Every time we see an increased chance that interest rate rises are over in the US, the market takes off. But then players can have second thoughts peppered by the bond market raising yields and the stock market pulls back. I’ve regularly argued that when rate rises are over, stock market influencers will search for growth companies that carry debt and have been beaten up since late 2021 (and across 2022), and these will drive stock market indexes higher.

When asked about the outlook for stocks, I suggest a 10% rise is very likely, but I wouldn’t rule out a 10% rise in stock prices plus 4% dividends and 2% franking credits. So, this could net some super fund players in the ‘no tax’ zone a 16% return by simply playing the index.

Let’s test out the likelihood of both the ‘conservative’ call of 10% and then the bigger 16% gain.

Given the power of US stocks to push our market, let’s see what the S&P 500 has done this year.

S&P 500

Year-to-date, the S&P 500 is up 16%, which is to be expected after 2022 saw the Index drop over 19%. It’s also the third year of a US president, which historically is the best for stocks.

That said, a lot of this uplift came from the big rise of the so-called Magnificent 7 tech stocks (M7), namely, Nvidia (NVDA), Meta Platforms (META), Amazon.com (AMZN), Microsoft (MSFT), Apple (AAPL), Alphabet (GOOGL) and Tesla (TSLA).

These account for 30% of the Index. Boomberg’s Nir Kaissar has looked at the P/E for the Index without the M7. “The numbers confirm that when the Magnificent Seven are excluded, the index’s current P/E ratio falls to 24 from 28,” he revealed. “But 24 times earnings are no bargain, either. It’s higher than the average P/E ratio of 21 for the S&P 500 excluding the top seven back to 1990. It’s also among the highest P/E ratios on record for that group, rarely exceeded before 2019 and mostly during the dot-com era.”

All this hoses down my enthusiasm for a big US stock market rebound when interest rate rises are halted by the Federal Reserve, which meets this week and is expected to keep pausing on rates. However, if the data doesn’t confirm that inflation is falling, they could easily raise rates again in November.

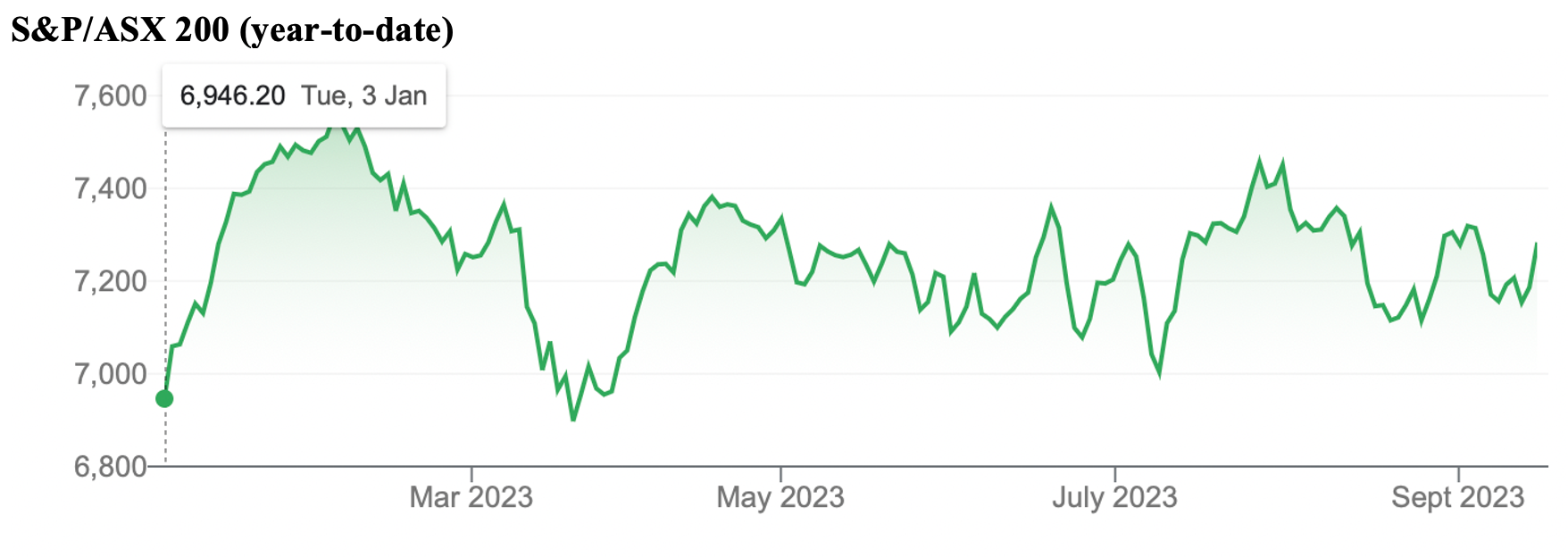

This means the market will be second-guessing the Fed and rates, which is likely to sustain the up and down pattern for stocks that has really shown up for our S&P/ASX 200 Index this year, as the chart below shows.

What this shows is that our market is still 379 points under the high in February, which was 7558. Year-to-date, we’re only up 4.8%. That follows 2022 which was a negative year where the Index was off 5.4%, which coincided with the worst year ever for bonds.

In fact, our market is still 4.5% below the August 2021 high of 7628.

S&P/ASX 200 (5 years)

The chart above shows how little progress has been made by the overall market and increases the likelihood that from here and into 2024 (the fourth year of a US president, which history says is the second-best year for US stocks), we could see an overdue rise for the Index.

Given how the US and local stock markets this year have responded to better inflation data and the possibility that interest rate rises are over, it seems like a reasonable bet that when the Fed gives out stronger signs that it’s “mission complete” with inflation and rate hikes, big market players will go looking for companies/stocks that have good growth prospects.

Given the fears about a recession in the US (and even here) are on the low side and the fact that the S&P 500 is around the same level it was two years ago, it adds to the argument that a rising market helped by the end of rate rises, isn’t a big stretch.

And I like this from CNBC’s Mike Santoli: “John Kolovos, technical market strategist at Macro Risk Advisors, went out on this limb late last week: ‘Seasonals aside, we are nearing turning points lower for rates, a major decline in the [U.S. dollar], and even the great and powerful WTI oil is poised to consolidate. Coupled with still loads of scepticism and growing oversold conditions for the broader equity complex, we need to be on the lookout for risk markets to trough and build towards fourth-quarter strength’.”

He added: “Kolovos has been anticipating a ‘long and winding road to 4800’ for the S&P 500, provided it doesn’t crack support near 4300 before then. Rising toward 4800 in coming months would complete the two-year round trip that the market has been tracing out for a while now.”

That’s about an 8% gain for the US market, and given we play follow the leader, if we can match that 8% gain, then with dividends and franking credits, a 10% gain for us looks very achievable.

The safe way to do that would be with an ETF such as VAS, IOZ, A200 or STW. Last week, I looked at the risky play via GEAR, which actually jumped 2.4% over the five days, while the Index was up 1.7%.

One final reason to back a positive year is the historical observation that over a 10-year period, the stock market gains 10% a year and rises seven to eight times out of 10.

Roughly counting, in 2018 our market was down 9.7%, up 20% in 2019, down 2% in 2020, up 13% in 2021, down 5% in 2022, and 2023 should be another positive year. But that means since 2018 (six years) we’ve had three negative years, which is another reason for me sticking with stocks.

I’m a believer in the Index play for the 12 months ahead but I could easily become defensive some time in 2024. It could be a ‘sell in May and go away’ year, especially if the Republican Convention in July is set to nominate Donald Trump as its presidential candidate.

Before that possibility, I still can see a 10% gain is very possible, such is the power of falling interest rates. As Investopedia tells us: “Generally, interest rates and the stock market have an inverse relationship.” That means when interest rates fall, share prices rises.

When the RBA cut rates in 2008, the stock market rose 30% in 2009. With the October 2011 cut, the market rose around 14%, while the March 2016 rate drop helped the market rise 15%. And then there was the 2019 cut, which saw stocks rise 20%.

I rest my case.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances