Are Chinese equities a new bull market or a dangerous bear trap?

That question is sparking debate among asset managers who believe Chinese equities are in the early stages of a bull market, and those who claim recent gains in the country’s share markets are mostly due to government intervention,

It’s an important question on three fronts. First, Chinese shares look cheap on paper. The iShares China Large-Cap ETF, a barometer of China’s 50 largest and most liquid stocks, trades on an average trailing Price Earnings (PE) multiple of just 11.5 times.

In contrast, the iShares S&P 500 ETF, a key barometer of the largest US stocks, trades on a comparable PE of 26.6 times.

Chinese equities, on average, should trade at a large discount to US equities given their greater governance and regulatory risks, and uncertainty about China’s economy. But the current discount to US equities is whopping.

Second, equity markets in several developed nations are trading near record highs, despite persistent higher inflation and doubts about the timing of interest-rate cuts. Partly rotating out of expensive equity markets into cheaper equity markets is an important consideration for asset allocators.

For comparison, the iShares S&P 500 ETF has an annualised return of over 16.3% over 10 years to end-May 2024. The iShares China Large-Cap ETF (IZZ) has returned a miserable 2.34% over the same period.

US equities have been a great trade in the past decade, but also true is that last decade’s winners have a habit of becoming this decade’s losers, and vice versa. Buying undervalued assets after a long period of underperformance is the key to producing an attractive long-term portfolio and reducing risk.

Third, Chinese equities have been battered. After a decade of poor returns, some prominent asset managers believe the worst is over and that China’s sluggish economy, by its standards, will start to grow a little faster.

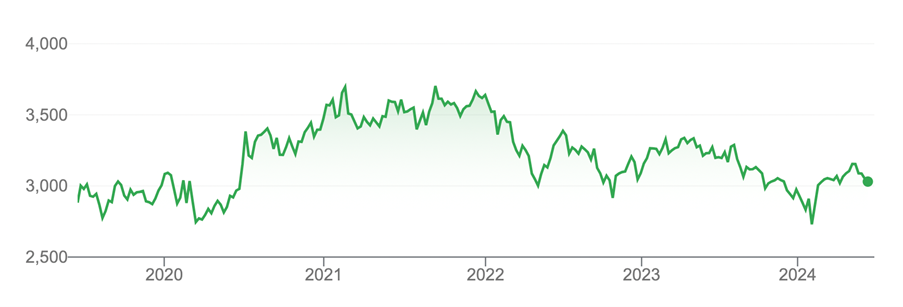

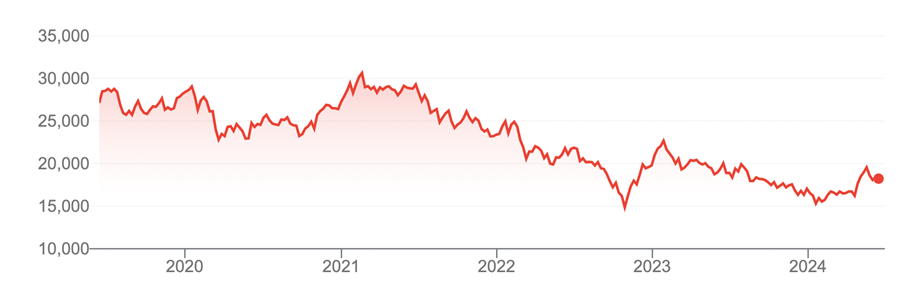

The Shanghai Composite Index’s 12% rally since the low of February 2024 spurred the China bulls. But it has retreated since mid-May amid more signs of weakness in China’s economy and uncertainty in its beleaguered property sector. Hong Kong’s Hang Seng Index has also been battered by investors, as the charts below show.

Chart 1: Shanghai Composite Index

Source: Google Finance

Chart 2: Hang Seng Index

Source: Google Finance

Still, after a lost decade of returns, it’s a fair question to ask whether the next 10 years will be much improved for Chinese equities.

Expect any recovery in Chinese equities to be one-and-half steps forward, one step back. The Economist this week argued that China is distorting its stock market by propping it up through purchases of Chinese equities by state-owned enterprises. Fewer Chinese Initial Public Offerings (IPOs) have also meant fewer exit opportunities for private investors in Chinese firms.

Meanwhile, China’s economy continues to receive fresh blows from tariffs imposed by the US, Turkey and other countries concerned about Chinese overcapacity, particularly in the production of traditional and electric vehicles. In late May, US President Joe Biden described China’s economy as ‘on the brink’.

In the medium term, China’s intention to reclaim Taiwan, possibly through an invasion by 2027, is a significant headwind for Chinese equities. Although some good judges believe such an invasion is unlikely, a potential China-Taiwan conflict remains a significant risk for prospective investors in Chinese equities.

Few doubt China’s macroeconomic or geopolitical challenges. But basing investment decisions on top-down forecasts, which are so often wrong, is dangerous. It’s better to focus on what matters most: company valuations.

Excluding the 2008-09 Global Financial Crisis, the average PE on Chinese equities is near its lowest point in almost two decades. The PE has mostly traded sideways since 2011, reflecting the awful performance of Chinese equities.

I identified opportunities in Chinese equities in this column in May 2023 and again earlier this year. That idea was initially about six months too early as Chinese equities slumped in December 2023 before recouping losses this year.

I still think it’s worth increasing portfolio allocation to Chinese equities, with a few caveats. Any change should be small and within the emerging-market component of portfolios, which should be less than 5% for most investors.

Also, prospective investors should recognise the high risks with Chinese equities; this is not a market for conservative investors or those new to investing.

Moreover, prospective investors need a timeframe of at least seven years and the tolerance to absorb high short-term volatility and potential further losses. No market recovers in a straight line and the best recoveries have a habit of flushing out investors who succumb to short-term market pressures.

Caveats aside, the best leverage to a long-term recovery in Chinese equities via ASX remains the iShares Large-Cap China ETF and VanEck FTSE China A50 ETF. Here is a quick recap of both:

- iShares Large-Cap China ETF (IZZ)

As mentioned, the iShares Large-Cap ETF provides exposure to 50 of the largest and most liquid Chinese companies listed in Hong Kong.

Australian investors will be familiar with Chinese companies in this index. Its top weightings include Alibaba Group Holdings, Tencent Holdings and JP.com.

I prefer the risk profile of Hong Kong-listed Chinese companies compared to mainland China shares. Thus, my ETF preference for China exposure is IZZ.

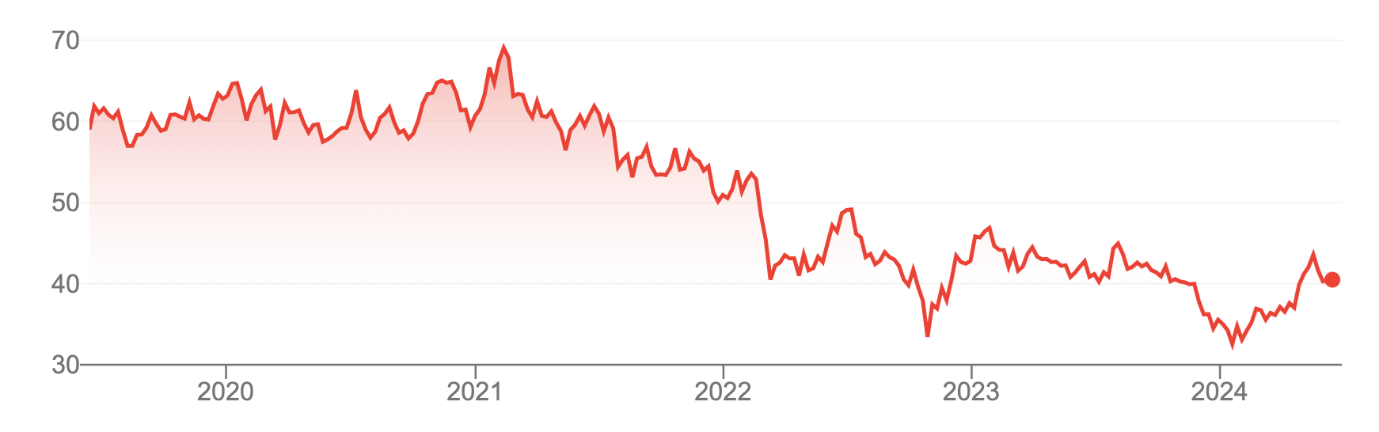

Over three years to end-May 2024, IZZ has burnt investors with an annualised loss of about -11%. Over five years, the annualised return is -5.53%. After such a long period of poor performance, IZZ was due for an improvement that came this year with its price rallying from a 52-week low of $31.63 to a high of $45,71, before settling this week at around $40. Further weakness would not surprise.

Chart 3: iShares Large-Cap China ETF

Source: Google Finance

- VanEck FTSE China A50 ETF (CETF)

CETF provides exposure to a diversified portfolio of China’s 50 largest companies in the mainland Chinese market, making it Australia’s only dedicated China-A share market benchmark exposure.

Just over half of CETF is invested in financial and consumer-staple companies, with no direct exposure to property developers (outside the financial sector).

CETF has fallen from $80 a share in early 2021 to around $50. In performance terms, CETF has disappointed investors in the past few years. Its average annualised return over three years to end-May 2024 is -9.8%. Since CETF’s inception in 2015, the annualised return is slightly negative.

CETF’s exposure to mainland Chinese equities (through China-A share market exposure) gives the ETF a higher risk profile. But it also provides greater opportunities for contrarians who understand the risks of this market and what to buy where the selling has been most intense.

At end-May 2024, CETF traded on an average PE of 11.,8 times, a price-to-book ratio of 1.47 times and a yield of almost 3%.

Such valuation metrics are unheard of in developed equity markets these days – a reflection of great uncertainty and risk in Chinese equities and possibly a market that has become too bearish on this asset and focused on short-term headwinds rather than a gradual recovery that could take a decade to play out.

Chart 4: VanEck FTSE China A50 ETF (CETF)

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 12 June 20