Friday night on Wall Street was negative but it’s more likely to be a consequence of profit-taking after a very positive week for the S&P 500 index — up 1.69% — and the Nasdaq Composite, which wacked on a whopping 3.54% to a record close!

The Dow actually lost 0.22% over the five trading days but it has less tech and AI benefitting stocks in the 30 components of its index. And part of that story explains why our ‘low tech’ market was negative this week as well. But it also didn’t get any help from the jobs report that saw unemployment fall, which doesn’t help those hoping for interest rate cuts ASAP to help stocks.

Thankfully, the US economy looks like it’s delivering data that raises the hopes that the world’s biggest economy, and the home of the most crucial stock markets, will see one or maybe two rate cuts this year.

This is how Jed Graham of investors.com summed up a good week: “Initial jobless claims jumped to the highest level since last summer, while the core producer prices were unchanged, lifting the odds for a Federal Reserve rate cut in September…”

But there was more, as the US CPI in May, which didn’t rise, gave out good vibes by coming in less than expected. And after the week’s data drops, markets now have a 69% chance of two quarter-point rate cuts this year. And while the better inflation readings are good for rate cuts, the rising jobless claims for workers out of work, is a sign that the US labour market is feeling the pinch and central banks want to see that before they start cutting rates.

Also overnight, the University of Michigan’s Survey of Consumers indicated that shoppers are dropping in confidence, with the June reading at 65.6. That’s down from 69.1 for May.

Of course, this raises the legitimate question: Should we be worried that a US recession fear will surface and hurt stocks? To that concern, I like this from Ross Mayfield, an investment strategy analyst at Baird, talking to CNBC: “The reality is that, even in these bull markets, there are going to be days where you take a pause and where people take some gains. We’ve had such a strong run, especially coming off a soft PPI and soft CPI … I think it’s a pretty natural place to take a pause after a pretty aggressive rally.”

Remember, like all rallies, this rally will eventually end when company profits look challenged, which isn’t a current concern or theme. The expectation of rate cuts (which were helped this week with US economic data and the driving force of artificial intelligence (AI) increasingly being thanked by CEOs for better profit prospects) should keep stocks rising for at least a year.

Adobe overnight is a case in point, with the company recognising the role of AI in its better-than-expected report, which then saw its share price spike 14%.

Even though the local driving forces for our stock market might be underwhelming right now, given the important role that Wall Street plays in driving our stock prices up, the good news for the US this week should be seen as an underlying plus for our share prices going forward.

To the local story and the S&P/ASX 200 was down 97.5 points (or 1.25%) for the week, despite the good inflation news in the US. The index stopped the week at 7724.30, which is about 170 points below the all-time high. We might have had a better week if our jobs report didn’t deliver more jobs than were expected and unemployment didn’t fall from 4.1% to 4%.

These numbers didn’t help those sweating on interest rate cuts to propel stock prices higher and neither did the notable falls in materials, industrials, and real estate shares. That said, consumer discretionary and tech shares were stronger, with the latter’s rise definitely driven by the good US news and its impact on the tech-heavy Nasdaq.

From the good news department, Tabcorp rose 10% to 65.5 cents on Friday after asking the NSW Government to change wagering laws that would hit its rivals hard. Telix rose 0.9% after dropping its plan to do a US listing and rare earths player Resouro Strategic Metals rose 40% on its first day on the ASX!

Meanwhile, the ASX’s share price slipped $1.56 (or 8%) to $57.18, which means this stock has dropped nearly 32% in five years.

What I liked

- The US CPI was flat in May compared to April, the first time in almost two years that it didn’t climb! Plus, the annual rate of core inflation came down to 3.4%, the lowest since April 2021. Plus, the release boosted the likelihood of Fed policymakers projecting two rate cuts for 2024!

- Here’s Reuters on a good PPI: “U.S. producer prices unexpectedly fell in May amid lower energy costs, another indication that inflation was subsiding after surging in the first quarter. The producer price index for final demand dropped 0.2% last month after advancing by an unrevised 0.5% in April. Economists polled by Reuters had forecast the PPI nudging up 0.1%. In the 12 months through May, the PPI increased 2.2% after rising 2.3% in April.”

- The US Federal Reserve kept the Fed Funds rate unchanged at 5.25-5.5%at its June meeting, as expected by economists and markets.

- AMP’s Diana Mousina reported that “Jerome Powell’s comments and tone in the press conference after the meeting leaned dovish and despite the changes to the dot plot for 2024, there is still the change of a September rate cut (before the Presidential election)”.

- Mousina again on jobs: “The May NAB business survey showed a decline in confidence, back into the negative and business conditions fell and appear to be “catching down” to the fall in business confidence and the broad slowing in economic activity”.

- US jobless claimswere higher over the week to 8 June, at 242,000 (expected to be 225,000), the highest level in 9 months. This is good for rate cuts.

What I didn’t like

- Unemployment locally falling from 4.1% to 4%, which doesn’t help the RBA cut rates ASAP.

- The European Commission announced new tariffs ranging between 17%-38% on Chinese electric vehicles,which will be levied on top of the existing 10% across-the-board tariff on all Chinese electric vehicle imports.

- China’s producer prices are still in deflation,down by 1.4% over the year to May.

President Trump again

Eighty big business leaders had a get together with the man who would be the US President again, Donald Trump. The likes of Apple’s Tim Cook and JPMorgan’s Jamie Dimon were there, and Donald promised “more of the same!”

Here were his big offerings:

- Lower income taxes.

- The corporate tax rate to drop from 21% to 20%.

- No tax on workers tips, which apparently was seen as a joke by some CEOs, but it sounds like a huge vote winner in a tip-mad USA!

Interestingly, Donald didn’t run his idea to raise tariffs to kill income taxes! This would have been a harder sell to big end-of-town businesses that rely on imports and who would fear get-even tariff slugs on their exports.

I tried to make the numbers work using total imports and possible tariff hikes and I couldn’t see how they’d cover the $US2.2 trillion plus paid annually by taxpayers there in recent years.

The rest of the year and what comes out of the US Presidential campaigns will be very interesting, but I don’t think it will seriously hurt or help stock prices.

Switzer This Week

Switzer Investing TV

- SwitzerTV Investing: no show this week due to public holiday, catch last week episode – Jun Bei Liu on shorted stocks that are a good buy + Paul Rickard explains how to create a great income portfolio

- BOOM, DOOM, ZOOM: Peter Switzer and Paul Rickard answer your questions on 360, MP1, YAL & more

Switzer Report

- 5 ‘super’ actions to take before the end of the financial year

- “HOT” stock: JB HiFi (JBH)

- Questions of the Week

- Contrarian opportunity in Chinese equities

- Four Australian data centre players

Switzer Daily

- Data shows it’s time politicians solved our housing problem

- Is the next Netflix movie to be called “The Aussie Bean Counters Who Shagged the World”?

- Is this the Coalition’s “Angus Taylor to the rescue” plan for interest rate sufferers?

- Demands escalate for boards to be more Aussie

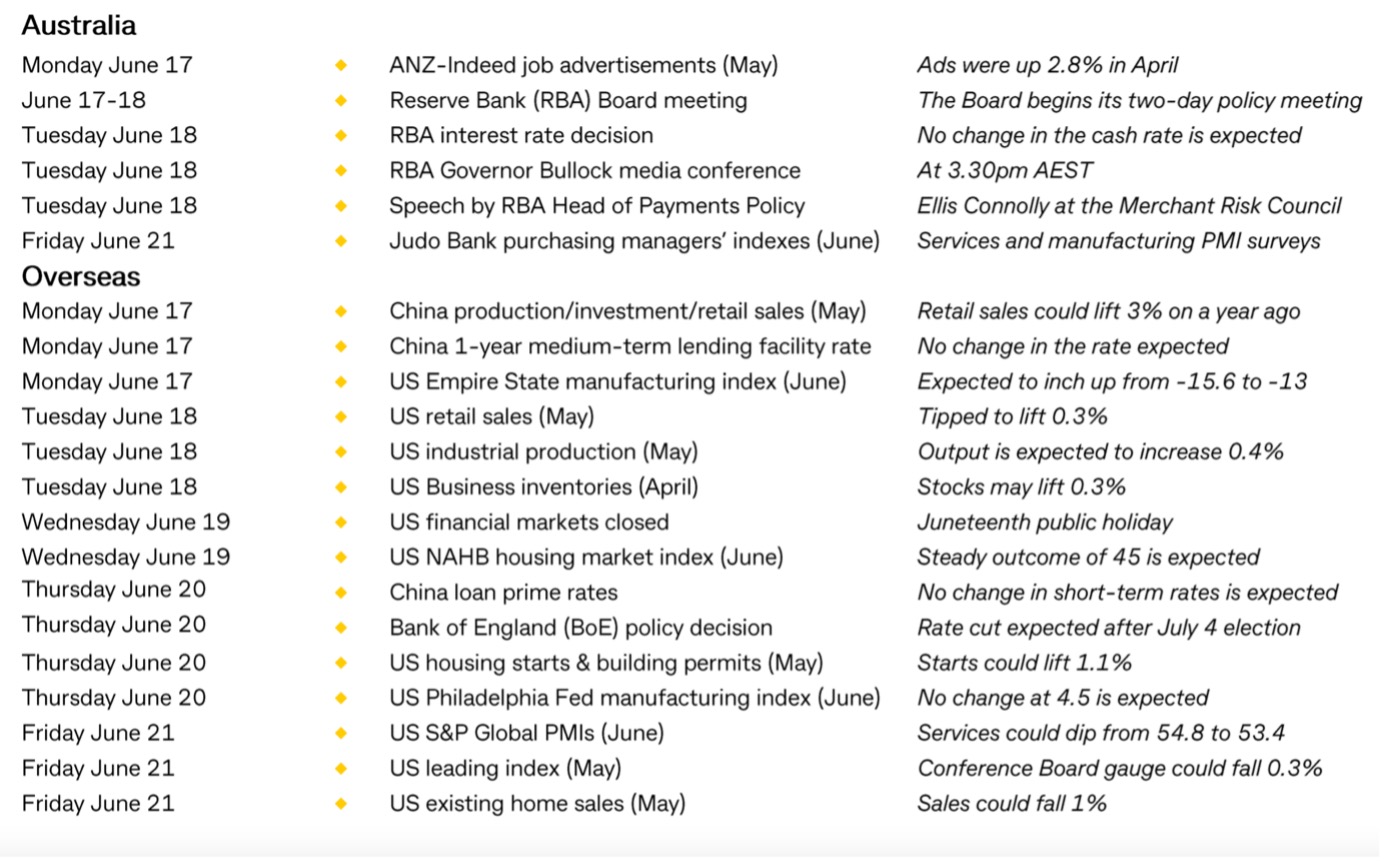

The Week Ahead

Top Stocks — how they fared

Most Shorted Stocks

Data from 3rd – 7th of June sue to the long weekend

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before

Quote of the Week

The Fed boss, Jerome Powell this week said: “We think policy is restrictive. And we think, ultimately, that if you just set policy at a restrictive level, eventually you will see real weakening in the economy. So, that’s always been the thought is that, you know, since we raised rates this far, we’ve always been pointing to cuts at a certain point.

“Not to eliminate the possibility of hikes, but no one has that as their base case — no one on the committee does.”

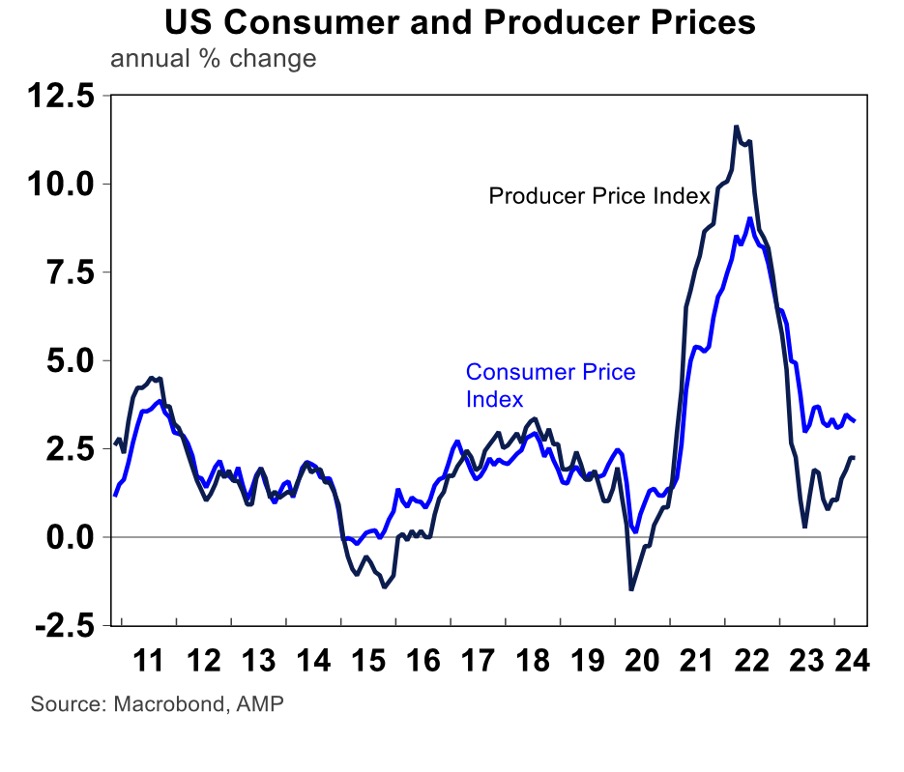

Chart of the Week

Remember, if US inflation falls it will be a plus for rate cuts and stock prices and so this chart showing lower inflation in the USA was a ripper!

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.