A Bloomberg article this month had a great line about working from home: “The only thing worse than having to go in-person for a job is not having one at all”.

The article claimed US workers were reluctantly returning to the office, fearful of losing their job as unemployment rises.

Forget employer-provided perks or cajoling to get people back into the office. The big driver is employee self-interest. It’s easier to cull workers who are out of sight than office workers who supposedly look busier and more committed.

Debates about the merits of working from home are not just a quirky human resources exercise. In February, The Economist questioned whether the work-from-home trend could spark the next financial crisis.

Office tower owners have battled higher vacancy rates with workers slow to return to corporate HQ after the COVID-19 pandemic. That’s forced building owners to pay costlier incentives to attract tenants in many markets.

Rising interest costs and higher energy and insurance bills have compounded the problems facing office owners. A sharper economic slowdown in Australia this year is another risk for office owners as insolvencies rise, company formation slows and more organisations cut costs by reducing their office space.

China’s property crisis is another wildcard if it forces some Chinese companies to liquidate their offshore property holdings in developed markets.

Then there’s talk of a four-day work week in some organisations and the boom in online conferencing that makes it easier to ditch or downsize the office. In many service industries, clients are more accepting of online meetings.

Yes, there are many reasons to avoid Australian Real Estate Investment Trusts (A-REITs) that own office towers. But we may be near ‘peak bad news’ for the sector, meaning it’s time to look at office A-REITs that have been battered in the past few years.

To be clear, I wouldn’t buy office A-REITs because of anecdotes about people returning to the office. The work-from-home trend is here to stay, albeit in a reduced form as unemployment rises and workers have less bargaining power. For many workers, a day or maybe two working from home will be the norm.

A recovery in office A-REITs will take time. It could get worse before it gets better – particularly if interest rates remain higher for longer – for office A-REITs. Prospective investors need at least a 3-5-year view, or preferably longer.

For contrarians who understand the value of buying assets at the bottom of a cycle – and holding them as they recover through the cycle – office A-REITs are worth considering. Some are trading at unusually large discounts.

With contrarian or deep-value investing, my strategy is to seek assets with reliable yield. That way, you’re being paid while you wait for the asset to recover and can earn an attractive return from income and some capital growth.

Here are two office A-REITs to consider:

1. Dexus (ASX: DXS)

Dexus’ $57.1. billion portfolio includes $15.8 billion of owned property in office, industry and healthcare properties, and retail and infrastructure assets. It also has $41.3 billion of assets under management in its funds-management business.

About 83% of Dexus’ funds from operations (FFO) is from its property assets; the rest is from funds management. Within property, office accounts for 60% of FFO, meaning Dexus relies heavily on the performance of its office assets.

An occupancy rate of 94.5% for Dexus offices exceeds the market average of 86.5%. Dexus office rents are above effective market rents because of the quality of its buildings. However, that implies Dexus will have to lower its average rent to keep tenants when leases expire and more firms look to downsize their space.

Yet, with an average lease expiry of 4.6 years, fixed annual rental increases, and 94.5% occupancy, the risk of sharply lower rents for Dexus when leases expire seems overstated. Unlike A-REIT managers with lower-quality portfolios, Dexus’ office portfolio is skewed to premium and A-grade buildings in prime CBD locations, where vacancy rates tend to be lower.

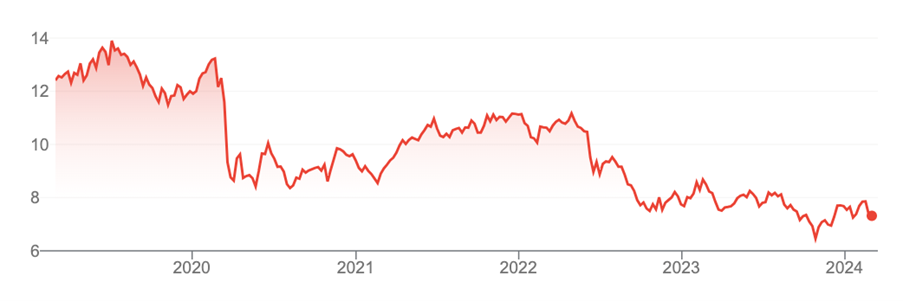

Dexus reported Net Tangible Assets (NTA) of $10.04 per unit at end-December 2023. That was down from an opening NTA of $10.88 at 1 July 2023 as weakening office demand led to reductions in office tower valuations. The current NTA of $10.04 implies Dexus is undervalued at recent trades of $7.33.

For the past few years, the market has expected larger future revisions in NTAs of office towers to reflect softening demand – a reason A-REIT prices tumbled. Larger NTA downgrades arrived last year and Dexus’ NTA is likely to fall further this year as the office property valuations continue to adjust.

At the current price, however, Dexus offers a reasonable margin of safety relative to its NTA (or a lower future NTA). After heavy price falls since 2020, Dexus’ valuation may not adequately reflect the long-term growth prospects of its funds-management operation or development pipeline.

Dexus’ forward dividend yield of 6.8% is another consideration for patient long-term investors who can wait for a recovery to play out – and can withstand further short-term volatility in the A-REIT sector. Still, it wouldn’t surprise to see Dexus retest its 52-week low of $6.30 if economic and market conditions deteriorate.

Longer term, some headwinds Dexus and other A-REITs have experienced could become tailwinds in the next few years.

Morningstar values Dexus at $10.80 a share. I’m not as bullish but see value in the A-REIT for long-term investors at the current price.

Chart 1: Dexus

Source: Google Finance

2. GPT Group (ASX: GPT)

GPT owns 27 premium and A-Grade office towers along the East Coast, a logistic portfolio of 69 assets, 10 shopping centres and a flexible workspace business. Office assets comprise around a third of GPT’s $15.4 billion portfolio.

In its FY23 result (released in February 2024), GPT noted that the office-leasing market remains challenging. Vacancy rates in Sydney and Melbourne are elevated, demand is subdued and tenant incentives remain high.

GPT noted that worker activity in Sydney and Melbourne CBDs has increased as more corporates insist that workers return to the office – a view that aligns with anecdotal reports of a slowdown in the work-from-home trend. GPT anticipates that the return of more workers to the office will aid leasing activity in 2024.

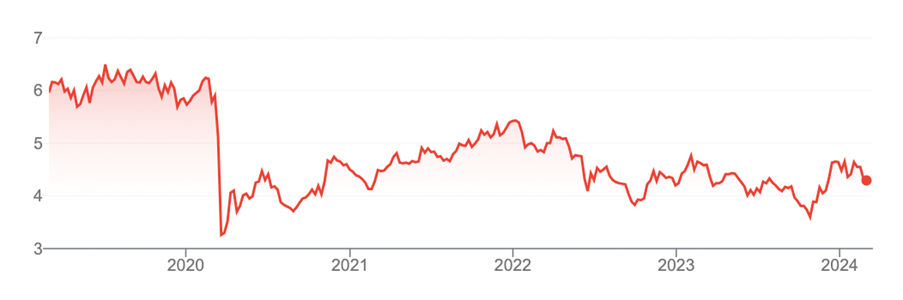

Like Dexus, GPT faces tough market conditions in office leasing. Also, like Dexus, GPT is trading well below its NTA. GPT’s last NTA of $5.61 per security in FY23 was down 6.2% on a year earlier, but well above its current price of $4.29.

An average price target of $4.60, based on the consensus of nine analysts, looks a touch bearish. GPT’s forward dividend yield of 5.8% will appeal to long-term investors who can wait for a recovery in the office sector.

Chart 2: GPT Group

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation, or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation, and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 28 February 2024