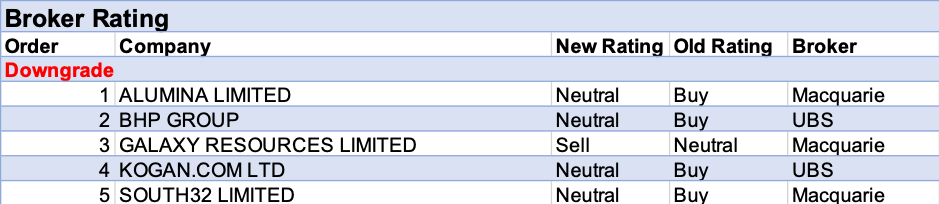

The long Easter weekend and Anzac public holiday made their impact felt in the week ending Friday 26 April 2019. For the week in total, FNArena registered five downgrades for ASX-listed entities, and not one single upgrade.

With four of the five downgrades affecting mining stocks, it’s probably a fair conclusion market scepticism is creeping into this year’s star performers. In earlier updates, we noticed a number of downgrades for yield providing stocks. And the energy sector has had their share as well, as did the banks.

The good news: most downgrades still transfer to Neutral/Hold.

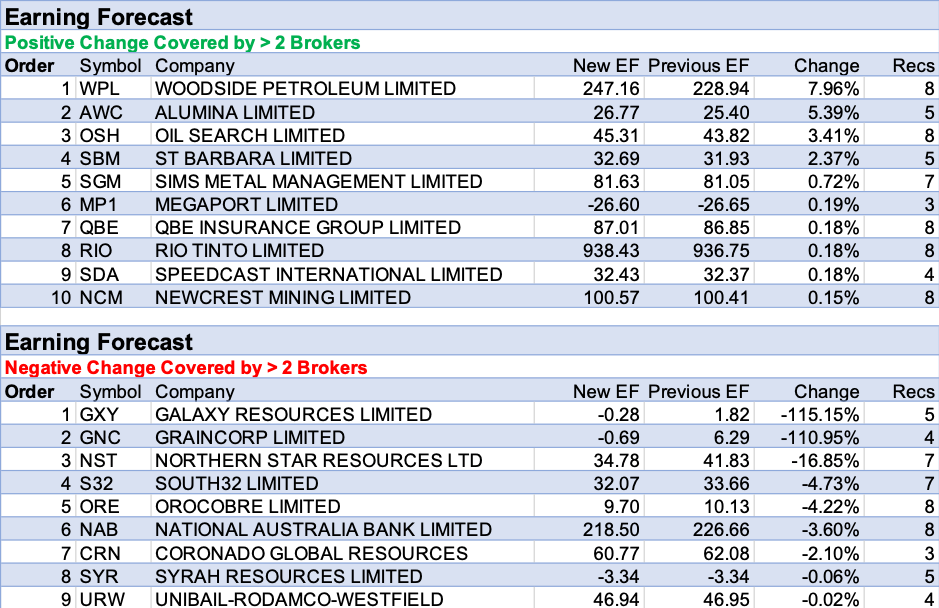

There was a bit more action in changes to earnings forecasts with resources stocks equally presented on the positive side of the week’s ledger. Woodside Petroleum, Alumina Ltd, Oil Search and St Barbara all enjoyed rising forecasts.

The negative side shows much larger numbers though with forecasts for the likes of Galaxy Resources and Graincorp falling like a rock, while Northern Star’s quarterly update also disappointed, and with sizeable cuts descending upon South32, Orocobre and National Australia Bank (yet to report).

This week sees an acceleration in the release of quarterly production reports, interspersed with shareholder gatherings and a number of out-of-season financial results. It’s getting busier at the micro level.

In the not-so-good books

1. ALUMINA LIMITED (AWC) was downgraded to Neutral from Outperform by Macquarie B/H/S: 2/2/1

Production of bauxite and alumina was in line with Macquarie’s estimates. Costs were 11% above estimates. This drives earnings downgrades. The resumption of full production at Alunorte presents a key downside risk to alumina prices, in the broker’s view. This is likely to weigh on the share price of Alumina Ltd and Macquarie downgrades to Neutral from Outperform. Target is reduced to $2.35 from $2.80.

2. BHP GROUP (BHP) was downgraded to Neutral from Buy by UBS B/H/S: 2/5/1

Stronger for longer commodity prices have allowed for steep appreciation in the share price but UBS analysts believe prices for iron ore and metallurgical coal are poised for weakness on a 6-12 months horizon, hence the analysts see further upside as limited. On this basis they have downgraded to Neutral from Buy. In addition, the outlook for crude oil prices is also seen as “subdued”, which is yet another headwind forming. Price target lifts to $36 from $35 on further updates to modelling input and forecasts.

3. GALAXY RESOURCES LIMITED (GXY) was downgraded to Underperform from Neutral by Macquarie B/H/S: 4/0/1

Better grades offset weak recoveries at Mount Cattlin, Macquarie observes. The company has stopped looking for a development partner for Sal de Vida and the broker notes no timeline has been provided, although the company still intends to develop the asset. As Sal de Vida is increasingly uncertain and Macquarie believes funding could be difficult to source during muted market conditions, the rating is downgraded to Underperform from Neutral. Weak recoveries at Mount Cattlin also remain of concern. Target is reduced to $1.50 from $2.10.

4. KOGAN.COM LTD (KGN) was downgraded to Neutral from Buy by UBS B/H/S: 0/1/0

The company has announced a strong March quarter of trading and two new vertical markets: Kogan Energy Compare and Kogan Cars with EclipX Group (ECX). UBS believes these will be slow profit producers. The company has also launched a retail subscription service to tie in with its upcoming credit card offer. UBS envisages near-term risk is to the upside for earnings but considers this priced into the stock. To become more positive, the broker requires a strong ramp up of at least one new vertical and improving cash flow. Rating is downgraded to Neutral from Buy and the target is raised to $5.80 from $5.00.

5. SOUTH32 LIMITED (S32) was downgraded to Neutral from Outperform by Macquarie B/H/S: 4/3/0

March quarter production was weak and guidance has been reduced for the alumina and thermal coal assets. This translates to -14-22% reductions to Macquarie’s earnings forecasts for the next four years. Cost guidance is also expected to come under pressure for a number of assets. Earnings upgrade momentum has vanished and Macquarie downgrades to Neutral from Outperform as a result. Target is reduced to $3.60 from $4.00.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

Important: The above was compiled from reports on FNArena. The FNArena database tabulates the views of eight major Australian and international stock brokers: Citi, Credit Suisse, Deutsche Bank, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.