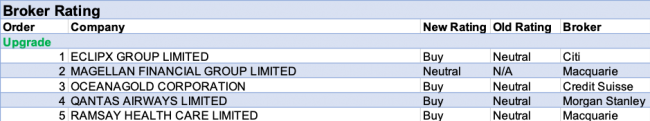

In the good books

MAGELLAN FINANCIAL GROUP LIMITED (MFG) was upgraded to Neutral from Underperform by Macquarie B/H/S: 0/2/5

Following a recent de-rating in the share price along with relative outperformance, Macquarie upgrades to Neutral from Underperform. Target is $50. The company’s $275m capital raising in isolation would result in just under -3% dilution, the broker calculates. Offsetting this, the proceeds will be used to launch the Magellan High Conviction Trust as well as a new retirement product and seed new investment strategies.

RAMSAY HEALTH CARE LIMITED (RHC) was upgraded to Outperform from Neutral by Macquarie B/H/S: 2/5/0

Macquarie expects contributions from Australian brownfield projects will support above-industry hospital growth in the near to medium term, although reduced participation in private health insurance presents a headwind for hospital volumes in Australia. The outlook for the UK and France has also improved. Valuation appears undemanding at current levels and the broker upgrades to Outperform from Neutral. Target is steady at $71.50.

In the not-so-good books

BEACH ENERGY LIMITED (BPT) was upgraded to Hold from Buy by Ord Minnett B/H/S: 0/5/0

Post a share price rally of 50% in the past month (!), Ord Minnett has decided it’s time to downgrade this stock to Hold from Buy. The target price remains at $2.55 but is now below the share price. The broker remains positive on the company’s outlook and cites further strengthening potential for the oil price as a key risk to its decision. A further US$10/bbl rise in the oil price would translate into a 20%-plus lift in forecasts.

CENTURIA METROPOLITAN REIT (CMA) was downgraded to Neutral from Buy by UBS B/H/S: 0/2/0

The company has acquired two assets for $380.5m, funded with a $273m equity raising. UBS increases the valuation, raising the target to $2.82 from $2.74, after incorporating the transaction, but downgrades to Neutral from Buy on valuation grounds. The company has acquired 8 Central Avenue Eveleigh, Sydney, and William Square, Northbridge, Western Australia. UBS assesses the overall transaction is neutral or marginally dilutive to free funds from operations (FFO). The company expects FFO in FY20 to be 18.7c per security.

DACIAN GOLD LIMITED (DNC) was downgraded to Underperform from Neutral by Macquarie B/H/S: 0/1/1

Net profit in FY19 was stronger than Macquarie expected, largely because of the better depreciation expense. Mount Morgans continues to be essential to meeting guidance in FY20. Macquarie downgrades to Underperform from Neutral because of recent share price strength. The broker notes the processing plant needs to perform well in excess of nameplate, given the recently revised life of mine plan. The company is also relying on continuing improvements from the Westralia underground mine. Target is steady at $1.20.

KATHMANDU HOLDINGS LIMITED (KMD) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 0/3/0

FY19 net profit was at the top end of guidance and above forecasts. Credit Suisse found the results solid, reflecting the full year impact of the Oboz acquisition as well as operating efficiencies. The company expects Oboz to continue delivering double-digit growth and this should largely offset the FX impact on gross margins in the core retail business. Same-store sales growth in FY20 to date has been strong, up 6.1%. While continuing to believe Kathmandu has attractive medium-term growth options there was nothing in the result to drive a materially higher valuation, in the broker’s view. Rating is downgraded to Neutral from Outperform. Target is raised to NZ$3.15 from NZ$3.00.

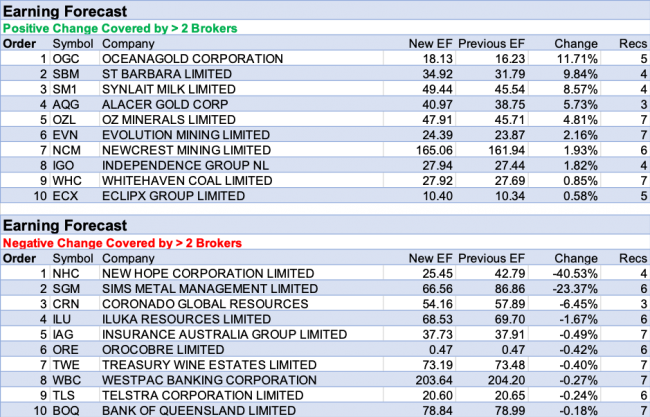

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stock brokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.