With recent economic readings suggesting that the RBA could be done with raising rates (or close to that situation), I want to find smaller cap companies that might have been victims of rising rates. Big cap companies have been more supported than smaller companies, but when rate rises are over, small cap stocks often outperform. So, here’s 5 small caps that I like.

1. Steadfast (SDF)

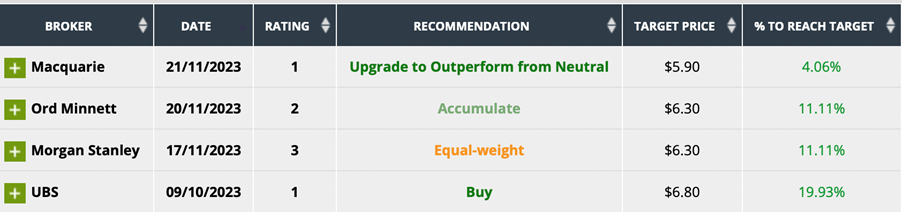

My first stock doesn’t totally fit my criteria of being small cap but Steadfast has a market cap of around $6.2 billion, while CBA is $178 billion. The FNArena survey of analysts says the company gets the thumbs up.

The consensus of analysts says an 11.6% rise ahead, and four out of four expert assessors like the company.

I was staggered to hear the boss of AIG say that last year there were 100 natural disasters — the most ever. Meanwhile, what business doesn’t need cyber insurance? I wouldn’t invest in the companies who have to do the risk but Steadfast has all the brokers/agents selling insurance, and if premiums are rising, so would their clip of the ticket.

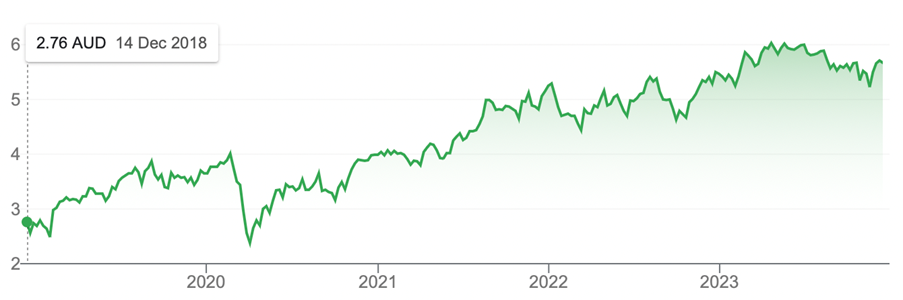

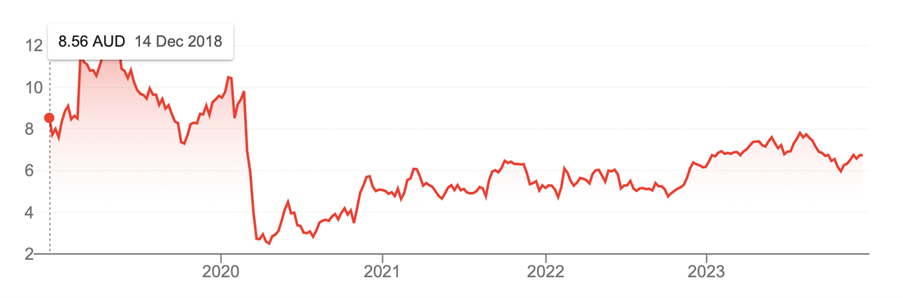

This chart actually shows SDF has done well, despite the troubled, high interest rate times.

Steadfast

2. Tyro (TYR)

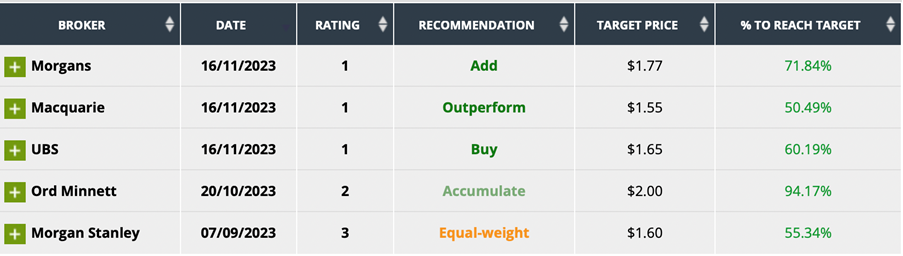

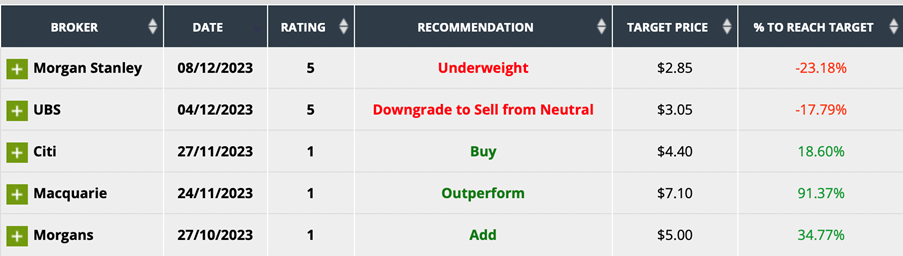

My next one has copped it since rates started rising but I’m clinging to the fact that Potentia wanted to pay $1.60 for Tyro, and there seems to be buyers under a dollar up to $1.30. If there’s any bad news for tech/growth stocks, Tyro gets hit. The chart below shows this pattern. The drop-backs could recede when rate rises are over and tech companies locally are supported, as they have been in the US.

Tyro

I know I keep beating this drum but I’m not alone. At $1.03, at least it’s in the buy zone for a quick killing, if that’s what you like. The consensus projected rise is 66.4% but there are some real Tyro fans among the analysts, as the table below shows.

Yep, I have exposure to TYR, but I can’t ignore the enthusiasm of these well-qualified company analysts.

3. Liontown Resources (LTR)

I have to have a miner and I’m split between Pilbara Minerals and Liontown Resources.

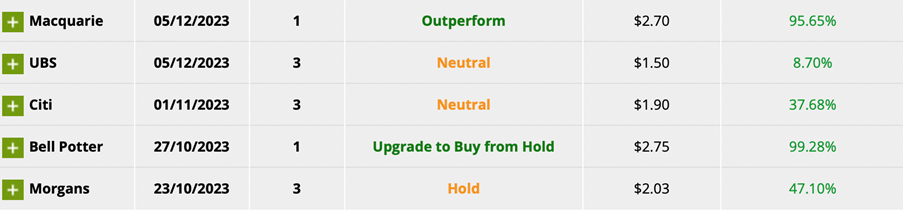

I’m leaning towards LTR because Albemarle thought it was worth $3 a share before Gina Rinehart chased them off, after buying 19.9% of the company at prices around $3. It’s now $1.38. But look at what the analysts, who are the opposites of short sellers, think:

Lithium is a gamble but it’s one I’m prepared to take in the speculative part of my portfolio.

In fact, the most-shorted stock on the ASX is Pilbara Minerals (PLS) and it too is liked by analysts, as you can see below. PLS has two doubters but note how Macquarie is such a big believer in the lithium/EV/battery play.

This was in the AFR two weeks ago and it gave me confidence that stocks like LTR and PLS are in the buy zone. “Australian Super is taking on the hedge funds after it quietly built up a 5.1 per cent stake in lithium giant Pilbara Minerals, the most shorted stock on the ASX,” Jonathan Shapiro reported. “AustralianSuper’s senior portfolio manager Luke Smith told The Australian Financial Review it has been investing in lithium and the electric vehicle thematic for over a decade”.

While that’s interesting, as an economist, I liked it more when Mr Smith said that the fall in lithium prices meant they were “now starting to breach the top end of the current cost curve of the industry, a marker in any commodity’s cycle. Overlaying this is the lithium and downstream electric vehicle market where supply and demand are both growing strongly at well over 15 per cent annually and the sector is forecast to remain strong for a number of years”.

I’m not naïve on what could change for lithium, such as a bigger-than-expected supply, slower demand/uptake of EVs, a new and better technology that renders lithium not needed, but these kinds of threats are out there for lots of businesses.

If they weren’t there, I’d have LTR and PLS as core holdings. But they are, so they look like good speculative plays that could offer nice alpha returns over time.

4. Technology One (TNE)

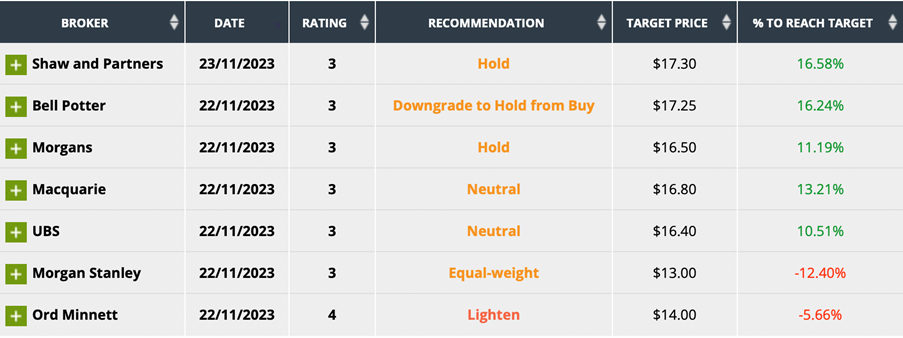

In the tech space, Technology One is a likely improver but it might not be a big boomer, though it could deliver nice returns. The consensus says 7.1% upside, but analysts are more positive.

I like TNE’s five-year chart, which shows how consistent this business is.

Technology One

I also thought it was a good sign that over the past year the stock was up 6.7%, but over the year-to-date it’s up 13.5%. This shows it’s benefiting from the gradual re-loving of tech stocks.

5. Webjet (WEB)

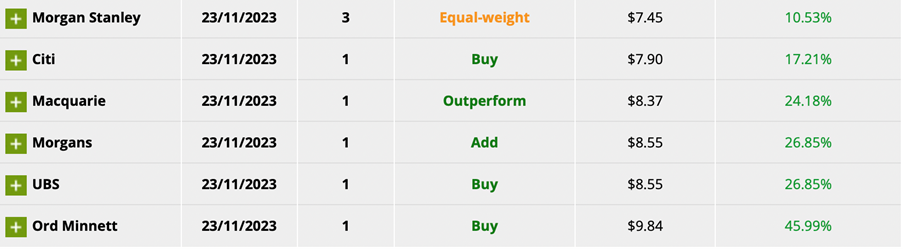

One of my favourites that we went long on after the Coronavirus crash of the market is Webjet. Over the last month, it has risen 7.1%. I suspect where there’s smoke, there’s fire. And the analysts agree with me, with the consensus rise being 25.3%. Six out of six give the company a big tick of approval, with Ord Minnett seeing a 45.9% gain ahead.

I have a big opinion of Webjet’s chief, John Gusic. I also think the outlook for the travel industry looks promising. The upward trend for this stock shows how the company’s bottom lines have impressed the market. Given its previous highs, there looks to be good upside, as the analysts’ calculations suggest.

Webjet

In coming weeks and months, we’ll keep looking for the companies that the analysts like that could be beneficiaries of the changing market attitudes to investing in stocks, with the likelihood of no more rate rises and even eventual rate cuts looming on the horizon.

In that kind of economic environment, there’ll be good companies that have been on the outer that will be some of the big winners in 2024.

Watch this space.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.