On Wall Street, stocks started the September quarter in the green, which should convince local players next week that their negativity has been excessive, though that’s not to say we’re set for a revival of sustained share buying.

Currently, the SPI futures points to a 100-point open on Monday but this is an early call that’s bound to pull back a bit, though at least it’s positive. That sustained rise is more likely to be a December quarter thing, though I suspect we’ll see some promising developments, stocks-wise, late in this quarter.

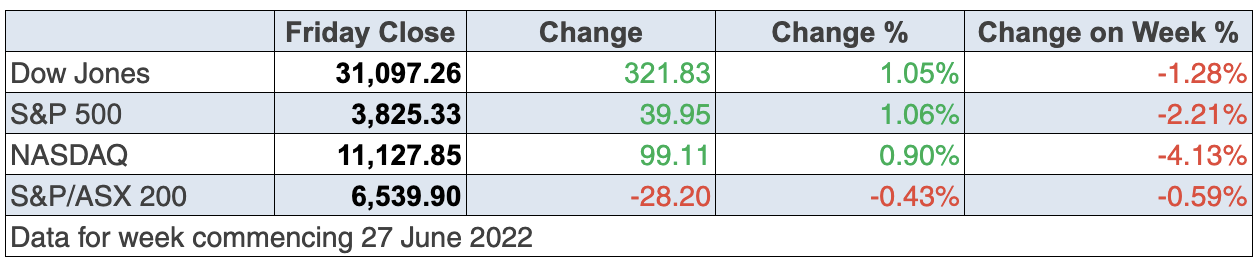

A bit of positivity is good to see after we were reminded that in the US for the June quarter, the Dow fell 11.3% and the S&P 500 lost 16.4%, which created the worst quarters since the March quarter of 2020 when the Coronavirus came to town. The Nasdaq slumped 22.4%, its worst quarterly stretch since 2008 which was the GFC crash!

And year-to-date, the Dow shed 15.3%, its worst first half-year since 1962. The S&P 500 dipped 20.6%, which was its worst first half since 1970. And the Nasdaq plunged 29.5%, which was its worst-ever first-half performance.

OK, that’s enough about the past, let’s get a bit more future focussed.

To be historically trite, let me remind you of the old saying I always resurrect in April/May each year: “Sell in May and go away, come back on St Leger’s Day”. This is around mid-September and that’s when I hope we’re seeing falling inflation, a rebounding Chinese economy, fewer fears about too many interest rate rises and maybe some positive developments on the Ukraine war.

After worrying about inflation, the Yanks overnight decided it was time to stress about a recession! Helping that happen was the Institute for Supply Management reading for manufacturing activity in June, which came in weaker than expected. This index of national factory activity dropped to 53 for the month, which was the lowest number since June 2020 — the fourth month of the pandemic lockdown for the US!

And the ISM’s new orders index also fell to 49.2 from 55.1. Any result under 50 means contraction and that hasn’t happened since May 2020. So we have more worriers focused on a US recession joining those still nervous about inflation, and now we’ll have those telling us that it will be earnings concerns that will take stocks down again in coming months.

This kind of analysis portrays stock players as people who can only focus on one thing at a time. I would’ve thought that selling or buying a stock would have had some remote connection to the likely progress of profit or loss for the company.

I guess women might remind us that the stock market is still very male-dominated and men are famous or infamous for only being able to process one thing at a time! (Is that sexist? Is it accurate? I won’t go there!)

The goal is simple: lower inflation to reduce interest rates rises and no recession, which will mean stocks take-off! Once again, I’m seeing that as a late September quarter thing, after reporting season and looking more convincing in the December quarter.

CNBC’s Fred Imbert reminds us of something I’ve shared with you before: “While some on Wall Street are optimistic the market will recover during the remainder of 2022 – history has shown that when the market is down more than 15% in the first half of the year, it tends to rally in the back half – others are preparing for lingering inflation and even more monetary tightening by the Federal Reserve that could set a potential rally back”.

That slowing economy data and other inflation forward indicators are giving me ‘inflation will eventually fall’ feelings. As Kath from ‘Kath and Kim’ fame would say: “I feel it in ‘me’ waters,” but I’m also helped by my interview with Chris Joye of AFR/Coolabah fame yesterday, which I’ll show on my Monday TV show, who’s also seeing some gradually positive developments on the US inflation front. For example, the key inflation measure (the core PCE deflator) lifted by 0.3% in May to be up 4.7% on the year, which was a tick lower than expected. This is the Fed’s preferred inflation indicator and is much lower than the CPI at 8.6%.

Against that, stuff like this isn’t helpful for stocks: “US Federal Reserve policymakers Mary Daly and John Williams promised further rapid interest rate hikes to bring down high inflation,” CommSec reported this week. However, they did push back against growing fears among investors that sharply higher borrowing costs will trigger a steep US economic downturn.

You can see there’s a wall of worry that stock indexes can’t climb right now and are more regularly seen as falling rather than rising. And that wasn’t helped by first-quarter GDP, which contracted as expected by 1.6%. And then the Atlanta Federal Reserve’s GDPNow tracker came out overnight pointing to another 1% decline in economic output for the second quarter. If this is right, then the US is facing “Recession!” headlines late in the September quarter.

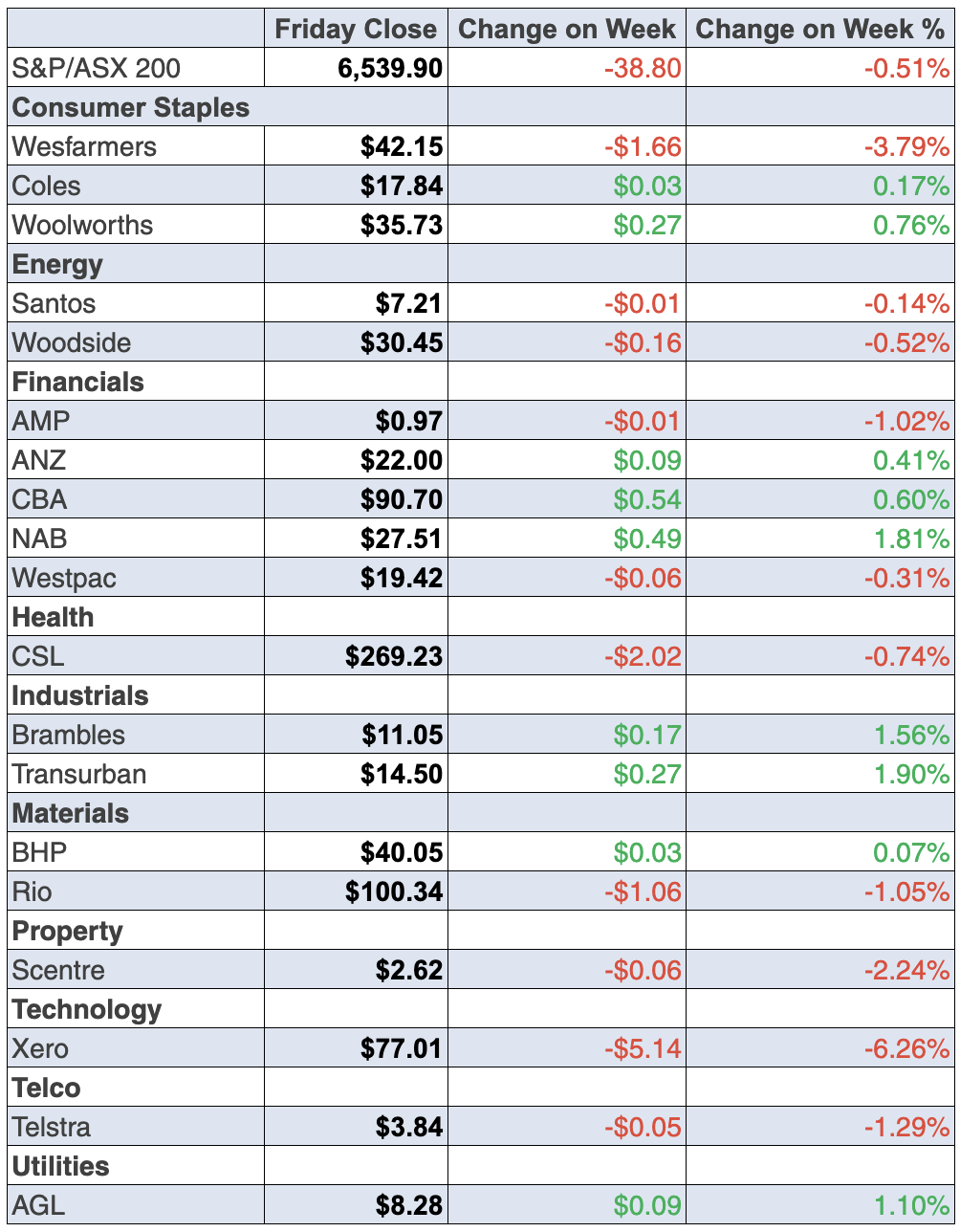

To the local story and the S&P/ASX 200 index gave up 0.43% (or 28.2 points) on Friday to finish the week at 6539.9, which was only a 0.6% loss for the week.

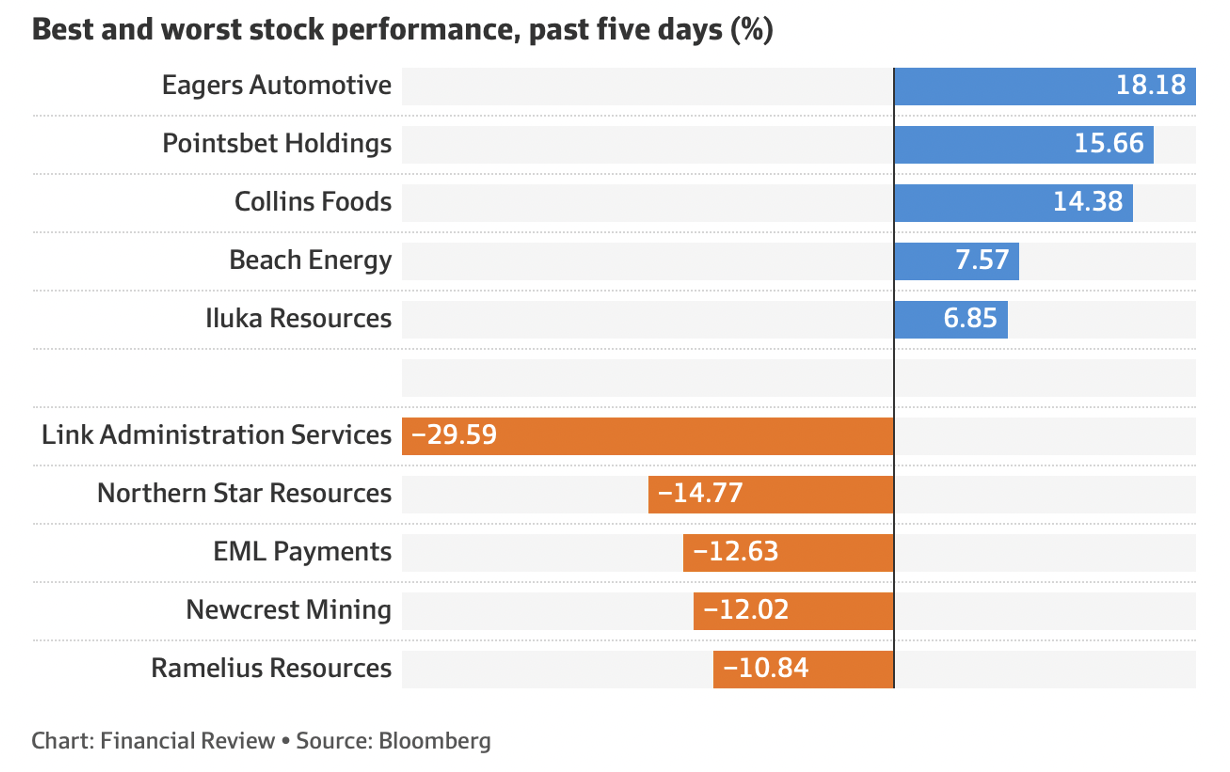

Here are the big winners and losers for the week.

The only notable takeout message was that when there’s a sniff of hope that future interest rates rises might be less than expected, either because of lower inflation or recession or both, beaten-up tech or biotech stocks get nibbled up by the courageous or long-term investors.

For example, Zip was up 9% on Friday to a low 48 cents but was down 13.5% for the week. Sure, tax-loss selling before June 30 was a big part of the story, followed by post-June 30 rebuying, but it’s not just that. Some of the current prices of tech/payments stocks are overwhelmingly short-term player determined.

Even Mesoblast rose 11.5% but its disappointing 68-cent price is a reflection of the management of this company that’s seen its share price sink nearly 67% over the year.

And if you’re wondering why the miners had a rough week, you can blame falling commodity prices that can only be linked to recession fears, which of course implies that this has to be good for inflation concerns. But who knows what the stock market will worry about most — inflation or recession? The only thing I like reminding myself about came from that great economist J.K.Galbraith, who told us that “in economics, the majority is always wrong!” It’s a tad excessive but they often get it wrong.

What I liked

- Households have accumulated $283.1 billion worth of savings during the pandemic (since February 2020) and this will help households cope with rising interest rates and help reduce the chances of a recession.

- The CoreLogic Home Value Index of national home prices fell by 0.6% in June, the biggest decline in almost two years. Capital city home prices fell by 0.8% and this is the process needed to bring down inflation.

- The AiGroup Australian Performance of Manufacturing Index (PMI) rose by 1.6 points to 54 in June. And the final S&P Global Australia Manufacturing PMI rose from 55.7 in May to 56.2 in June. Readings over 50 denote an expansion in activity. Also, business expectations remain ‘strongly positive’. This is a good reading to believe that inflation can come down without creating a recession.

- The value of work done in engineering construction (including structures like bridges, roads and dams) fell by 1.6% in real (inflation-adjusted) terms in the March quarter of 2022 but was still up 3.5% on the year. Work commenced in the quarter increased by 62.1% in original terms, the most in four years. I like moderate falls in economic activity to lower inflation without a recession.

- The APRA authorised deposit-taking institutional statistics reveal that loans to households via credit cards were steady at $28.1 billion in May, but credit card lending is down 5.5% on the year. Lower borrowing is good for reducing inflation.

- Infrastructure work yet to be done rose to 7-year highs nationally and to record highs in NSW, which is good to fight recession fears.

- Tourism Research Australia’s National Visitor Survey released last week shows that domestic overnight trips rose by 1% in the March quarter of 2022 to 24.6 million. And domestic tourism spending jumped by 14% or $2.6 billion in the quarter to $20.1 billion. More spending on services means less on retail, leading to a build-up of stocks and price-cutting, which will help lower inflation.

- In US data, the economy (as measured by GDP) contracted at a 1.6% annual pace in the March quarter (survey: -1.5%), which is OK provided the June quarter ends up being a small positive. I don’t want to see “Recession!” headlines for the US. I’d prefer: “Recession dodged!”. The fact that durable goods orders rose by 0.7% in May (survey: 0.1%), while pending home sales rose by 0.7% in the same month are good readings to help growth in the June quarter.

- The University of Michigan consumer sentiment index dropped from 58.4 to a record low of 50 in June (survey: 50.2). I know it’s a big drop but the Fed has to hose down the hot consumer spending to lower inflation, so I like something I’d usually hate!

- The Conference Board consumer confidence index fell from 103.2 to 98.7 in June (survey: 100), which should help lower inflation.

What I didn’t like

- What the Fu#k! The weekly ANZ-Roy Morgan consumer confidence index rose by 3.7% (the biggest lift in 14 months!) to 84.7 points (the long-run average since 1990 is 112.4 points). How did that happen? It has to be driven by jobs for all! It’s not great for convincing the RBA that inflation will fall.

- The Australian Bureau of Statistics (ABS) reported that retail trade rose by 0.9% in May, lifting for five consecutive months. Sales are up by 10.4% on a year ago (the strongest annual growth rate in 13 months) to a fresh record high of $34.2 billion. Also, spending is up 23.2% on pre-pandemic levels (February 2020). Great numbers but not great for beating inflation. I reckon the June numbers will peel off following the RBA’s 0.5% rate rise. They better or there’ll be too many rate rises!

- According to the Australian Bureau of Statistics (ABS), in seasonally adjusted terms, job vacancies rose by 13.8% in the three months to May, or by 58,200 positions, to a record 480,100 available positions. Vacancies are up 29.7% (or 109,900 available positions) in May compared to a year ago. This is bad for wage demands and inflation but a positive for a strong economy. We need foreign workers and fast!

- Private sector credit (effectively outstanding loans) rose by 0.8% in May to be up 9% on a year ago – the strongest annual growth rate in 13½ years (since October 2008). This is too strong to lower inflation but the RBA didn’t get serious and scary about rate rises until June. That’s when borrowing should drop off.

- According to the Australian Institute of Petroleum, the national average unleaded petrol price rose by 6.4 cents to 211.9 cents a litre last week, the second-highest level on record (data since 2004). I hope the RBA sees this petrol price rise as ‘virtual’ interest rate hikes and reduces the number of rate increases, but I’m not sure if Dr Lowe is seeing or saying that.

Note this call

Michael Burry of The Big Short fame who called the GFC crash has now warned that the rout in financial markets is only halfway through and that corporations will see declines in earnings next. This guy is a short-seller and these types like to use the media to make money. Also, over time, big call merchants usually only have one good big call in them.

Remember my mate Professor Steve Keen got the GFC right but his ‘house prices will crash’ prediction was wrong. Nouriel Roubini also got the GFC call right but his predictions since have failed to enhance his big call reputation.

The week in review:

- For the week ending Friday June 24, our stock market rose 1.6%, making it the best trading week for over 3 months. The market reaction showed that if inflation data improves and a serious recession is unlikely, stocks (especially tech) will be bought. The big question in my article this week went as follows: Was Friday 24 June the bottom of the market?

- Being the logical investor that he is, Paul (Rickard) is always amazed why someone would pay $1.20 for something worth $1. But he says that’s what happens when investors buy into some listed investment companies (LICs). Paul goes through 3 LICs to consider selling and what you could invest in as an alternative. And on the eve of the new financial year, Paul went through 5 important superannuation changes that come into effect on July 1.

- Tony Featherstone says that the gaming sector is a candidate for more takeover activity as private-equity firms or gaming multinationals pounce on weakened companies. For investors who are comfortable with the gaming sector, Tony looks at two takeover themes and four stocks to watch.

- James Dunn says that while the fintech sector has been hammered as growth stocks have fallen from favour, there are still some businesses to address large potential markets. James wrote about three fintechs he thinks are worth a look at current price levels:

- In Buy, Hold, Sell — Brokers Say, there were 11 upgrades and 9 downgrades in the first edition and 5 upgrades and 14 downgrades in the second edition.

- In our “HOT” stock column, Michael Gable, Managing Director of Fairmont Equities, explains why he thinks Codan (CDA) is a stock worth keeping on your radar.

- And finally, in Questions of the Week, Paul (Rickard) answers subscribers’ queries about how much of your portfolio should be invested in BHP; whether it’s a good time to invest in your model portfolios; Why Sigma Pharmaceuticals has shot up in price? And whether there are any changes to the super caps next financial year.

Our videos of the week:

- The best way to combat COVID is to keep your immune system healthy. Here’s how! | The Check Up

- Is it time to buy tech stocks? + Has the stock market bottomed? | Switzer Investing (Monday)

- Are we in the bottoming process for this stock market sell-off? + House price bubble set to burst! | Mad about Money

- Has the stock market bottomed? + Rudi & Kelli on the stocks they like right now! | Switzer Investing (Thursday)

- Boom! Doom! Zoom! | 30 June 2022

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday July 4 – Building approvals (May)

Monday July 4 – Lending indicators (May)

Monday July 4 – Job advertisements (June)

Monday July 4 – Inflation gauge (June)

Tuesday July 5 – Reserve Bank board meeting

Tuesday July 5 – Retail trade (May)

Tuesday July 5 – New vehicle sales (June)

Thursday July 7 – International trade (May)

Thursday July 7 – Weekly payroll jobs & wages (June 11)

Friday July 8 – Business turnover (May)

Overseas

Tuesday July 5 – China Caixin services gauge (June)

Tuesday July 5 – US factory orders (May)

Wednesday July 6 – US JOLTS job openings (May)

Wednesday July 6 – US ISM services index (June)

Wednesday July 6 – US FOMC meeting minutes (June 15)

Thursday July 7 – US trade balance (May)

Thursday July 7 – US ADP employment (June)

Thursday July 7 – US Challenger job cuts (June)

Friday July 8 – US non-farm payrolls (June)

Friday July 8 – US consumer credit (May)

Saturday July 9 – China money & lending data (June)

Saturday July 9 – China inflation data (June)

Food for thought: “Experience is what you get when you didn’t get what you wanted.” — Randy Pausch

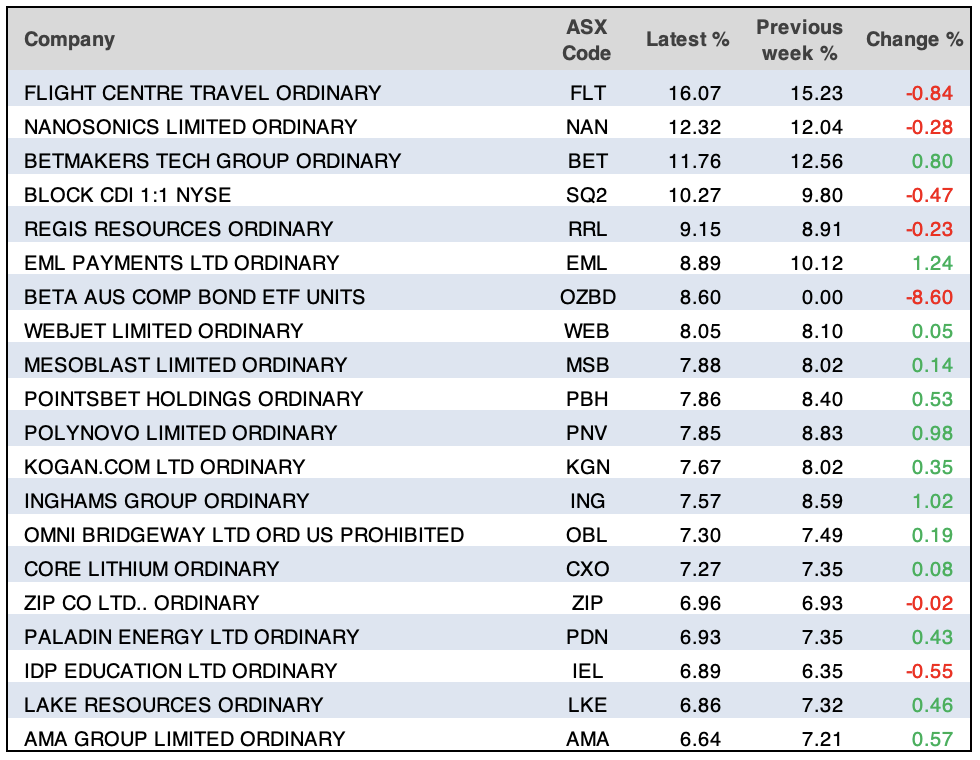

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

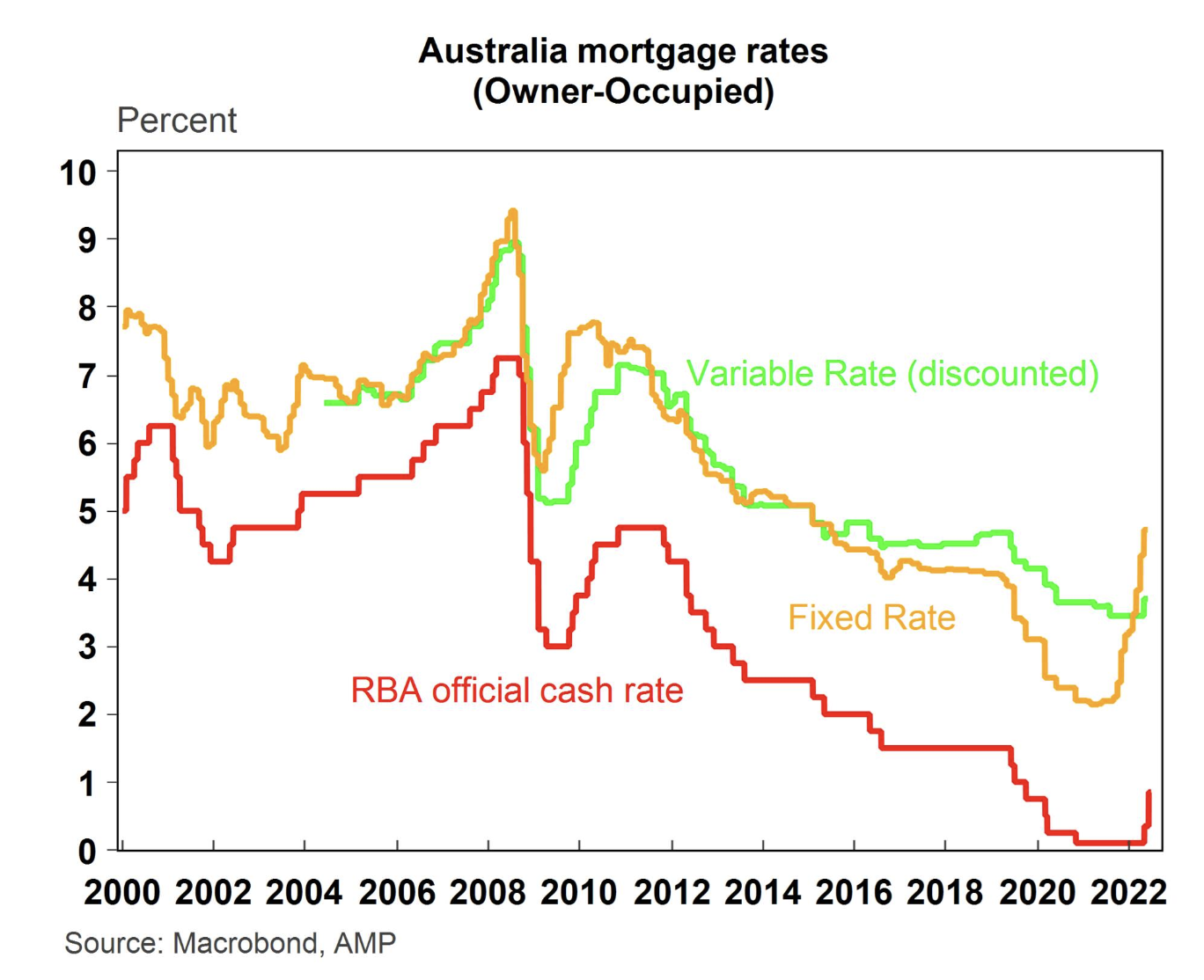

Our chart of the week couldn’t be more timely given CBA’s decision yesterday to leapfrog the RBA in raising its rates by 140 bps. The effects rising rates have on consumers is significant, and as Shane Oliver of AMP Capital notes, this is primarily felt with mortgage holders.

“Consumers feel the impacts from changes to the RBA cash rate mainly through adjustments to mortgage rates, with around 37% of households having a mortgage, and this doesn’t account for those with an investment property so the actual share would be higher. In Australia, mortgage rates are either fixed or variable,” says Shane.

“Historically, most home loans (~75%) have been on variable rates which has been effective in the last 12 years as the cash rate has been coming down. In the last 2-3 years, a record low cash rate, expectations of low interest rates and high competition between lenders had been forcing down mortgage rates, especially for fixed loans with around 50% of new lending being fixed. But, from mid-2021, a re-pricing of RBA rate hike expectations because of the removal of the 0.1% bond yield target and a quick lift in inflation has caused a lift in fixed rates with the average 3-year owner-occupied rate more than doubling from 2.1% in March 2021 to 4.7% in May 2022. Variable interest rates have moved in line with changes in the cash rate so far.”

Top 5 most clicked:

- Was Friday June 24 the bottom of the market? – Peter Switzer

- 3 listed investment companies to sell – Paul Rickard

- 3 fintechs to consider – James Dunn

- Super changes for the new year – Paul Rickard

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.