$330m originally planned, due to commissioning delays at fulfilment centres.

- CEDAR WOODS PROPERTIES LIMITED ((CWP)) was downgraded to Hold from Buy by Bell Potter. B/H/S: 0/2/0

Cedar Woods Properties FY23 result was broadly in line with Bell Potter’s forecasts, although turnover proved a beat thanks to a high number of property settlements in June, largely from apartments. Its full-year dividend has fallen to 20c from an expected 26c.

No FY24 guidance was provided given uncertainty around construction costs and interest rates.

Bell Potter appreciates that Cedar Woods Properties is exposed to the more affordable end of the market and expects an uptick in sales when interest rates stabilise. But construction costs are expected to continue to pressure margins and the broker expect margins will be stable in FY24.

EPS forecasts fall -9.3% in FY24; and -13.7% in FY25.

Rating downgraded to Hold from Buy. Target price rises to $5.30 from $5.20.

- DOMAIN HOLDINGS AUSTRALIA LIMITED ((DHG)) was downgraded to Underperform from Neutral by Macquarie. B/H/S: 0/3/1

The FY23 EBITDA from Domain Holdings Australia was down -13% and below Macquarie’s forecasts.

The company has guided to operating expenditure growth in the mid-to high single digits for FY24, higher than expected, while trading in the first six weeks reflects an early recovery in listings, the broker observes.

Domain Holdings has indicated it will sell the home loans business as it is not performing to expectations.

Macquarie observes the stock has had a “good run based on dwelling price movements” and screens expensive. Rating is downgraded to Underperform from Neutral. Target is reduced by -30% to $2.80.

- EBOS GROUP LIMITED ((EBO)) was downgraded to Sell from Neutral by Citi. B/H/S: 3/0/1

FY23 results were in line with expectations. Citi observes management has been able to offset cost inflation and therefore expects to maintain margins in FY24.

No numerical guidance was provided, and the broker points out cost inflation, the introduction of 60-day dispensing, and the unwinding of the Chemist Warehouse contract are risks for the short term which do not seem to be reflected in the valuation multiple.

Rating is downgraded to Sell from Neutral as organic revenue growth is expected to decelerate. Target is reduced to $32 from $36.

- ELANOR COMMERCIAL PROPERTY FUND ((ECF)) was downgraded to Hold from Accumulate by Ord Minnett. B/H/S: 0/1/0

Following Elanor Commercial Property Fund’s FY23 results, Ord Minnett downgrades its rating to Hold from Accumulate on caution around the Office sector outlook.

FY23 funds from operations (FFO) were in line with the broker’s forecasts though the implied FY24 guidance of 10cpu falls short of the consensus expectation for 10.6cpu.

This guidance includes the divestment of Nexus and Limestone Centre in October last year. Proceeds will be used to reduce debt, explain the analysts.

Ord Minnett’s target falls to 83c from 97c partly because a further 50bps cap rate expansion is assumed.

- ESTIA HEALTH LIMITED ((EHE)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 0/1/0

Estia Health’s underlying earnings fell -6% short of Macquarie but the result showed half on half earnings improvement, with increased

occupancy and higher government revenue more than offsetting wage costs and inflation.

Occupancy continues to improve and refundable accommodation deposit (RAD) flows are solid.

Estia expects a broadly neutral outcome for the sector in FY24 from the combined effect of increased government funding, the 15% increase in the Aged Care Award, mandated minimum care minutes, and general wage increases and inflation.

Target falls to $3.08 in line with the private equity takeover bid of $3.20 minus the dividend. Downgrade to Neutral from Outperform.

- HUB24 LIMITED ((HUB)) was downgrade to Neutral from Outperform by Macquarie and to Hold from Add by Morgans and to Neutral from Buy by UBS. B/H/S: 2/4/0

Hub24’s FY23 result outpaced consensus’ and Macquarie’s forecasts by 2% to 3%, thanks to a 23% beat on platform cost growth and a lower tax rate. FY25 guidance was a beat of similar magnitude to the result.

EPS forecasts rise 5.8% in FY24; 6.2% in FY25; and 6% to 7% thereafter to reflect the lower tax rate and cost base.

Rating is downgraded to Neutral from Outperform on valuation. Target price rises to $33.60 from $31.40.

Hub24’s FY23 results were in-line with Morgans expectations with a group profit beat, but only on lower tax.

While the broker likes the long-term growth profile, and ultimately expects share price appreciation, the rating is downgraded to Hold from Add in the hope for a short-term share price pullback. The target rises to $32.80 from $29.50.

Management’s outlook comments were incrementally positive, according to the analysts, with Q1 FY24 flows beginning at a higher run-rate compared to Q4 FY23.

Implying greater than 47% growth over two years, observes the broker, management is targeting funds under administration in FY25 of $92-100bn, up from $80-89bn.

FY23 earnings were slightly weaker than expected yet the outlook from Hub24 was largely positive as funds-under administration guidance has increased by 12-15%, extending out to FY25.

On further analysis, UBS lifts forecasts although notes the reaction in the market leaves only modest upside for the short term and, hence, downgrades to Neutral from Buy.

The $50m buyback was a surprise and could signal a stronger trajectory for organic growth over the next year. Target is raised to $33 from $30.

- IDP EDUCATION LIMITED ((IEL)) was downgraded to Hold from Buy by Bell Potter. B/H/S: 3/3/0

IDP Education posted a strong FY23 result which was broadly in line with Bell Potter’s forecasts. There was no formal outlook although management noted that IELTS is expected to be subdued in FY24 and marketing expenditure will increase in the second half.

The broker downgrades revenue forecasts by less than -2% for both FY24 and FY25 because of reductions in IELTS forecasts and slightly higher overheads. Target is reduced to $26.70 from $27.00 and the rating is downgraded to Hold from Buy. See also IEL upgrade above.

- JUDO CAPITAL HOLDINGS LIMITED ((JDO)) was downgraded to Equal weight from Overweight by Morgan Stanley. B/H/S: 1/2/0

FY23 results from Judo Capital were welcomed in that guidance was achieved and the medium-term “metrics at scale” targets have been maintained.

No specific guidance for FY24 was provided, although the company has signalled a sharp margin decline, and Morgan Stanley reduces its margin forecasts for FY24 by -20 basis points expecting margins to drop as low as 2.8% in the second half.

CEO Joseph Healy stressed the business is managing “growth and margin and risk” and the broker suspects this will lead to slower loan growth, forecasting revenue growth of just 7.5% in FY24.

Rating is downgraded to Equal weight from Overweight and the target lowered to $1.20 from $1.70. Industry View: In-Line.

- MEGAPORT LIMITED ((MP1)) was downgraded to Hold from Add by Morgans. B/H/S: 3/3/0

While FY23 results for Megaport were largely pre-released, FY24 underlying earnings (EBITDA) were upgraded by around 24%.

Following a significant share price rally the broker’s rating is lowered to Hold from Add, while the target increases to $13 from $10.

Every $1 the company spends on Customer Acquisition Cost (CAC) returns 5.5x that in gross profits (Life Time Value), highlight the analysts. The long-term opportunity is considered material. See also MP1 upgrade.

- ORECORP LIMITED ((ORR)) was downgraded to Speculative Hold from Buy by Bell Potter. B/H/S: 0/1/0

OreCorp’s board has unanimously recommended acceptance of the binding scheme of implementation with Silvercorp Metals.

The full takeover will comprise 15c cash and 0.0967 of a Silvercorp share, which was valued at 45c, representing an implied value of 60c a share, a 42% premium on the company’s 20-day weighted average price. Silvercorp will also supply $28m in funding through a 70.4m OreCorp share issue at 40c to develop the Nyanzaga Gold Project (NGP).

Bell Potter says the implied valuation did not match up to its valuation but considered it an attractive deal none-the-less, citing the company’s strong balance sheet (US$200m in cash and no debt) and pointing out the NGP would have required a dilutive equity raising.

Rating downgraded to Speculative Hold from Buy. Target price falls to 53c from 97c.

- PEPPER MONEY LIMITED ((PPM)) was downgraded to Neutral from Buy by Citi. B/H/S: 0/2/0

First half net profit missed Citi’s estimates, entirely because of net interest margins. The broker was surprised by the contraction to a first half exit of 2.04% from the December exit net interest margin of 2.29%.

The broker observes Pepper Money has deliberately sacrificed price, including incomplete customer mortgage price rises to mitigate churn, and, while assets are largely in line with forecasts, this has come at a significantly lower net customer yield.

Rating is downgraded to Neutral from Buy and the target is lowered to $1.45 from $1.90.

PWR HOLDINGS LIMITED ((PWH)) was downgraded to Hold from Buy by Bell Potter. B/H/S: 2/2/0

PWR Holdings delivered a FY23 result that was mixed with revenue and EBITDA slightly beating forecasts while net profit was below. No guidance was provided, in keeping with company policy.

Bell Potter points out the company did signal extensive organic growth opportunities across regions and divisions. OEM remains strong while aerospace & defence has expanded significantly.

The broker modestly upgrades estimates and now forecasts FY24 revenue and net profit growth of 16% and 21%, respectively. Rating is downgraded to Hold from Buy, given the valuation. Target is steady at $10.50.

- REECE LIMITED ((REH)) was downgraded to Reduce from Hold by Morgans and to Lighten from Hold by Ord Minnett. B/H/S: 0/0/4

Despite a slight beat for FY23 results, Morgans downgrades its rating for Reece to Reduce from Hold on valuation and a weaker outlook.

The broker explains the result was mainly driven by price increases, with price growth in the A&NZ region and the US of 9% and14%, respectively, during the year. US earnings growth far exceeded expectation though volumes deteriorated as the year progressed.

Management anticipates volumes will continue to decline and expects margin pressure from higher costs in both regions in FY24.

The target falls to $15.50 from $15.60.

FY23 results from Reece were slightly below Ord Minnett’s forecasts at the net profit line, attributed to a slowing construction market. Demand moderated in the second half and with higher interest charges led to a -9.2% decline in second half net profit.

The broker reduces FY24 and FY25 estimates for earnings by -14.2% and -13.6%, respectively. Amid elevated valuation multiples, Ord Minnett downgrades to Lighten from Hold while raising the target to $16.50 from $15.50.

- RELIANCE WORLDWIDE CORP. LIMITED ((RWC)) was downgraded to Equal weight from Overweight by Morgan Stanley. B/H/S: 2/4/0

Reliance Worldwide delivered a solid FY23 result, either in-line or beating on most metrics, Morgan Stanley notes, but the FY24 outlook

disappointed.

The key negative in the broker’s view is that some -US$16m of cost-outs will be required to maintain rather than boost margins. This

points to modest earnings declines in FY24.

With a more muted growth outlook Morgan Stanley believes the current share price approximates fair value and downgrades to Equal weight from Overweight. Target rises to $4.20 from $4.00. Industry view: In-Line.

- SOUTH32 LIMITED ((S32)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 3/3/0

Macquarie found South32’s FY23 report a rather mixed affair, but with a positive surprise via the declared dividend. FY24 cost guidance proved worse than anticipated.

With higher costs to dominate the outlook, earnings estimates have been pared back. South32 also took a noncash impairment for Hermosa (Taylor deposit) of -US$1.3bn.

Higher costs are also responsible for the broker pulling back its rating to Neutral from Outperform. Earnings estimates have received quite the sizable haircut.

Target price has been cut to $3.60 from $4.40.

- SOUTHERN CROSS MEDIA GROUP LIMITED ((SXL)) was downgraded to Neutral from Buy by UBS. B/H/S: 1/2/1

UBS has downgraded Southern Cross Media to Neutral from Buy with a sharply reduced-price target of 74c versus $1.70 previously.

Continued softness in metro and regional ad markets, combined with a flattish growth outlook into FY24 have triggered large reductions to forecasts for FY24/26.

On current forecasts, FY25 should herald the next cyclical recovery. UBS is notable cautious about the outlook for the TV operations.

More optimistic are the forecasts for Digital where EBITDA break-even is expected in FY25 with an 10% EBITDA margin forecast to steadily grow to 20% longer term.

- WHITEHAVEN COAL LIMITED ((WHC)) was downgraded to Sell from Hold by Bell Potter and to Accumulate from Buy by Ord Minnett and to Neutral from Buy by Citi. B/H/S: 4/2/1

Whitehaven Coal’s FY23 results were in line with expectations. The company has temporarily suspended its share buyback program to provide growth options. Bell Potter finds the initial FY24 production guidance weaker than previously expected with indications of just an 8% increase in ROM coal production and 3% in equity coal sales.

Werris Creek will reach the end of its mine life in the second half while significant capital expenditure is planned, at Narrabri and Vickery, the largest since the development of Maules Creek almost a decade ago.

Thermal coal exposures are increasingly excluded from lender and equity mandates and Bell Potter expects a fragmented supply response in the reshaping of the energy economy will lead to higher costs for capital. Rating is downgraded to Sell from Hold. Target is steady at $6.

According to Ord Minnett, Whitehaven Coal’s FY23 report surprised through a much larger dividend, but guidance for FY24 disappointed through higher costs and higher capex.

FY23 overall was a little above expectations also because costs proved lower-than-expected.

Target price decreases to $7.20 from $8.40 and the broker downgrades to Accumulate from Buy. The suspension of the share buyback suggests management is preparing for M&A, the broker suggests (without naming BHP’s coal assets).

Ord Minnett continues to see the stock as attractively priced.

Whitehaven Coal’s FY23 result met both consensus and Citi’s forecasts and its dividend proved a 21% beat on consensus.

As expected, the result was marked by higher labour, fuel, explosives and port costs. The company averaged a $445/t coals price, up from $325 the previous year.

Cash from operations jumped $1.6bn to $4.2bn due to a capital unwind in relation to lower trade receivables. At close of June 30, the company held net cash of $2.65bn. Citi advises the buyback has been suspended in favour of growth opportunities (Daunia is still on the table).

FY24 guidance proved a miss, resulting in cuts to EPS. Management guided lower coal sales, higher unit costs and heavy capital expenditure (forecast to range between $460m and $570m). Rating downgraded to Neutral from Buy. Target price falls to $7.60 from $7.80.

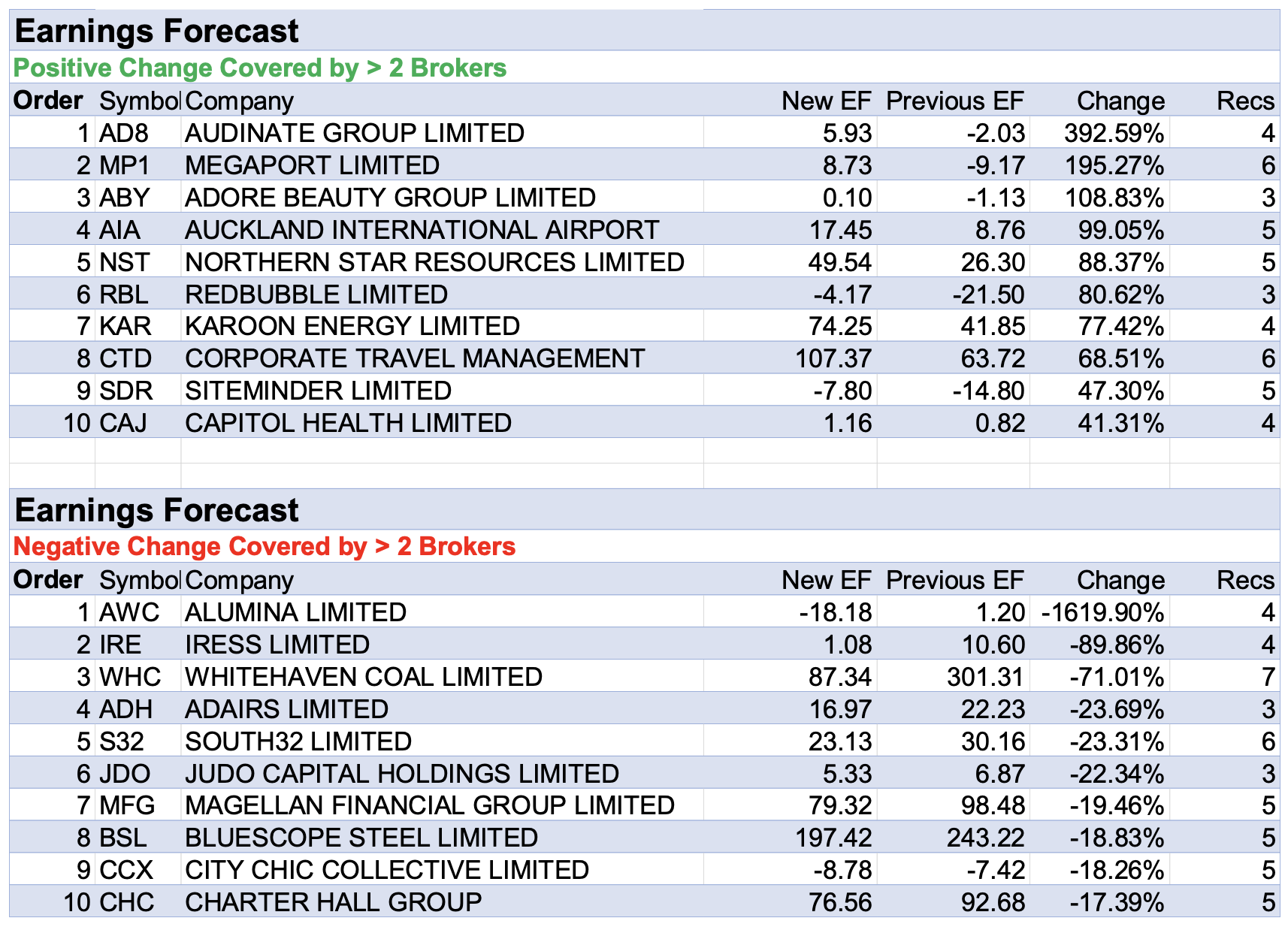

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.