Monday should be a good day for the local stock market as the Dow is on track for its best month since 1987! And this was helped by the double good news that inflation seems to be on track for a meaningful slide and, at the same time, fears about a worrying US recession eased on the back of better-than-expected economic data.

All three major indexes were set to have a big finish on Friday but I’m not totally cheering about something I’ve been predicting for months because this stock price surge wasn’t a blanket re-loving of bashed up tech stocks. That will come a little later.

This has been a rally on quality tech companies such as Apple making profits. Apple was up over 8% on Friday. Also, value stocks such as Caterpillar, energy and financial companies and so on have gone for a nice run.

Quality always is the wise and easy target after signs that the big drivers for a stock sell-off might be changing. Companies and especially tech businesses making profits will be targeted as smart players try and get in before the likely bigger surge for stocks when the fall in inflation is more convincing and showing in the CPI.

All week we’ve seen indicators that suggest inflation might be waning and the stock market has lapped up these data drops. “The market got a boost after the core personal consumption expenditure price index in September increased 0.5% from the previous month and 5.1% from a year ago, still high but mostly in-line with expectations,” CNBC reported. “This is the preferred gauge of inflation for the Federal Reserve. Personal spending rose 0.6%, more than expected, the data showed.”

And earlier in the week, the economic growth number for the September quarter came in at a nice 2.6%, which hosed down recession fears, and GDP prices rose by a lower-than-tipped 4.6% against a forecast of 5.3%.

Adding to a better picture for US stocks has been the recent reporting season. This is how AMP’s Diana Mousina summed it up on Friday: “Around 50% of US listed companies have reported September quarter earnings and so far, the results have been positive. Around 71% of company results have surprised to the upside (slightly under the historical average of 76%). Annual earnings growth is running at 2.7% year on year, slightly up from the 2.4% expected at the beginning of the earnings season. Strong energy earnings are flattering the result with ex-energy earnings expected to be ‑3.8% year on year. The earnings estimates are (so far) not in line with a recessionary-like environment.”

That last observation (about the results not looking like they’re predicting a recession is imminent) is important for stock market optimists.

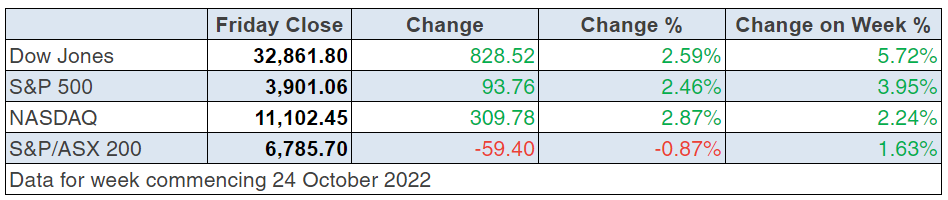

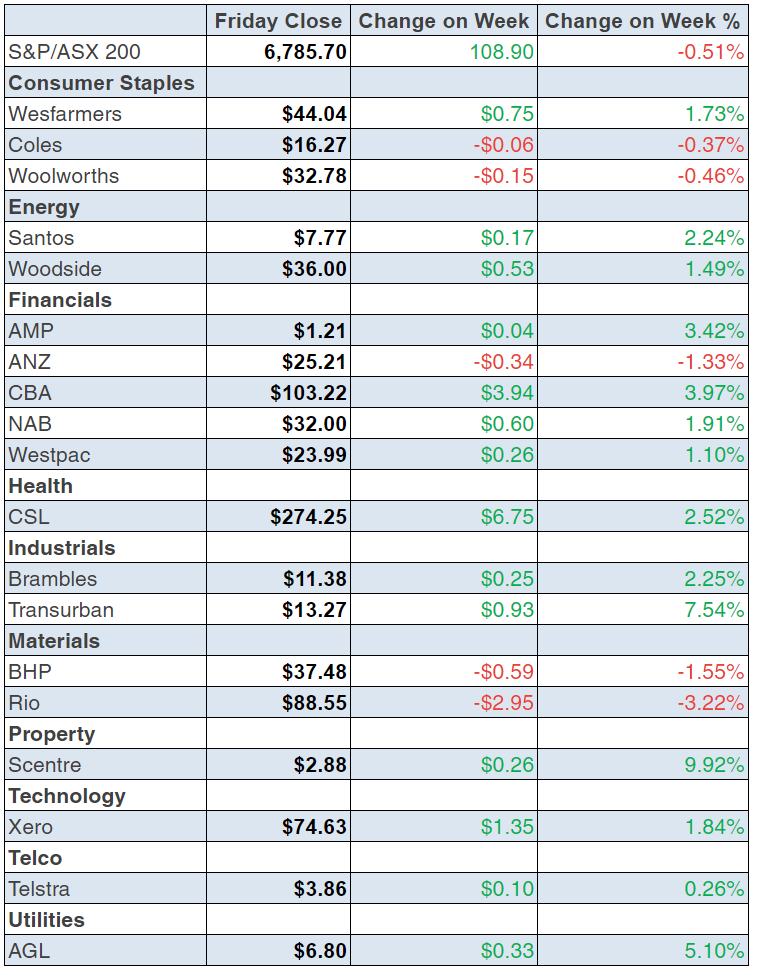

To the local story and our big miners copped the backlash from a fall in iron ore prices, which hit the lowest level since the Coronavirus crash year of 2020. This helped take the S&P/ASX 200 down 0.9% on Friday, which took the gloss off a surprise, positive week for the Index which popped 1.63% (or 108.9) points to finish at 6785.70.

Not helping were concerns that another Covid lockdown was on the cards in China, as Xi Jinping became the newly reinstalled leader for this market-challenging country.

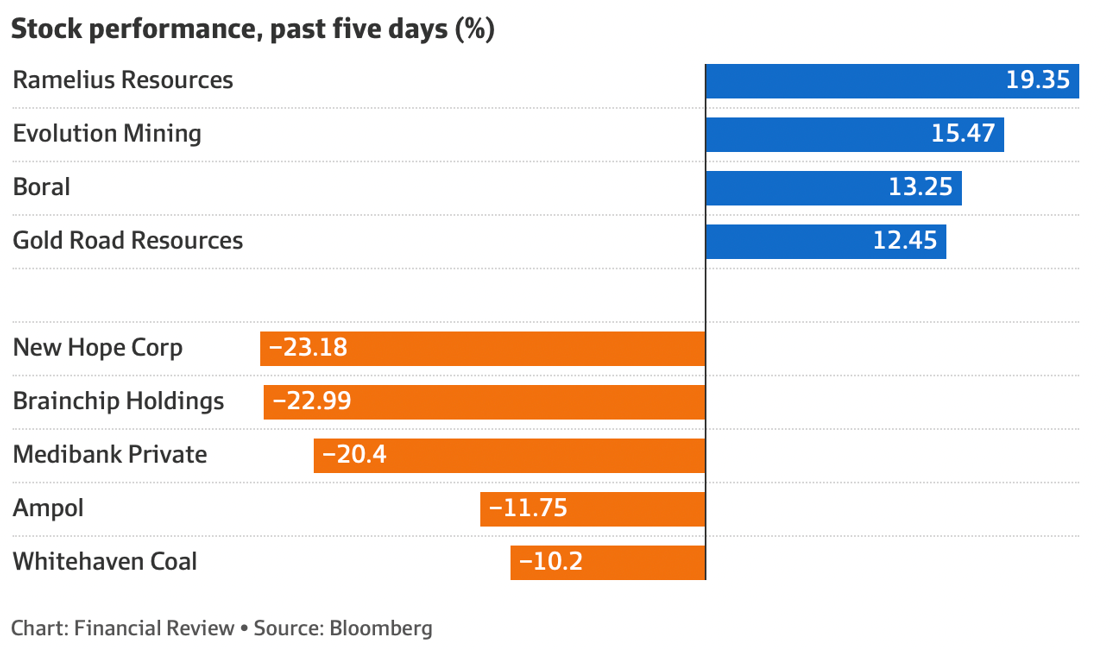

The falls were big as the AFR pointed out yesterday:

“The local materials sector slumped 4 per cent as Fortescue Metals Group fell 8.2 per cent to $14.76, BHP dropped 5 per cent to $37.48 and Rio Tinto declined 4.4 per cent to $88.55.”

Behind this sell-off is news that Chinese steel mills were reducing production, as a reaction to higher energy prices.

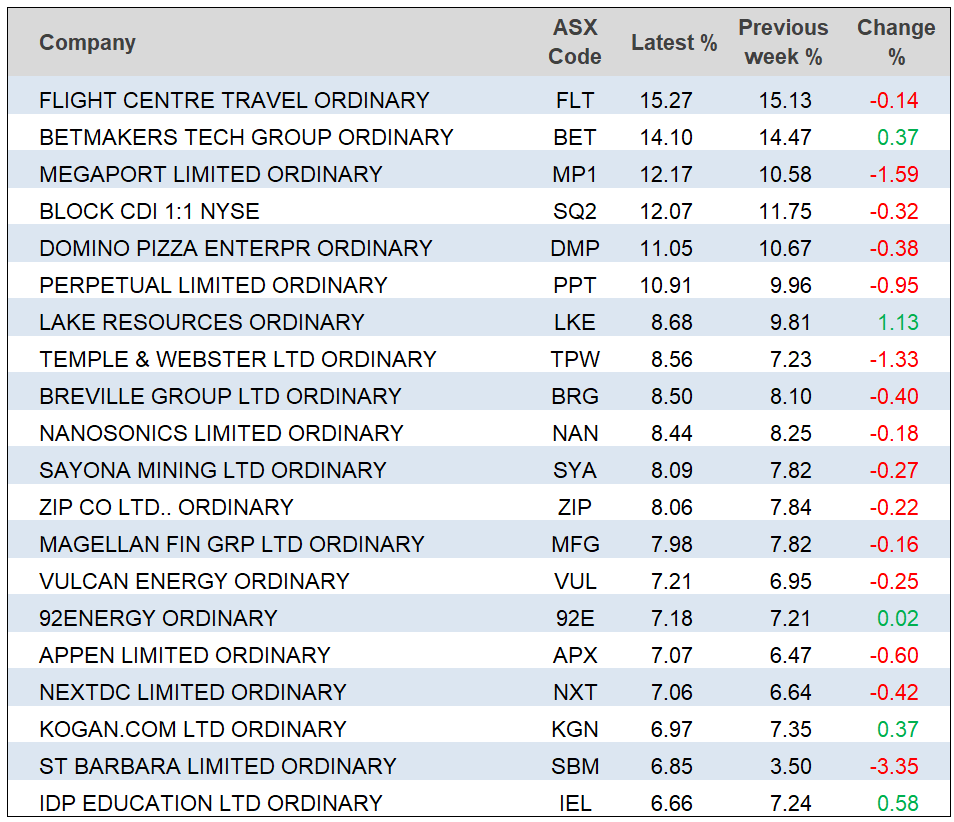

Here are the winners and losers for the week:

As you can see, coal miners had a rough week, but a coal miner such as Whitehaven is up 241% year-to-date! In contrast, the big banks spiked around 0.8% to 0.9% for the week.

What I liked

- The US stock market turnaround!

- In terms of macroeconomic effects, the Budget was largely responsible

- The US economy expanded at a 2.6% annualised rate in the September quarter (survey: 2.4%). GDP prices were up 4.1% on the year (survey: 5.3%). It said inflation is falling and the economy is not in a recession.

- The main measure of inflation in Australia i.e., the Consumer Price Index (CPI), rose by 1.8% in the September quarter (consensus: 1.6%). The annual rate of the CPI rose from 6.1% to 7.3% – the highest annual rate in 32 years (since June quarter 1990).

- The US Conference Board consumer confidence index fell from 107.8 to 102.5 in October (survey: 106).This helps reduce inflation.

- The Chinese economy, as measured by GDP, expanded by 3.9% in the September quarter from a year ago, above economist’s estimates for 3.3%, and stronger than the 0.4% growth rate in the June quarter.

- Chinese industrial production rose 6.3% in September from a year earlier, up from August’s 4.2% lift (survey: 4.8%).

- The S&P Global manufacturing purchasing managers’ index (PMI) for the US fell from 52 to 49.9 in October (survey: 51). The S&P Global services PMI eased from 49.3 to 46.6 in October (survey: 49.5). These are falls but they help the US achieve lower inflation readings.

- As expected, the European Central Bank (ECB)hiked its benchmark policy rates by 75 basis points. The benchmark deposit facility rate rose to 1.5%. The ECB signalled that smaller rate hikes lay ahead.

What I didn’t like

- The “final demand” component of producer prices (business inflation) rose by 1.9% in the September quarter to be up 6.4% on a year ago, the strongest annual growth rate in the history of the series (since September quarter 1998).

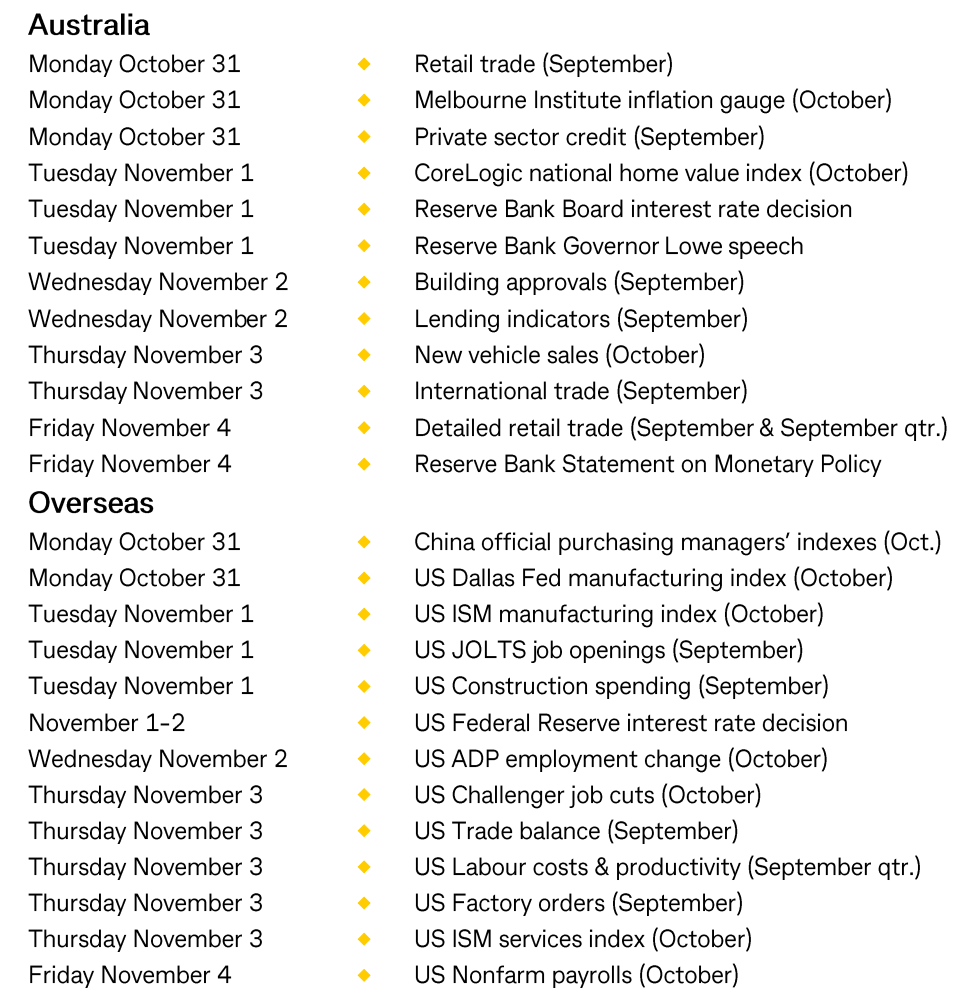

- Talk of a 0.5% interest rate rise here on Tuesday from the RBA. It might be needed but I still don’t like it.

We’re seeing progress

I’d love to do a George W. Bush and look at the US inflation and recession threats to our stock’s portfolios but it’s too early for a safe call, but we are seeing progress. November 4 (that’s next Friday) brings the latest US jobs numbers. On November 10 comes the biggie: the inflation reading with the Consumer Price Index.

If these two data points are worse than expected, markets will sell-off again. But once again we are seeing a decent sneak preview of what’s going to happen to stocks when inflation falls and if the US avoids a recession.

The week in review:

- With ‘inflation will soon drop’ speculation building, in this week’s Switzer Report, I discuss what are the good, bad and ugly plays for those trying to rebuild their portfolios after a rough few years.

- Notwithstanding Friday’s pullback, the banking sector has been a top performer in October as institutions switch out of resource stocks and re-weight towards banks. Paul (Rickard) talks about what should you look out for in these reports? Who could star, and who do the brokers fancy?

- Too many investors fall into the same trap with megatrends, they focus on seductive growth forecasts and overlook the challenges of building market share. Long-term investors could snap up thematic opportunities, after heavy price falls. Tony Featherstone reveals 3 smart ways to play megatrends via ETFs.

- “Small-caps,” or companies considered by professional investors to be small in terms of total market value (or capitalisation), are usually regarded as offering higher capital-growth prospects than their larger “big cap” counterparts – but with commensurately higher risk. Here are three small-caps that James Dunn thinks look very attractively valued right now.

- In our Hot Stock column this week, Raymond Chan, Head of Asian Desk at Morgans, tells us why he thinks Telstra (TLS) is a buy. Plus, Michael Gable, Managing Director of Fairmont Equities, reveals his thoughts on Lynas Rare Earths (LYC).

- In Buy, Hold, Sell – Brokers Say, there were 14 upgrades and 6 downgrades in the first edition and 7 upgrades and 9 downgrades in the second edition.

- And finally, In Paul’s (Rickard) Questions of the Week, why has Newcrest Mining fallen so far? When do the new rules about the downsizer super contribution come into effect? Are off-market share buybacks now dead? Why did Coles and Woolworths dive on Wednesday?

Our videos of the week:

- Peter’s good, bad & the ugly plays to make money when stocks take off! + OZL & Lithium stocks a buy? | Switzer Investing (Monday)

- Is this a responsible budget + Do you like the downsizing change? | Mad about Money

- Boom! Doom! Zoom! | 27 October 2022

- Expert likes these stocks: AD8, REA, SEK! Plus, best areas to invest in right now & which to avoid? | Switzer Investing (Thursday)

Top Stocks – how they fared:

The Week Ahead:

Food for thought: “When buying shares, ask yourself, would you buy the whole company?” – Rene Rivken

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

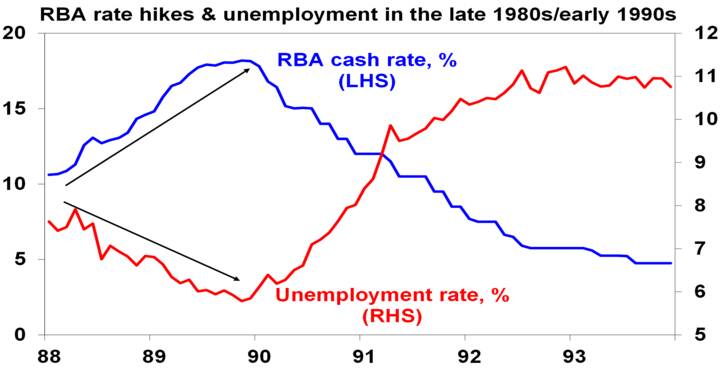

Unemployment kept falling through 1988 and 1989 – to 5.8% which was considered low at the time after it rose above 10% in the early 1980s – as the RBA progressively hiked rates to 18%. But by then it was too late as the impact of past rate hikes hit the economy hard in 1990 and it went into deep recession, with the RBA then having to rapidly reverse course as unemployment surged. Of course, things were different back then with very low debt & very high inflation expectations resulting in much higher interest rates than are needed today – but the lags are still relevant. To avoid overtightening as in 1989, the key is to slow down the pace of hikes to allow time for the lags to work – and this is what the RBA now appears to be doing. – Shane Oliver AMP Capital.

Top 5 most clicked:

- The good, bad & ugly plays for investors wanting to rebuild their portfolios – Peter Switzer

- What should you look out for in bank reporting season? Who will star? – Paul Rickard

- 3 small caps – James Dunn

- “HOT” stock – Telstra (TLS) – Maureen Jordan

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.