The fear and anxiety that has captured the market this week rolled into Friday’s trade on Wall Street, with the combined impact of the Israel-Hamas battle and rising bond yields understandably spooking stock players. However, note this: the bonds are the biggest concern, but it will be short term. So, if you’re a trader, you should be nervous. But if you’re a long-term player, it’s time to look for value. (More on this really important market play on Monday — don’t miss it!)

Back to this week, and it’s the bond market in control of stock market direction that’s most influencing stocks, but there is something about this surge in yields, which has the 10-year Treasury yield over 5% for the first time since 2007. That’s a little surprising.

A rising bond yield should occur because of a stronger-than-expected US economy ahead of a fear of rising inflation. We can all accept interest rates will stay higher for longer, but no one really knows what that exactly means.

For example, there could be a rate cut next year, but it might only be a small cut or two because inflation might remain sticky at 3% when the Fed wants 2%. Also, the economy might not pullback as much as the Fed hoped, so interest rates could stay higher for longer.

By the way, current interest rates are closer to what’s historically normal, so it isn’t like we’re in a disaster zone for the economy and stocks. This chart of our home loan rates shows that.

Central bankers know the full hit of their rate rises haven’t taken effect, so they remain caught between: “Should I worry about inflation or recession?”

Right now, the bond market isn’t worried about recession, which is why bond yields are rising, but apart from competing with stocks with 5% safe yields on government bonds, some stock market players could be worrying that these high-yielding bonds that carry over to loan rates could cause a recession.

This is classic ‘wall of worry’ stuff that stock markets do, but at the moment it’s the sliding part of the climb we’re in! And don’t worry, it’s confusing many experts and not just you. “The stock market is watching the bond market and doesn’t like what it sees,” said David Donabedian, chief investment officer of CIBC Private Wealth Management. “Yields are rising, even with the relatively good news about inflation. This is the primary reason the stock market has been weak,” he added.

Note what Donabedian said: “…even with the relatively good news about inflation”. This probably explains why many influential market players think the Fed will hold rates in November because they might think the bond market is doing the scaring work and therefore slowing the US economy. Well, let’s hope so.

This rate rise anxiety has some time to play out. The Middle East tragedy (apart from everything else) isn’t helping because it drives up oil prices and keeps inflation (you got it) stronger for longer, so it’s important for stocks, but it’s not a massive long-term shock to stocks. It could be short term, especially if Iran buys into this, but all in all it makes sense that stocks have turned down. (I have to confess as someone who helps you play stocks, I didn’t see the Hamas rockets coming. It’s a tough gig guessing market direction, but someone has to do it.)

Not surprisingly, despite a negative week for stocks, consumer staples did well in the US because it’s a defensive play, while energy stocks rose (as they did here) as oil prices spiked as missiles and rockets tragically screamed across the skies over Israel and Gaza. (Our energy stocks followed the US script as the table later in this Report shows but Woolies and Coles copped it, showing how odd markets can be, though WOW is up over 10% year-to-date, which could explain a bit of the pullback this week.)

To the local story and the S&P/ASX 200 lost 150.3 points (or 2.1%) for the week to 6900.70, which wasn’t bad when you think of the curve balls that stocks have copped recently. We’re now down 2.3% for the month but it’s the past six months that have brought the problems for wealth-building via stocks, with the index down 5.86%. This has meant index players have dropped 0.66%, but thank God for dividends, which will bring us in at least on par with term deposits (or a little bit better with franking credits).

That said, it hasn’t been pretty for stock players in 2023 and Gina Rinehart’s curious and potentially selfish play didn’t make Liontown (LTR) shareholders happy with their $3 a share offer whisked away, when Gina’s 19.9% stake on LTR scared Albemarle off. This from the AFR captures this week’s LTR drama: “Australia’s richest person, Gina Rinehart, has turned Liontown Resources’ future on a dime. Now the company can only hope she plays nice and helps get its Kathleen Valley project into production.”

As an LTR shareholder, I think I speak for most other shareholders in saying: “Not happy Gina. Not happy.” This chart could be on our nasty Christmas Card to Gina:

Liontown (LTR) one month:

I repeat: “Not happy Gina. Not happy.”

The Israel-Gaza concerns drove the gold price up to US $1,990 an ounce, which took the Aussie price to $3,150 an ounce — a record high!

Surprisingly, the Qantas share price rose 3 cents to $4.77 on Friday, but it lost 3.8% for the week and is now down 10.1% for the month. Over the six months that the Joyce drama has played out like a Shakespearian play, the share price is off 27.95%. This week Olivia Wirth, the chief customer officer, resigned (is anyone surprised?) and shareholders went baying for the blood of director Todd Sampson, who was on the board for his expertise in brand-building being a top ad executive and star on Gruen on the ABC.

What I liked

- The jobs report that showed interest rates are softening the labour market. Even though unemployment fell, it was helped by a lower participation rate. (See my Quote of the Week and Chart of the Week below.)

- The jobs report told us that employment rose by a modest 6,700 in September, following a big lift of 63,300 in August, while unemployment fell from 3.7% to 3.6%, but this was for statistical reasons rather than a revving up economy. Hopefully, the RBA will get that.

- Dwelling commencements fell by 11.8% to 40,720, which is bad for the economy, but it might make the RBA realise that 12 rate rises are enough!

- US September quarter earnings reporting season is good so far.Only 16% of S&P 500 companies have reported but 75% have come in better than expected.

- AMP’s Shane Oliver gave China a thumbs up. “More signs that Chinese growth has bottomed with economic activity data stronger than expected,” he noted. “GDP slowed to 4.9% year-on-year in the September quarter, but this was stronger than expected, with quarterly GDP growth of 1.3% quarter-on-quarter up from 0.5%.” Growth in industrial production and retail sales also surprised on the upside in September and unemployment fell. This followed stronger-than-expected import, export, and credit data.

What I didn’t like

- Israel-Hamas ‘war’ and its impact on oil prices and potentially inflation.

- Fed boss Powell’s comments that sent bond yields higher. He thinks US economic growth needs to slow and that will mean another rate rise is possible.

- The US money market has priced in a 25% chance of a rate hike in November (up from just 6% a week ago) and an 88% chance by March (up from 40% a week ago).

- US economic data that said another rate rise might be needed. In a surprise, US retail sales rose solidly in September pointing to a strong September quarter, with consumer spending, industrial production also coming in better than expected, while jobless claims remained low.

What next for the market?

It’s simple — data drops will be everything for views on interest rates and that will help or hinder stock prices. On Wednesday, we get our September quarter CPI. In the US, economic growth as well as the core personal consumption expenditures deflator (core PCE), which the Fed takes very seriously, is out on Friday. Watch this space.

The Week in Review

Switzer TV

- Boom Doom Zoom: 19th October 2023

- SwitzerTV: 16th October 2023

Switzer Report

- Two philanthropic LICs in the spotlight

- “HOT” stock: Deep Yellow (DYL)

- Questions of the Week

- 10 catch-up stocks

- Origin & Liontown – how do you play these takeovers?

- HOT STOCK: Washington H Soul Pattinson & Co (SOL)

- 3 potential critical minerals stars

- Buy, Hold, Sell — What the Brokers Say

Switzer Daily

- Dr Jim set to tax backpackers out of the workforce

- Albo set to toast China dropping its huge tariff on Aussie wine

- Earning shocks awaits 50% of males and 80% of women

- Should politicians and companies be careful about supporting big social issues?

- Odds firming for rate rise on Cup Day

- Has Voice referendum proved we’re more Anglo than the Poms? – By Malcom Mackerras

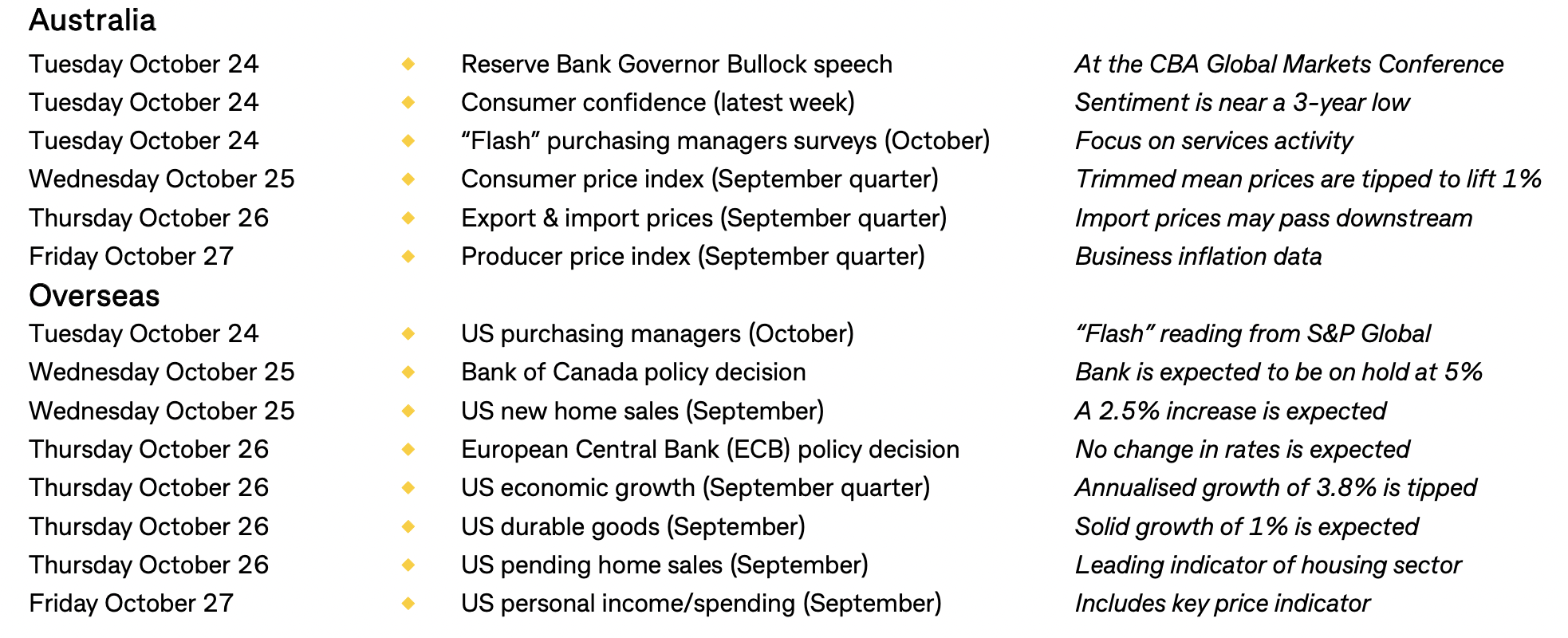

The Week Ahead

Top Stocks — how they fared.

Quote of the Week

“We expect a further deterioration in labour market conditions and a rise in the unemployment rate from here based on leading indicators of jobs growth like job advertisements, job vacancies, business hiring intentions and applicants per advertised job (see the chart below)…(AMP economist, Diana Mousina)

Chart of the Week

That fast-falling green line says the labour market is set to feel the pinch of 12 rate rises. Hope the RBA has seen this!

Stocks Shorted

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.